This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule A

for the current year.

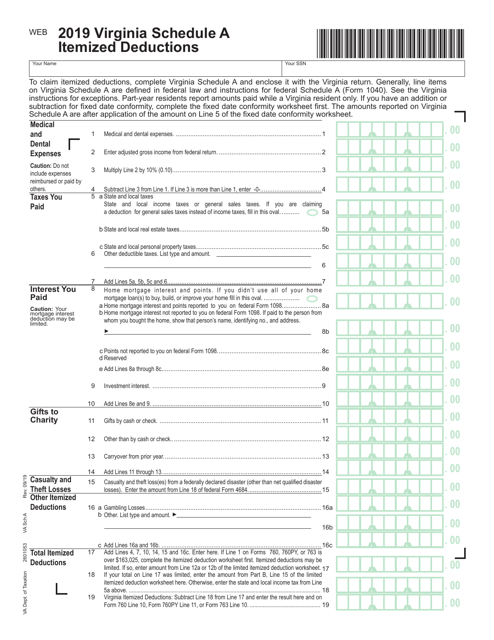

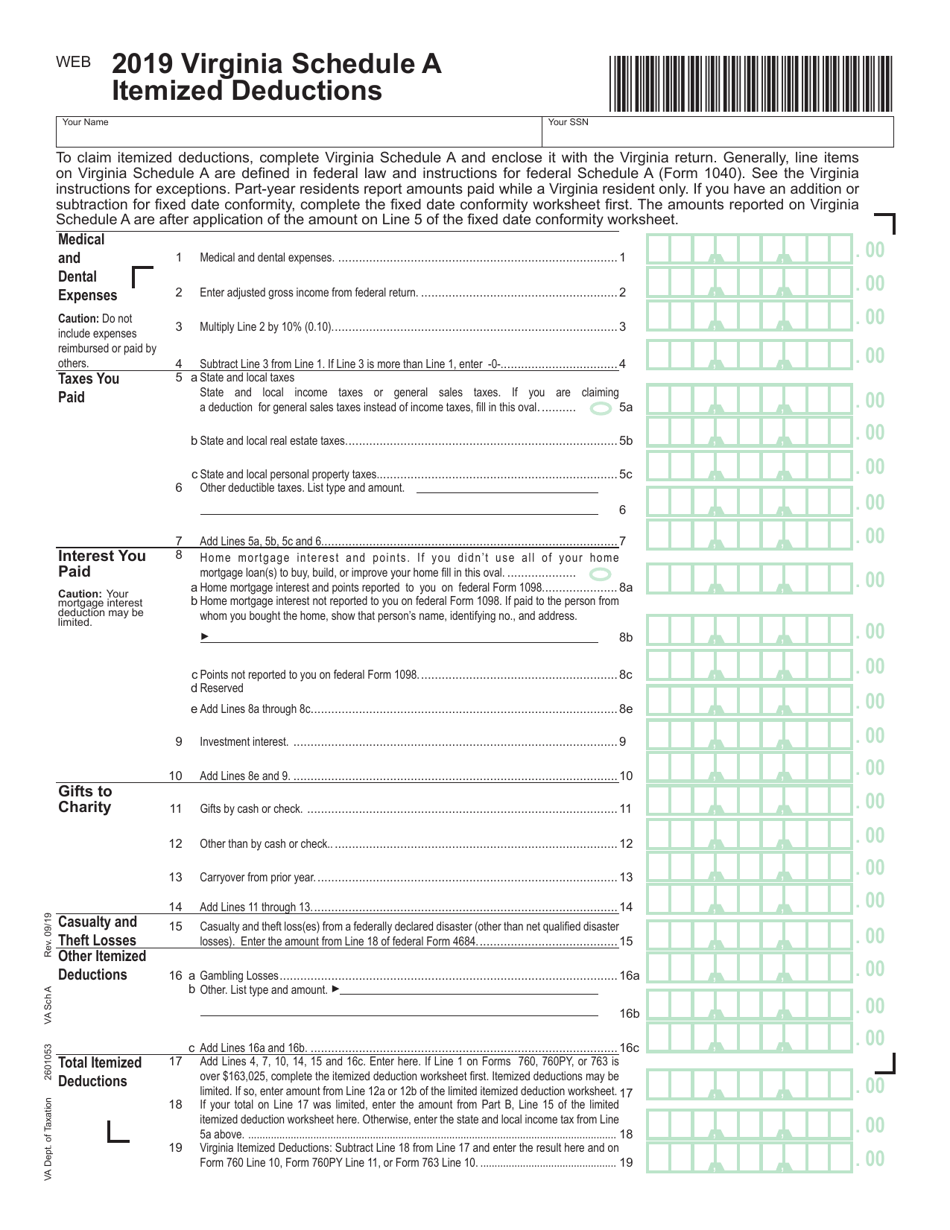

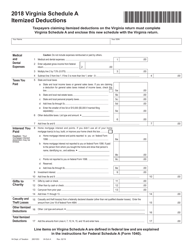

Schedule A Itemized Deductions - Virginia

What Is Schedule A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What are Schedule A itemized deductions?

A: Schedule A itemized deductions are expenses that individuals can deduct from their taxable income to reduce their overall tax liability.

Q: What types of expenses can be claimed as itemized deductions on Schedule A?

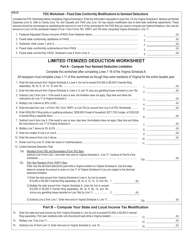

A: Some common types of expenses that can be claimed as itemized deductions on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: Can I claim Schedule A itemized deductions in Virginia?

A: Yes, Virginia taxpayers can claim Schedule A itemized deductions on their state income tax return if they also claimed itemized deductions on their federal tax return.

Q: What is the standard deduction in Virginia?

A: For the tax year 2021, the standard deduction for individuals in Virginia is $4,500 for single filers and married individuals filing separately, and $9,000 for married couples filing jointly and heads o f household.

Q: Do I need to keep records of my Schedule A itemized deductions?

A: Yes, it is important to keep records of your Schedule A itemized deductions in case you are audited by the IRS. This includes keeping receipts, invoices, and other documentation to support your claimed expenses.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.