This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-F Schedule M-1, M-2

for the current year.

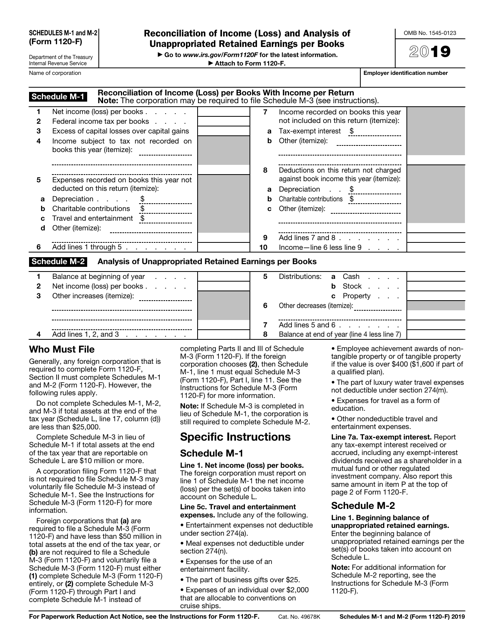

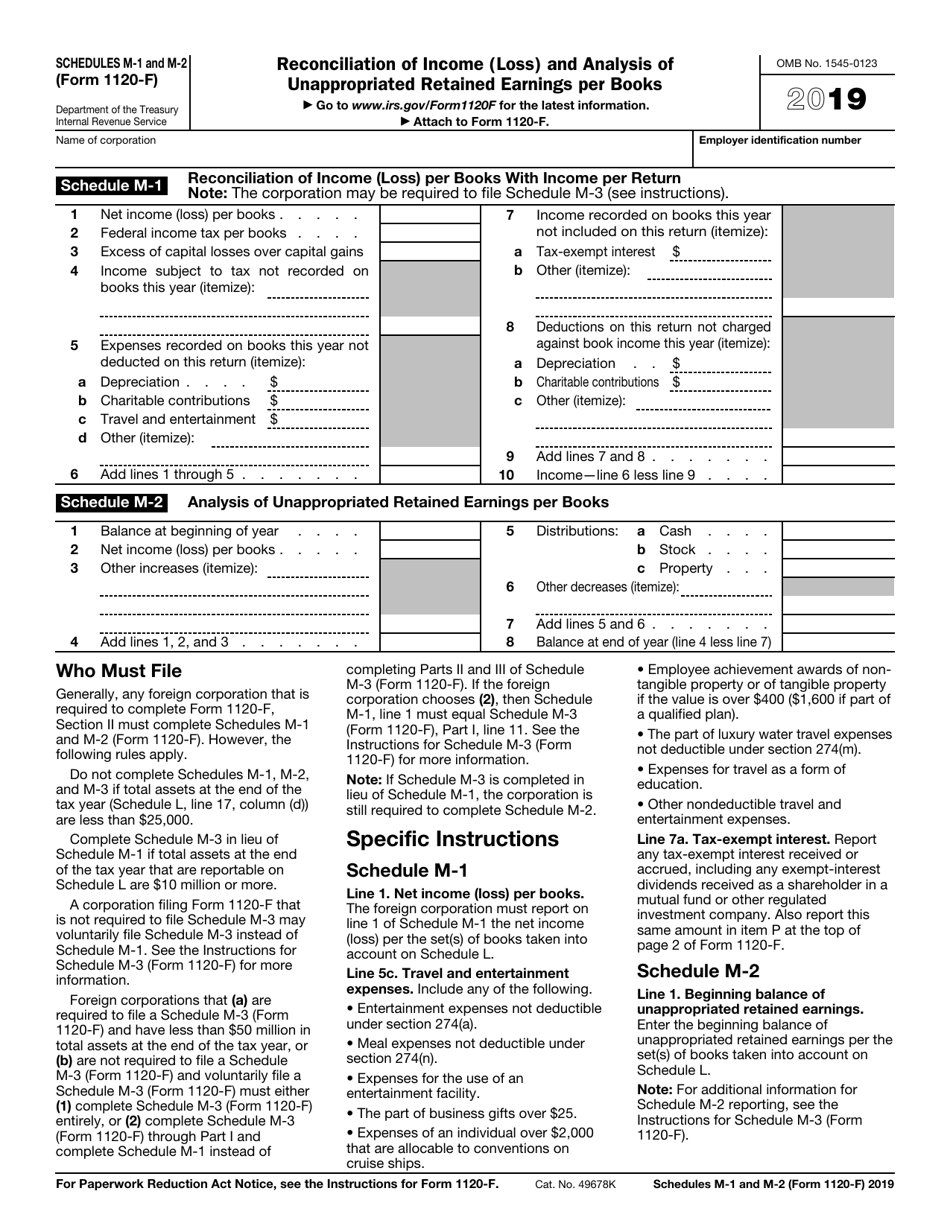

IRS Form 1120-F Schedule M-1, M-2 Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings Per Books

Fill PDF Online

Fill out online for free

without registration or credit card

What Is IRS Form 1120-F Schedule M-1, M-2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. As of today, no separate filing guidelines for the form are provided by the IRS.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Additional instructions and information can be found on page 1 of the document;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule M-1, M-2 through the link below or browse more documents in our library of IRS Forms.