This version of the form is not currently in use and is provided for reference only. Download this version of

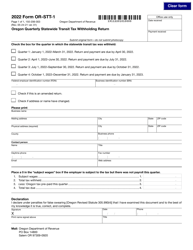

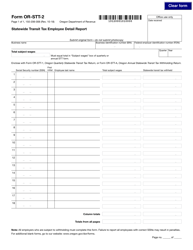

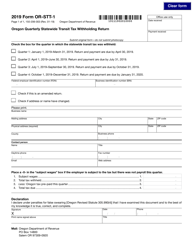

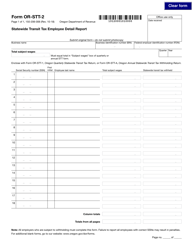

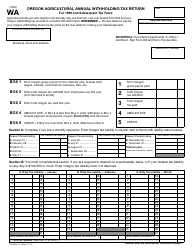

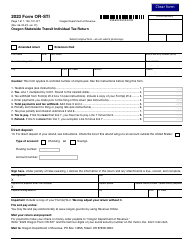

Form OR-STT-A (150-206-001)

for the current year.

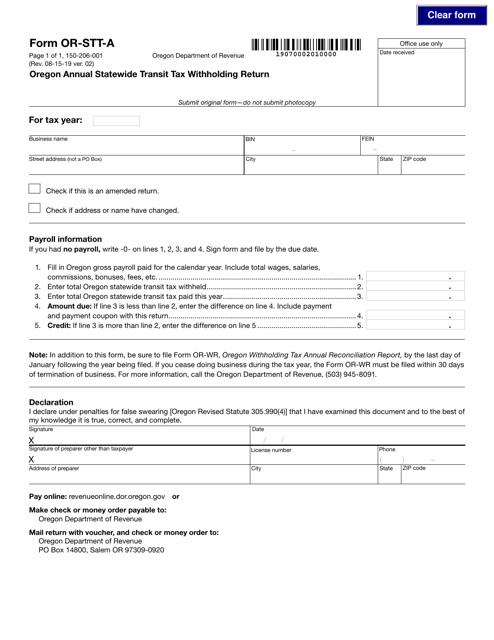

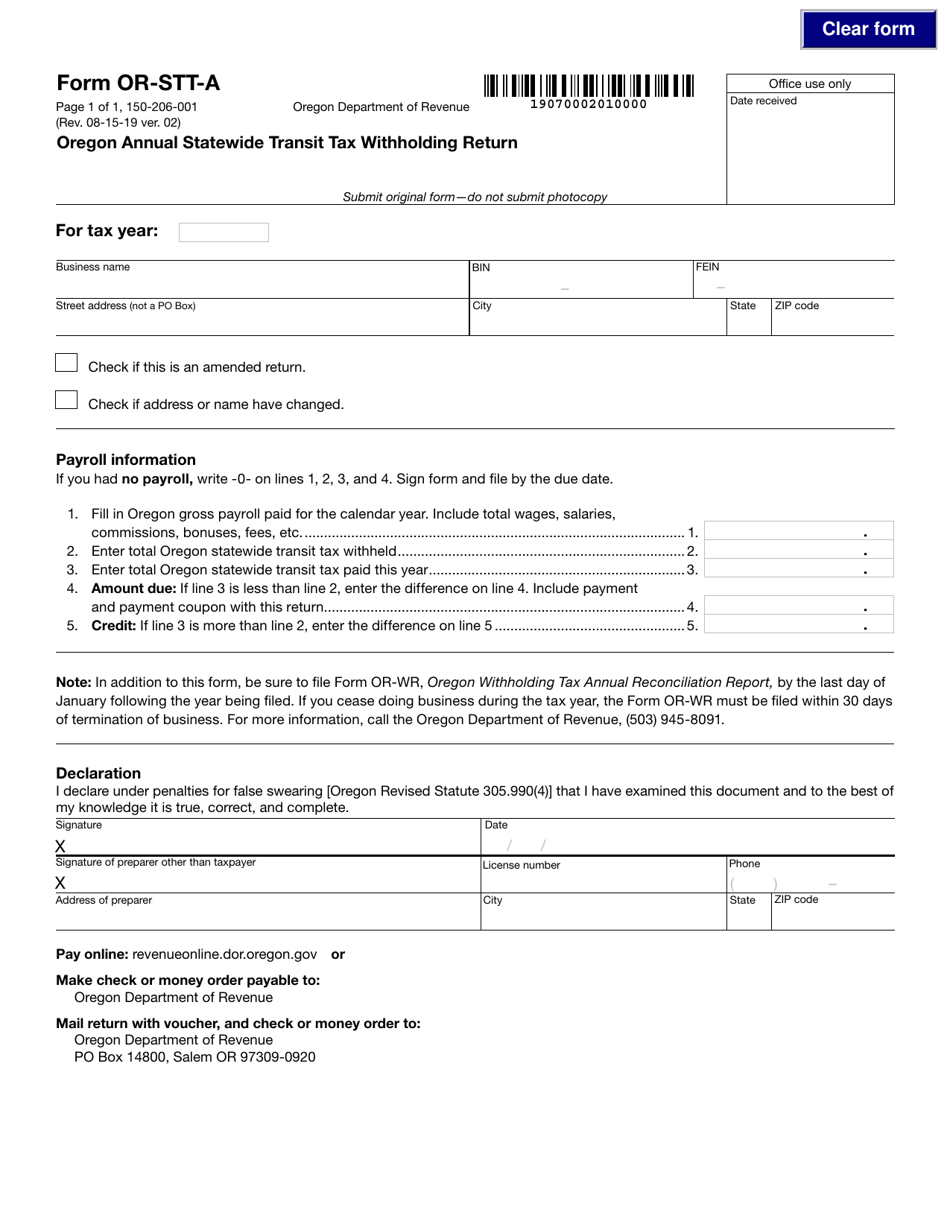

Form OR-STT-A (150-206-001) Oregon Annual Statewide Transit Tax Withholding Return - Oregon

What Is Form OR-STT-A (150-206-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-STT-A (150-206-001)?

A: OR-STT-A (150-206-001) refers to the Oregon Annual Statewide Transit Tax Withholding Return.

Q: What is the purpose of OR-STT-A (150-206-001)?

A: The purpose of OR-STT-A (150-206-001) is to report and remit the state transit tax withheld from employees' wages.

Q: Who needs to file OR-STT-A (150-206-001)?

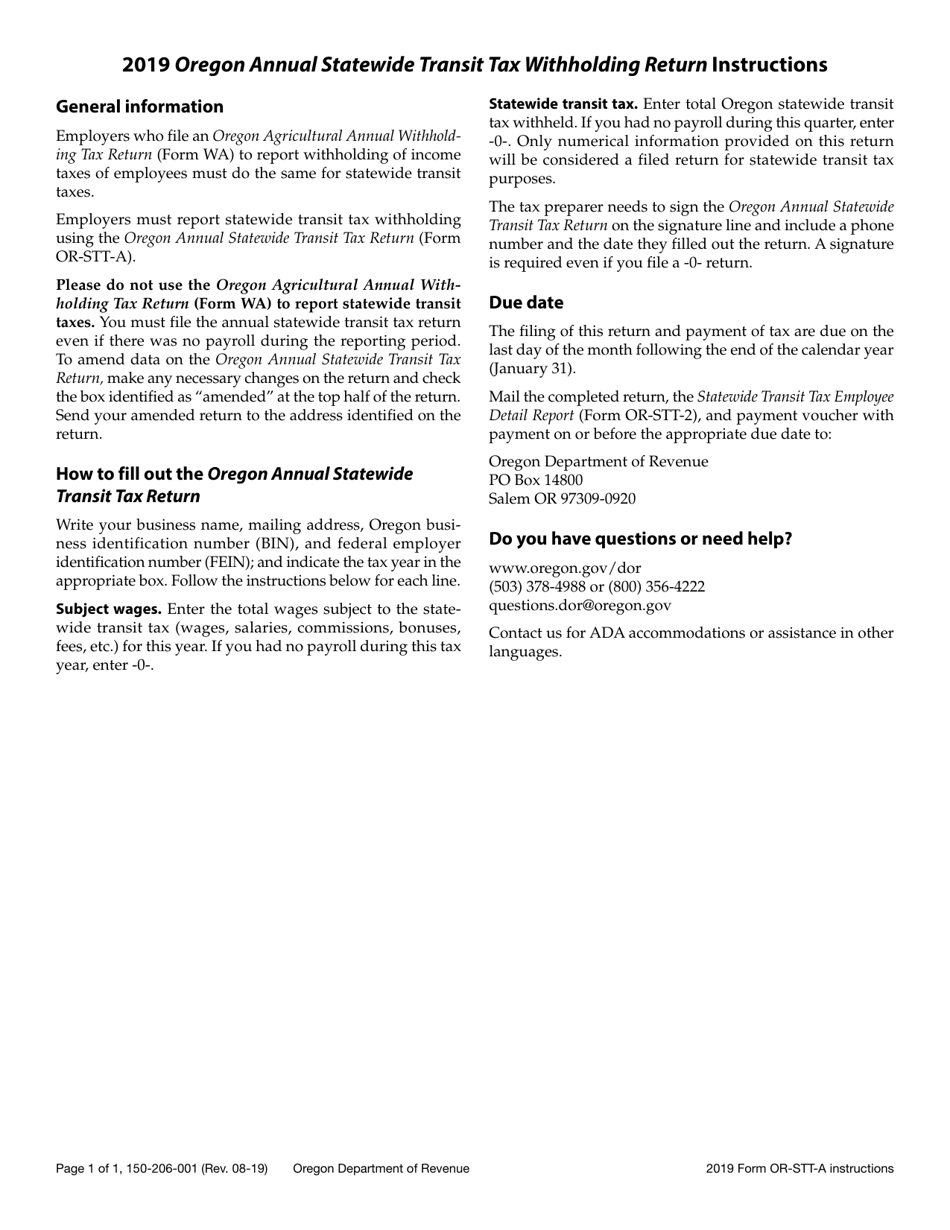

A: Employers who have employees subject to the Oregon Statewide Transit Tax are required to file OR-STT-A (150-206-001).

Q: When is OR-STT-A (150-206-001) due?

A: OR-STT-A (150-206-001) is due on or before the last day of the month following the end of each calendar quarter.

Q: Is OR-STT-A (150-206-001) only applicable to Oregon residents?

A: No, OR-STT-A (150-206-001) is applicable to employers who have employees subject to the Oregon Statewide Transit Tax, regardless of their residency.

Form Details:

- Released on August 15, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-STT-A (150-206-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.