This version of the form is not currently in use and is provided for reference only. Download this version of

Form 568

for the current year.

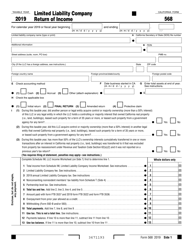

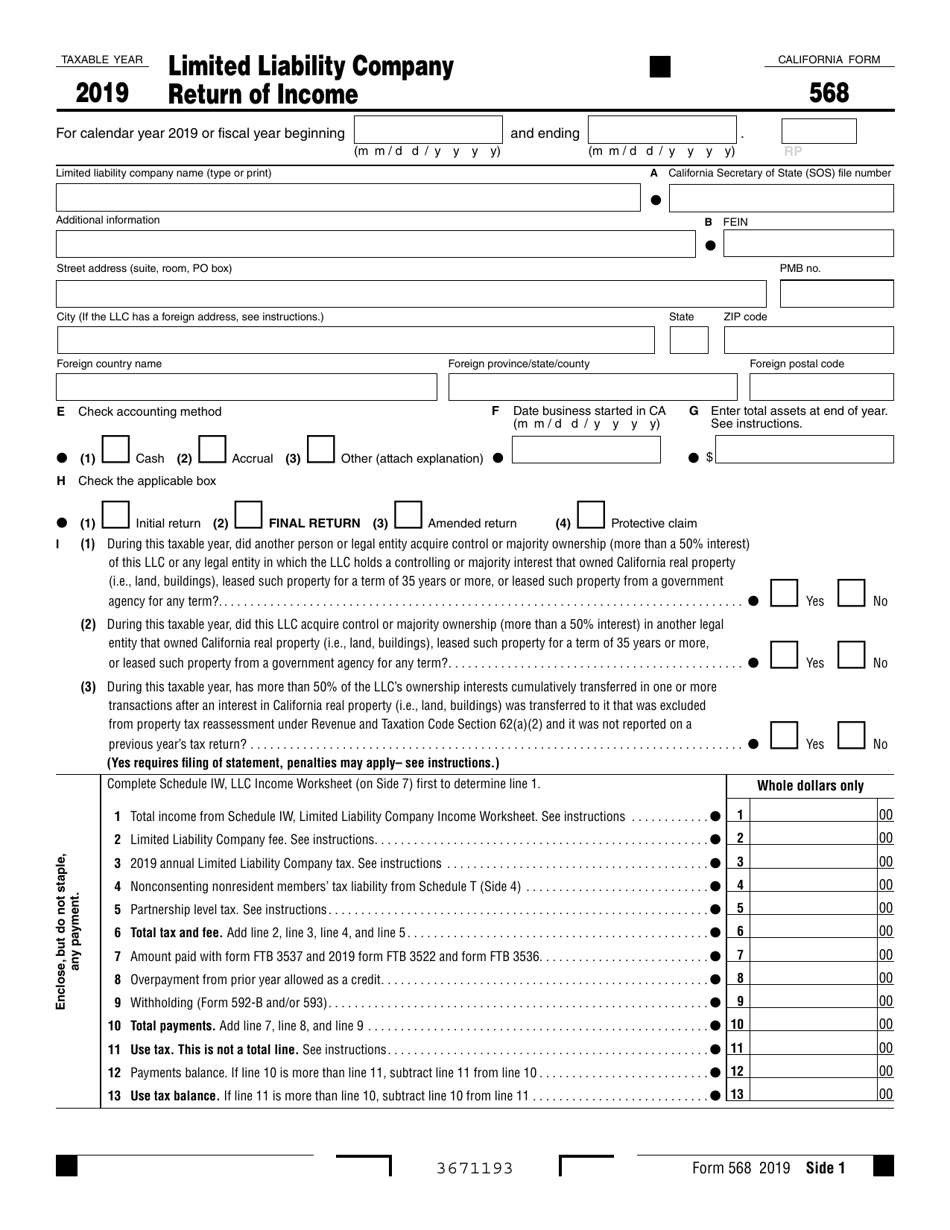

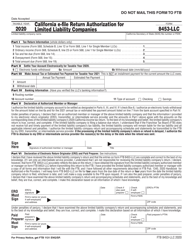

Form 568 Limited Liability Company Return of Income - California

What Is California Form 568?

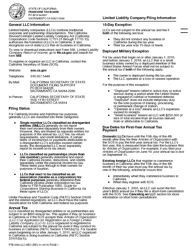

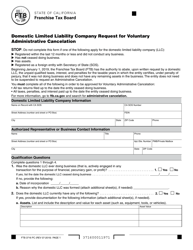

California Form 568, Limited Liability Company Return of Income , is an application issued by the State of California Franchise Tax Board (California FTB) . It is an income tax return that should be filed every year. A fillable CA 568 Form is available for download below.

The purpose of the document is very wide and includes:

- Reporting a filer's fee, annual tax, income, deductions, losses, etc.

- Determining the amount of the fee based on an applicant's total California income.

- Paying any nonconsenting nonresident members' tax.

The document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. If an LLC is classified as a general corporation, they must file Form 100, California Corporation Franchise or Income Tax Return. If an LLC is classified as an S corporation, they must file Form 100S, California S Corporation Franchise or Income Tax Return.

CA Form 568 Instructions

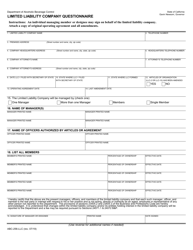

California Form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. The application starts with open gaps where an applicant must enter information about the LLC. It includes its legal name, address, California Secretary of State file number, federal employer identification number, and private mailbox number (if applicable). Schedules in the document include:

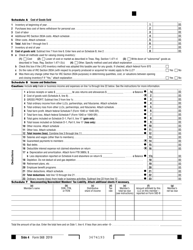

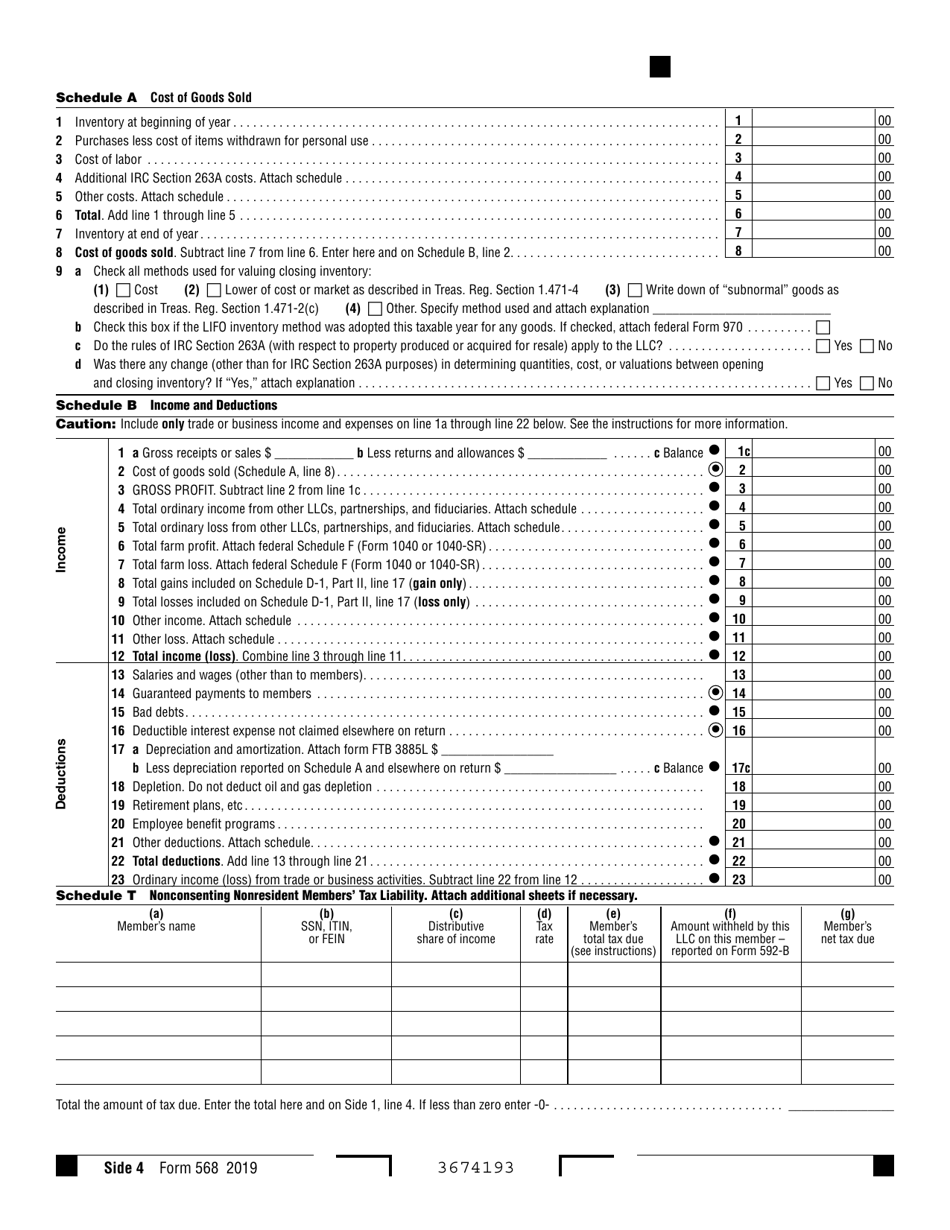

- Cost of goods sold . This section requires an applicant to enter numbers such as inventory at the beginning of the year, cost of labor, cost of goods sold, etc;

- Income and deductions . Businesses use this section to show data about their total income and total deductions, which includes their gross profit, losses, bad debts, etc.

- Nonconsenting nonresident members' tax liability . Here an applicant is offered to fill out the information about members and their total tax due. It also includes the amount withheld by the LLC from the member.

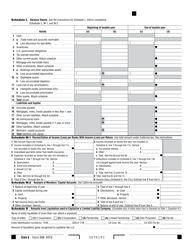

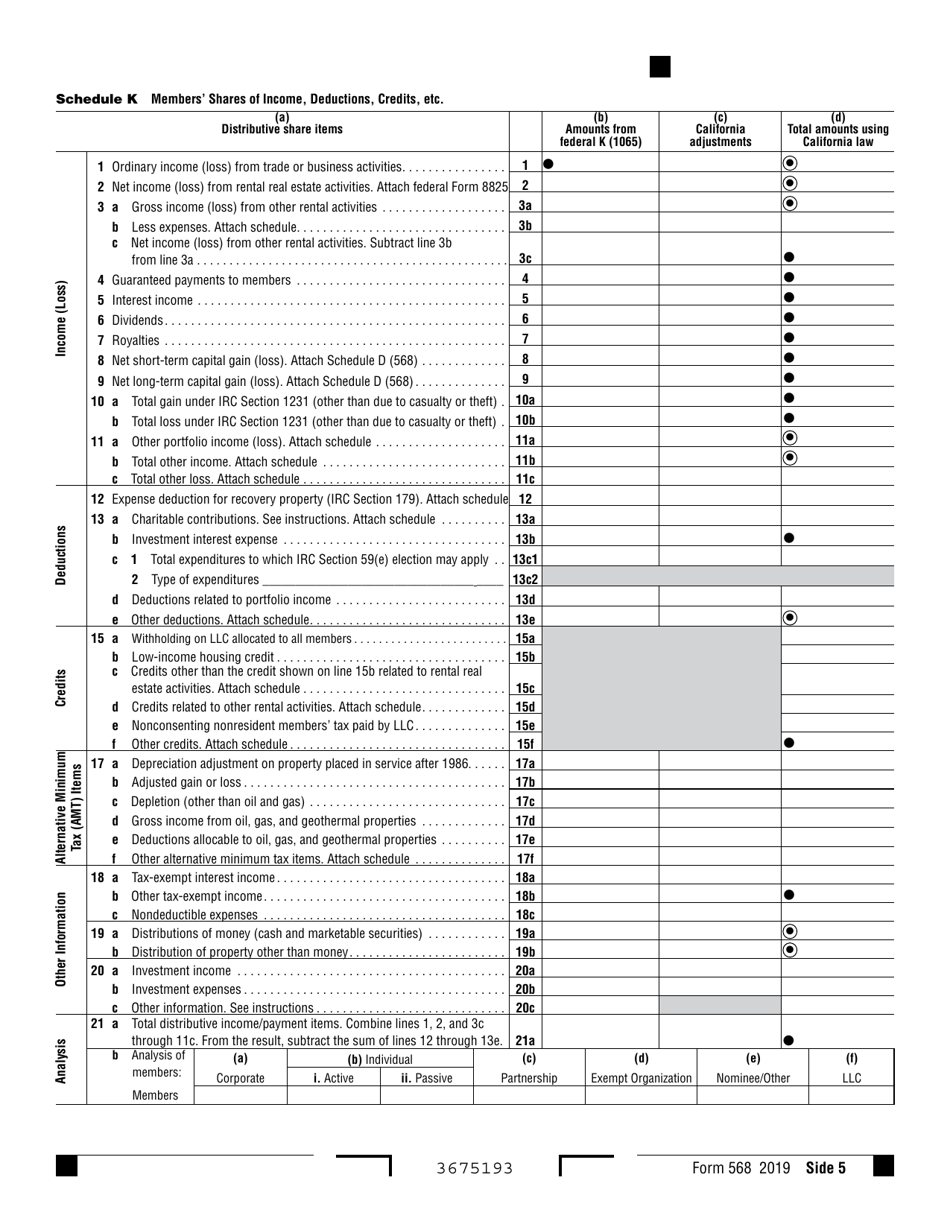

- Members' shares of income, deductions, credits, etc . In this section, a filer must designate information about dividends, charitable contributions, adjusted gain or loss, tax-exempt income, etc.

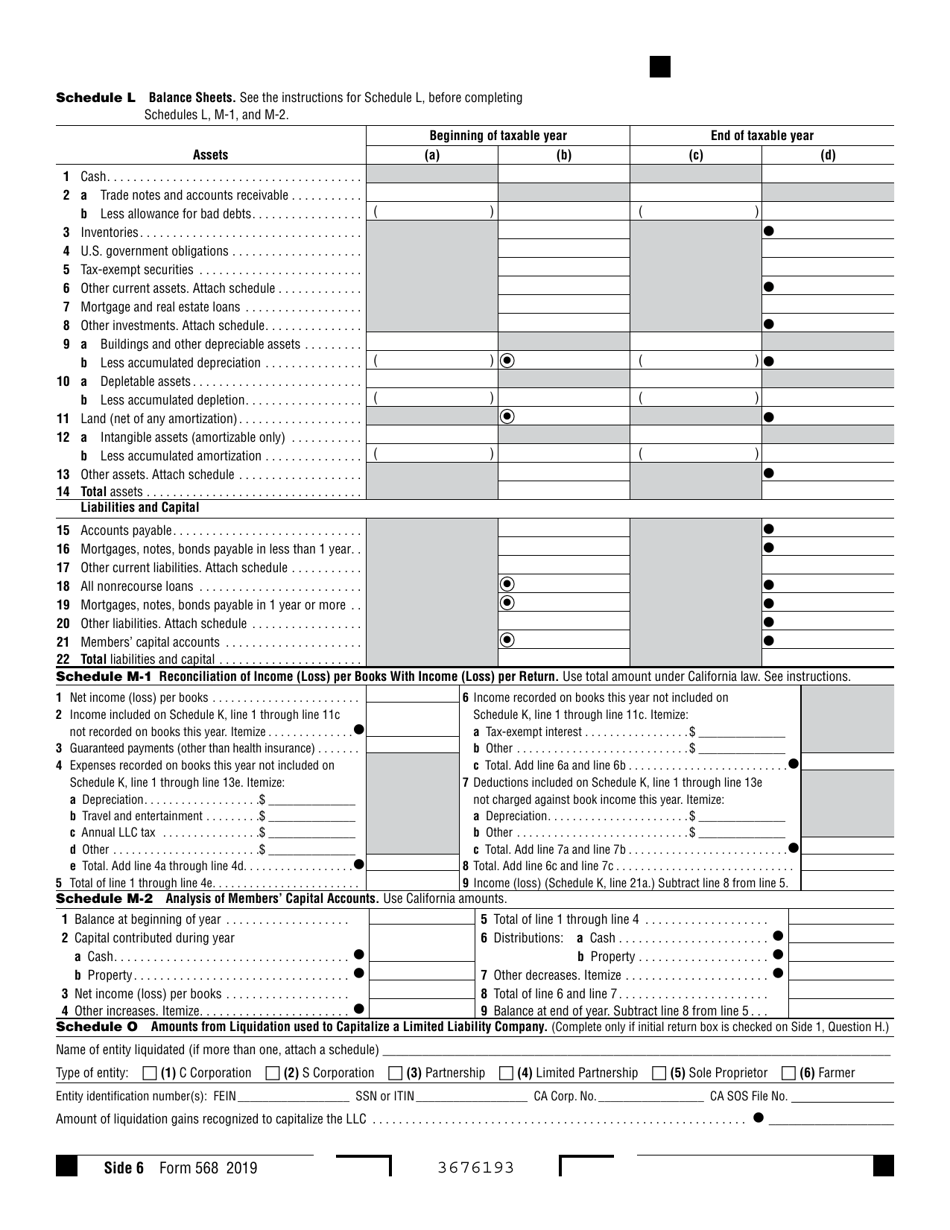

- Balance Sheets . Applicants are required to indicate their assets here. To do so they must state the numbers for the beginning of the taxable year and the end of it. The numbers include cash, inventories, mortgage, and real estate loans, etc.

- Reconciliation of Income (Loss) per Books With Income (Loss) per Return . This section covers net income (loss) per books, guaranteed payments, annual LLC tax, and other expenses recorded on books, deductions, etc.

- Analysis of Members' Capital Accounts . LLCs must designate here their balance at the beginning of the year, capital their members contributed during the year (with cash or with property), and other increases.

- Amounts from Liquidation used to Capitalize a Limited Liability Company . An applicant must fill in this part of the application only if they are filing an initial return and checked an appropriate box at the beginning of the document.

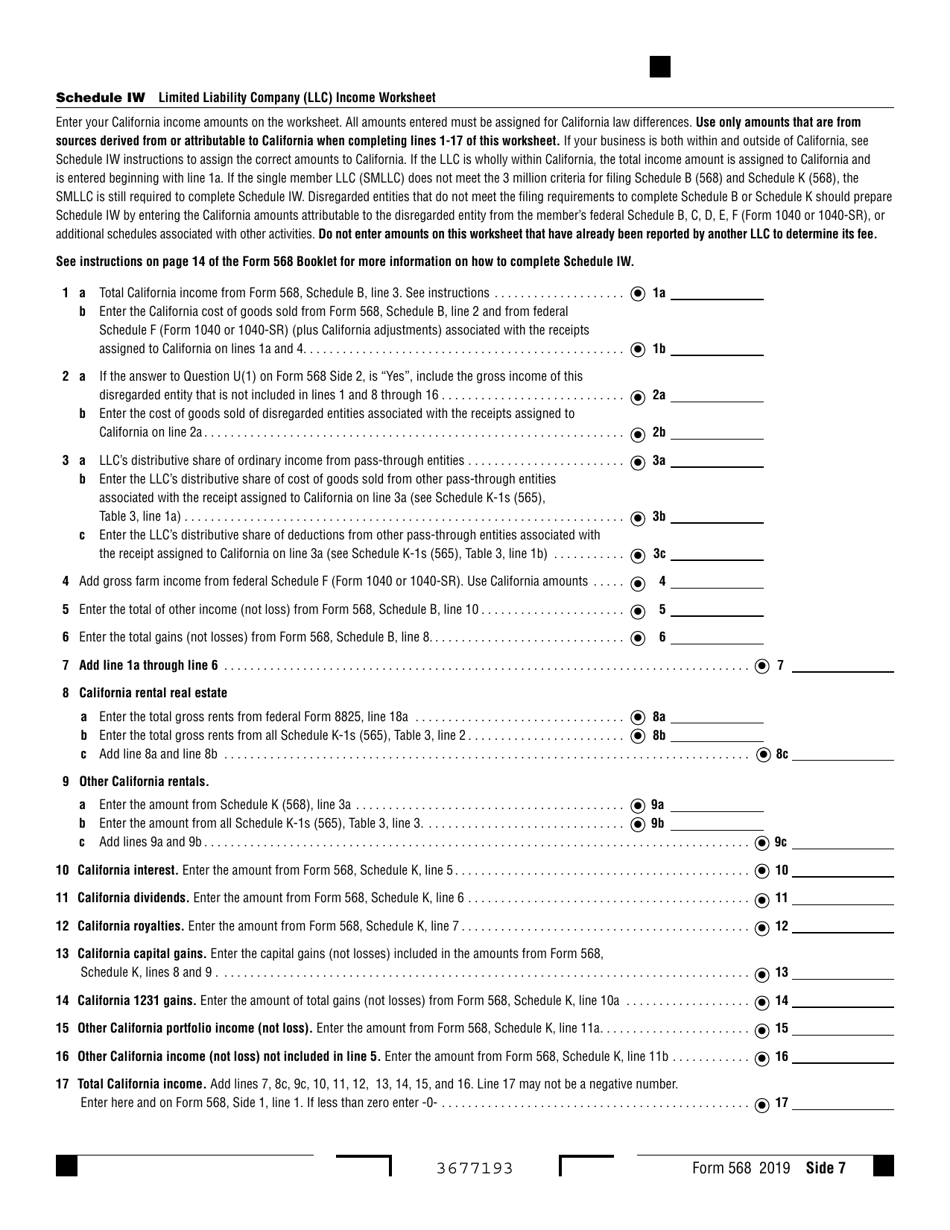

- Limited Liability Company Income Worksheet . To complete this worksheet a filer must only use amounts derived from California (or attributable to California). The applicant is also required to fill in the gaps with the numbers from different schedules in order to count their total California income.

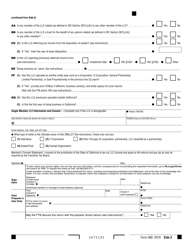

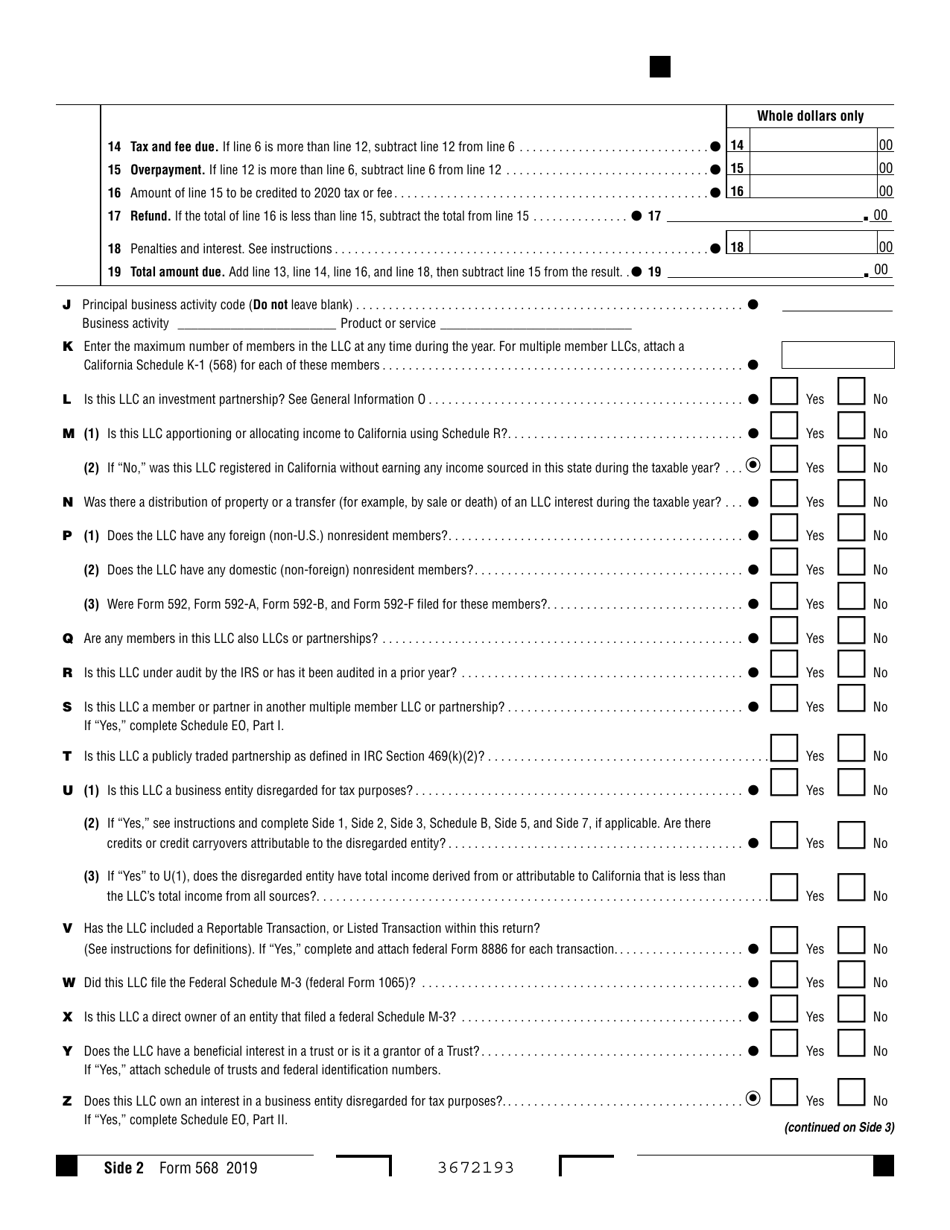

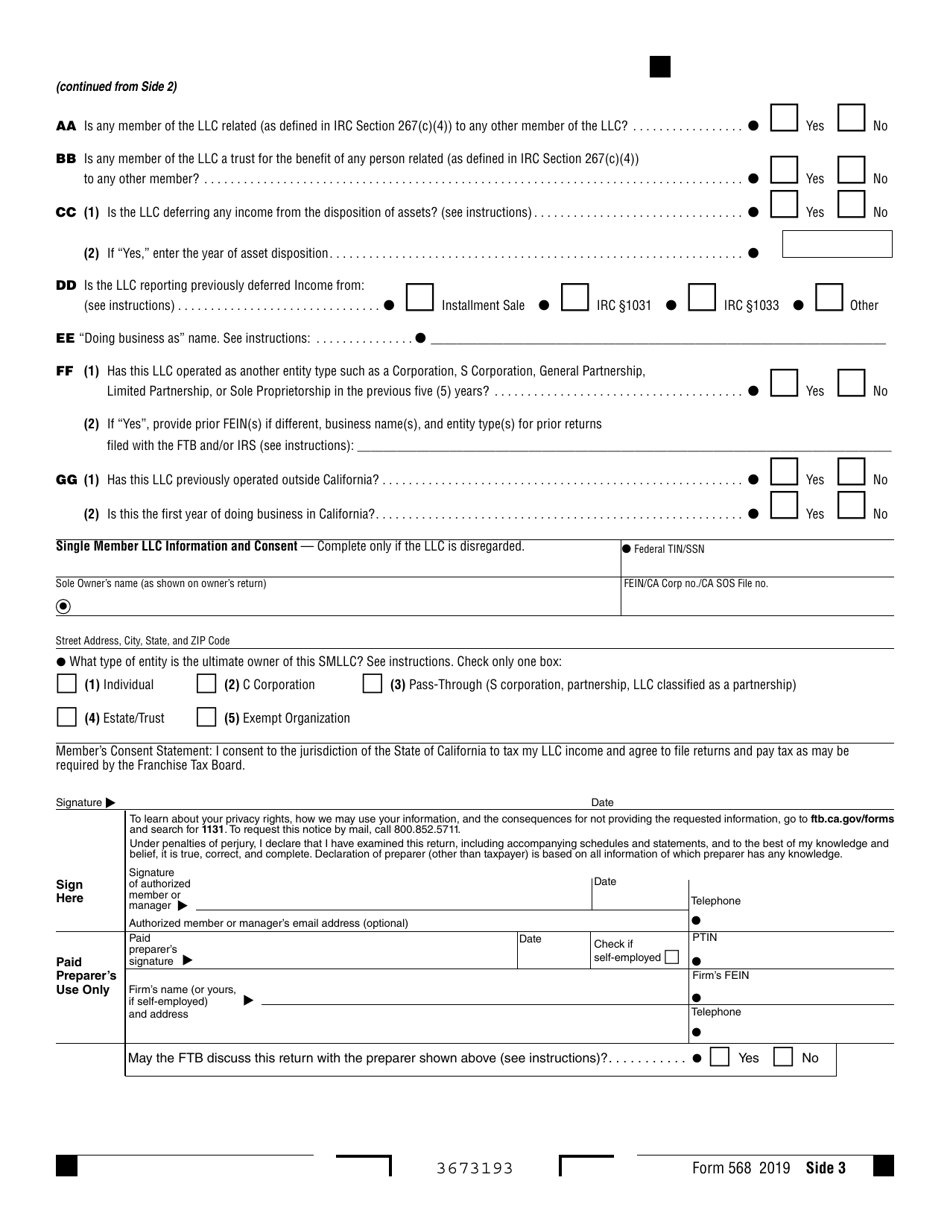

Apart from the schedules listed below, an applicant must answer questions about the LLC, such as:

- Is the LLC an investment partnership?

- Does the LLC have any foreign nonresident members?

- Is the LLC under audit by the Internal Revenue Service or has it been audited in a prior year?

According to the instructions, a Form 568 extension is seven months. All LLCs that are in good standing and classified as partnerships have an automatic extension, they are not required to file for an extension.

Where to Mail California Form 568?

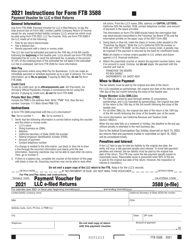

After completing the form, an applicant must mail it with payment to the California FTB. According to the latest LLC Tax Booklet, the address for that location is PO box 942857, Sacramento, California 94257-0501 .