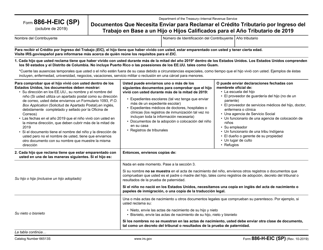

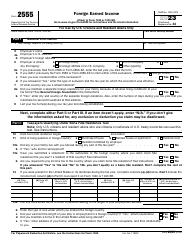

This version of the form is not currently in use and is provided for reference only. Download this version of

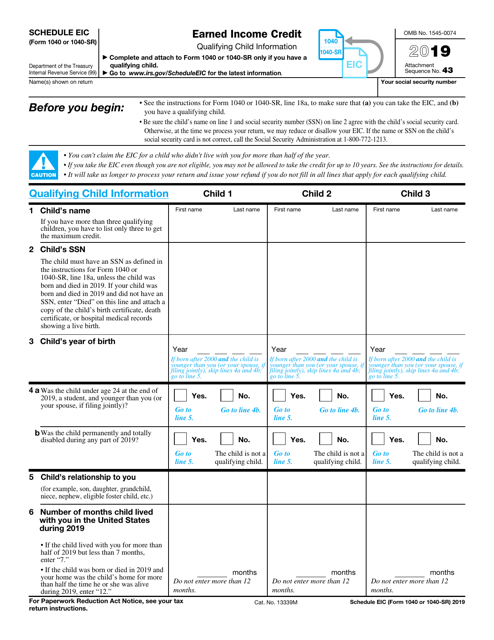

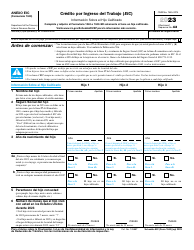

IRS Form 1040 (1040-SR) Schedule EIC

for the current year.

IRS Form 1040 (1040-SR) Schedule EIC Earned Income Credit

What Is IRS Form 1040 (1040-SR) Schedule EIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, and IRS Form 1040-SR. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is the IRS Form 1040?

A: The IRS Form 1040 is the standard individual income tax return form in the United States.

Q: What is the IRS Form 1040-SR?

A: The IRS Form 1040-SR is a simplified version of the Form 1040 designed for senior citizens.

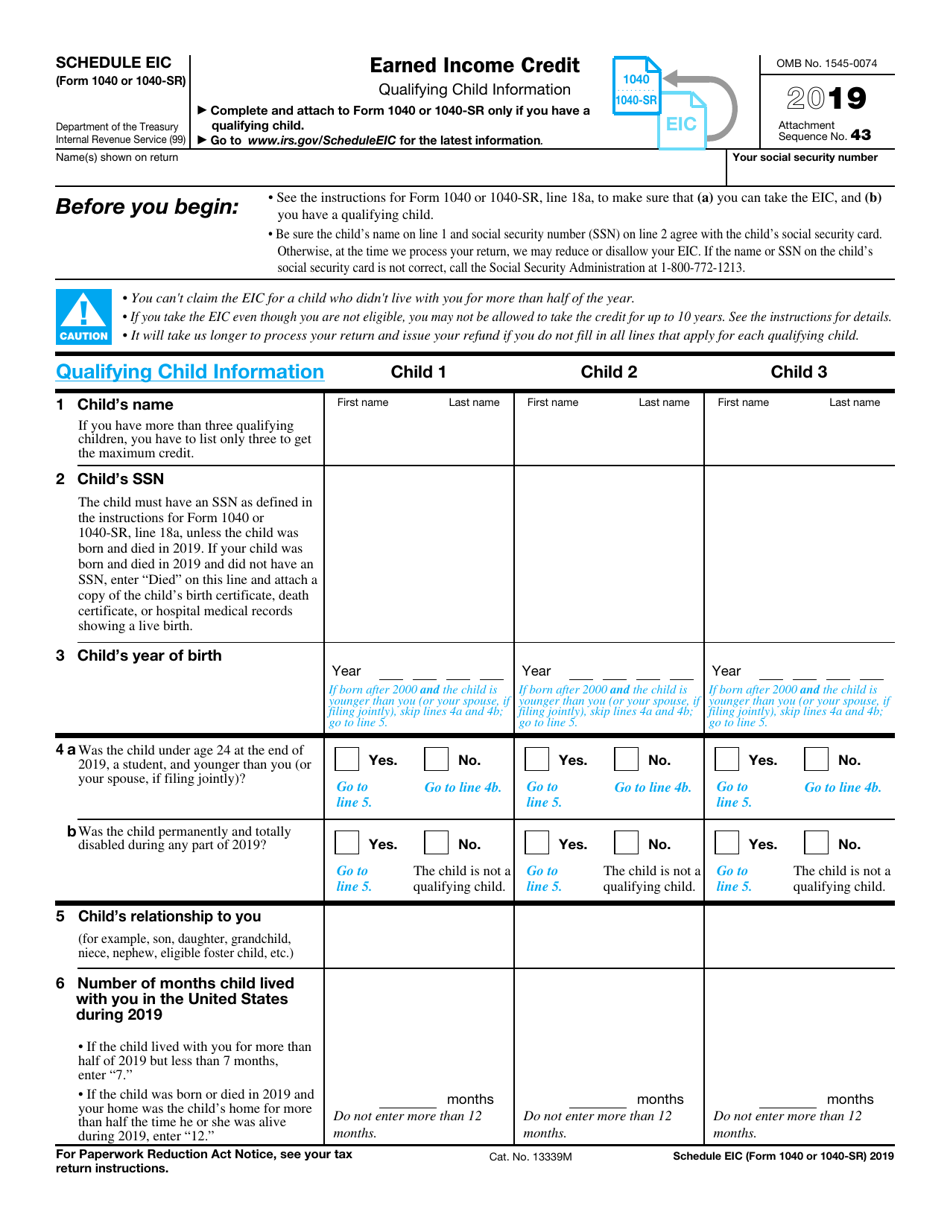

Q: What is Schedule EIC?

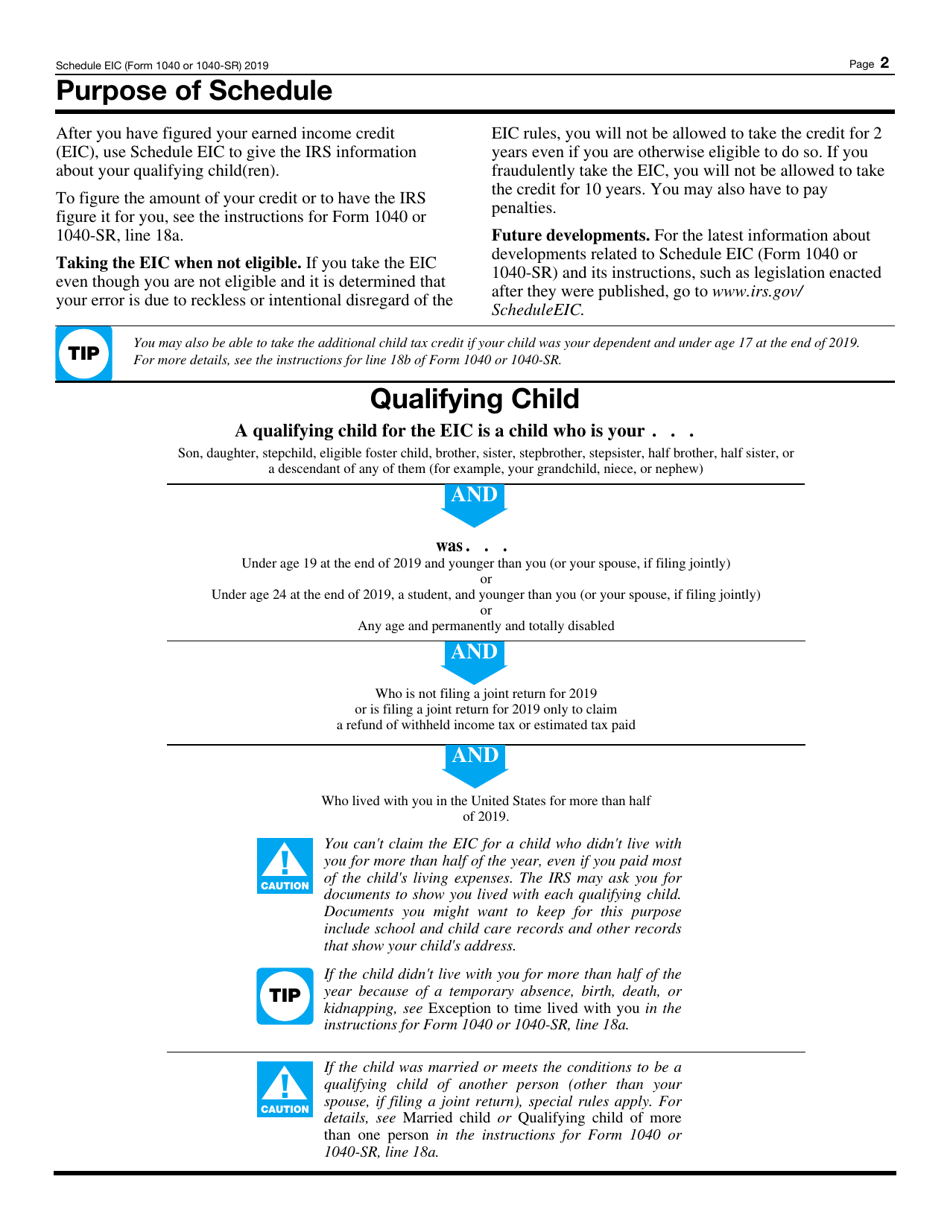

A: Schedule EIC is a tax form used to claim the Earned Income Credit (EIC), a refundable tax credit for low to moderate-income individuals and families.

Q: What is the Earned Income Credit (EIC)?

A: The Earned Income Credit (EIC) is a tax credit designed to provide financial assistance to low to moderate-income individuals and families who have earned income from work.

Q: Who is eligible for the Earned Income Credit (EIC)?

A: To be eligible for the Earned Income Credit (EIC), you must meet certain income and filing status requirements and have earned income.

Q: How do I claim the Earned Income Credit (EIC)?

A: To claim the Earned Income Credit (EIC), you need to file either Form 1040 or Form 1040-SR and complete Schedule EIC.

Q: What documentation do I need to claim the Earned Income Credit (EIC)?

A: To claim the Earned Income Credit (EIC), you will need to provide certain documents such as your Social Security number, income statements, and proof of residency.

Q: How much is the Earned Income Credit (EIC) worth?

A: The amount of the Earned Income Credit (EIC) is based on your income, filing status, and number of qualifying children. It is a refundable tax credit, meaning that if the credit exceeds your tax liability, you can receive the remaining amount as a refund.

Q: When is the deadline to claim the Earned Income Credit (EIC)?

A: The deadline to claim the Earned Income Credit (EIC) is the same as the deadline for filing your tax return, which is usually April 15th of each year.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 (1040-SR) Schedule EIC through the link below or browse more documents in our library of IRS Forms.