Form STW20009-A Voluntary Tire Recycling Fee Return - Oklahoma

What Is Form STW20009-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the STW20009-A Voluntary Tire Recycling Fee Return?

A: STW20009-A Voluntary Tire Recycling Fee Return is a form used in Oklahoma to report and remit the voluntary tire recycling fee.

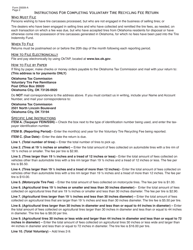

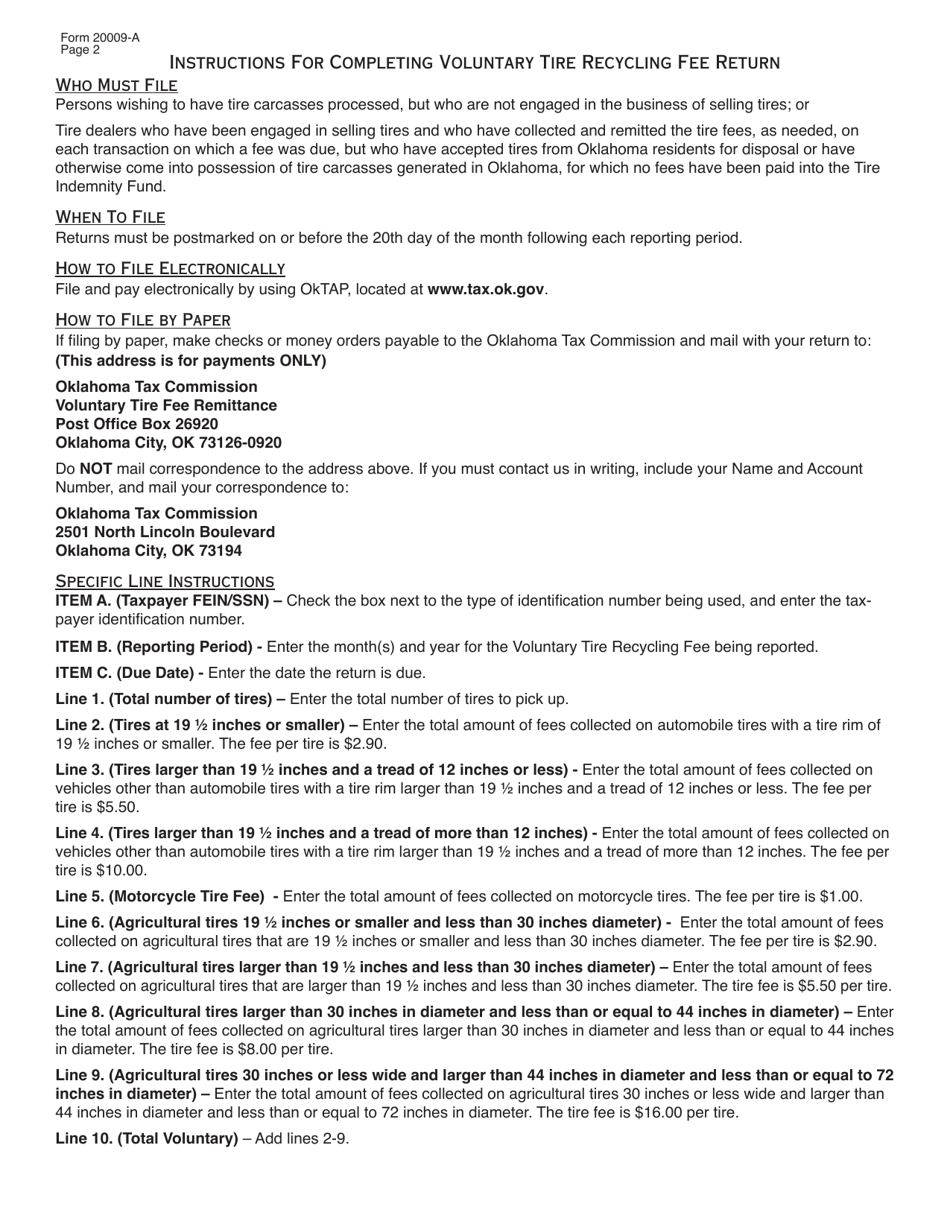

Q: Who needs to file the STW20009-A Voluntary Tire Recycling Fee Return?

A: Tire retailers, wholesalers, and manufacturers in Oklahoma need to file the STW20009-A Voluntary Tire Recycling Fee Return.

Q: What is the purpose of the voluntary tire recycling fee?

A: The voluntary tire recycling fee is used to fund tire recycling programs and promote proper tire disposal in Oklahoma.

Q: When is the deadline for filing the STW20009-A Voluntary Tire Recycling Fee Return?

A: The deadline for filing the STW20009-A Voluntary Tire Recycling Fee Return is generally the last day of the month following the reporting period.

Q: Are there any penalties for late or non-filing of the STW20009-A Voluntary Tire Recycling Fee Return?

A: Yes, there are penalties for late or non-filing of the STW20009-A Voluntary Tire Recycling Fee Return, including late payment fees and interest charges.

Q: Can I claim a refund of the voluntary tire recycling fee?

A: No, the voluntary tire recycling fee is non-refundable.

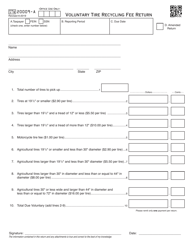

Q: What information do I need to provide on the STW20009-A Voluntary Tire Recycling Fee Return?

A: The STW20009-A Voluntary Tire Recycling Fee Return requires information such as the total number of tires sold or manufactured, the amount of voluntary fee collected, and the total amount remitted.

Q: Is there a minimum threshold for filing the STW20009-A Voluntary Tire Recycling Fee Return?

A: Yes, tire retailers and wholesalers who sell or distribute less than 50 tires annually are exempt from filing the STW20009-A Voluntary Tire Recycling Fee Return.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STW20009-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.