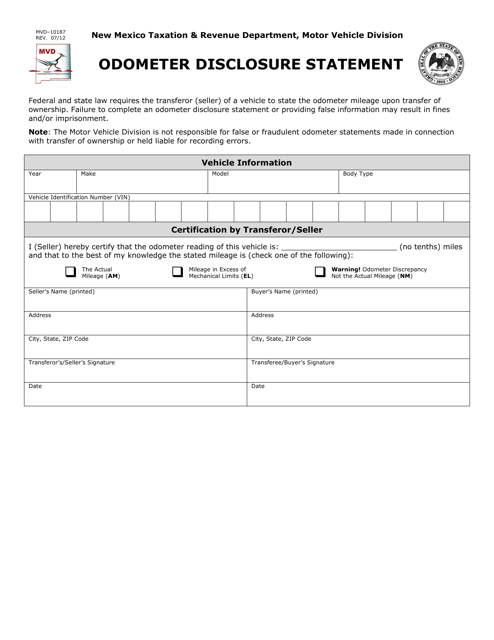

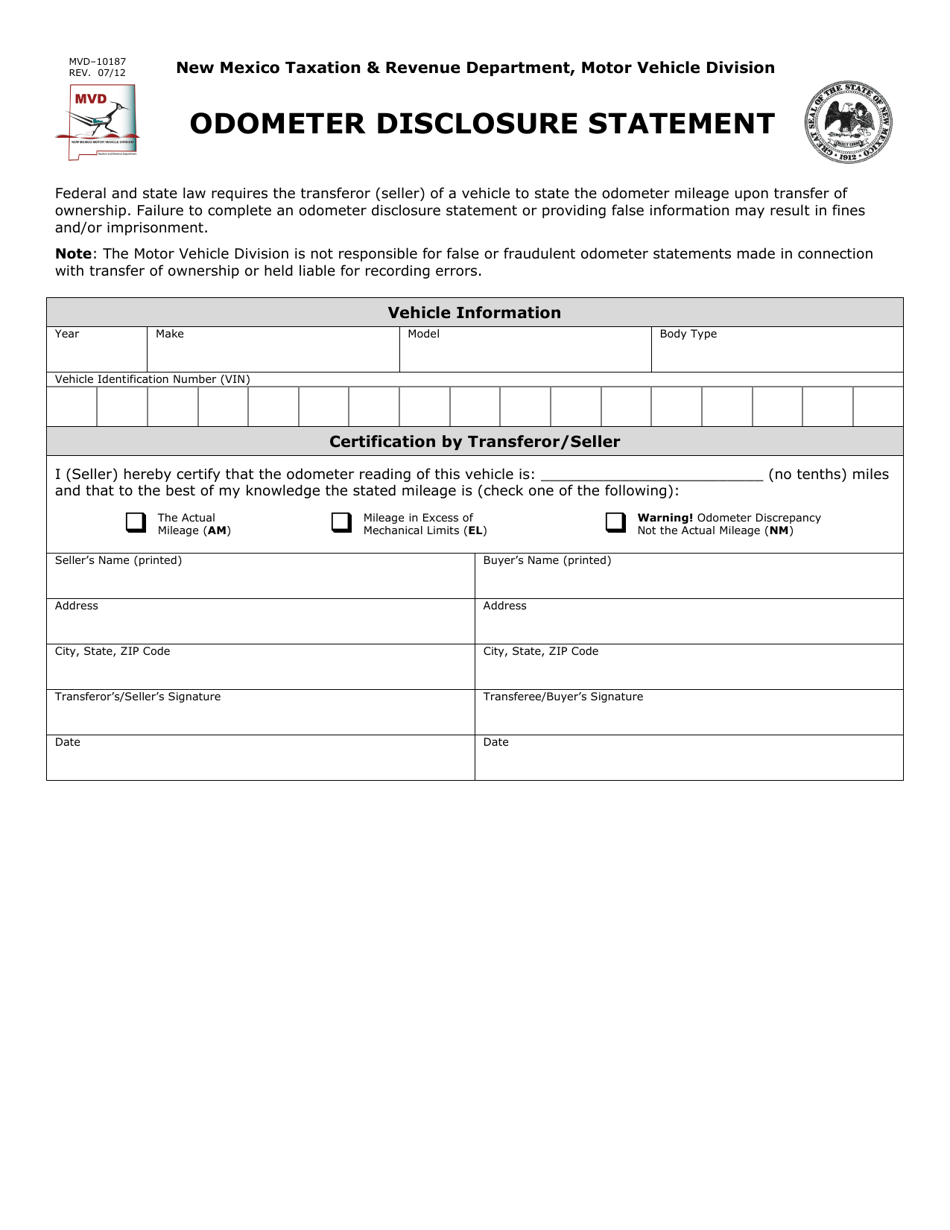

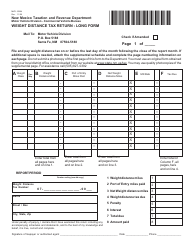

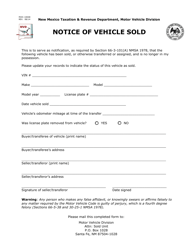

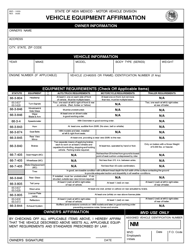

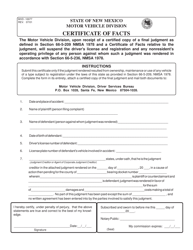

Form MVD-10187 Odometer Disclosure Statement - New Mexico

What Is Form MVD-10187?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MVD-10187?

A: Form MVD-10187 is the Odometer Disclosure Statement used in the state of New Mexico.

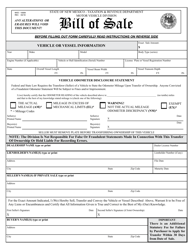

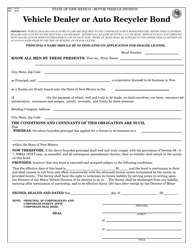

Q: Who needs to fill out Form MVD-10187?

A: Anyone who is selling or transferring ownership of a motor vehicle in New Mexico needs to fill out Form MVD-10187.

Q: What information is required on Form MVD-10187?

A: Form MVD-10187 requires the vehicle's odometer reading, the date of sale or transfer, the vehicle identification number (VIN), and the signature of the seller and buyer.

Q: Do I need to notarize Form MVD-10187?

A: No, notarization is not required for Form MVD-10187 in New Mexico.

Q: Are there any fees associated with submitting Form MVD-10187?

A: Yes, there is a fee for processing Form MVD-10187, which can vary depending on the county.

Q: What happens if I don't submit Form MVD-10187?

A: Failing to submit Form MVD-10187 may result in penalties, fines, or legal consequences.

Q: Can I make corrections on Form MVD-10187 after it has been completed?

A: No, corrections cannot be made on Form MVD-10187 once it has been completed. Any errors should be clarified with the buyer or seller before submitting the form.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MVD-10187 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.