This version of the form is not currently in use and is provided for reference only. Download this version of

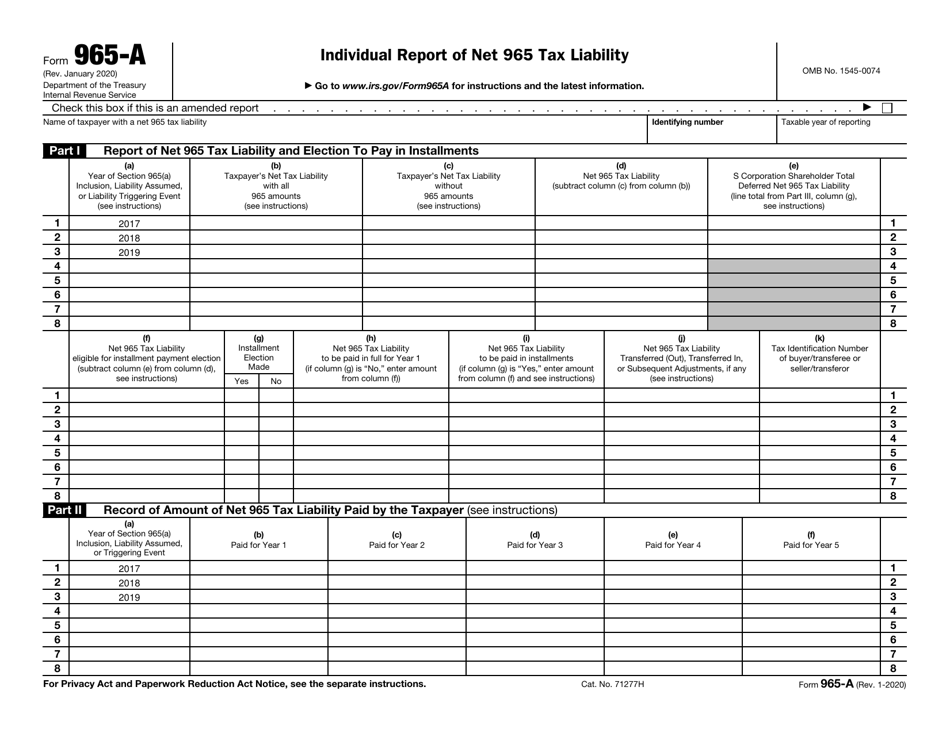

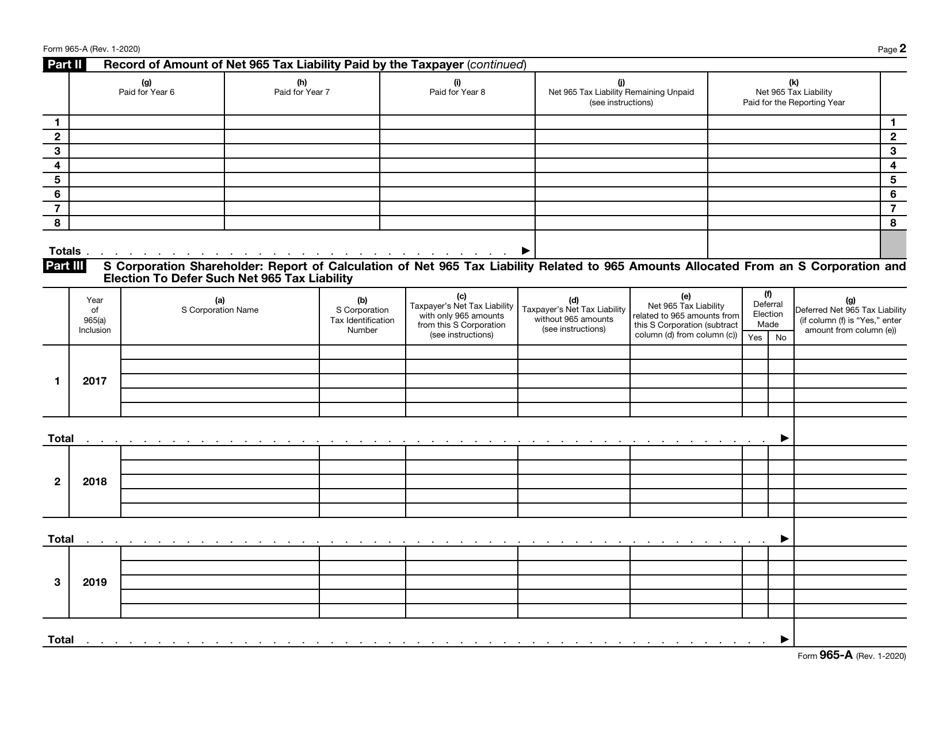

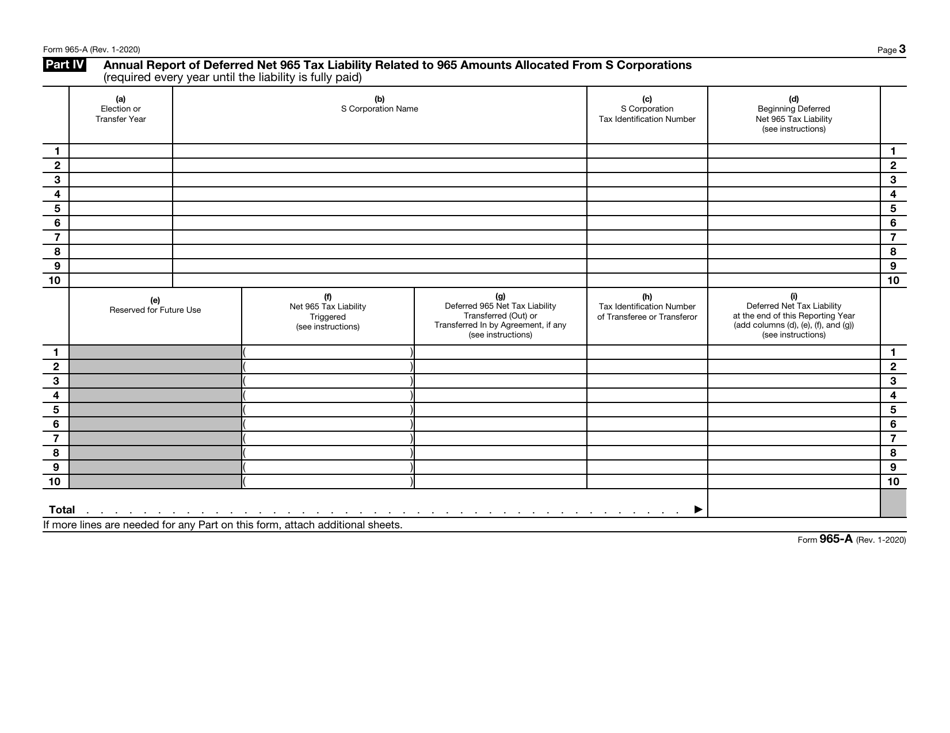

IRS Form 965-A

for the current year.

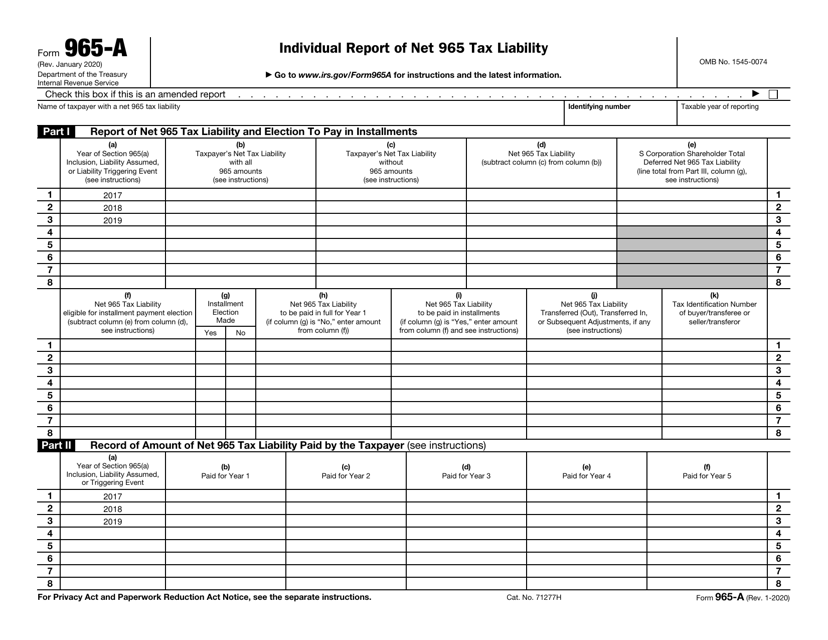

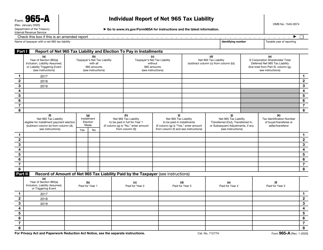

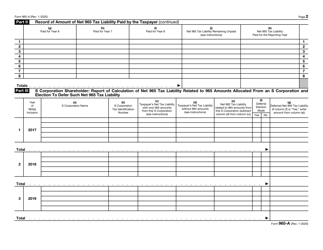

IRS Form 965-A Individual Report of Net 965 Tax Liability

What Is IRS Form 965-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 965-A?

A: IRS Form 965-A is the Individual Report of Net 965 Tax Liability.

Q: Who needs to file IRS Form 965-A?

A: Individual taxpayers who have net tax liability under section 965 of the Internal Revenue Code need to file IRS Form 965-A.

Q: What is section 965 of the Internal Revenue Code?

A: Section 965 of the Internal Revenue Code is a provision that imposes a one-time tax on the untaxed foreign earnings of certain specified foreign corporations.

Q: What information is required on IRS Form 965-A?

A: IRS Form 965-A requires information related to the computation of your net tax liability under section 965.

Q: When is the deadline to file IRS Form 965-A?

A: The deadline to file IRS Form 965-A is generally the same as your income tax return due date, including extensions.

Q: Are there any penalties for not filing IRS Form 965-A?

A: Yes, there may be penalties for not filing IRS Form 965-A or for filing it late. It is important to comply with the filing requirements to avoid penalties.

Q: Can I e-file IRS Form 965-A?

A: No, currently, the IRS does not accept e-filed versions of IRS Form 965-A. It must be filed on paper.

Q: Do I need to attach any supporting documents with IRS Form 965-A?

A: Yes, you will need to attach a copy of your section 965 transition tax statement or other supporting documentation.

Q: Can I request an extension to file IRS Form 965-A?

A: Yes, you can request an extension to file IRS Form 965-A by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 965-A through the link below or browse more documents in our library of IRS Forms.