This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-S Schedule D

for the current year.

Instructions for IRS Form 1120-S Schedule D Capital Gains and Losses and Built-In Gains

This document contains official instructions for IRS Form 1120-S Schedule D, Capital Gains and Losses and Built-In Gains - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-S Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120-S Schedule D?

A: IRS Form 1120-S Schedule D is a tax form used by S corporations to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are profits made from selling assets, while capital losses are the opposite.

Q: What is a built-in gain?

A: A built-in gain refers to a gain that is realized by an S corporation on the sale of an asset acquired when the corporation was still a C corporation.

Q: When is IRS Form 1120-S Schedule D filed?

A: IRS Form 1120-S Schedule D is filed with the S corporation's annual tax return, Form 1120-S.

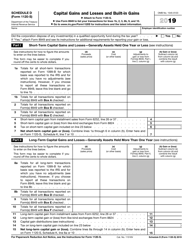

Q: What information is required on Schedule D?

A: Schedule D requires information on the types of assets sold, the purchase and sale dates, and the gains or losses realized.

Q: Are there any special rules for built-in gains?

A: Yes, there are special rules that determine the tax treatment of built-in gains and the timing of their recognition.

Q: Is Schedule D used for individual tax returns?

A: No, Schedule D is specifically for S corporations and not for individual tax returns.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.