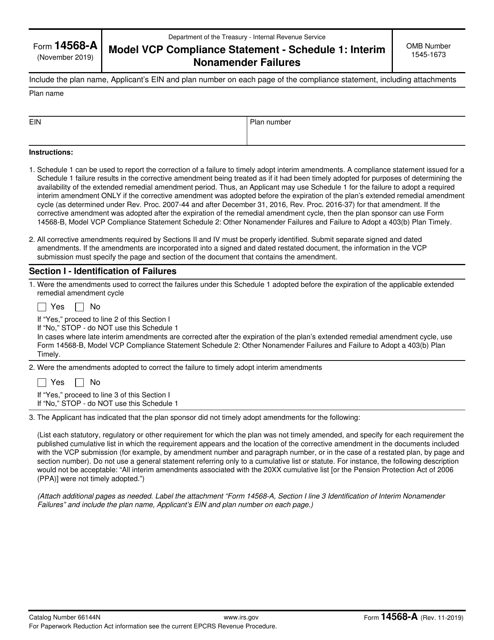

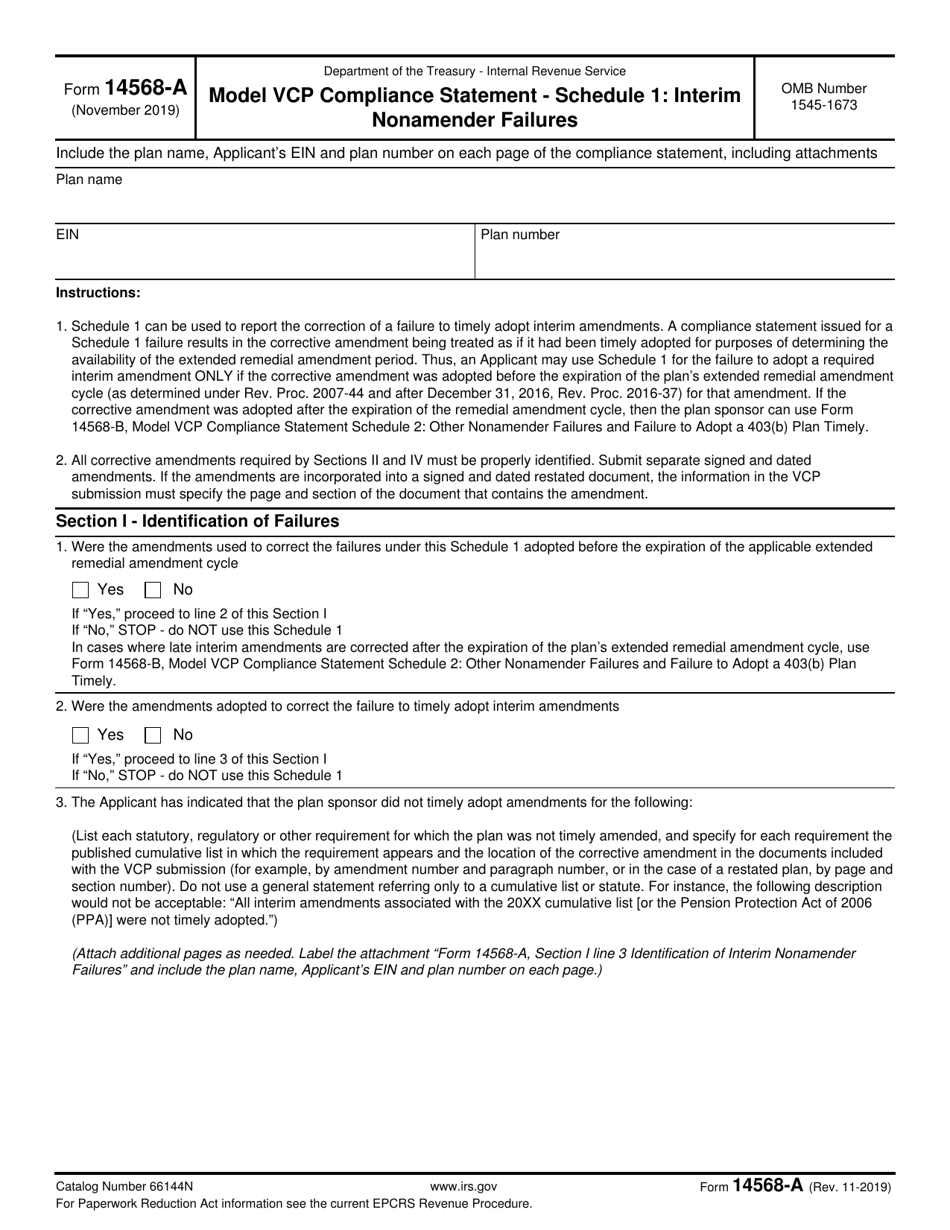

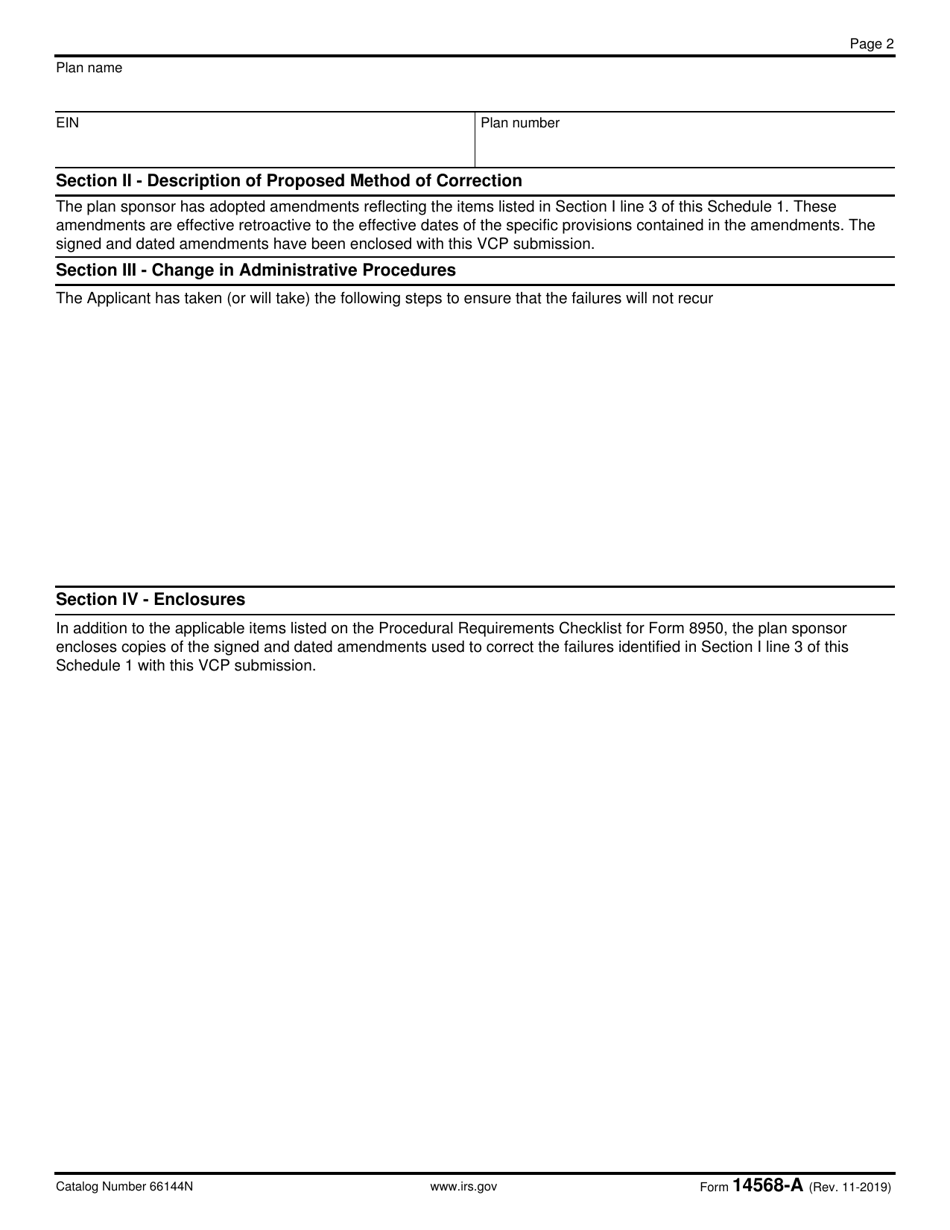

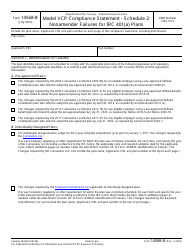

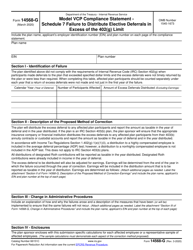

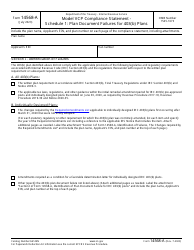

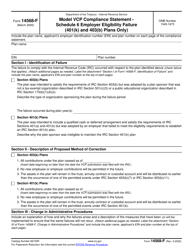

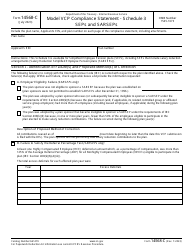

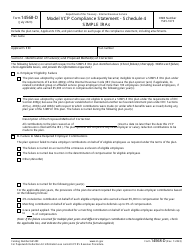

IRS Form 14568-A Schedule 1 Model Vcp Compliance Statement - Interim Nonamender Failures

What Is IRS Form 14568-A Schedule 1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

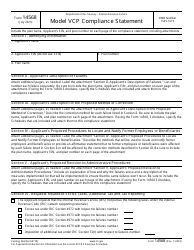

Q: What is IRS Form 14568-A?

A: IRS Form 14568-A is a form used for VCP compliance.

Q: What is VCP compliance?

A: VCP compliance refers to the Voluntary Correction Program, which allows plan sponsors to correct retirement plan failures.

Q: What is Schedule 1 on IRS Form 14568-A?

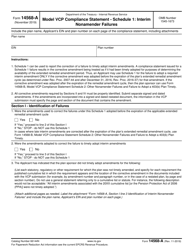

A: Schedule 1 on IRS Form 14568-A is the section where you provide information on interim nonamender failures.

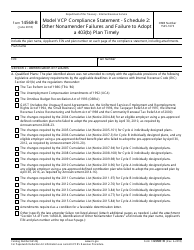

Q: What are interim nonamender failures?

A: Interim nonamender failures refer to failures to amend a plan by the applicable deadline.

Q: What information is required on Schedule 1 for interim nonamender failures?

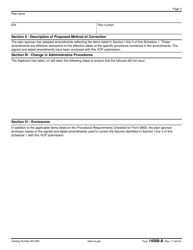

A: Schedule 1 requires you to provide details about the failure and the steps taken to correct it.

Q: What is the purpose of the Model VCP Compliance Statement?

A: The Model VCP Compliance Statement helps you document your correction of retirement plan failures.

Q: Who should use IRS Form 14568-A?

A: IRS Form 14568-A should be used by plan sponsors who want to correct nonamender failures in their retirement plans.

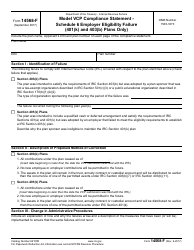

Q: Is there a deadline for submitting IRS Form 14568-A?

A: There is no specific deadline for submitting IRS Form 14568-A, but it should be filed as soon as possible after the failure is corrected.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-A Schedule 1 through the link below or browse more documents in our library of IRS Forms.