Instructions for IRS Form 6198 At-Risk Limitations

This document contains official instructions for IRS Form 6198 , At-Risk Limitations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 6198 is available for download through this link.

FAQ

Q: What is IRS Form 6198?

A: IRS Form 6198 is used to calculate the amount of at-risk income a taxpayer can claim on their tax return.

Q: Who needs to file IRS Form 6198?

A: Taxpayers who are involved in certain business activities, such as partnerships, S corporations, or real estate rental activities, may need to file IRS Form 6198.

Q: What is the purpose of IRS Form 6198?

A: The purpose of IRS Form 6198 is to determine the taxpayer's amount at risk in a specific activity and to calculate any limitations on the amount of loss that can be claimed.

Q: How do I fill out IRS Form 6198?

A: You will need to provide information about the specific activity, any outstanding liabilities, and any amounts at risk. The form includes instructions on how to complete each section.

Q: What are at-risk limitations?

A: At-risk limitations are rules that restrict the amount of loss that can be claimed on a tax return for a specific business activity.

Q: What types of activities are subject to at-risk limitations?

A: Activities such as partnerships, S corporations, real estate rental activities, and certain other businesses are subject to at-risk limitations.

Q: Can I carry forward losses that exceed my at-risk amount?

A: Yes, you can carry forward losses that exceed your at-risk amount to future tax years.

Q: What happens if I don't file IRS Form 6198?

A: If you are required to file IRS Form 6198 but fail to do so, you may lose the ability to claim certain tax deductions or credits related to at-risk activities.

Q: When is the deadline to file IRS Form 6198?

A: The deadline to file IRS Form 6198 is typically the same as the deadline for your individual tax return, which is usually April 15.

Q: Can I e-file IRS Form 6198?

A: No, IRS Form 6198 cannot be e-filed and must be filed by mail along with your tax return.

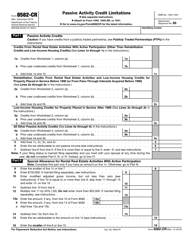

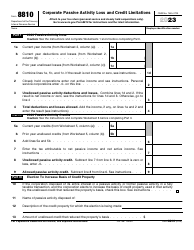

Q: What other forms may be required in addition to IRS Form 6198?

A: Depending on the specific activity and taxpayer's situation, additional forms such as Form 8582 or Form 8810 may be required in conjunction with IRS Form 6198.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.