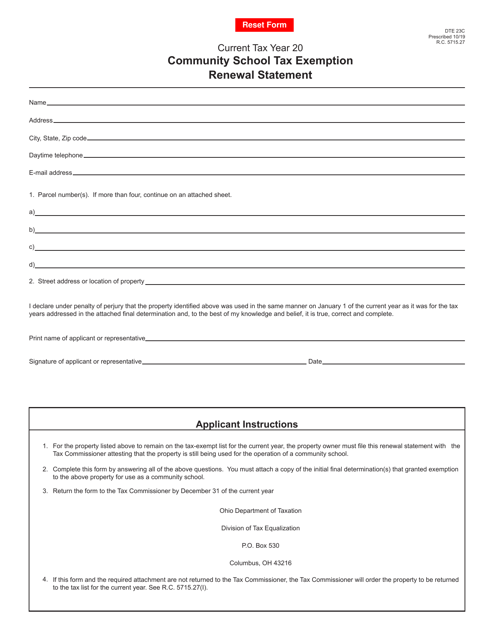

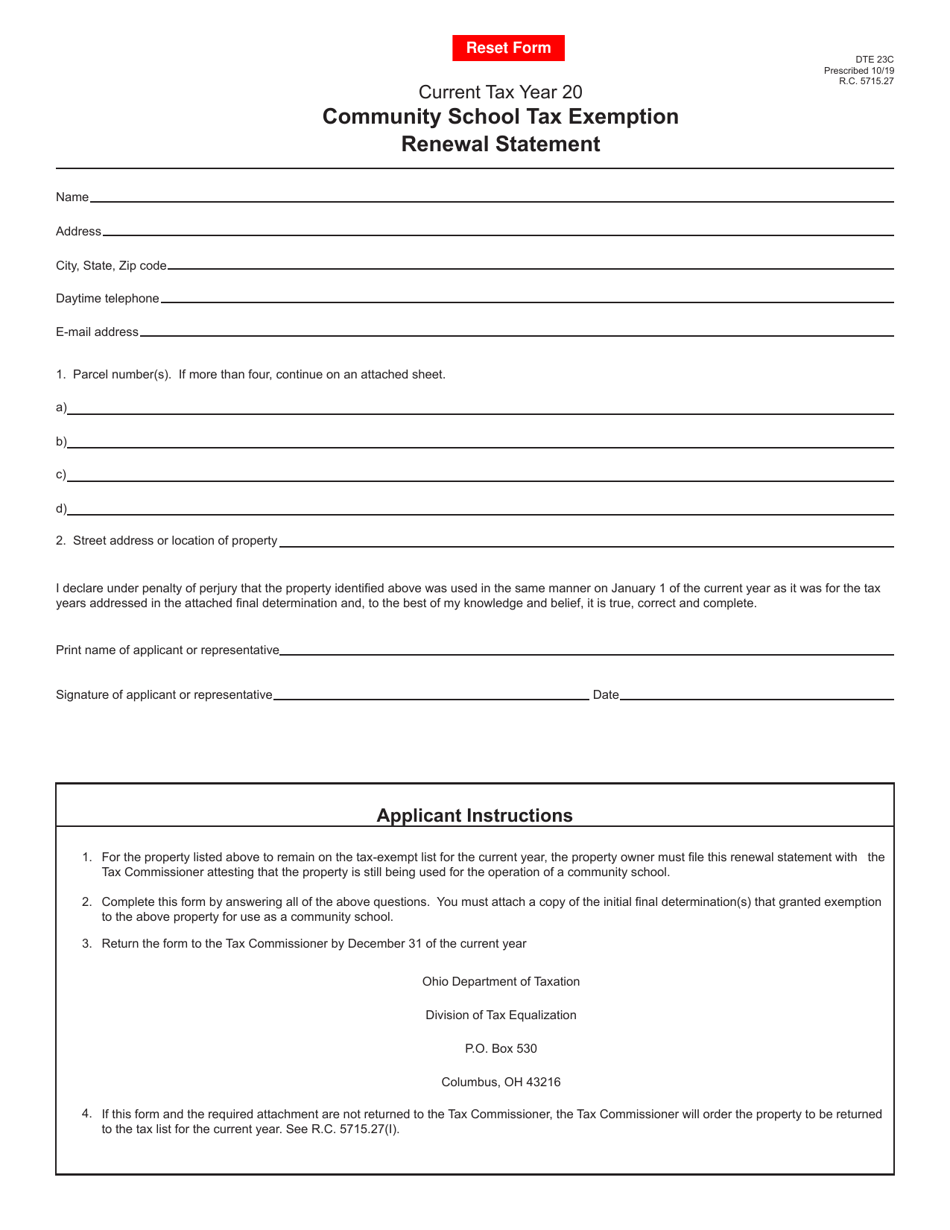

Form DTE23C Community School Tax Exemption Renewal Statement - Ohio

What Is Form DTE23C?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE23C?

A: Form DTE23C is the Community School Tax Exemption Renewal Statement in Ohio.

Q: What is the purpose of Form DTE23C?

A: The purpose of Form DTE23C is to renew the tax exemption status for community schools in Ohio.

Q: Who needs to complete Form DTE23C?

A: Community schools in Ohio need to complete Form DTE23C to renew their tax exemption status.

Q: Are all community schools in Ohio eligible for tax exemption?

A: Not all community schools in Ohio are eligible for tax exemption. They need to meet certain criteria to qualify.

Q: When is the deadline for submitting Form DTE23C?

A: The deadline for submitting Form DTE23C varies and is determined by the Ohio Department of Taxation.

Q: What happens if a community school fails to renew its tax exemption status using Form DTE23C?

A: If a community school fails to renew its tax exemption status using Form DTE23C, it may lose its tax-exempt status and be subject to taxation.

Q: Is there a fee associated with submitting Form DTE23C?

A: There is no fee associated with submitting Form DTE23C to renew the tax exemption status for community schools in Ohio.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE23C by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.