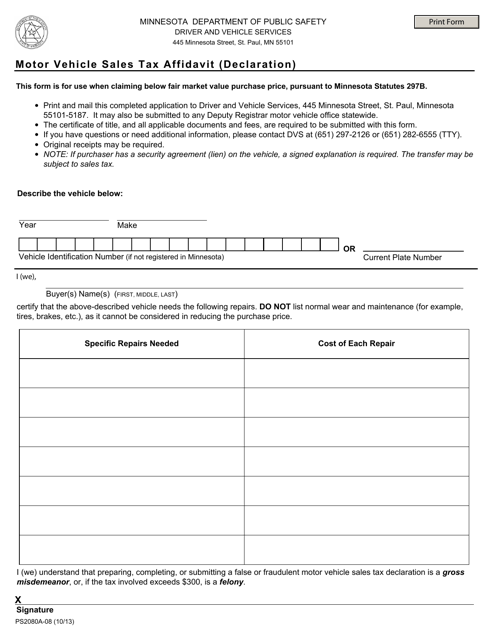

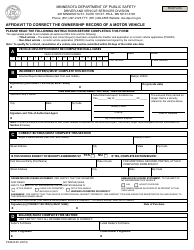

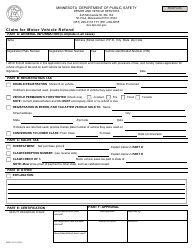

Form PS2080A-08 Motor Vehicle Sales Tax Affidavit (Declaration) - Minnesota

What Is Form PS2080A-08?

This is a legal form that was released by the Minnesota Department of Public Safety - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PS2080A-08 Motor VehicleSales Tax Affidavit?

A: The PS2080A-08 Motor Vehicle SalesTax Affidavit is a declaration form used in Minnesota for reporting motor vehicle sales tax.

Q: Who needs to fill out this form?

A: This form needs to be filled out by the seller of a motor vehicle in Minnesota.

Q: What is the purpose of this affidavit?

A: The purpose of this affidavit is to declare the sale and purchase price of the motor vehicle for calculating the appropriate sales tax.

Q: Do I need to submit this form to the Minnesota Department of Revenue?

A: Yes, the completed form must be submitted to the Minnesota Department of Revenue within 10 days of the sale of the motor vehicle.

Q: Is there a fee for filing this form?

A: No, there is no fee for filing the PS2080A-08 Motor Vehicle Sales Tax Affidavit.

Q: Do I need to include any supporting documents with this form?

A: Yes, you need to include a photocopy of the certificate of title or manufacturer's certificate of origin.

Q: What happens if I don't submit this form?

A: Failure to submit this form may result in penalties and interest charges on the unpaid sales tax.

Q: Can I make changes to the form after submitting it?

A: No, once you have submitted the form, you cannot make changes to it. If you need to make corrections, you must contact the Minnesota Department of Revenue.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Minnesota Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PS2080A-08 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Public Safety.