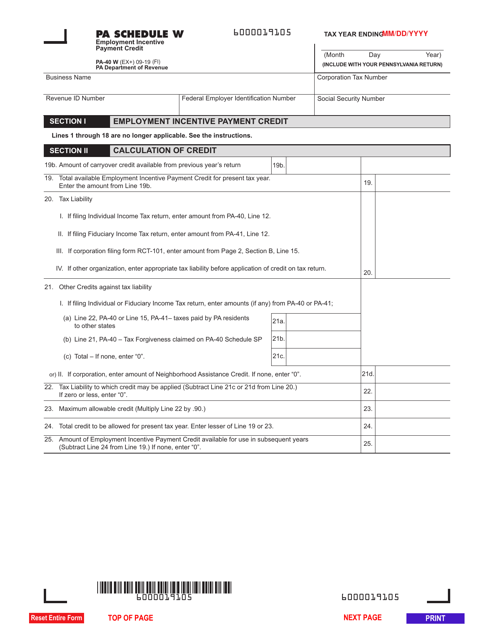

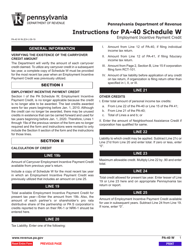

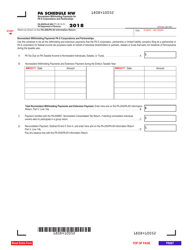

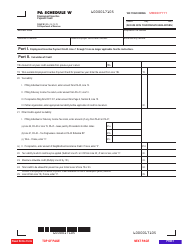

Form PA-40 Schedule W Employment Incentive Payment Credit - Pennsylvania

What Is Form PA-40 Schedule W?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule W?

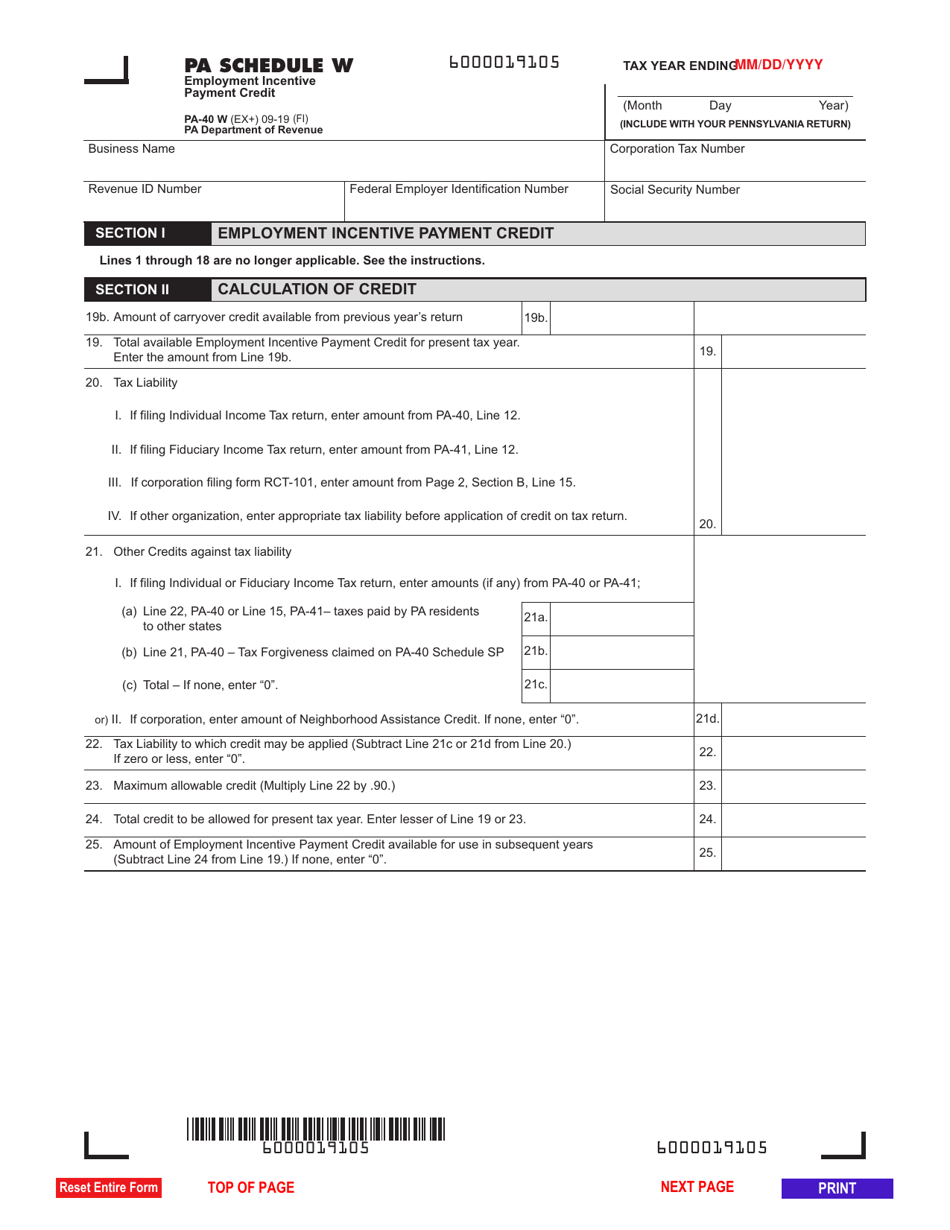

A: PA-40 Schedule W is a tax form used in Pennsylvania to claim the Employment Incentive Payment Credit.

Q: What is the Employment Incentive Payment Credit?

A: The Employment Incentive Payment Credit is a tax credit in Pennsylvania that provides an incentive for qualified businesses to create jobs.

Q: Who is eligible for the Employment Incentive Payment Credit?

A: Qualified businesses that create new, full-time jobs in Pennsylvania may be eligible for the Employment Incentive Payment Credit.

Q: How do I claim the Employment Incentive Payment Credit?

A: To claim the Employment Incentive Payment Credit, you need to complete and file PA-40 Schedule W along with your Pennsylvania tax return.

Q: What information do I need to complete PA-40 Schedule W?

A: You will need information about the new, full-time jobs created by your business, including the number of jobs and the amount of wages paid to employees.

Q: Is there a deadline to file PA-40 Schedule W?

A: PA-40 Schedule W must be filed along with your Pennsylvania tax return by the due date of the return.

Q: Can I claim the Employment Incentive Payment Credit for part-time jobs?

A: No, the Employment Incentive Payment Credit is only available for new, full-time jobs.

Q: What is the benefit of claiming the Employment Incentive Payment Credit?

A: By claiming the Employment Incentive Payment Credit, qualified businesses can reduce their Pennsylvania tax liability and potentially save money on their taxes.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule W by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.