This version of the form is not currently in use and is provided for reference only. Download this version of

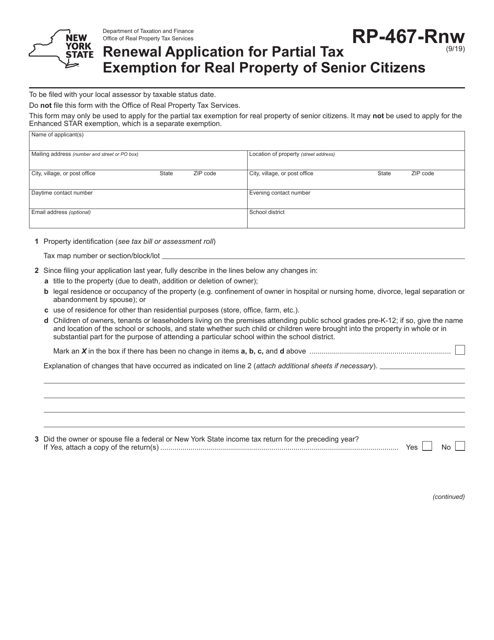

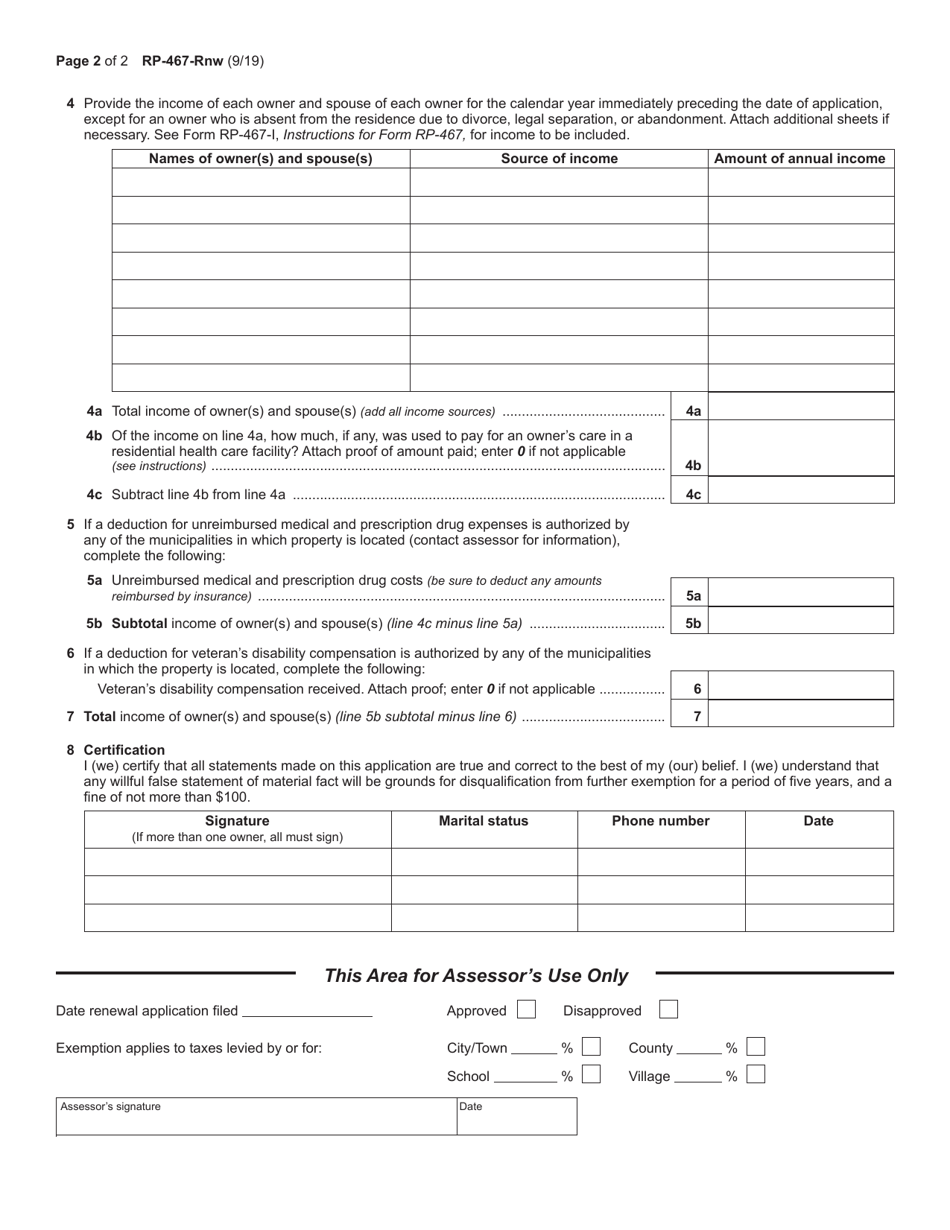

Form RP-467-RNW

for the current year.

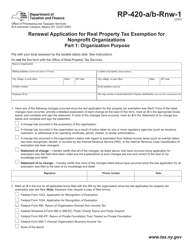

Form RP-467-RNW Renewal Application for Partial Tax Exemption for Real Property of Senior Citizens - New York

What Is Form RP-467-RNW?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-467-RNW?

A: Form RP-467-RNW is the Renewal Application for Partial Tax Exemption for Real Property of Senior Citizens in New York.

Q: Who is eligible for the partial tax exemption?

A: Senior citizens who meet certain criteria are eligible for the partial tax exemption.

Q: How do I renew the partial tax exemption?

A: To renew the partial tax exemption, you need to fill out and submit Form RP-467-RNW.

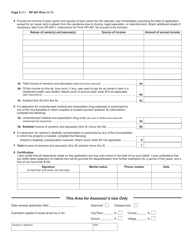

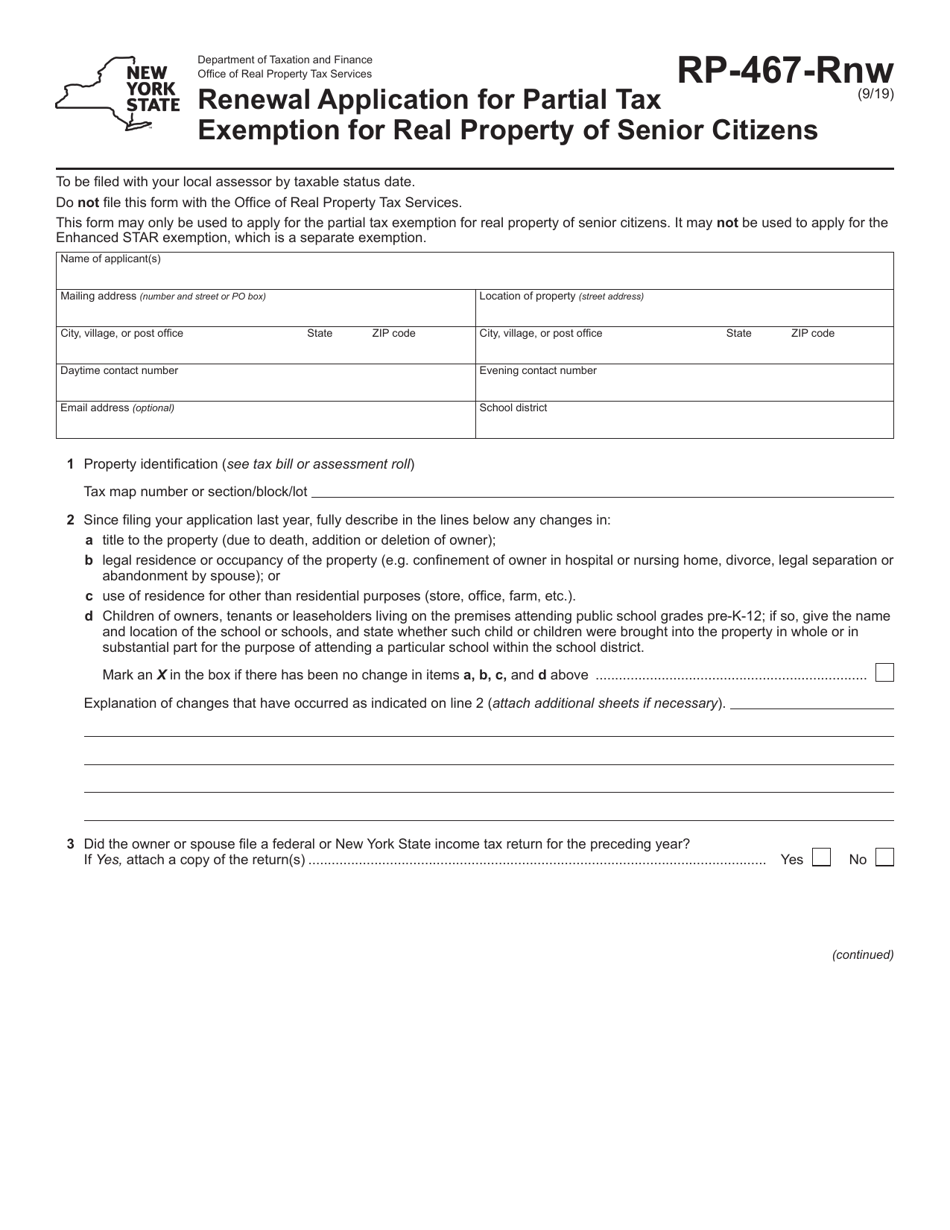

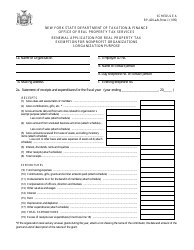

Q: What information do I need to provide on the form?

A: You will need to provide your personal information, property details, and income information on the form.

Q: What is the deadline for renewing the partial tax exemption?

A: The deadline for renewing the partial tax exemption is usually on or before the taxable status date in your municipality.

Q: What happens if I don't renew the partial tax exemption?

A: If you don't renew the partial tax exemption, you may lose the tax benefits associated with it.

Q: Can I get assistance in filling out the form?

A: Yes, you can seek assistance from the New York State Department of Taxation and Finance or a qualified tax professional.

Q: Is there a fee for renewing the partial tax exemption?

A: There is no fee for renewing the partial tax exemption.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-RNW by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.