This version of the form is not currently in use and is provided for reference only. Download this version of

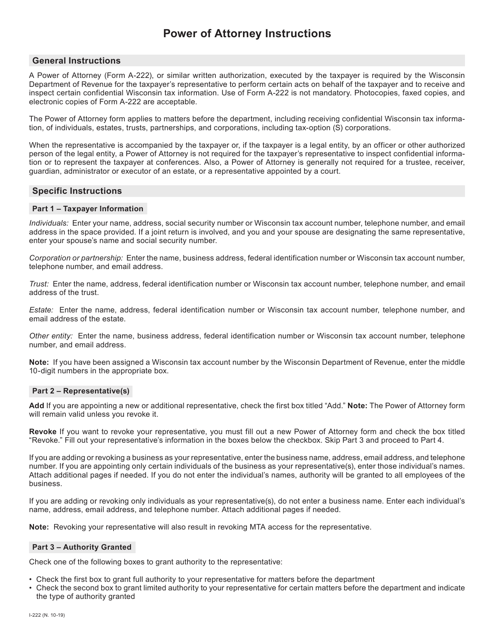

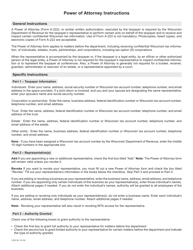

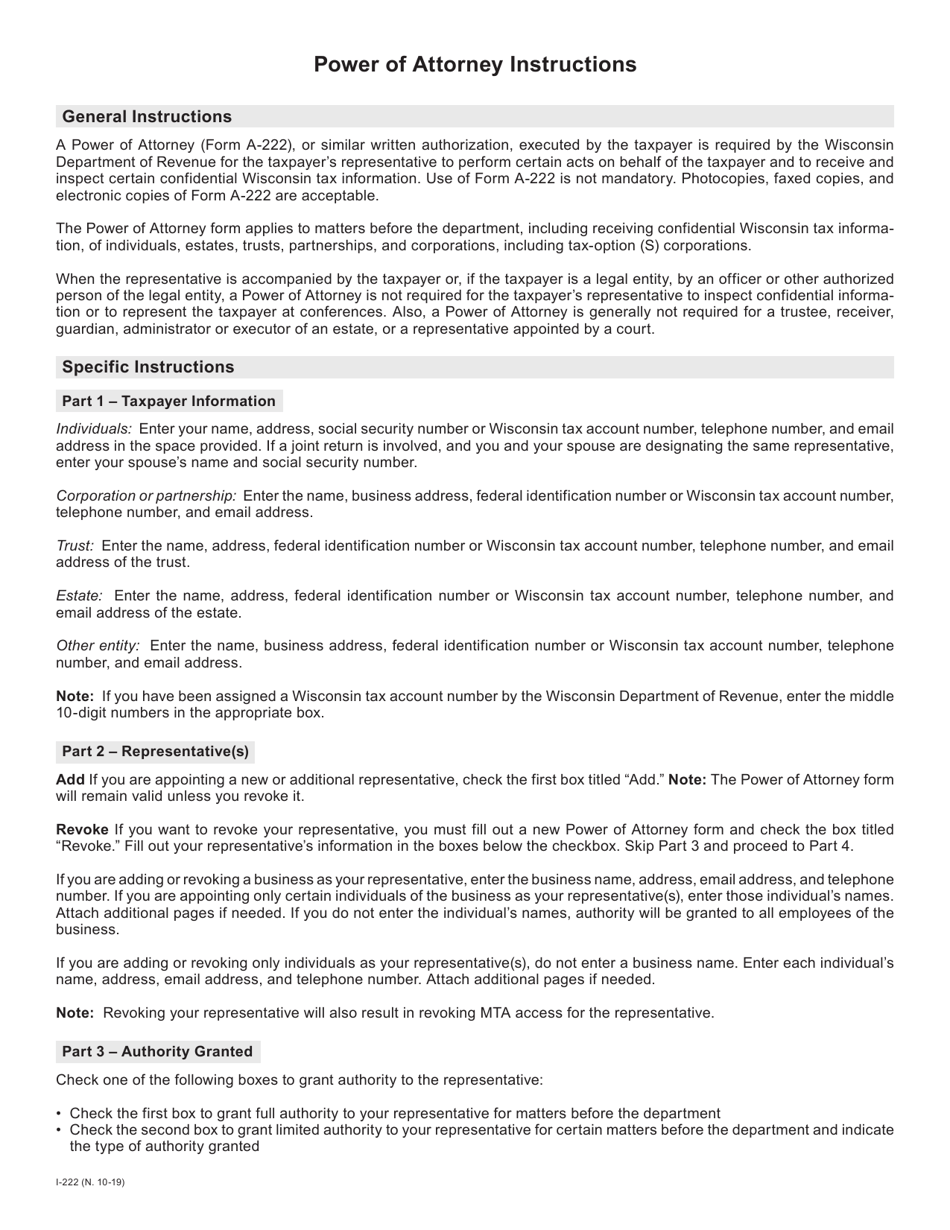

Instructions for Form A-222

for the current year.

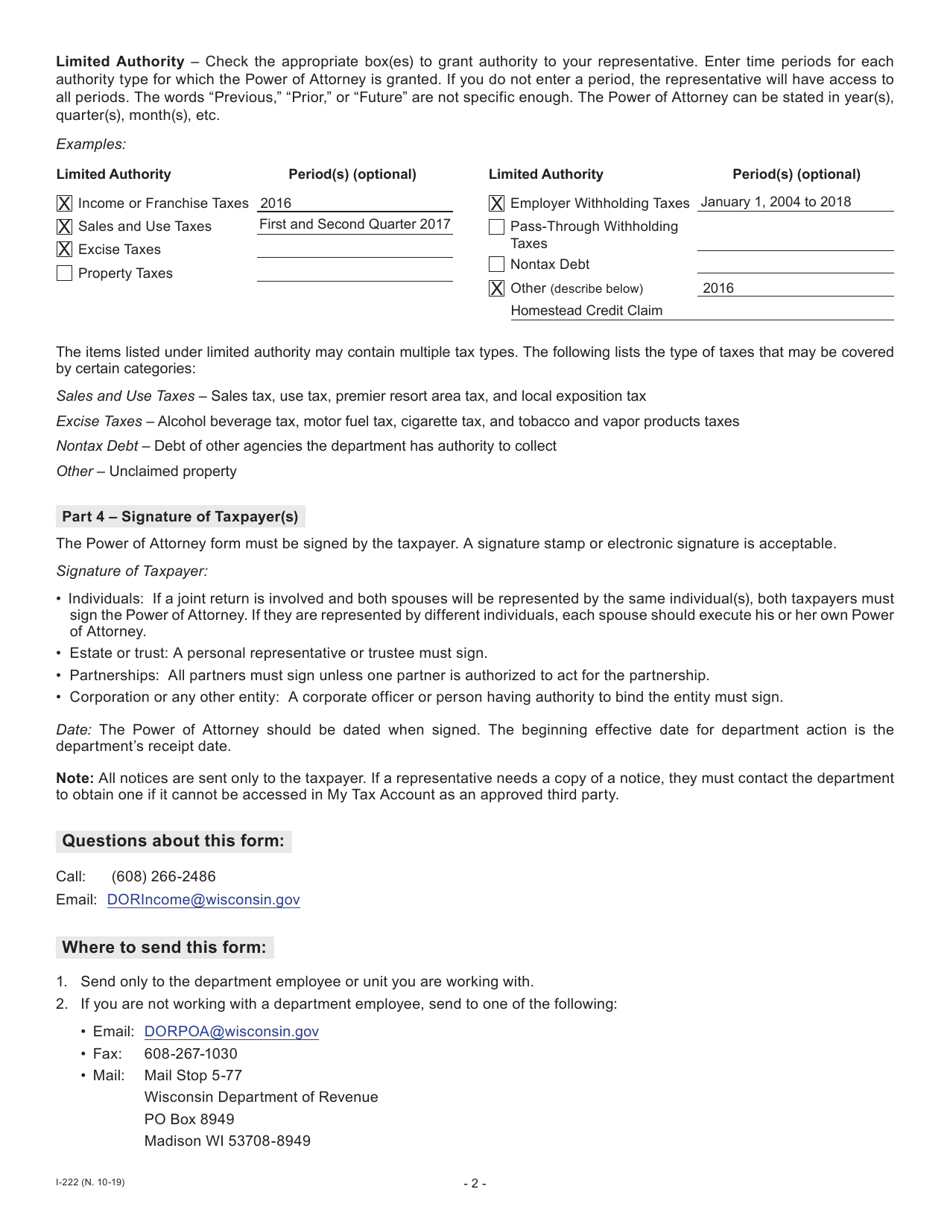

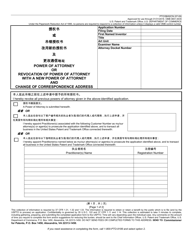

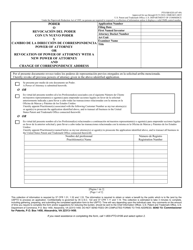

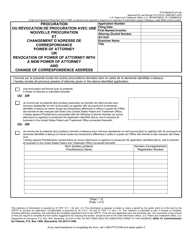

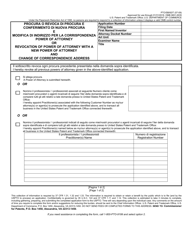

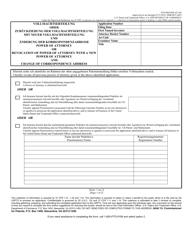

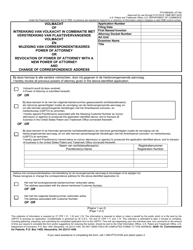

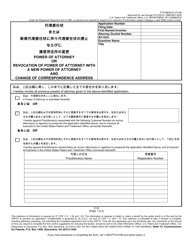

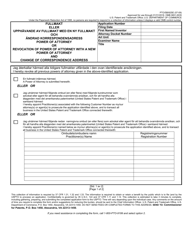

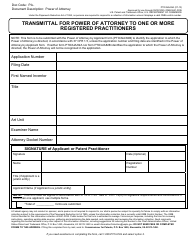

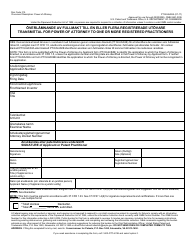

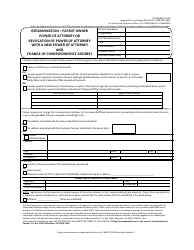

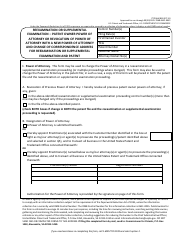

Instructions for Form A-222 Power of Attorney - Wisconsin

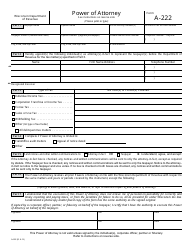

This document contains official instructions for Form A-222 , Power of Attorney - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form A-222 is available for download through this link.

FAQ

Q: What is Form A-222 Power of Attorney?

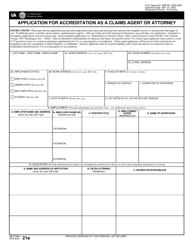

A: Form A-222 Power of Attorney is a legal document that allows an individual (the principal) to appoint someone else (the agent) to act on their behalf in legal matters within the state of Wisconsin.

Q: What is the purpose of Form A-222 Power of Attorney?

A: The purpose of Form A-222 Power of Attorney is to authorize another person to handle your tax matters or any other specific financial transactions on your behalf.

Q: Who can use Form A-222 Power of Attorney?

A: Any individual residing in Wisconsin who wants to appoint someone else to act as their agent in legal matters can use Form A-222 Power of Attorney.

Q: Is Form A-222 Power of Attorney specific to Wisconsin?

A: Yes, Form A-222 Power of Attorney is specific to the state of Wisconsin and cannot be used for legal matters outside of Wisconsin.

Q: Are there any fees associated with Form A-222 Power of Attorney?

A: No, there are no fees associated with Form A-222 Power of Attorney.

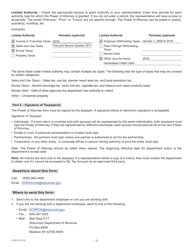

Q: What should I do after completing Form A-222 Power of Attorney?

A: After completing Form A-222 Power of Attorney, you should sign the form in the presence of a notary public and provide a copy to your appointed agent.

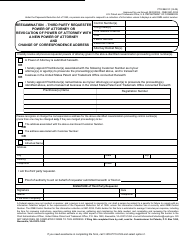

Q: Can I revoke or cancel Form A-222 Power of Attorney?

A: Yes, you can revoke or cancel Form A-222 Power of Attorney at any time by completing a revocation form and notifying your appointed agent.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.