This version of the form is not currently in use and is provided for reference only. Download this version of

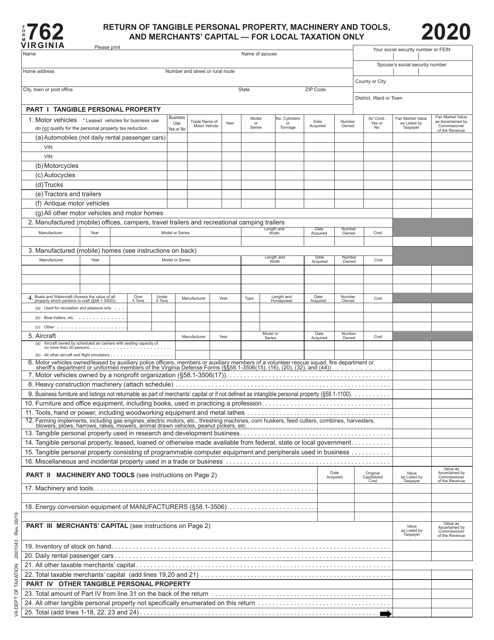

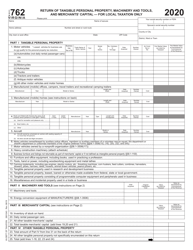

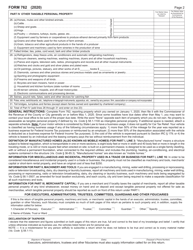

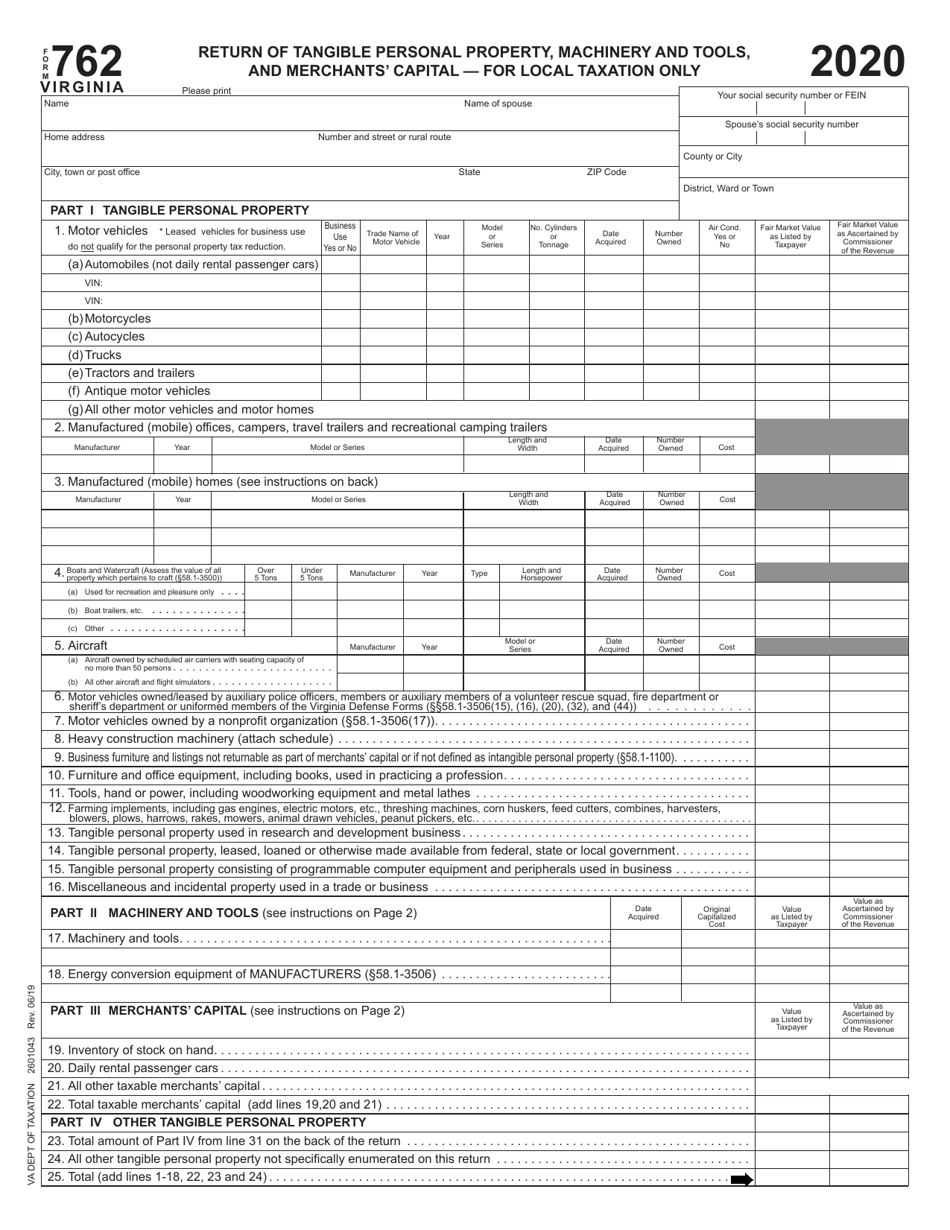

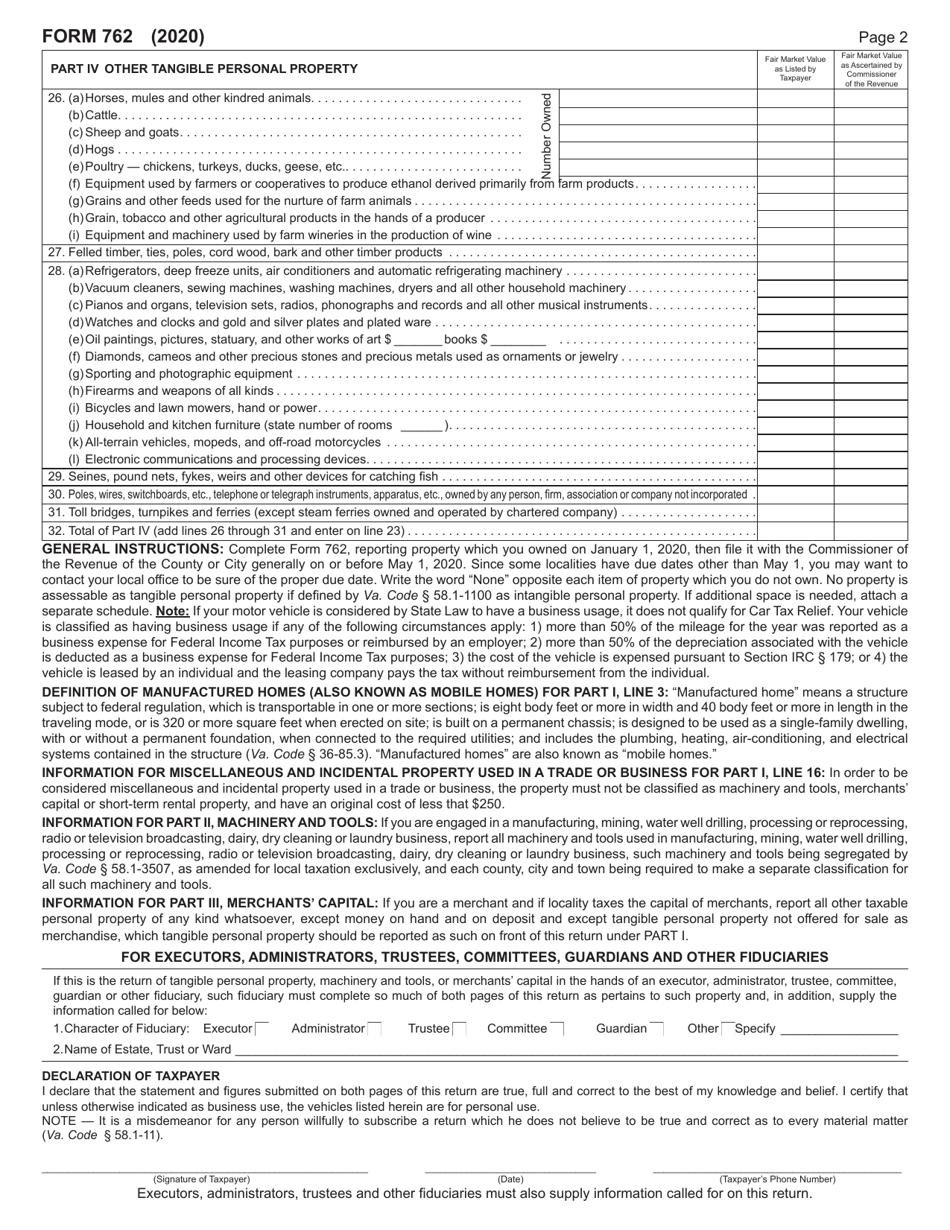

Form 762

for the current year.

Form 762 Return of Tangible Personal Property, Machinery and Tools, and Merchant's Capital - for Local Taxation Only - Virginia

What Is Form 762?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 762?

A: Form 762 is a tax return used in Virginia for reporting tangible personal property, machinery and tools, and merchant's capital for local taxation purposes.

Q: Who uses form 762?

A: Form 762 is used by businesses in Virginia to report their tangible personal property, machinery and tools, and merchant's capital for local tax purposes.

Q: What information is required on form 762?

A: Form 762 requires businesses to provide details about their tangible personal property, machinery and tools, and merchant's capital, including their cost, date of acquisition, and other related information.

Q: Is form 762 used for state or federal taxes?

A: No, form 762 is only used for local taxation in Virginia and is not related to state or federal taxes.

Q: When is form 762 due?

A: The due date for form 762 varies depending on the local tax jurisdiction. Business owners should consult their local tax authority for the specific deadline.

Q: Are there any penalties for not filing form 762?

A: Yes, failure to file form 762 or filing it late may result in penalties and interest charges imposed by the local tax authority.

Q: Can form 762 be filed electronically?

A: It depends on the specific local tax jurisdiction. Some jurisdictions may allow electronic filing, while others may require paper filing. Business owners should check with their local tax authority for their preferred filing method.

Q: What if I have questions or need assistance with form 762?

A: If you have questions or need assistance with form 762, you should contact your local tax authority or seek guidance from a tax professional familiar with Virginia local taxation regulations.

Q: Is form 762 applicable in other states besides Virginia?

A: No, form 762 is specific to Virginia and is not used for local taxation in other states.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 762 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.