This version of the form is not currently in use and is provided for reference only. Download this version of

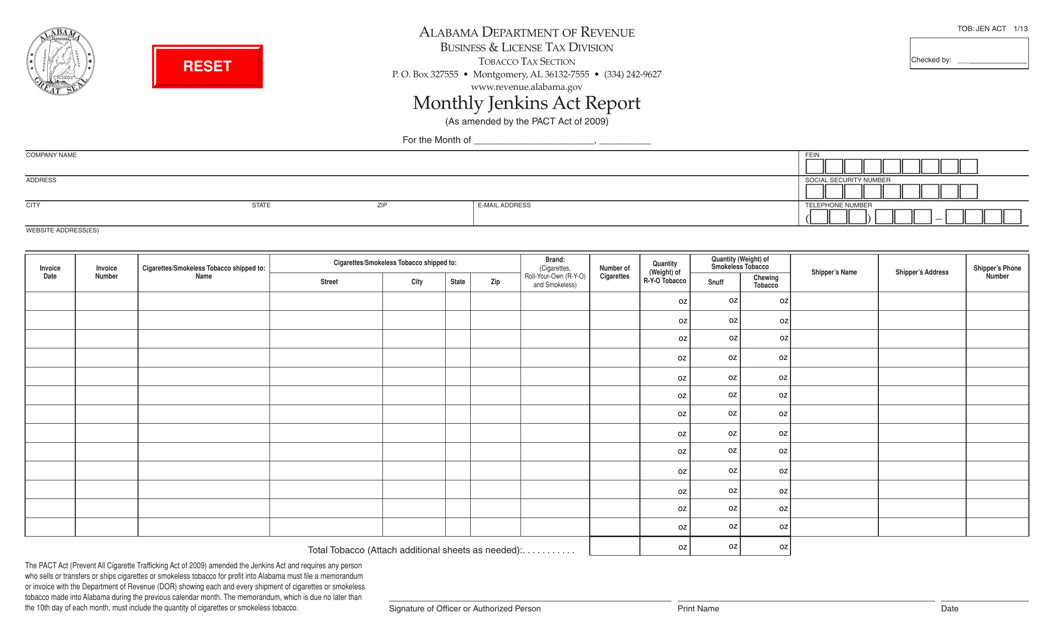

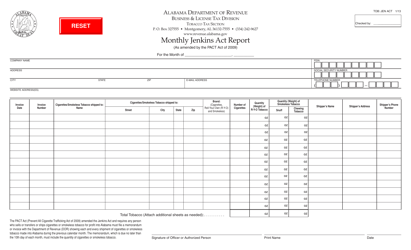

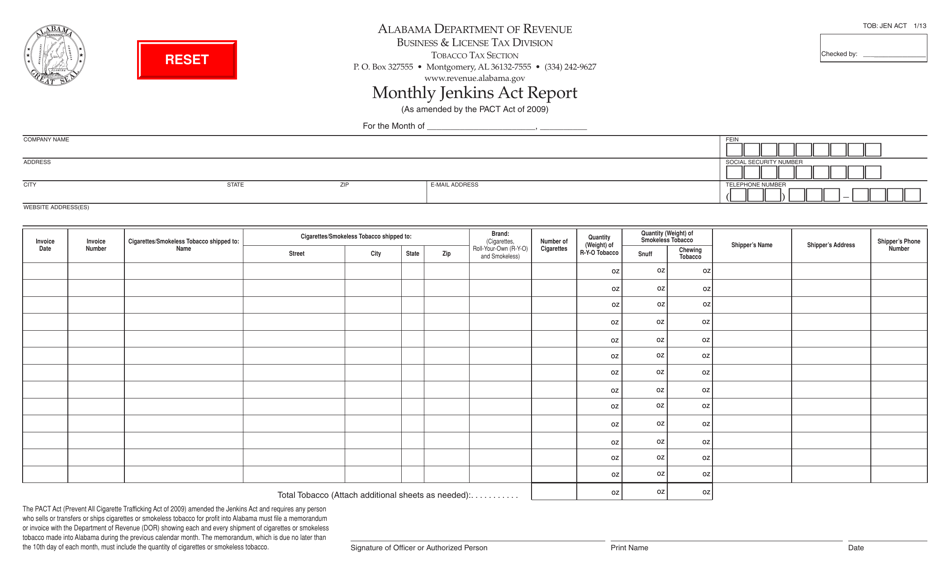

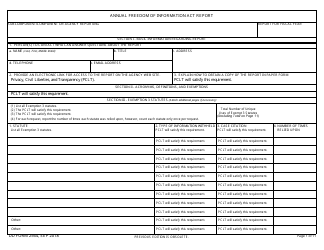

Form TOB: JEN ACT

for the current year.

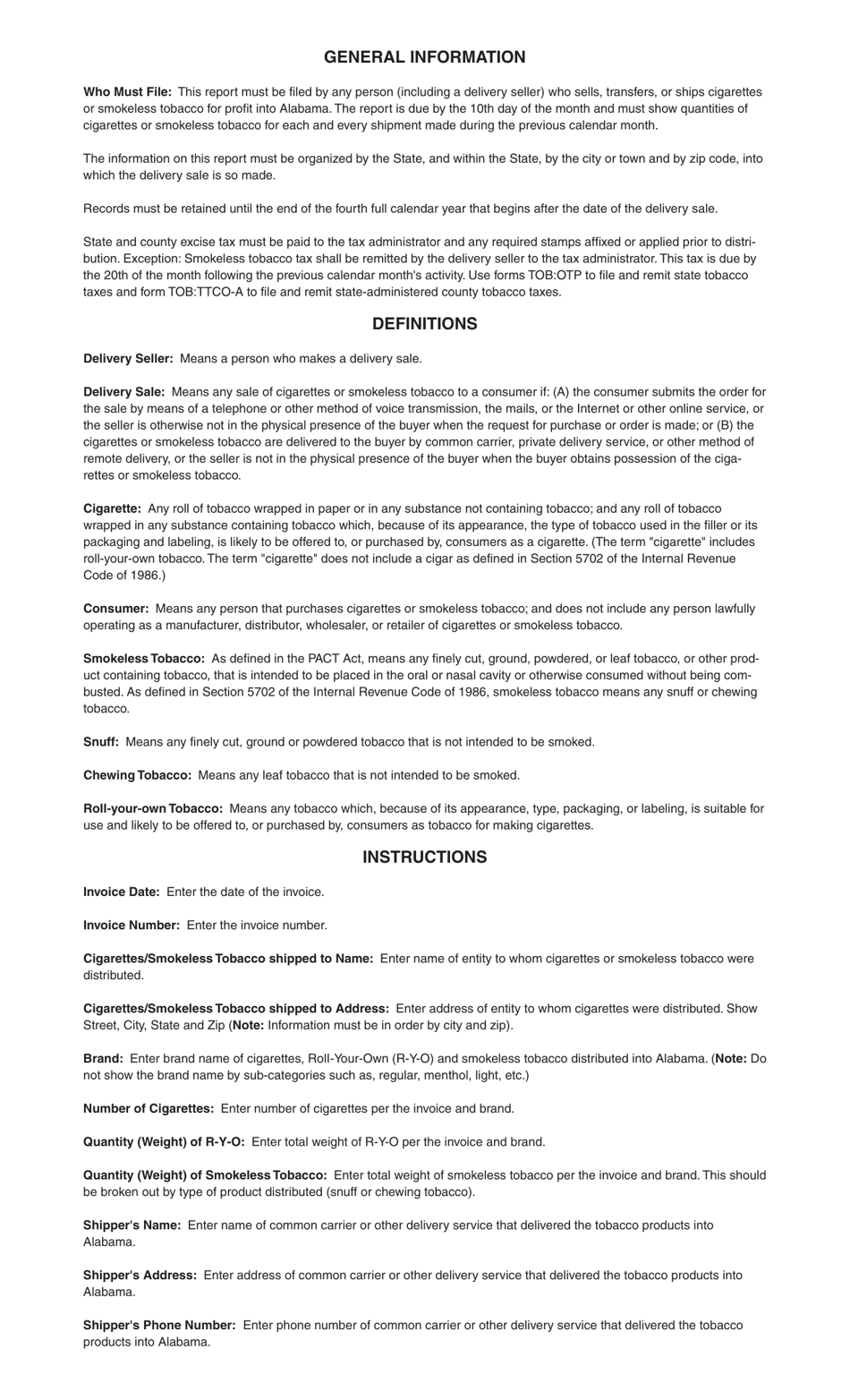

Form TOB: JEN ACT Monthly Jenkins Act Report - Alabama

What Is Form TOB: JEN ACT?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

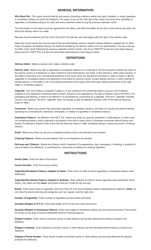

Q: What is the Jenkins Act?

A: The Jenkins Act is a federal law that requires out-of-state sellers to report details of their sales of cigarettes and tobacco products to state tax administrators.

Q: What is the purpose of the Jenkins Act?

A: The purpose of the Jenkins Act is to prevent tax evasion and ensure that state governments can collect the appropriate taxes on cigarette and tobacco sales.

Q: What is the monthly Jenkins Act report?

A: The monthly Jenkins Act report is a report that out-of-state sellers of cigarettes and tobacco products are required to submit to the state tax administrators detailing their sales activity.

Q: Who is required to submit the monthly Jenkins Act report in Alabama?

A: Out-of-state sellers of cigarettes and tobacco products are required to submit the monthly Jenkins Act report in Alabama.

Q: What information is included in the monthly Jenkins Act report?

A: The monthly Jenkins Act report includes details such as the name and address of the seller, the quantities and types of cigarettes and tobacco products sold, and the names and addresses of the buyers.

Q: What are the consequences of not submitting the monthly Jenkins Act report?

A: Failure to submit the monthly Jenkins Act report can result in penalties, fines, and legal consequences.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TOB: JEN ACT by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.