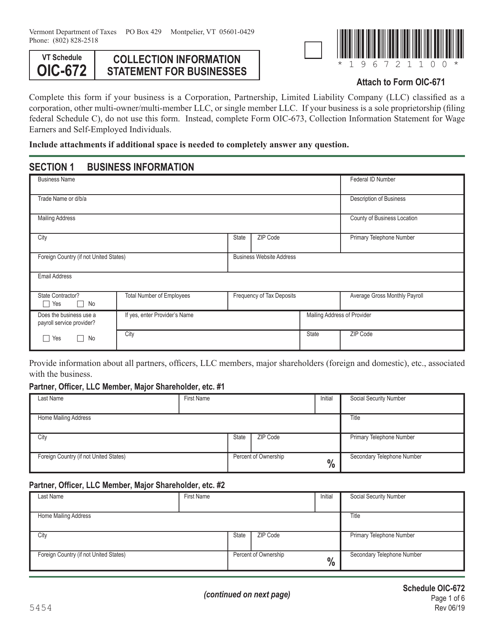

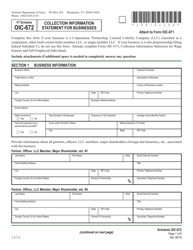

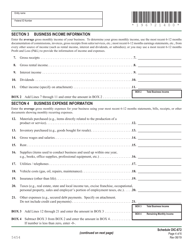

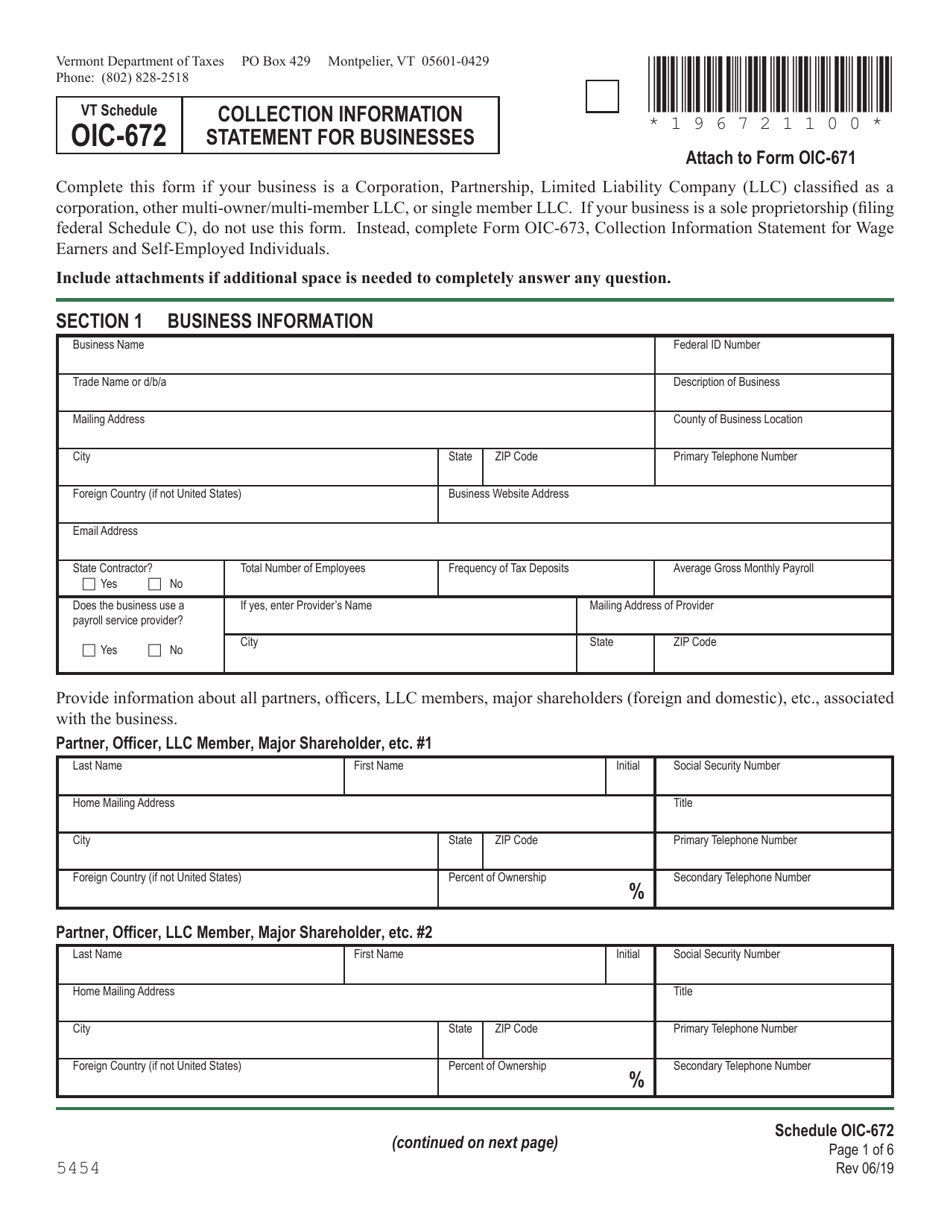

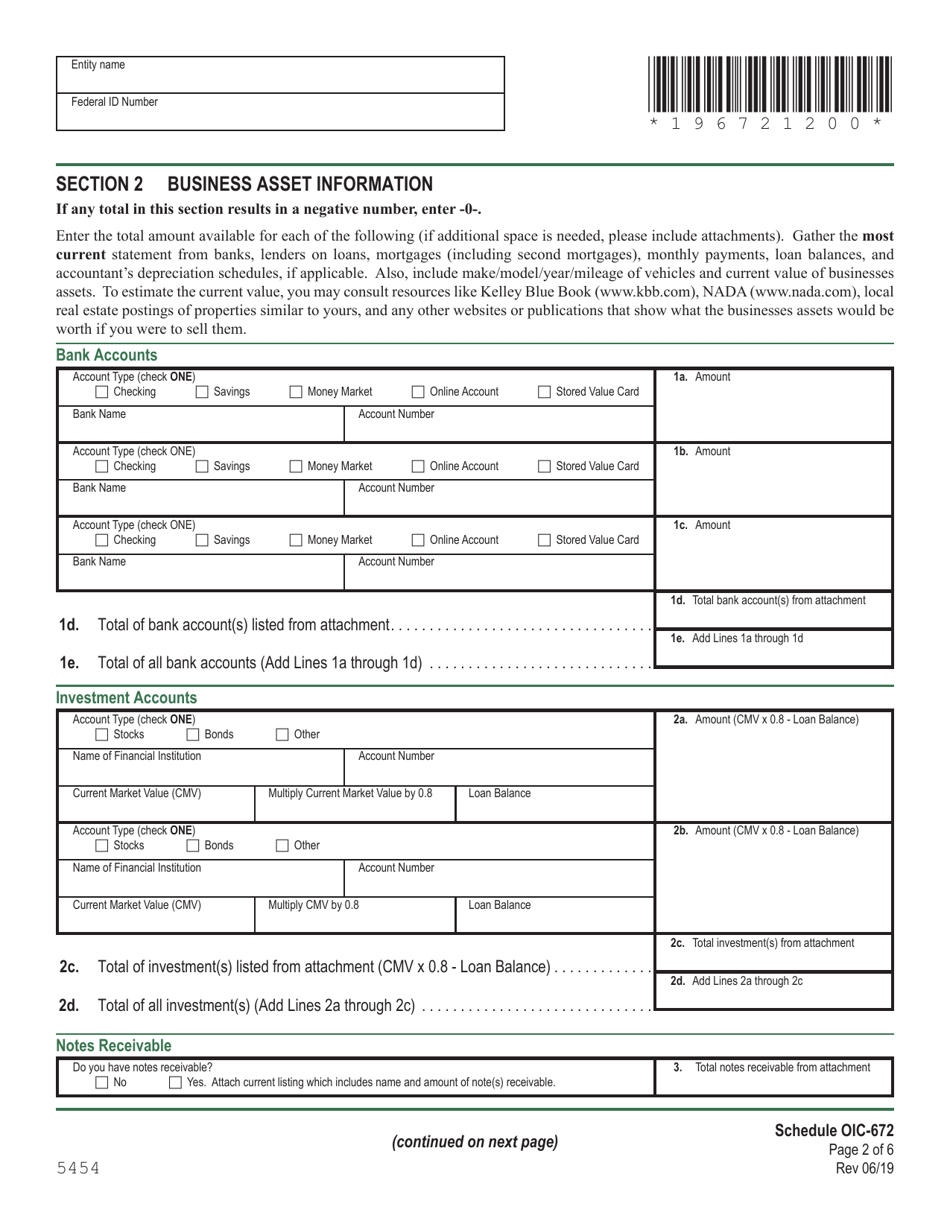

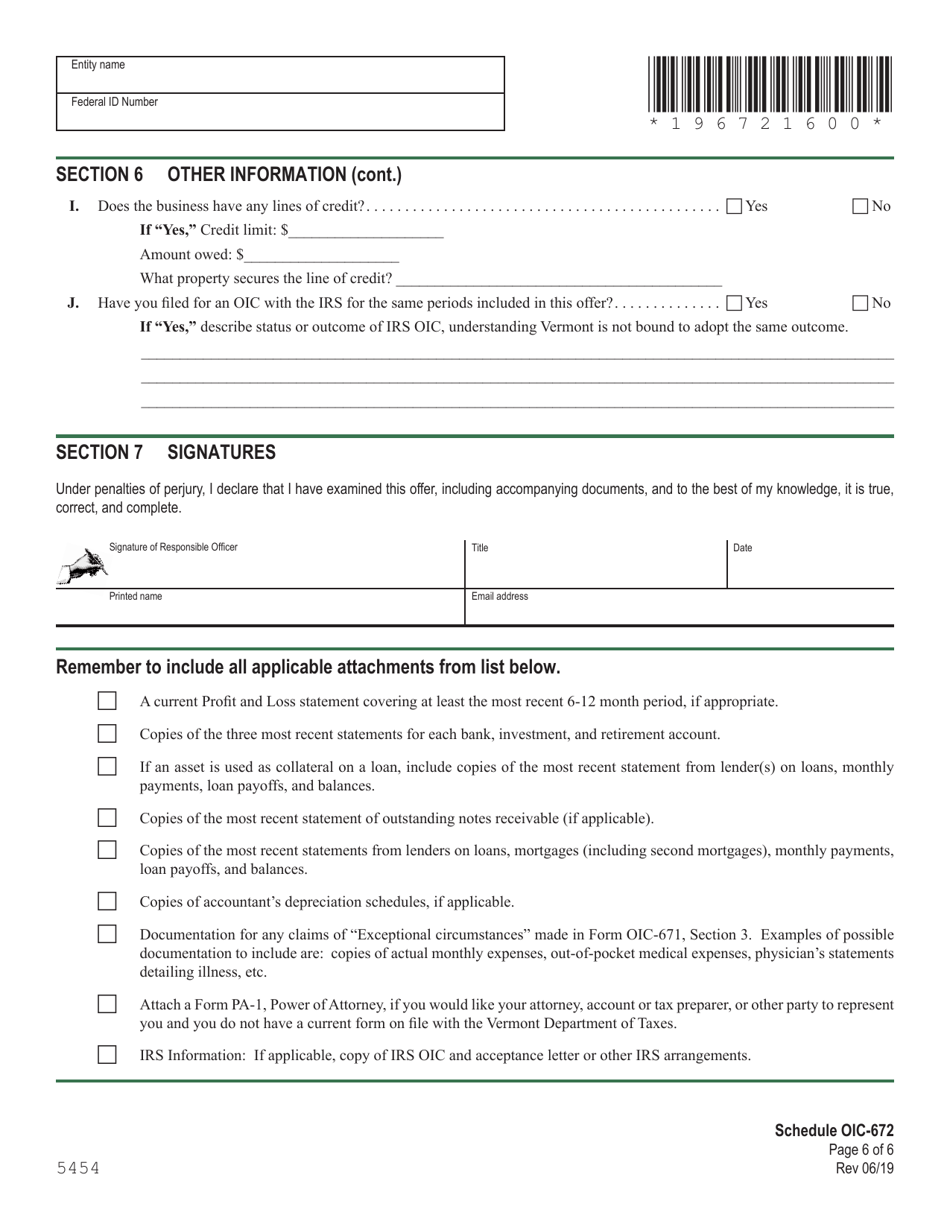

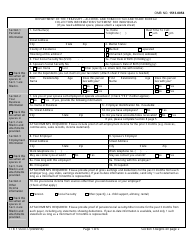

Schedule OIC-672 Collection Information Statement for Businesses - Vermont

What Is Schedule OIC-672?

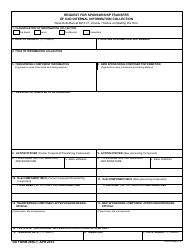

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule OIC-672?

A: Schedule OIC-672 is the Collection Information Statement for Businesses.

Q: Who uses Schedule OIC-672?

A: Businesses in Vermont use Schedule OIC-672.

Q: What is the purpose of Schedule OIC-672?

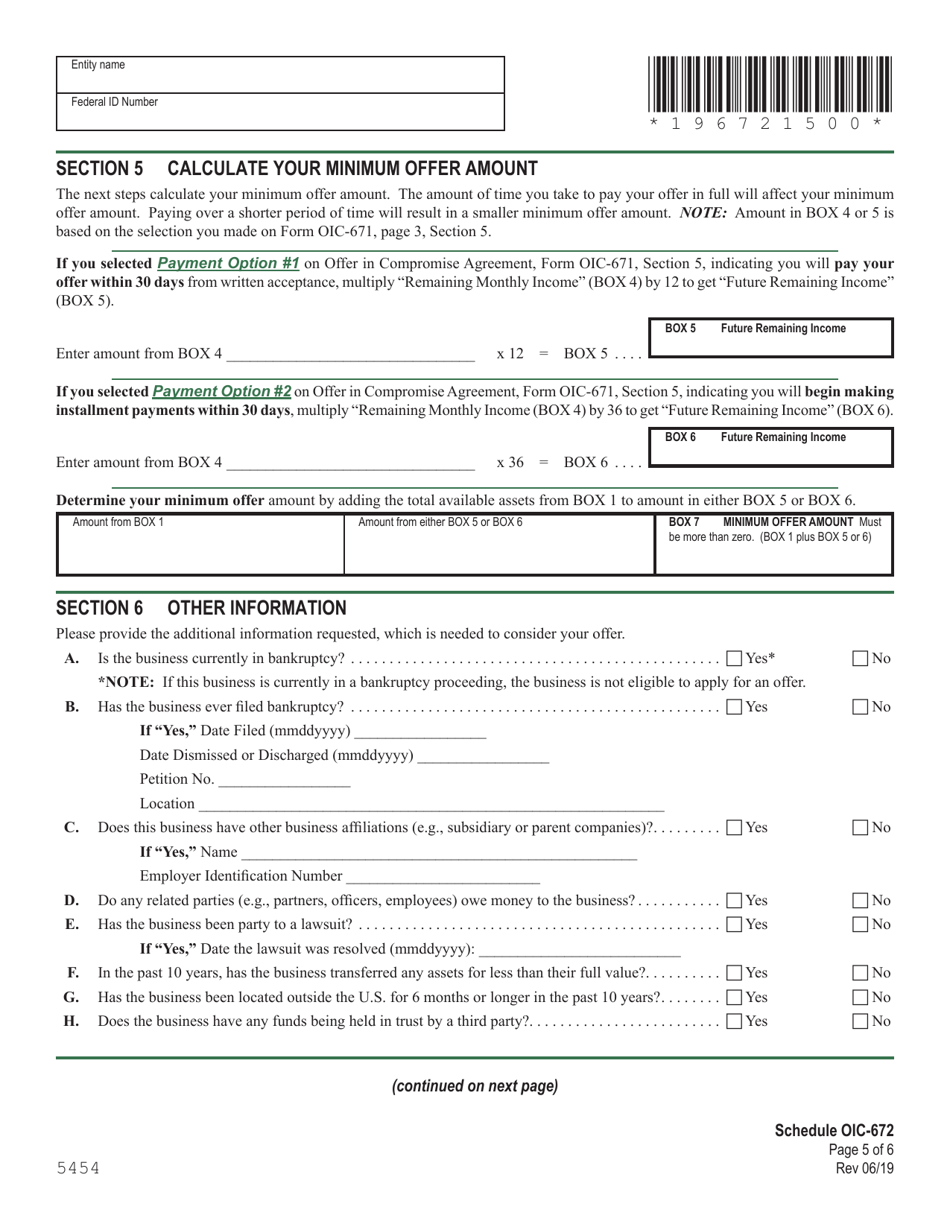

A: The purpose of Schedule OIC-672 is to provide detailed financial information about businesses in order to determine their ability to pay off their tax debt.

Q: Is Schedule OIC-672 specific to Vermont?

A: Yes, Schedule OIC-672 is specific to businesses in Vermont.

Q: Do all businesses in Vermont need to file Schedule OIC-672?

A: Not all businesses in Vermont need to file Schedule OIC-672. It is typically required for businesses with outstanding tax liabilities or those seeking a payment plan or offer in compromise.

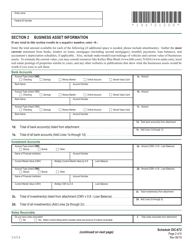

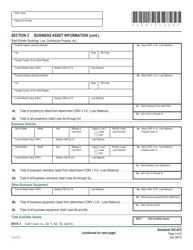

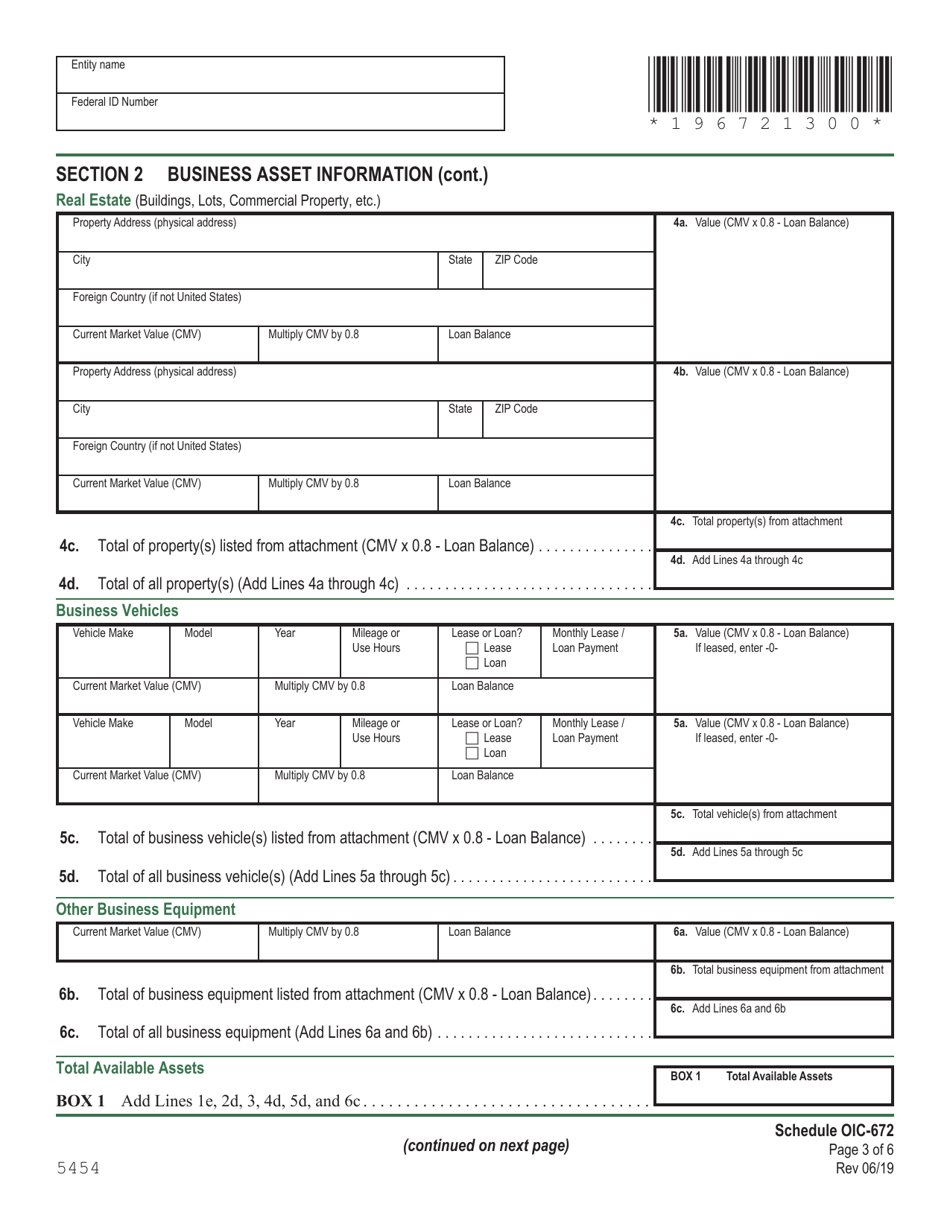

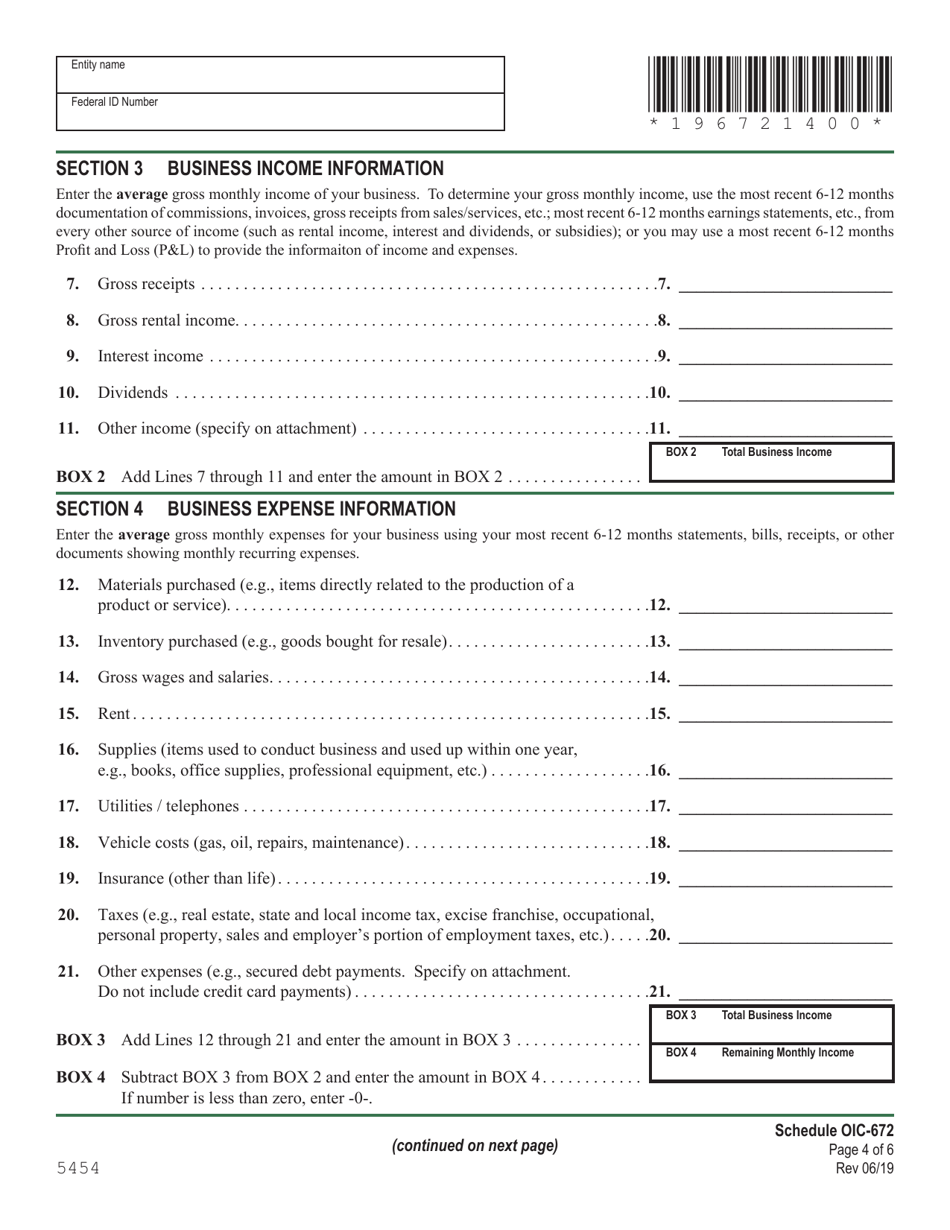

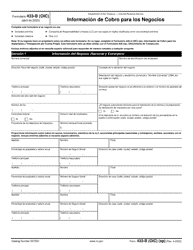

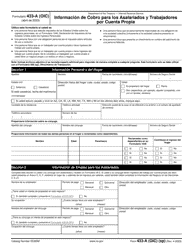

Q: What information is required on Schedule OIC-672?

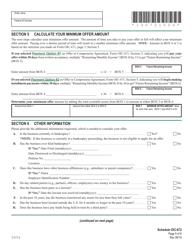

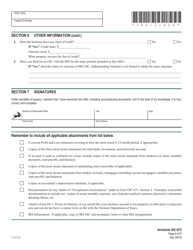

A: Schedule OIC-672 requires businesses to provide detailed financial information, including income, expenses, assets, and liabilities.

Q: What happens after filing Schedule OIC-672?

A: After filing Schedule OIC-672, the Vermont Department of Taxes will review the provided information to determine the feasibility of a proposed payment plan or offer in compromise.

Q: Are there any penalties for not filing Schedule OIC-672?

A: Failure to file Schedule OIC-672 when required can result in penalties imposed by the Vermont Department of Taxes.

Q: Can I request an extension to file Schedule OIC-672?

A: Yes, you can request an extension to file Schedule OIC-672. Contact the Vermont Department of Taxes for more information.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule OIC-672 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.