This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-EZ

for the current year.

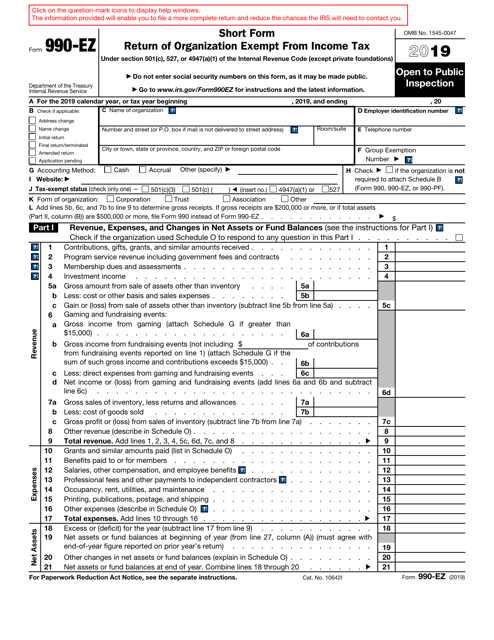

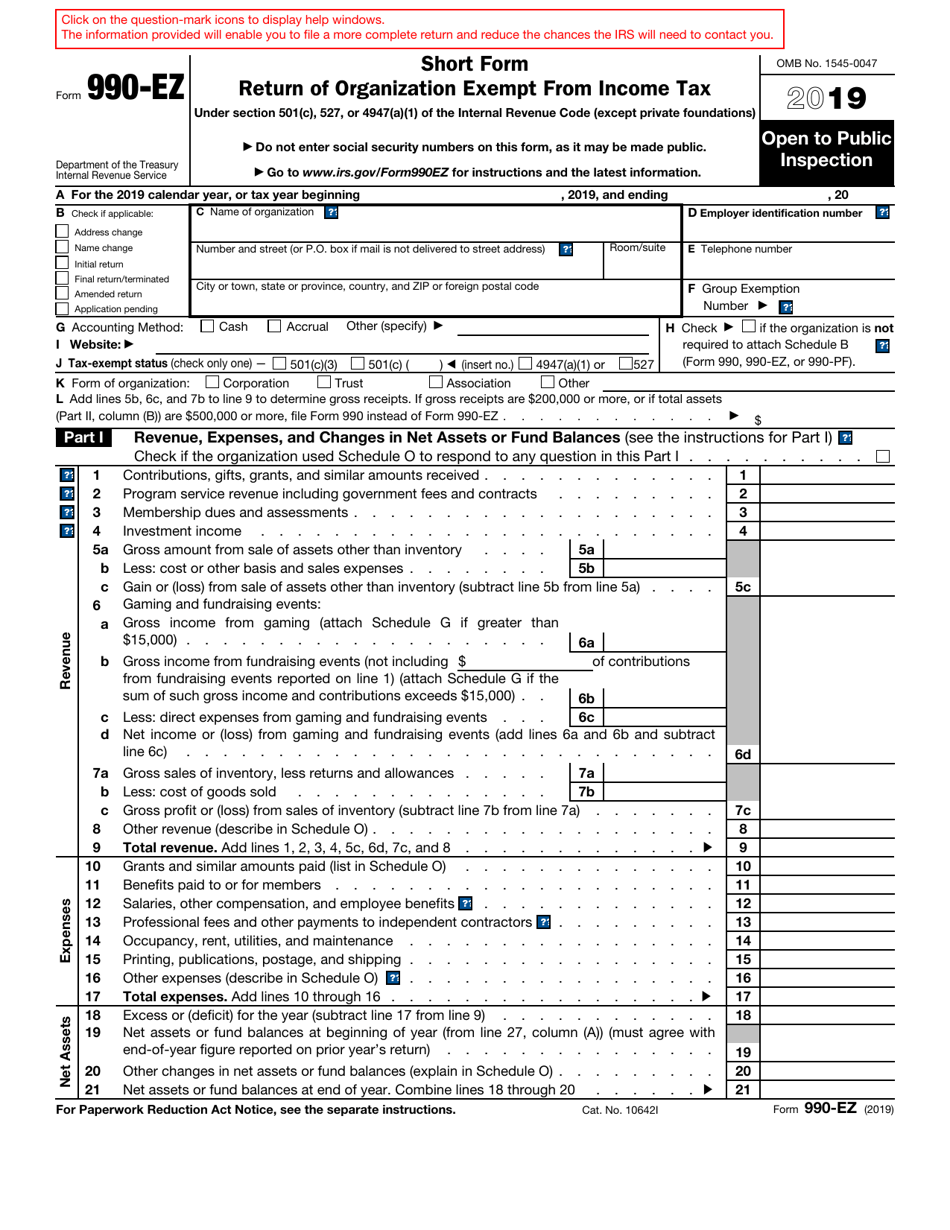

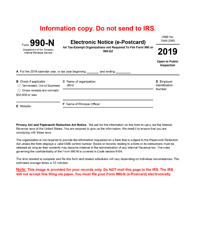

IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

What Is Form 990-EZ?

IRS Form 990-EZ, Short Form Return of Organization Exempt from Income Tax , is a form used to report the financial information required by Section 6033 to the Internal Revenue Service (IRS). This information is usually available for public inspection. The public often relies on this form as the primary source of information about a specific organization; public perception of the organization may depend on the information provided in the return.

Form 990-EZ was issued by the IRS and the last revision of the document was in 2019 . You can download the form and see the instructions below.

Who Can File 990-EZ?

IRS Form 990-EZ can be filed by Section 527 political organizations, nonexempt charitable trusts that are not considered private foundations, and tax-exempt organizations. For the organization to be eligible to file this form instead of Form 990, Return of Organization Exempt from Income Tax, its gross receipts must be less than $200,000, and its total assets must be less than $500,000 at the end of the tax year.

When Is Form 990-EZ Due?

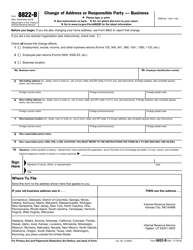

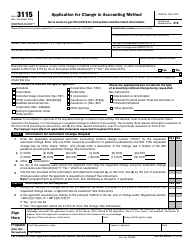

The Form 990-EZ due date is the 15th day of the 5th month after the end of the organization's accounting period. If the organization is dissolved, terminated, or liquidated, submit the short form return by the 15th day of the 5th month after your organization was liquidated, dissolved, or terminated. If the deadline falls on a Saturday, Sunday, or a legal holiday, you may submit your form on the next business day. Fill outForm 8868, Application for Automatic Extension of Time to File an Exempt Organization Return, to request an extension of the filing time. If you fail to submit the form on time, the IRS will apply a $20 penalty for each day you return is late. The total amount of penalties will not exceed $10,000 or 5% of the yearly gross receipt, whichever is less. However, if your annual gross receipt exceeds $1,046,500, the daily penalty will grow to $100, and the maximum penalty can attain $52,000.

IRS Form 990-EZ Schedules

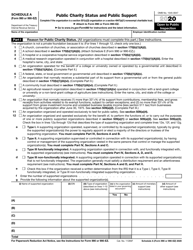

- Schedule A, Public Charity Status and Public Support.

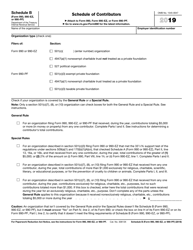

- Schedule B, Schedule of Contributors.

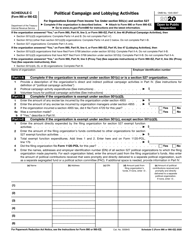

- Schedule C, Political Campaign and Lobbying Activities.

- Schedule E, Schools.

- Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities.

- Schedule L, Transactions with Interested Persons.

- Schedule N, Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

- Schedule O, Supplemental Information to Form 990.

How to Complete Form 990-EZ?

Follow these steps to complete the Form 990-EZ:

- Heading. Items A - L. Most items in this part are self-explanatory. The group exemption number demanded in Item F is a four-digit number assigned by the IRS to the central organization of the group. It can be found in the group exemption letter. Fill out this item only if your organization is included in a group exemption;

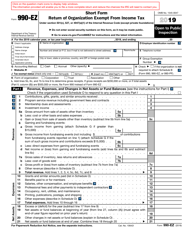

- Part I. Revenue, Expenses, and Changes in Net Assets or Fund Balances. This part is obligatory. Do not provide Form 5500, or Department of Labor Forms LM-2 and LM-3 instead of filling out this part, as they will not be accepted;

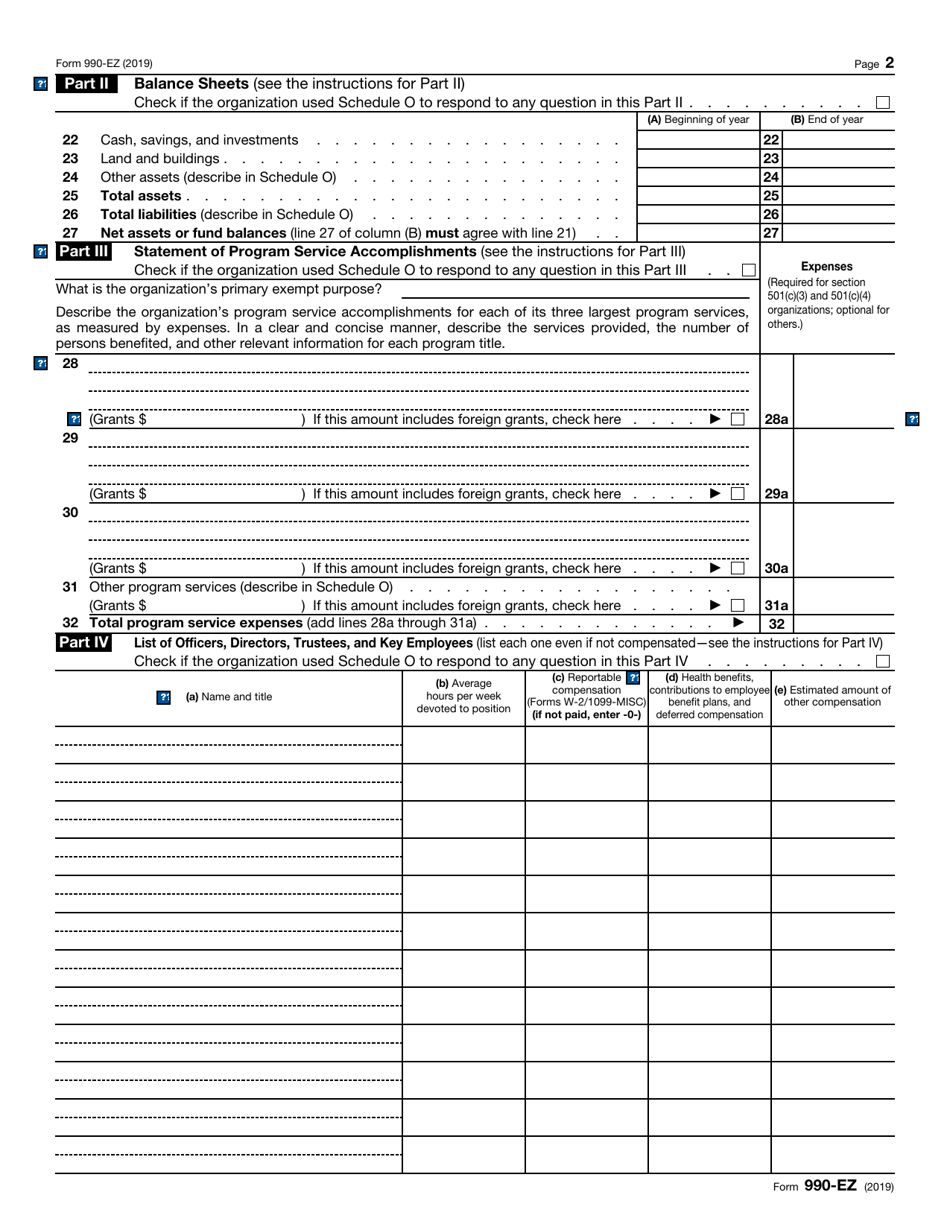

- Part II. Balance Sheets. Fill out this part to calculate the assets and liabilities of your organization. This part is required. Do not submit a substitute balance sheet instead of completing this part;

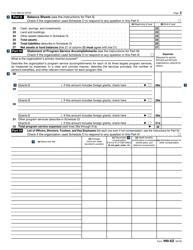

- Part III. Statement of Program Service Accomplishments. State the primary exempt purpose of your organization, describe the organization's program service accomplishments and describe the objective of the activity. If the exact figures are not available, give reasonable estimates and indicate that this information is estimated;

- Part IV. List of Officers, Directors, Trustees, and Key Employees. List every person who was a director, trustee, officer, or a key employee at any period during the tax year, even if this person received no compensation from the organization;

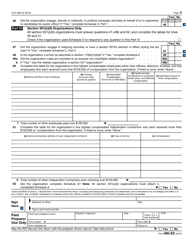

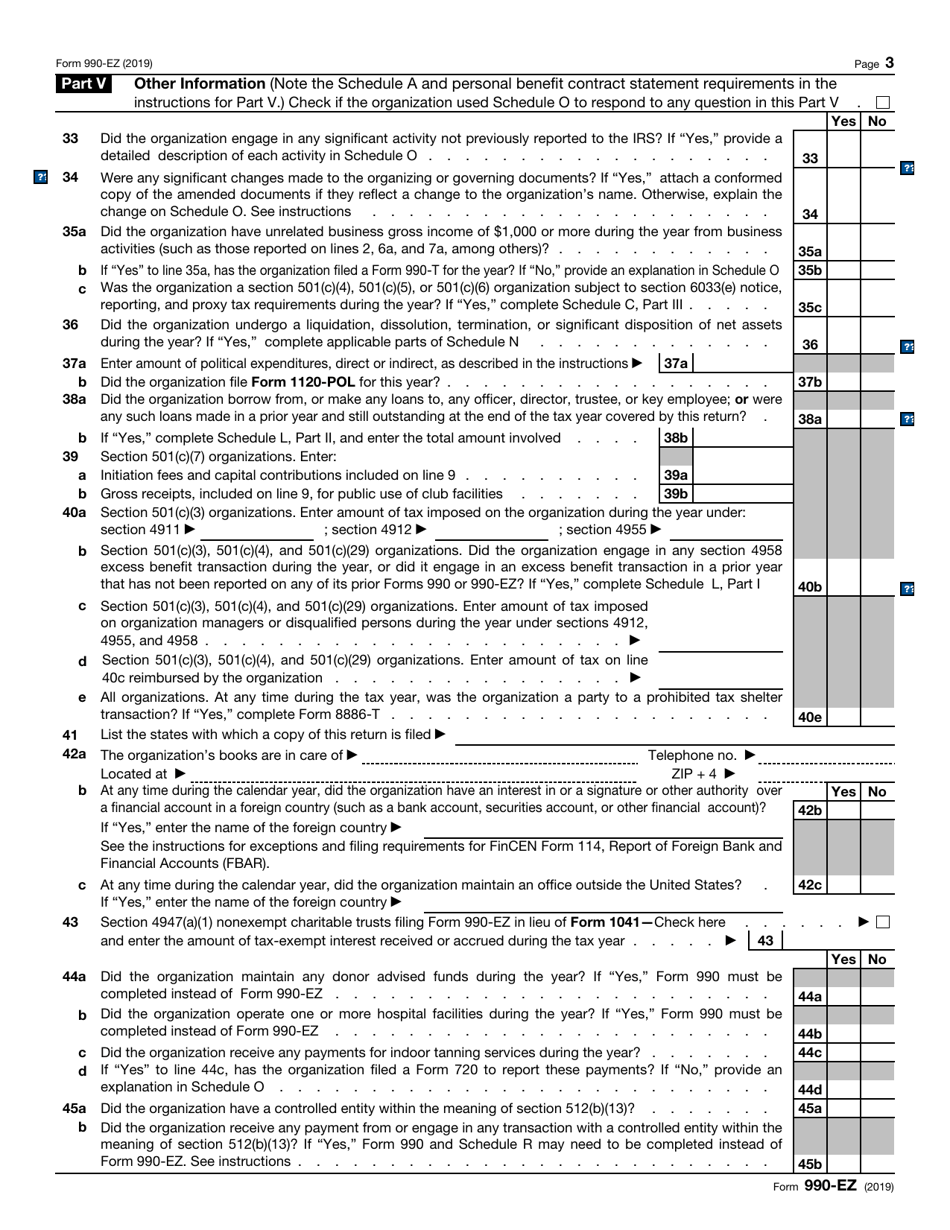

- Part V. Other Information. Answer the questions and explain them on Schedule O if necessary. If you submit this form for a section 501(c)(3) organization, attach Schedule A;

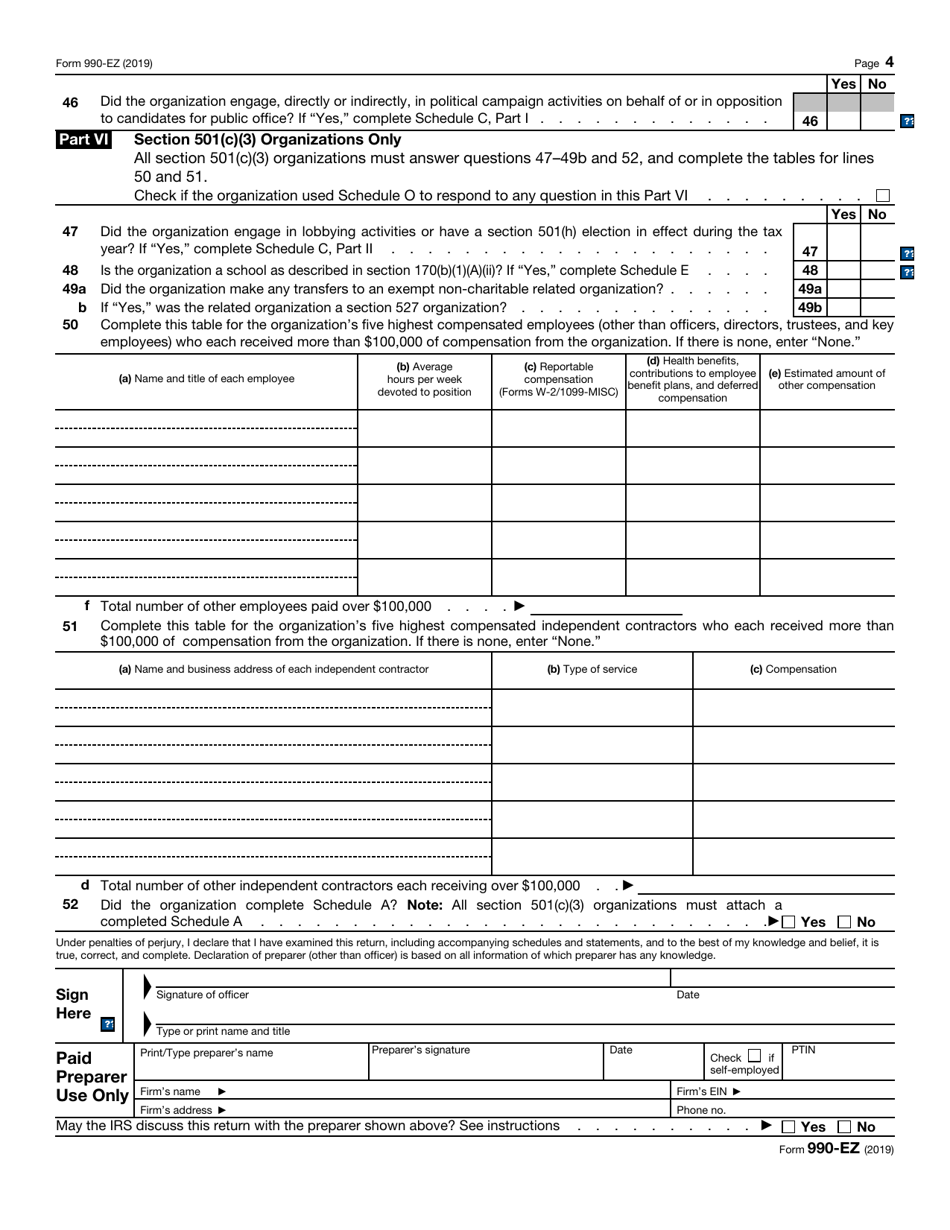

- Part VI. Section 501(c)(3) Organizations Only. If you fill out this form for a section 501(c)(3) organization, complete this part. Otherwise, skip it;

- Sign Here. Sign the form if you are a current president, vice president, chief accounting officer, treasurer, assistant treasurer, or any other officer (e.g., tax officer) authorized to sign. The form is not valid until you sign it.

Form 990-EZ Instructions

Find detailed Form 990-EZ instructions with explanations, examples, and all the required addresses here or on the IRS website. The instructions were last revised with the form.

IRS 990-EZ Related Forms: