This version of the form is not currently in use and is provided for reference only. Download this version of

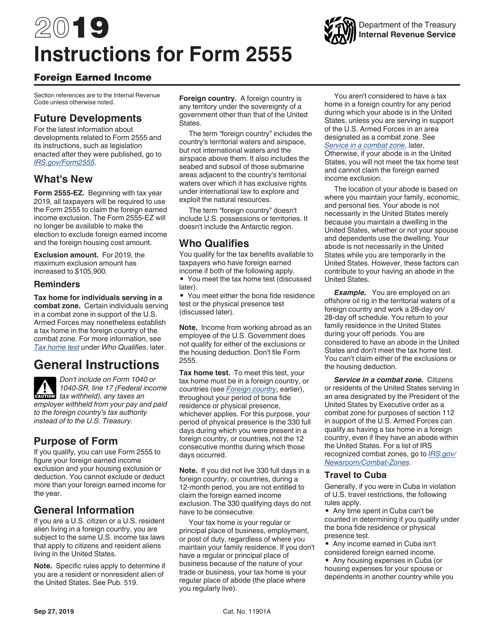

Instructions for IRS Form 2555

for the current year.

Instructions for IRS Form 2555 Foreign Earned Income

This document contains official instructions for IRS Form 2555 , Foreign Earned Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2555 is available for download through this link.

FAQ

Q: What is IRS Form 2555?

A: IRS Form 2555 is a tax form used by taxpayers who have foreign earned income and want to claim the foreign earned income exclusion.

Q: Who needs to file IRS Form 2555?

A: Taxpayers who have foreign earned income and meet the eligibility requirements for the foreign earned income exclusion may need to file IRS Form 2555.

Q: What is the foreign earned income exclusion?

A: The foreign earned income exclusion is a tax benefit that allows eligible taxpayers to exclude a certain amount of their foreign earned income from their taxable income.

Q: How do I determine if I am eligible for the foreign earned income exclusion?

A: To be eligible for the foreign earned income exclusion, you must meet either the physical presence test or the bona fide residence test.

Q: What is the physical presence test?

A: The physical presence test requires you to be physically present in a foreign country or countries for at least 330 full days during a 12-month period.

Q: What is the bona fide residence test?

A: The bona fide residence test requires you to be a bona fide resident of a foreign country for an uninterrupted period that includes a full tax year.

Q: How do I claim the foreign earned income exclusion on IRS Form 2555?

A: You can complete the relevant sections of IRS Form 2555 to calculate and claim the foreign earned income exclusion.

Q: Are there any other requirements or limitations for claiming the foreign earned income exclusion?

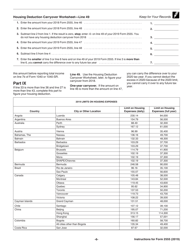

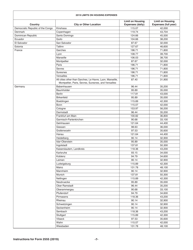

A: Yes, there are additional requirements and limitations for claiming the foreign earned income exclusion, such as the foreign housing exclusion or deduction and the overall limit on the exclusion amount.

Q: When is the deadline for filing IRS Form 2555?

A: The deadline for filing IRS Form 2555 is usually the same as the deadline for filing your federal income tax return, which is April 15th of each year.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.