This version of the form is not currently in use and is provided for reference only. Download this version of

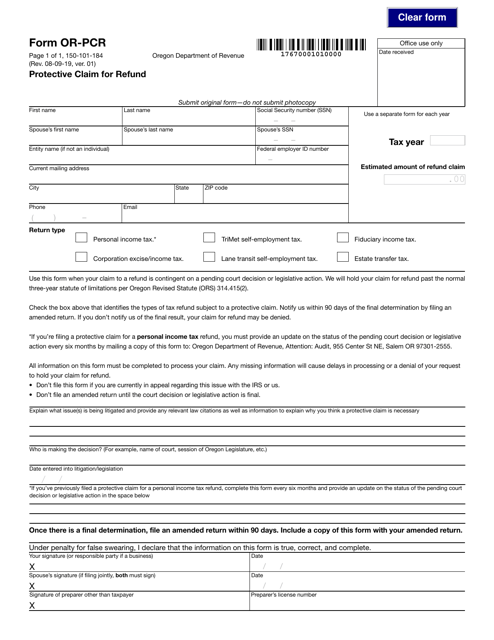

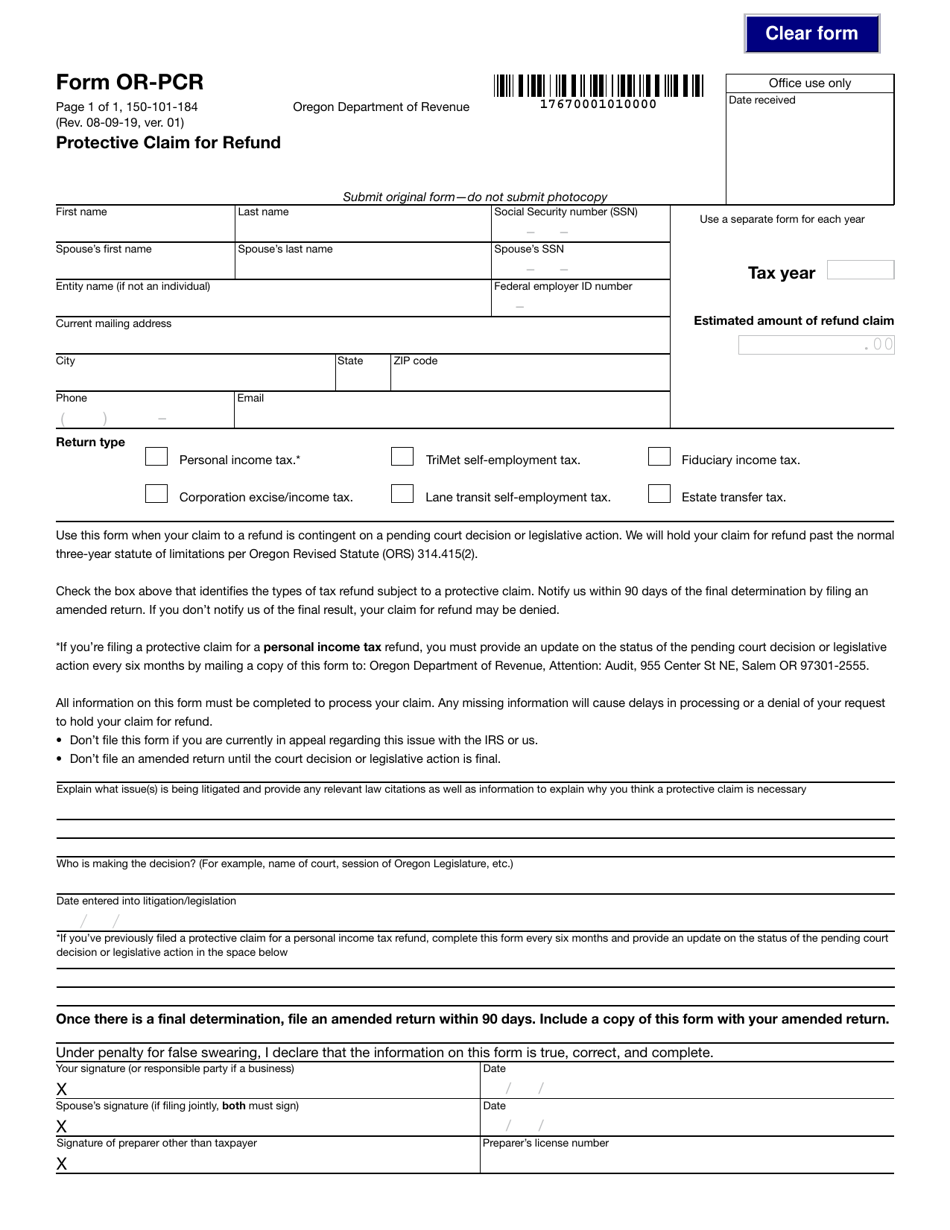

Form OR-PCR (150-101-184)

for the current year.

Form OR-PCR (150-101-184) Protective Claim for Refund - Oregon

What Is Form OR-PCR (150-101-184)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-PCR?

A: Form OR-PCR is the Protective Claim for Refund form for the state of Oregon.

Q: What is a Protective Claim for Refund?

A: A Protective Claim for Refund is a claim filed to protect your right to a refund of tax in case the amount you claimed on your original tax return is denied or reduced.

Q: When should I use Form OR-PCR?

A: You should use Form OR-PCR when you want to protect your potential refund by filing a claim with the Oregon Department of Revenue.

Q: What information is required on Form OR-PCR?

A: Form OR-PCR requires your personal information, the type of tax, the amount of overpayment, and an explanation of why you believe you are entitled to a refund.

Q: Is there a deadline for filing Form OR-PCR?

A: Yes, Form OR-PCR must be filed within the time limits specified by Oregon tax law. Consult the instructions or contact the Oregon Department of Revenue for the specific deadline.

Form Details:

- Released on August 9, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-PCR (150-101-184) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.