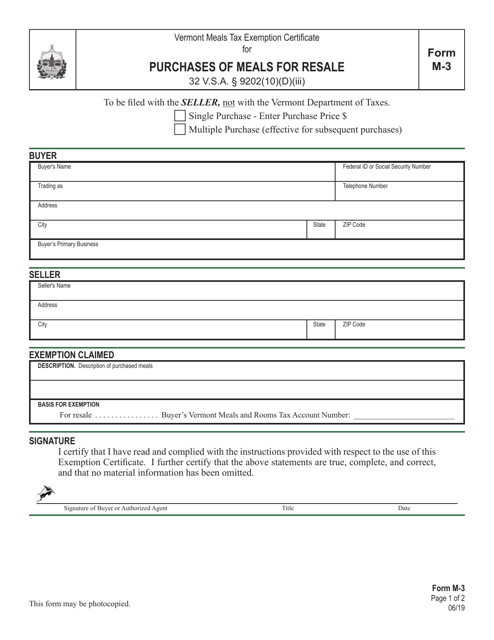

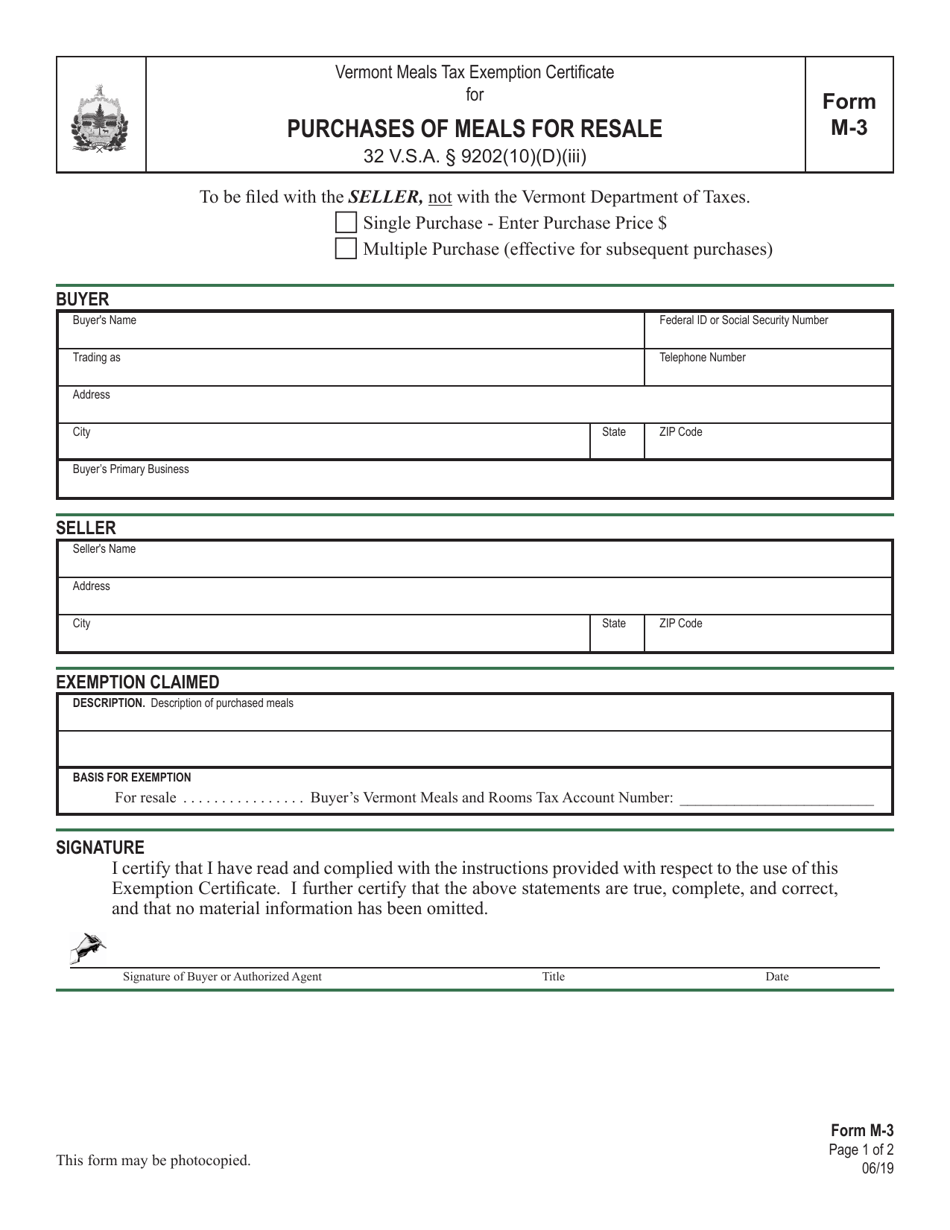

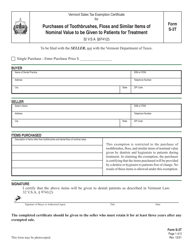

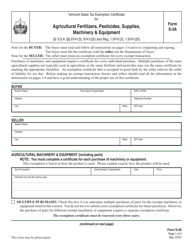

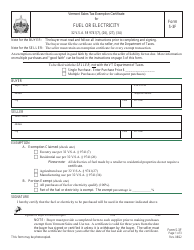

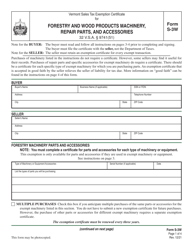

Form M-3 Vermont Meals Tax Exemption Certificate for Purchases of Meals for Resale - Vermont

What Is Form M-3?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-3?

A: Form M-3 is the Vermont Meals Tax Exemption Certificate for Purchases of Meals for Resale.

Q: Who can use Form M-3?

A: Businesses or individuals who purchase meals for resale in Vermont can use Form M-3.

Q: What is the purpose of Form M-3?

A: The purpose of Form M-3 is to claim an exemption from the Vermont Meals Tax for meals purchased for resale.

Q: How do I fill out Form M-3?

A: You must provide your business information, vendor information, and certify that the meals will be resold.

Q: Do I need to keep a copy of Form M-3?

A: Yes, you should keep a copy of Form M-3 for your records in case of an audit or verification.

Q: Are all meals exempt from the Vermont Meals Tax?

A: No, only meals purchased for resale are exempt from the Vermont Meals Tax.

Q: Can I use Form M-3 for personal meals?

A: No, Form M-3 is strictly for purchases of meals for resale, not for personal use.

Q: Is there a deadline for submitting Form M-3?

A: There is no specific deadline for submitting Form M-3, but it should be provided to the vendor at the time of purchase.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-3 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.