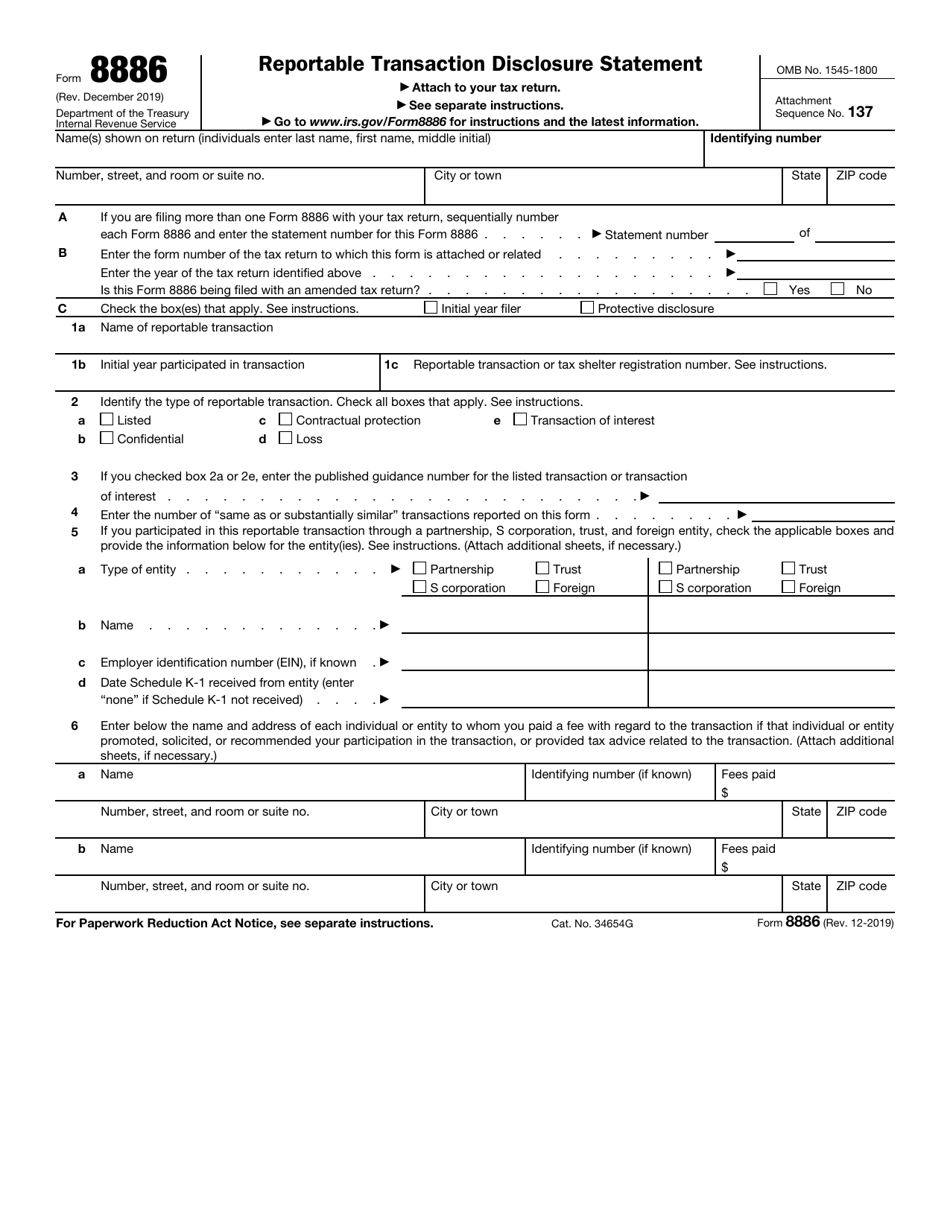

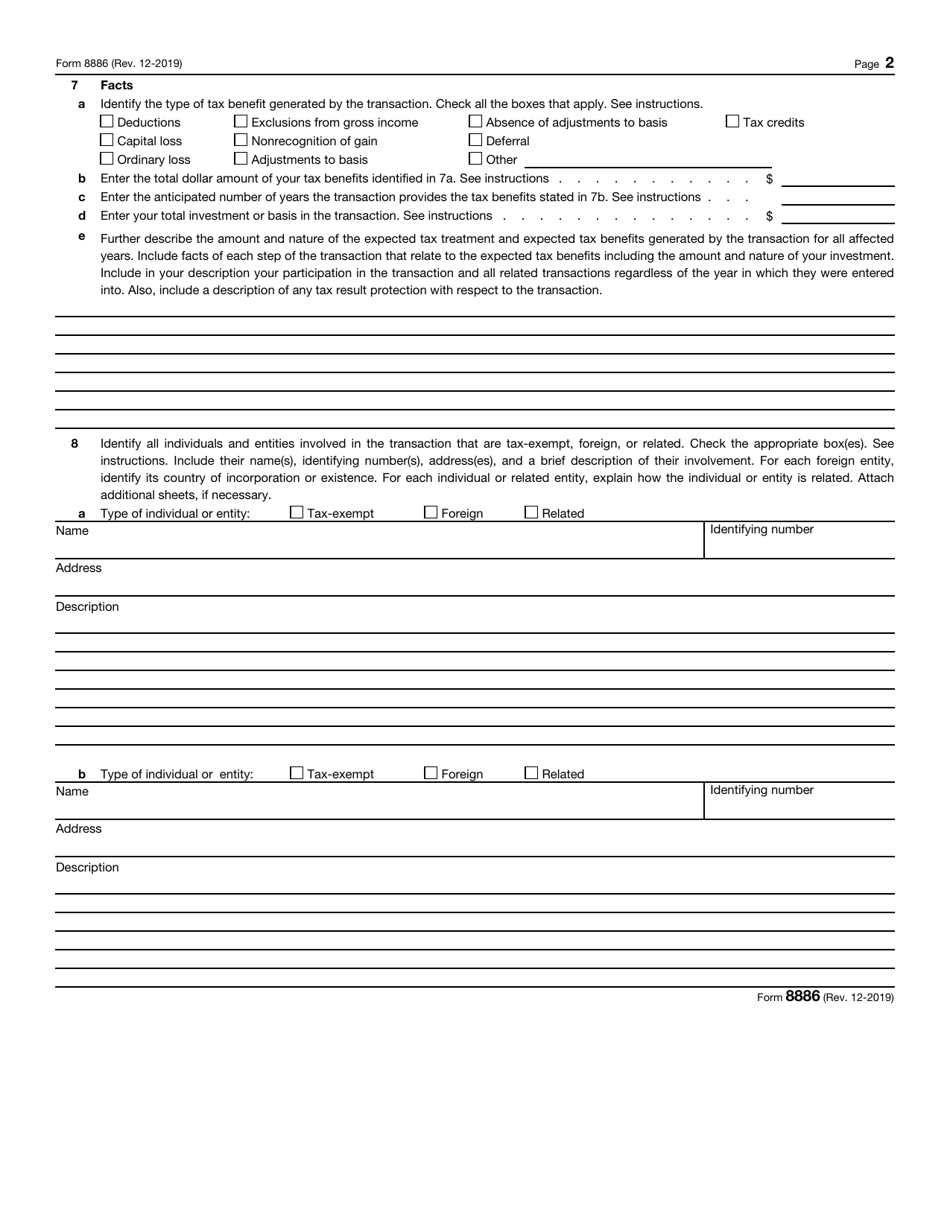

IRS Form 8886 Reportable Transaction Disclosure Statement

What Is IRS Form 8886?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8886?

A: IRS Form 8886 is a Reportable Transaction Disclosure Statement.

Q: What is the purpose of IRS Form 8886?

A: The purpose of IRS Form 8886 is to report certain transactions that may be subject to additional tax obligations.

Q: Which transactions need to be reported on IRS Form 8886?

A: Certain transactions, such as tax shelters and certain listed transactions, need to be reported on IRS Form 8886.

Q: Who needs to file IRS Form 8886?

A: Taxpayers who participated in reportable transactions are required to file IRS Form 8886.

Q: When is IRS Form 8886 due?

A: IRS Form 8886 is generally due before the extended due date of your tax return, including extensions.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8886 through the link below or browse more documents in our library of IRS Forms.