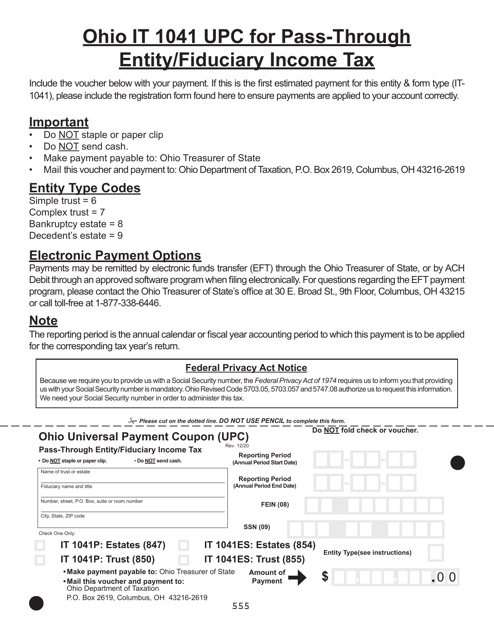

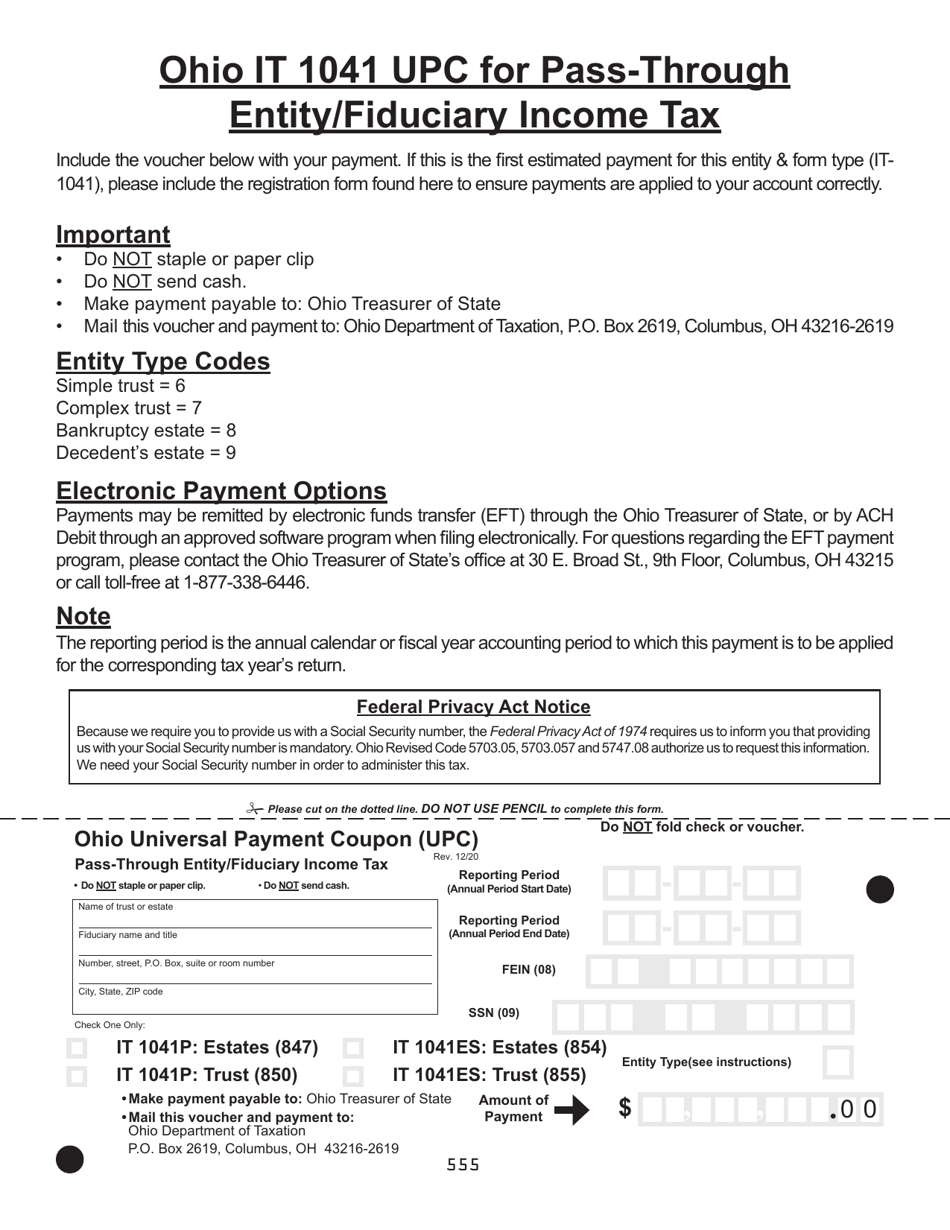

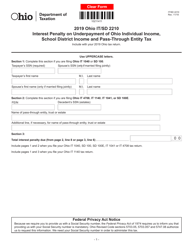

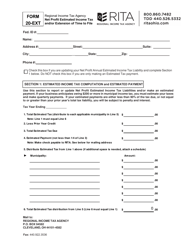

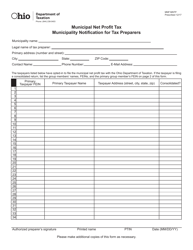

Form IT1041 UPC Ohio Universal Payment Coupon (Upc) Pass-Through Entity / Fiduciary Income Tax - Ohio

What Is Form IT1041 UPC?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

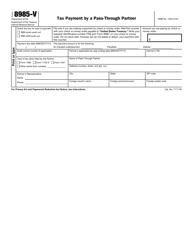

Q: What is a Form IT1041 UPC?

A: Form IT1041 UPC is a Universal Payment Coupon (Upc) used for Pass-Through Entity/Fiduciary Income Tax in Ohio.

Q: Who needs to file Form IT1041 UPC?

A: Pass-Through Entities and Fiduciaries in Ohio need to file Form IT1041 UPC.

Q: What is Pass-Through Entity/Fiduciary Income Tax?

A: Pass-Through Entity/Fiduciary Income Tax is a tax imposed on income earned by pass-through entities (such as partnerships, S corporations, and LLCs) and fiduciaries (such as trustees or executors of estates) in Ohio.

Q: What is the purpose of Form IT1041 UPC?

A: The purpose of Form IT1041 UPC is to make a tax payment for Pass-Through Entity/Fiduciary Income Tax in Ohio.

Q: When is the due date for filing Form IT1041 UPC?

A: The due date for filing Form IT1041 UPC varies, but it is generally April 15th following the close of the tax year.

Q: Do I need to include any attachments or supporting documents with Form IT1041 UPC?

A: It depends on your specific situation. You may need to include additional forms, schedules, or supporting documents to accurately report your income and deductions.

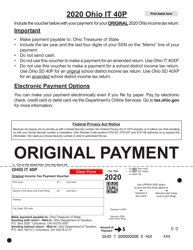

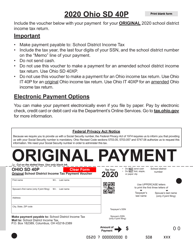

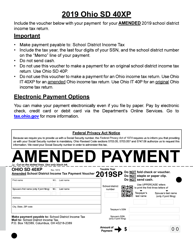

Q: Can Form IT1041 UPC be filed electronically?

A: Yes, Form IT1041 UPC can be filed electronically using the Ohio Business Gateway or through approved tax software.

Q: What happens if I don't file Form IT1041 UPC or make the required tax payment?

A: If you fail to file Form IT1041 UPC or make the required tax payment, you may be subject to penalties and interest charges.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT1041 UPC by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.