This version of the form is not currently in use and is provided for reference only. Download this version of

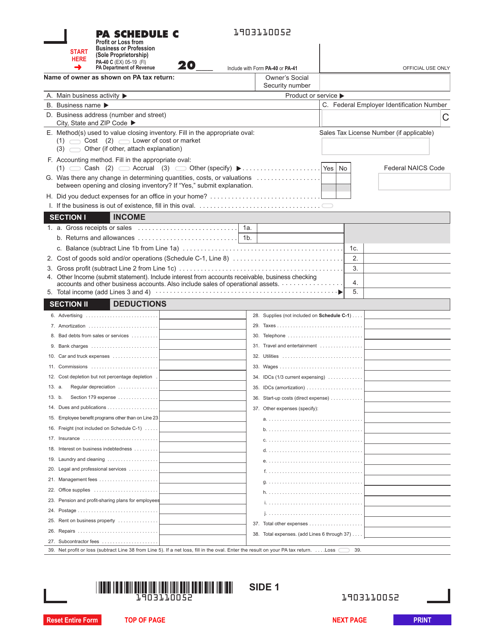

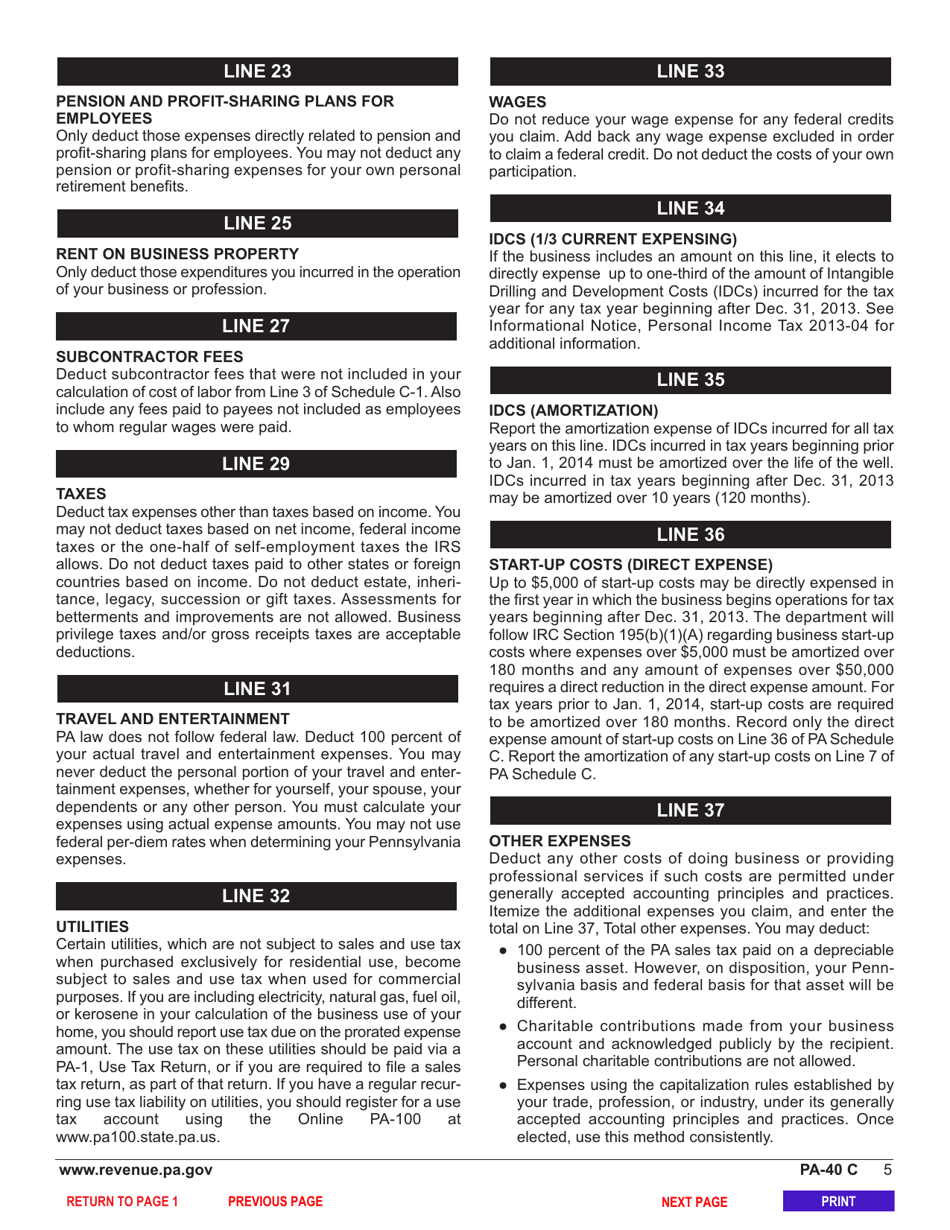

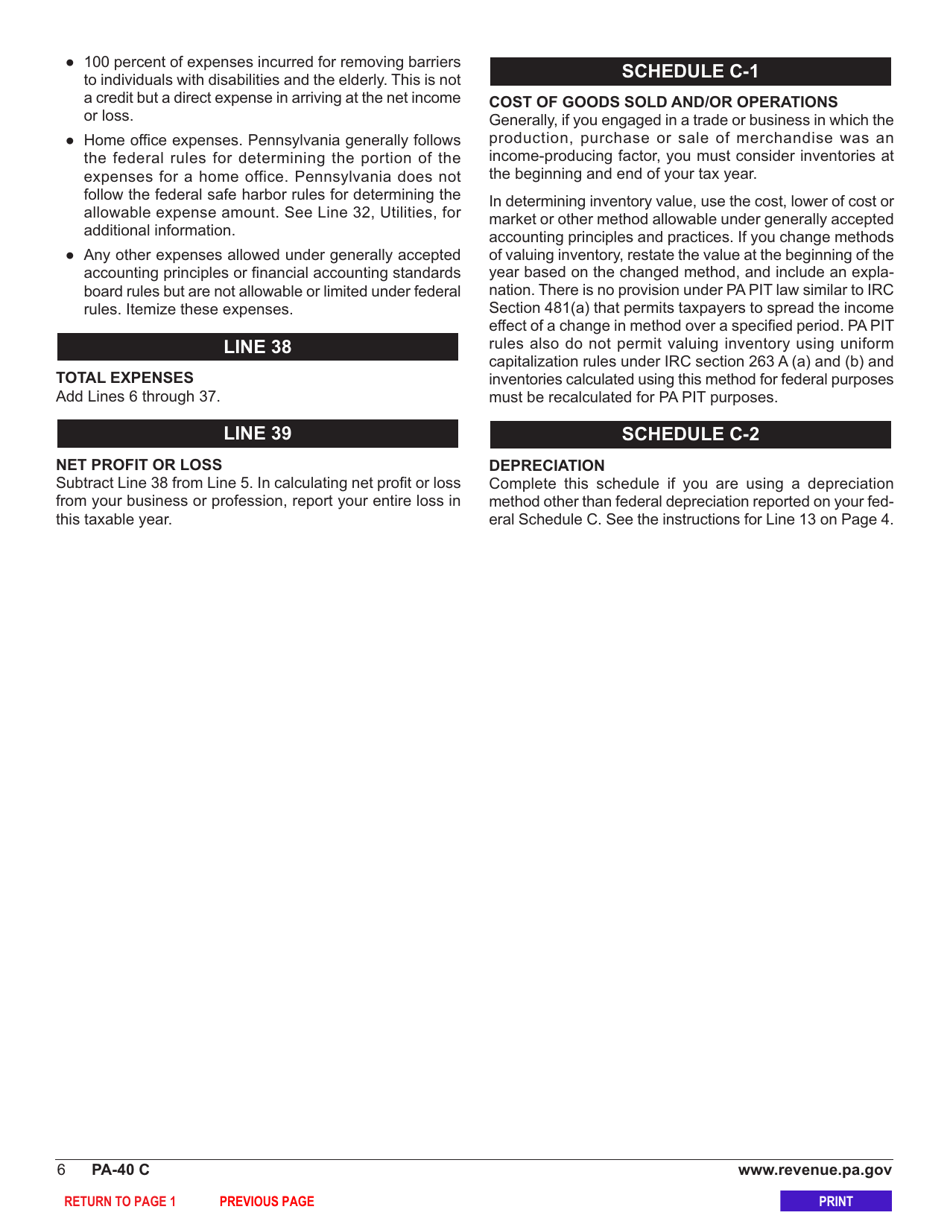

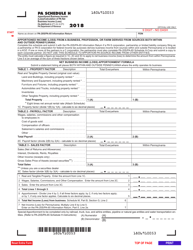

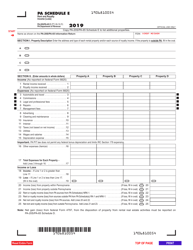

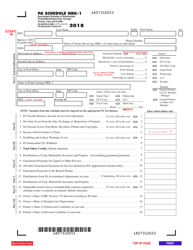

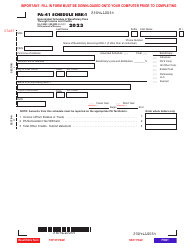

Form PA-40 Schedule C

for the current year.

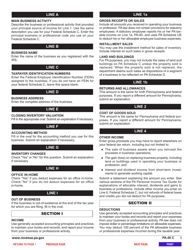

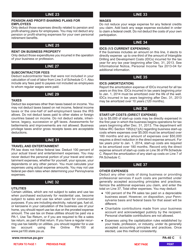

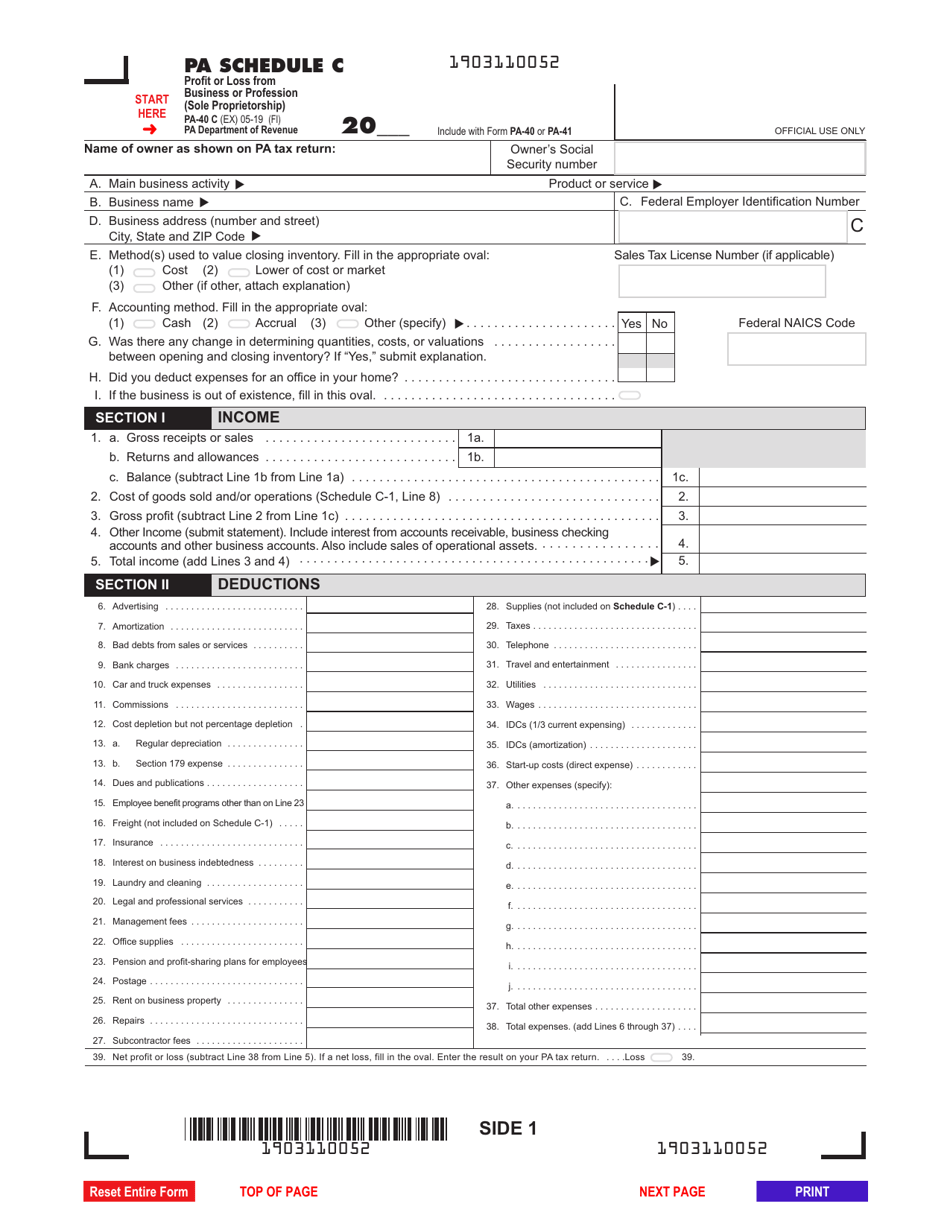

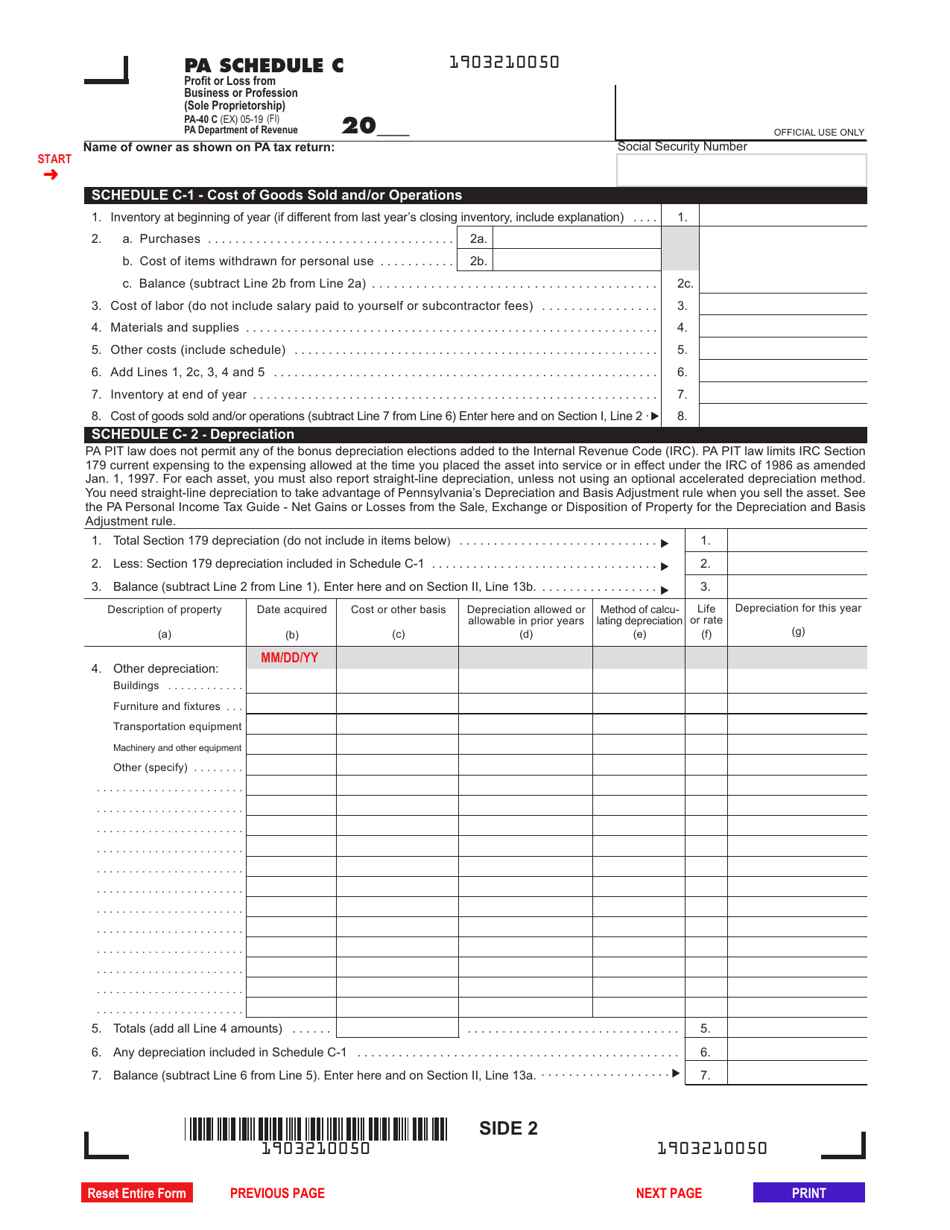

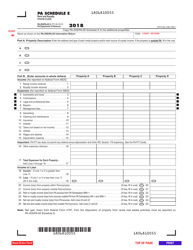

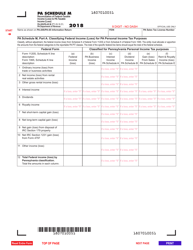

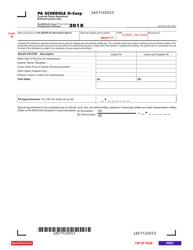

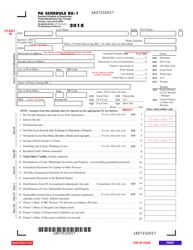

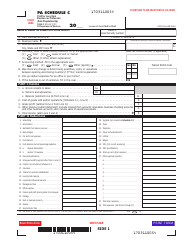

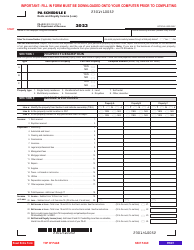

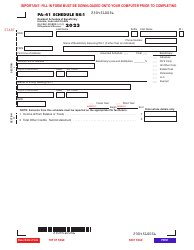

Form PA-40 Schedule C Profit or Loss From Business or Profession (Sole Proprietorship) - Pennsylvania

What Is Form PA-40 Schedule C?

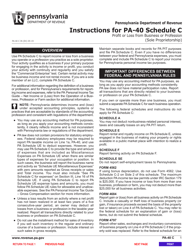

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule C?

A: Form PA-40 Schedule C is a tax form used in Pennsylvania to report the profit or loss from a sole proprietorship business or profession.

Q: Who needs to fill out Form PA-40 Schedule C?

A: Sole proprietors who operate a business or profession in Pennsylvania need to fill out Form PA-40 Schedule C.

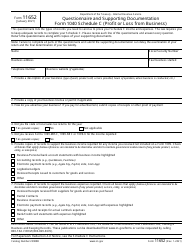

Q: What information is required on Form PA-40 Schedule C?

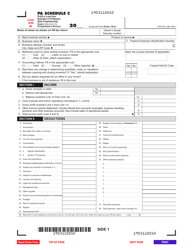

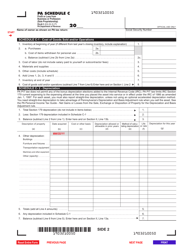

A: Form PA-40 Schedule C requires information about the business or profession, such as income, expenses, and deductions.

Q: How do I file Form PA-40 Schedule C?

A: Form PA-40 Schedule C is filed along with the Pennsylvania Personal Income Tax Return (Form PA-40).

Q: Is there a deadline for filing Form PA-40 Schedule C?

A: Form PA-40 Schedule C is due on the same date as the Pennsylvania Personal Income Tax Return (Form PA-40), which is typically April 15th.

Q: Are there any penalties for not filing Form PA-40 Schedule C?

A: Yes, failure to file Form PA-40 Schedule C or filing it late may result in penalties and interest charges.

Q: Can I deduct expenses on Form PA-40 Schedule C?

A: Yes, you can deduct ordinary and necessary business expenses on Form PA-40 Schedule C.

Q: What if I have multiple businesses or professions?

A: If you have multiple businesses or professions, you will need to file a separate Form PA-40 Schedule C for each.

Q: Do I need to include supporting documentation with Form PA-40 Schedule C?

A: You should keep records of your income and expenses, but you do not need to submit them with Form PA-40 Schedule C. However, you may be asked to provide them if the Pennsylvania Department of Revenue requests them.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.