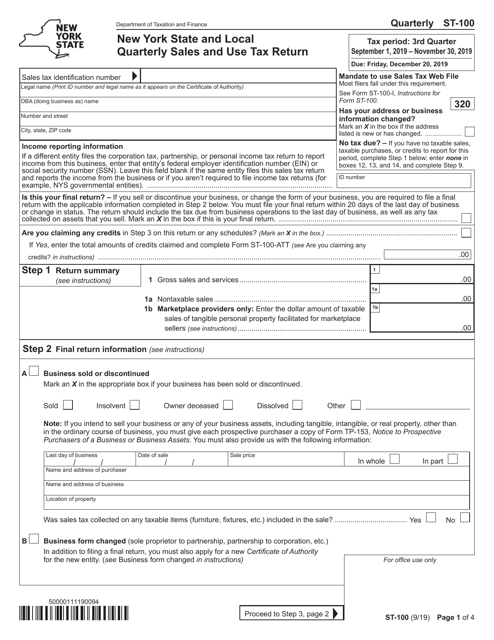

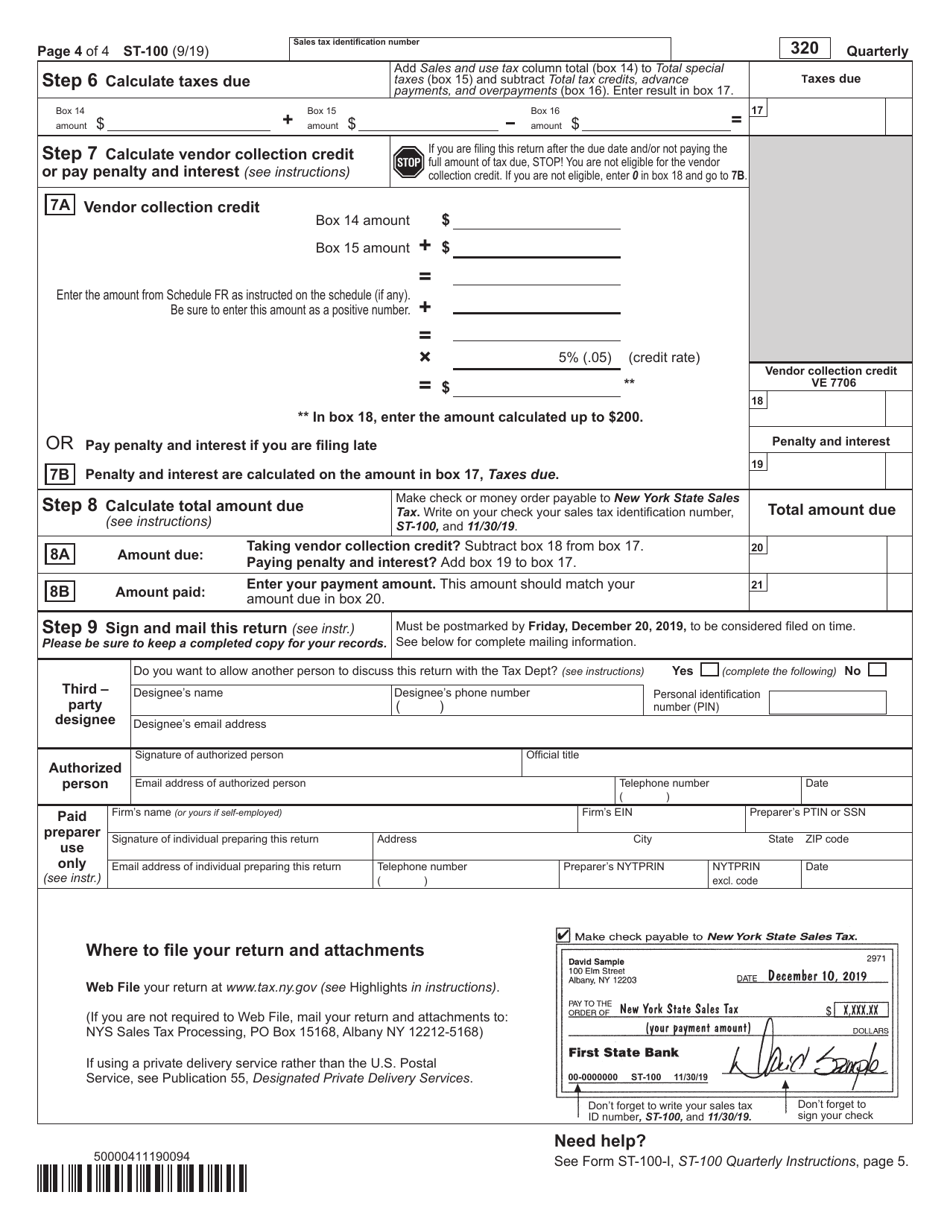

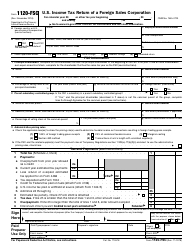

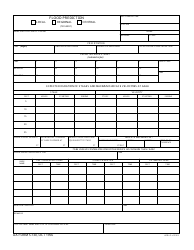

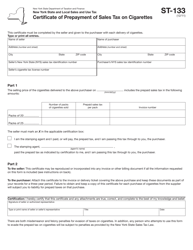

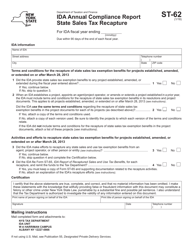

Form ST-100 New York State and Local Quarterly Sales and Use Tax Return - New York

What Is Form ST-100?

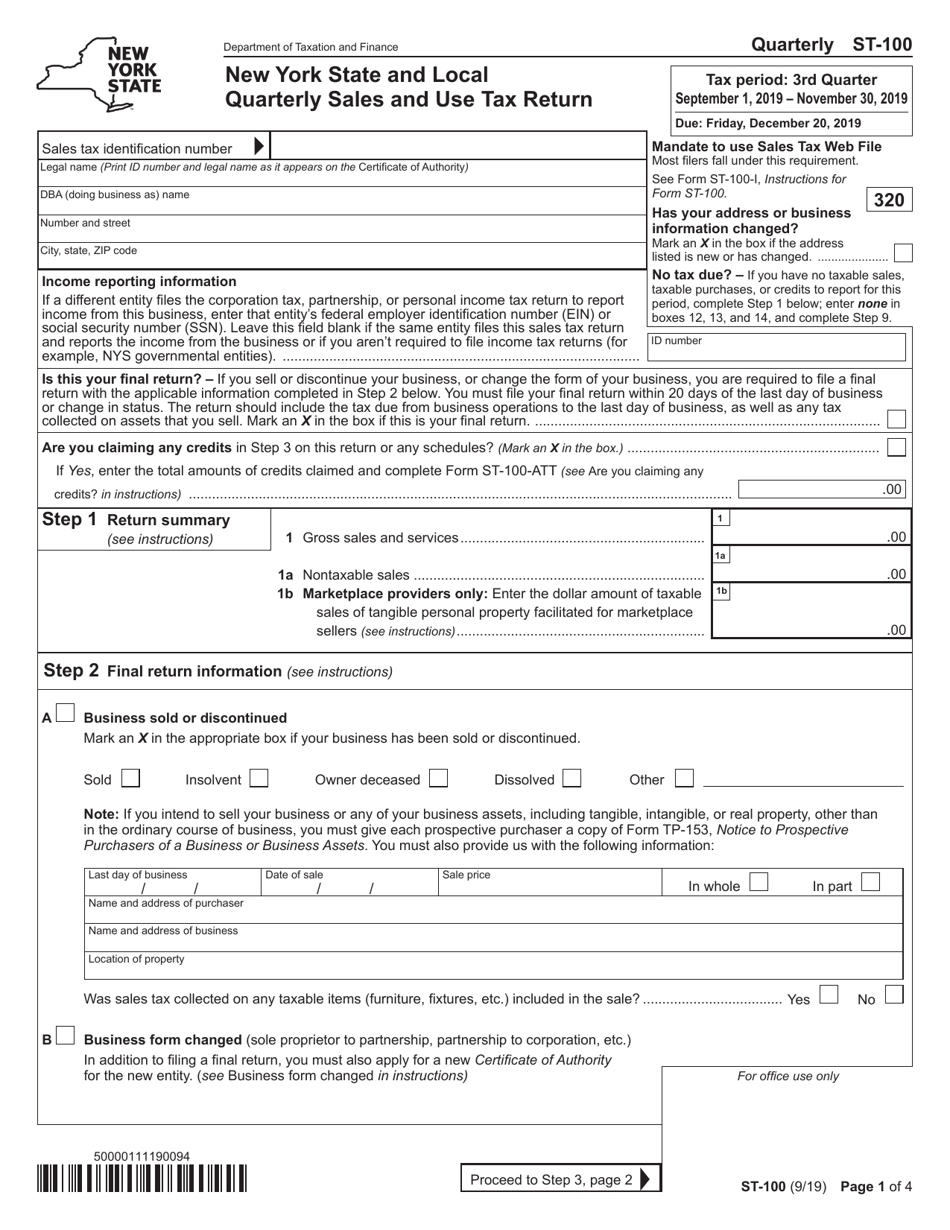

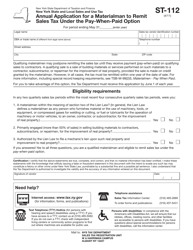

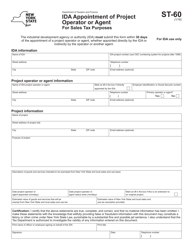

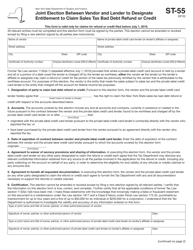

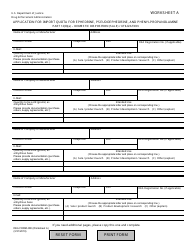

Form ST-100, New York State and Local Quarterly Sales and Use Tax Return , is a formal document used by companies based in New York to notify the tax authorities about the total amount of sales of goods, purchases, and credits every quarter of the calendar year. This statement summarizes the business activity of your organization by listing the number of sales, services, purchases, and your current identification information. Unless you had a notification that confirmed you are an annual filer, you need to use ST-100 Form once every four months - even if there is no tax to report.

Alternate Name:

- New York Sales Tax Form.

This form was released by the New York State Department of Taxation and Finance . The latest version of this return was issued on September 1, 2019 , with all previous editions obsolete. Download an ST-100 printable form via the link below.

Form ST-100 Instructions

Instructions for Form ST-100 are as follows:

- Write down your sales tax identification number, legal name and business name, and your business location. If you have changed your address, put an X in the box to notify the authorities about it.

- If a different organization files the return for your business, state its federal employer identification number or social security number.

- Indicate whether this is the last return you are filing and whether you want to claim any credits.

- Record all taxable, nontaxable, and exempt services and sales from all your business locations. Indicate the amount of sales of tangible personal property subject to tax if you are a marketplace provider.

- If your business was discontinued or sold, check the appropriate box and provide the relevant information - the last day of business, date, and price of sale, name and contact information of the buyer, and location of the property transferred. Answer "yes" if the sales tax was paid on the sold property.

- Check the box if the form of your business has changed.

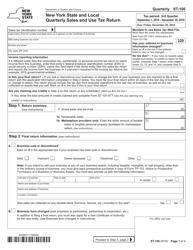

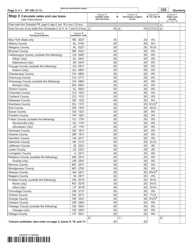

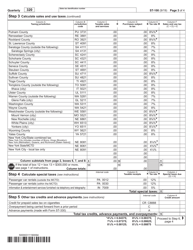

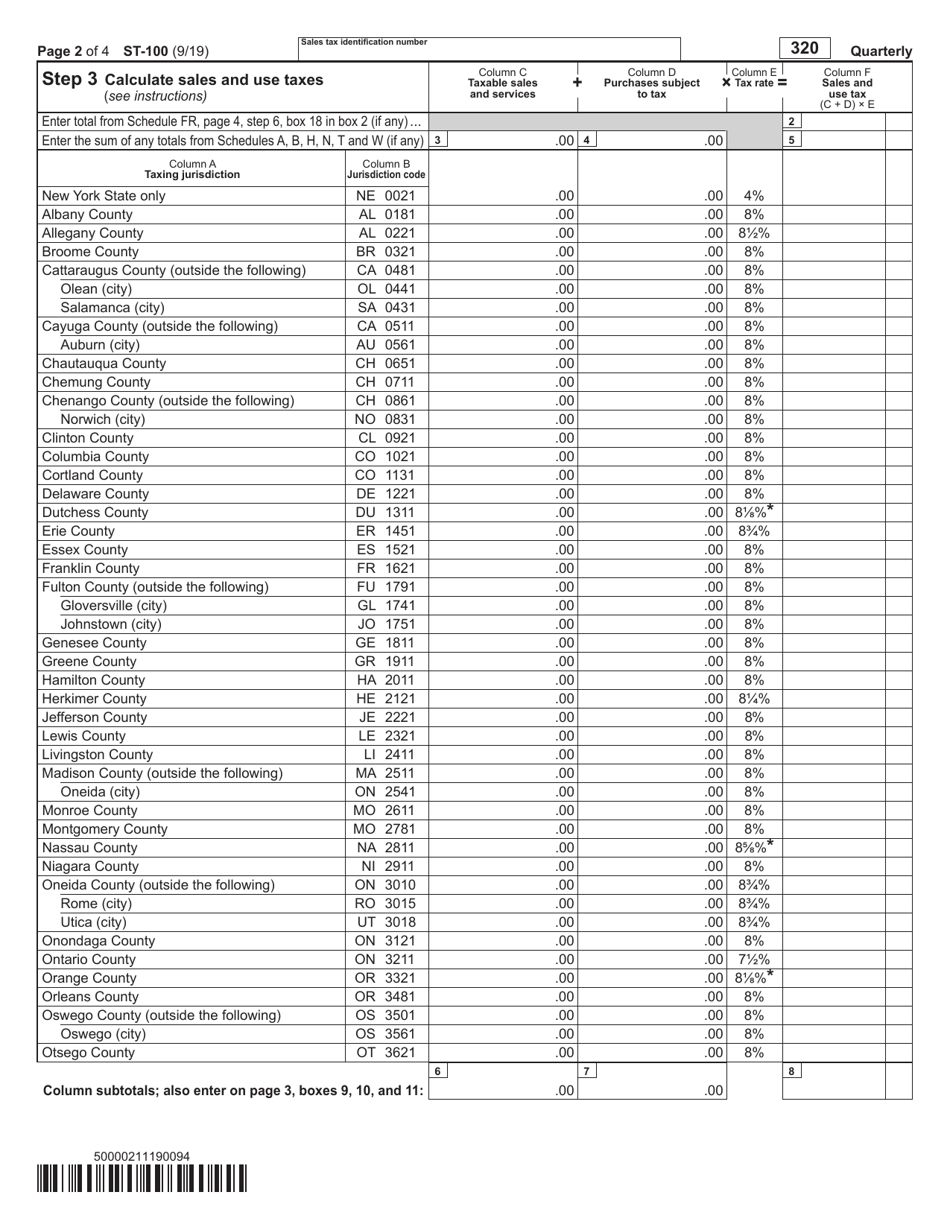

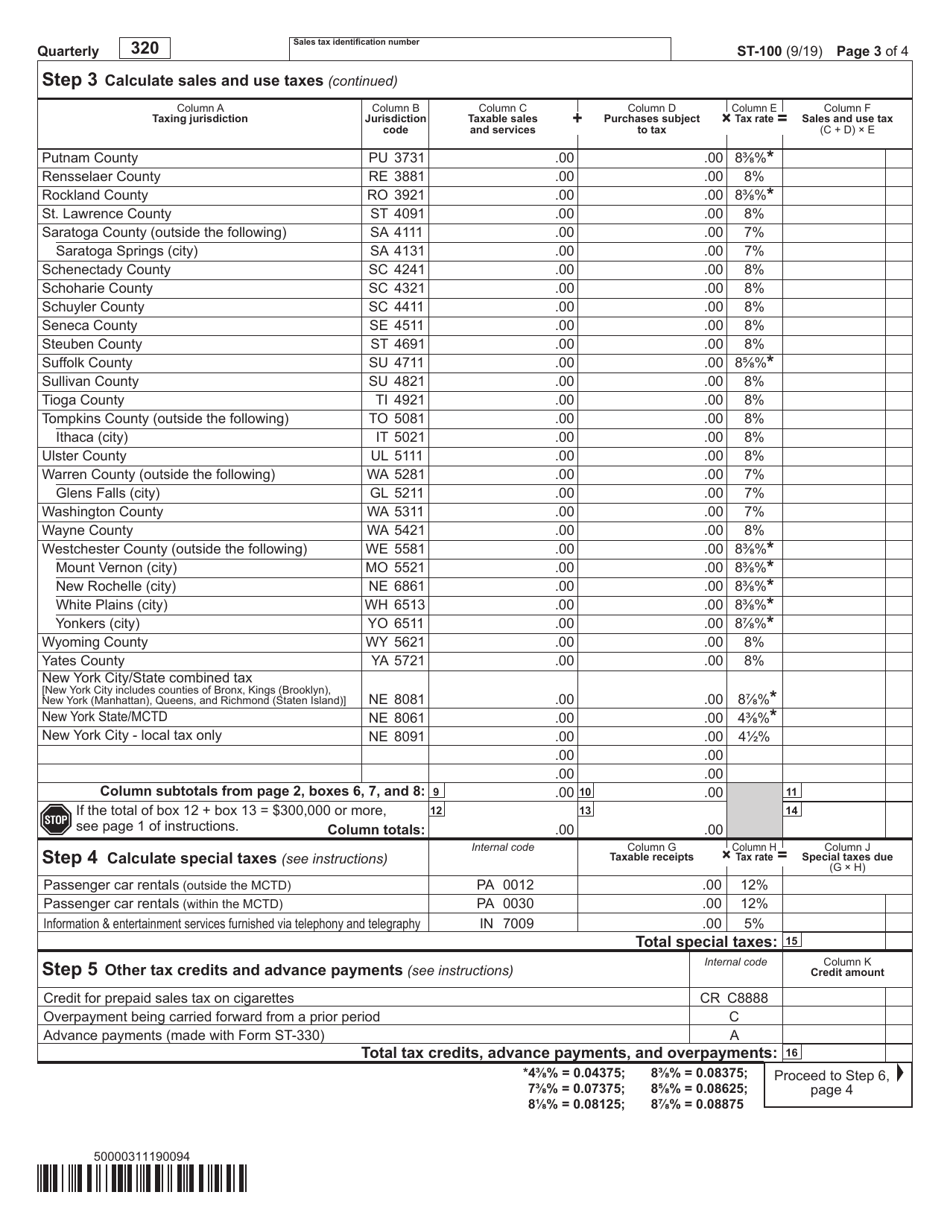

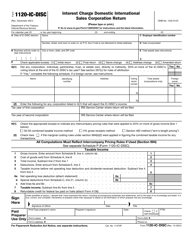

- Compute the sales and use tax. Find your taxing jurisdiction in the table, add the sales and services to purchases, multiply this result by the tax rate stated in the table, and calculate the sales and use tax.

- Record special taxes - multiply the receipts by the tax rate. You have to report car rentals, telephony and telegraphy services used for entertainment and information purposes, and vapor products.

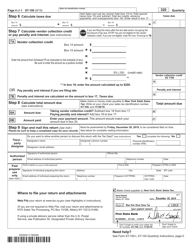

- List the credits and advance payments you want to claim and figure out the total amount of taxes due by subtracting the latest result from the combined amount of sales and use tax and special taxes.

- Calculate the vendor collection credit if you are filing the documentation later than the due date.

- Sign the document, enter your name, title, identification numbers, and contact information. Additionally, the return can be filled out and signed by the paid preparer.

You may submit this form electronically or mail the documentation to the NYS Sales Tax Processing, PO Box 15168, Albany, New York 12212-5168.

Related Forms: