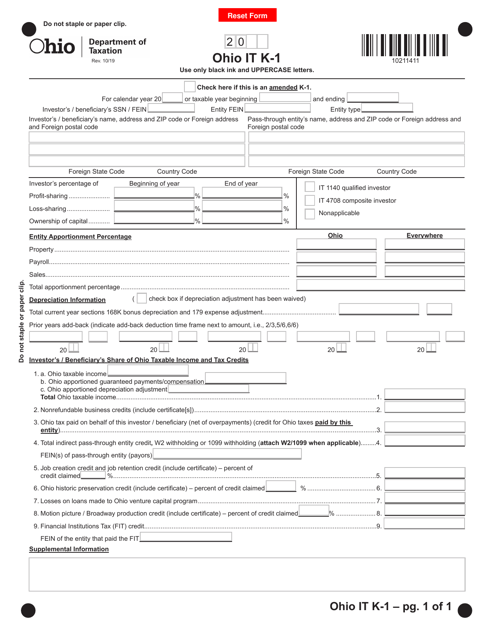

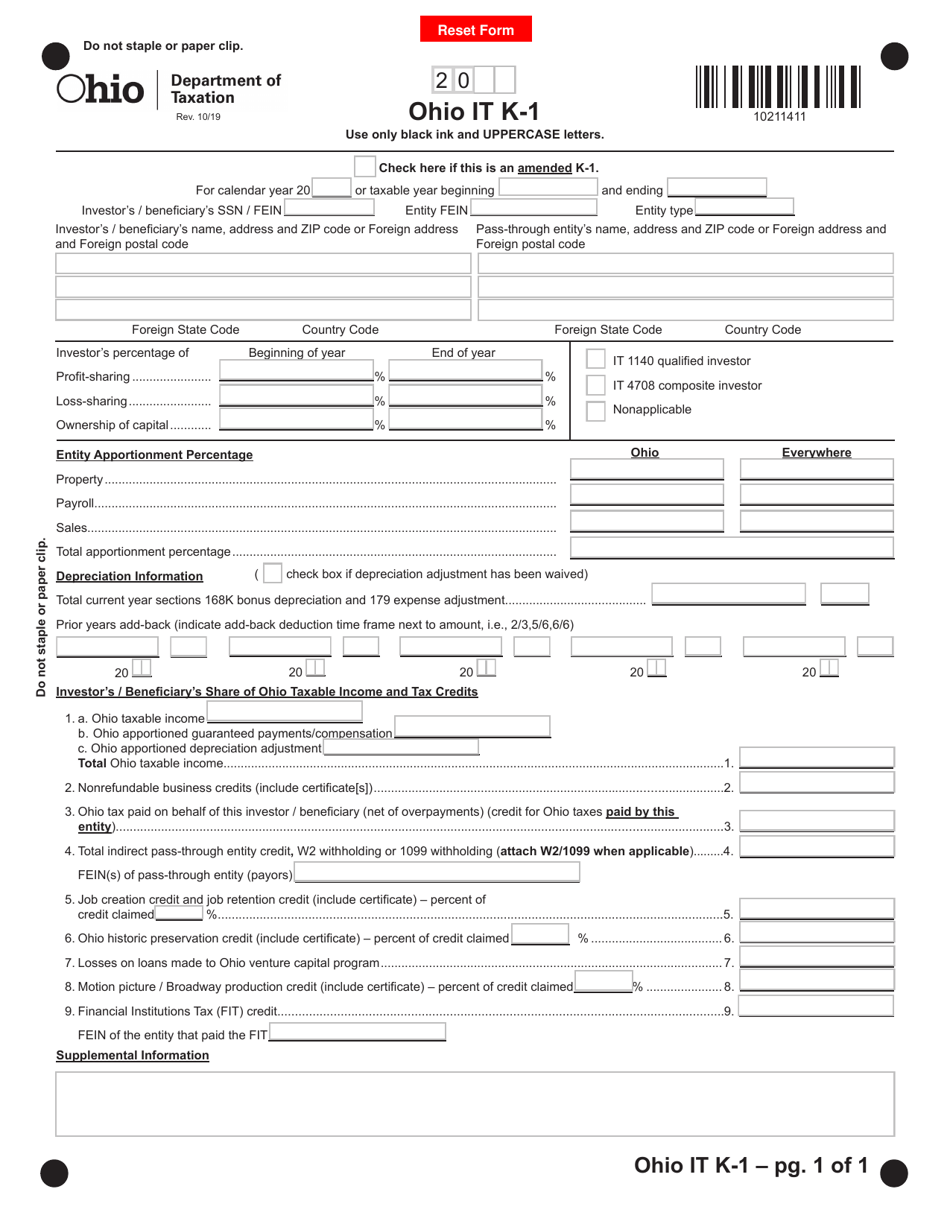

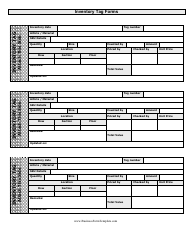

Form IT K-1 - Ohio

What Is Form IT K-1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT K-1?

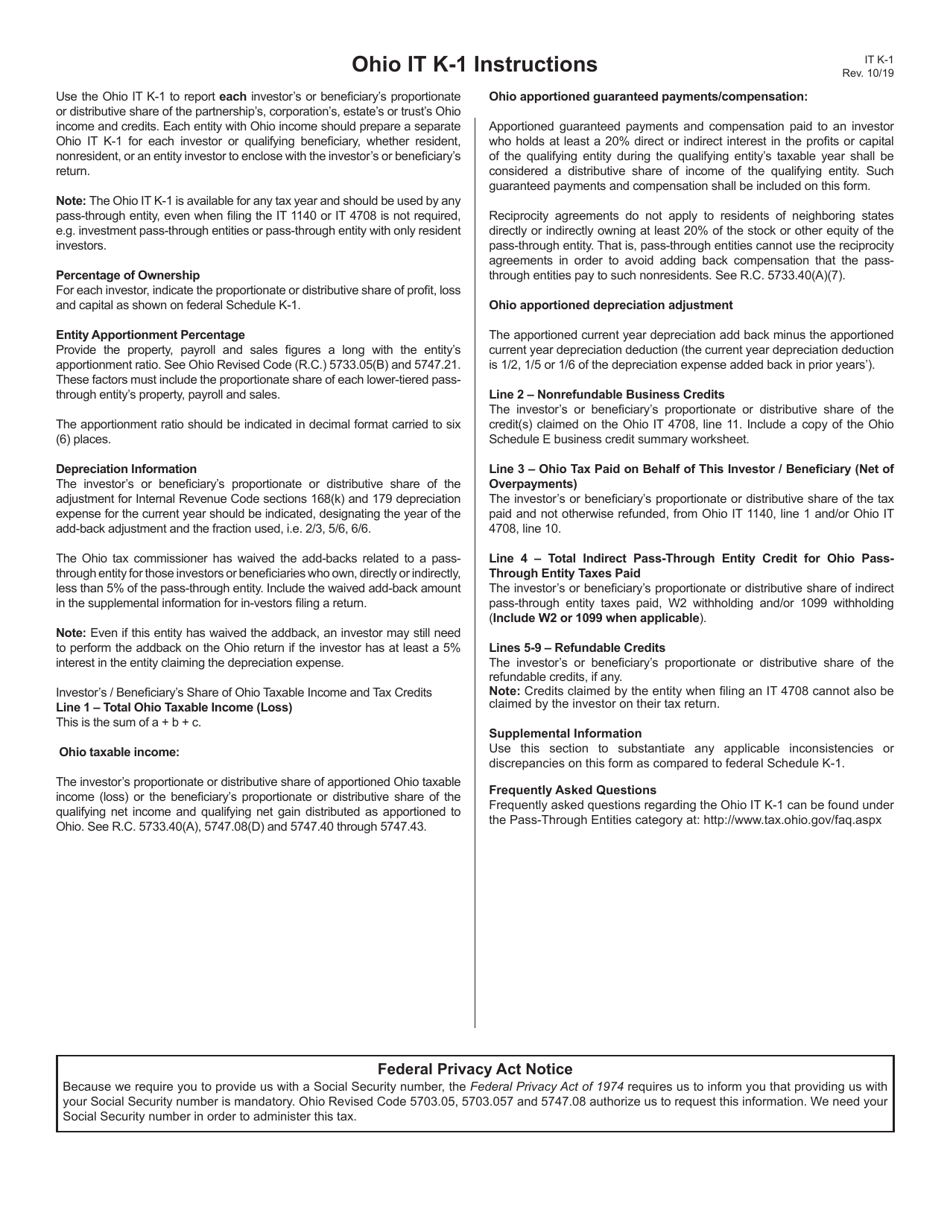

A: Form IT K-1 is a tax form used by individuals in Ohio to report their share of income, deductions, credits, and other tax-related information from a partnership or S corporation.

Q: Who needs to file Form IT K-1?

A: Form IT K-1 needs to be filed by individuals who are partners in a partnership or shareholders in an S corporation and receive income or deductions from the entity.

Q: What information do I need to complete Form IT K-1?

A: You will need the partnership or S corporation's identification number, your share of income, deductions, credits, and other tax-related information, and any supporting documentation.

Q: When is Form IT K-1 due?

A: Form IT K-1 is due on the same date as your individual income tax return, which is typically April 15th.

Q: Are there any penalties for late or incorrect filing of Form IT K-1?

A: Yes, there may be penalties for late or incorrect filing of Form IT K-1, including penalties for failure to file, failure to pay, and accuracy-related penalties.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT K-1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.