This version of the form is not currently in use and is provided for reference only. Download this version of

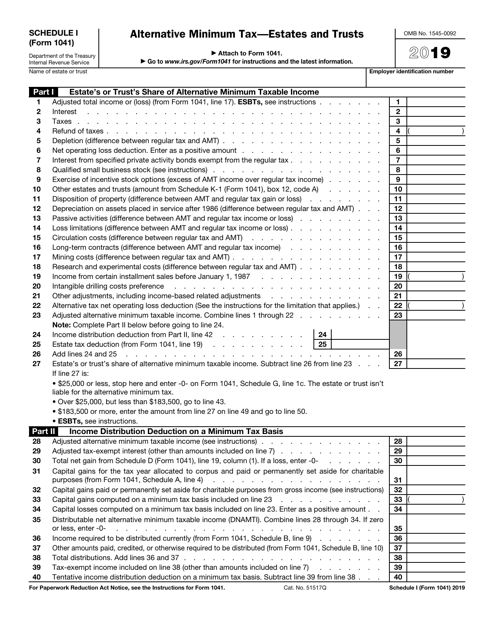

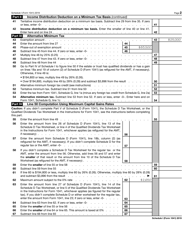

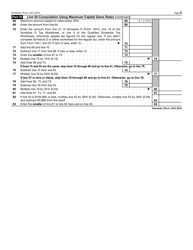

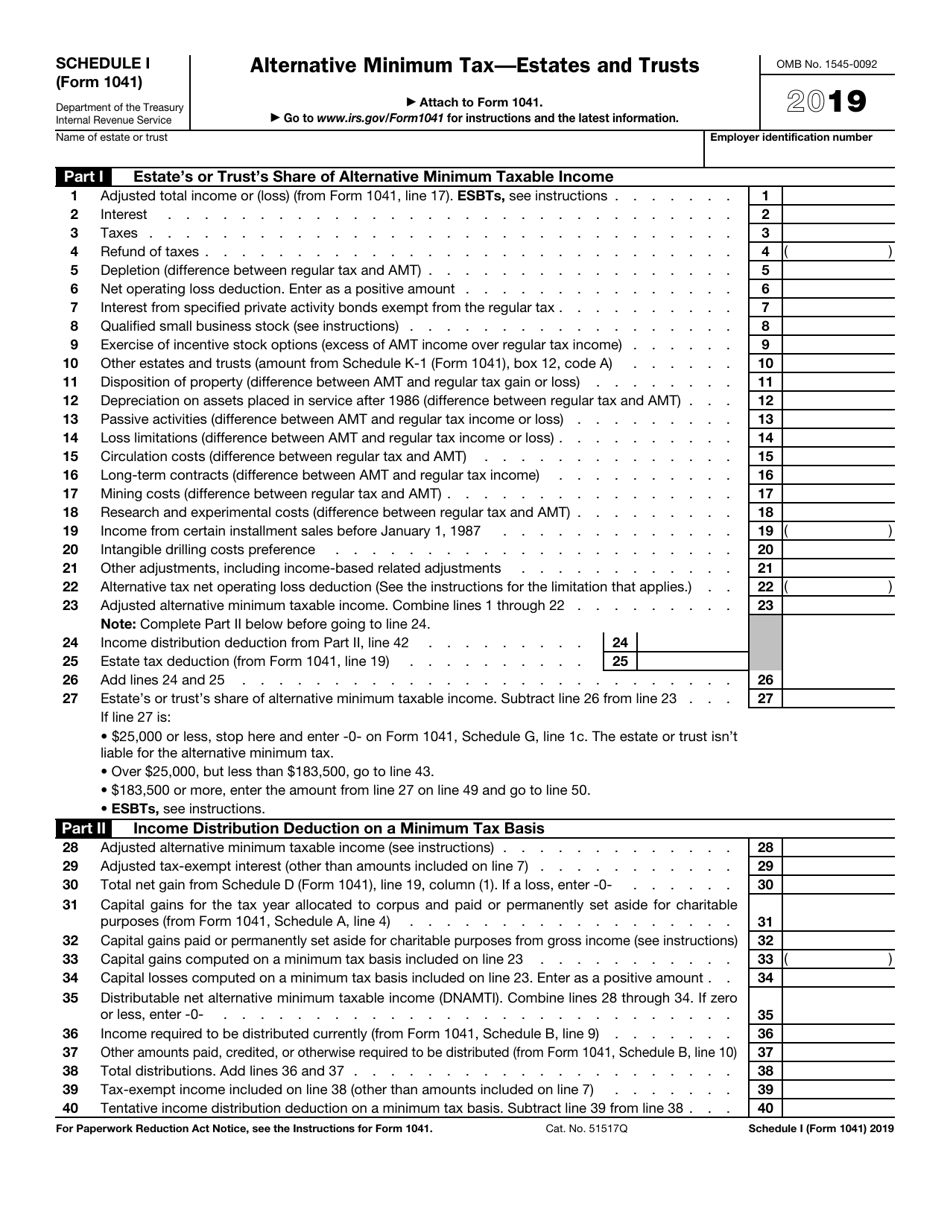

IRS Form 1041 Schedule I

for the current year.

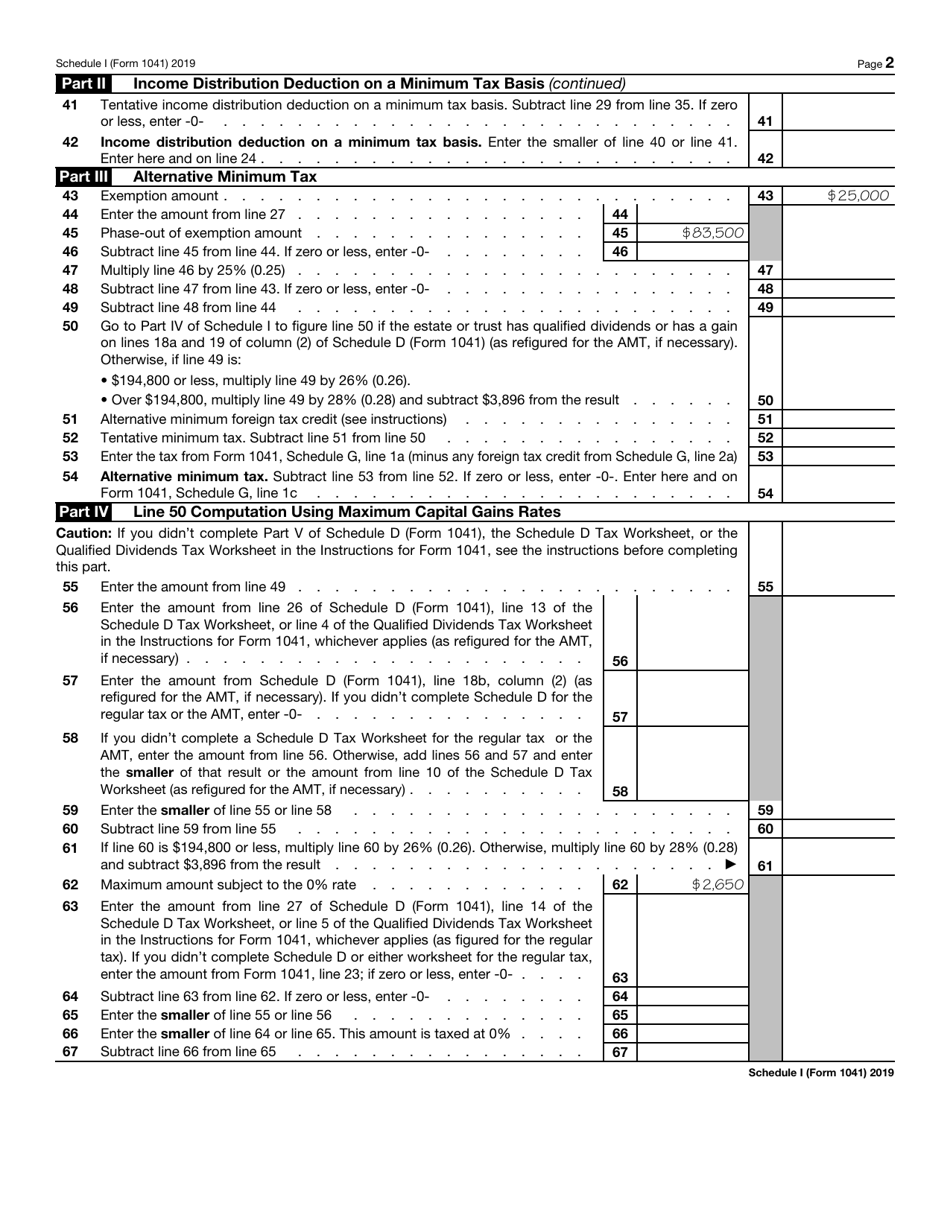

IRS Form 1041 Schedule I Alternative Minimum Tax - Estates and Trusts

What Is IRS Form 1041 Schedule I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041?

A: IRS Form 1041 is a tax form for reporting income, deductions, and distributions for estates and trusts.

Q: What is Schedule I of IRS Form 1041?

A: Schedule I is used to calculate the Alternative Minimum Tax (AMT) for estates and trusts.

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a separate tax calculation designed to prevent high-income individuals, estates, and trusts from avoiding taxes through certain deductions and exemptions.

Q: Who needs to file Schedule I of IRS Form 1041?

A: If an estate or trust meets the criteria for AMT, it needs to file Schedule I along with IRS Form 1041.

Q: What information is required to complete Schedule I?

A: To complete Schedule I, you will need to provide information such as the estate or trust's taxable income, adjustments, and exemptions.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule I through the link below or browse more documents in our library of IRS Forms.