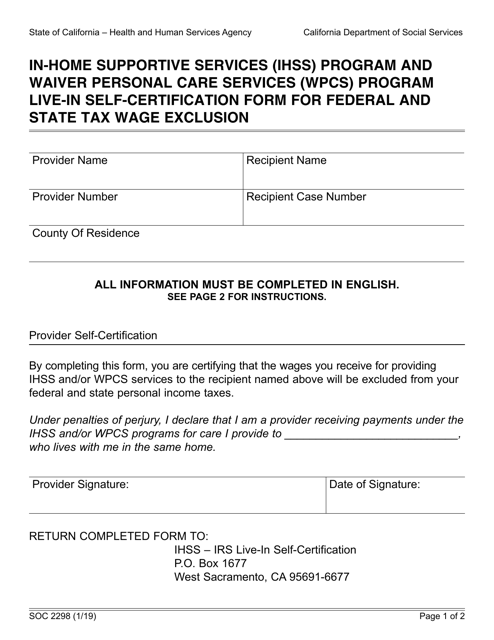

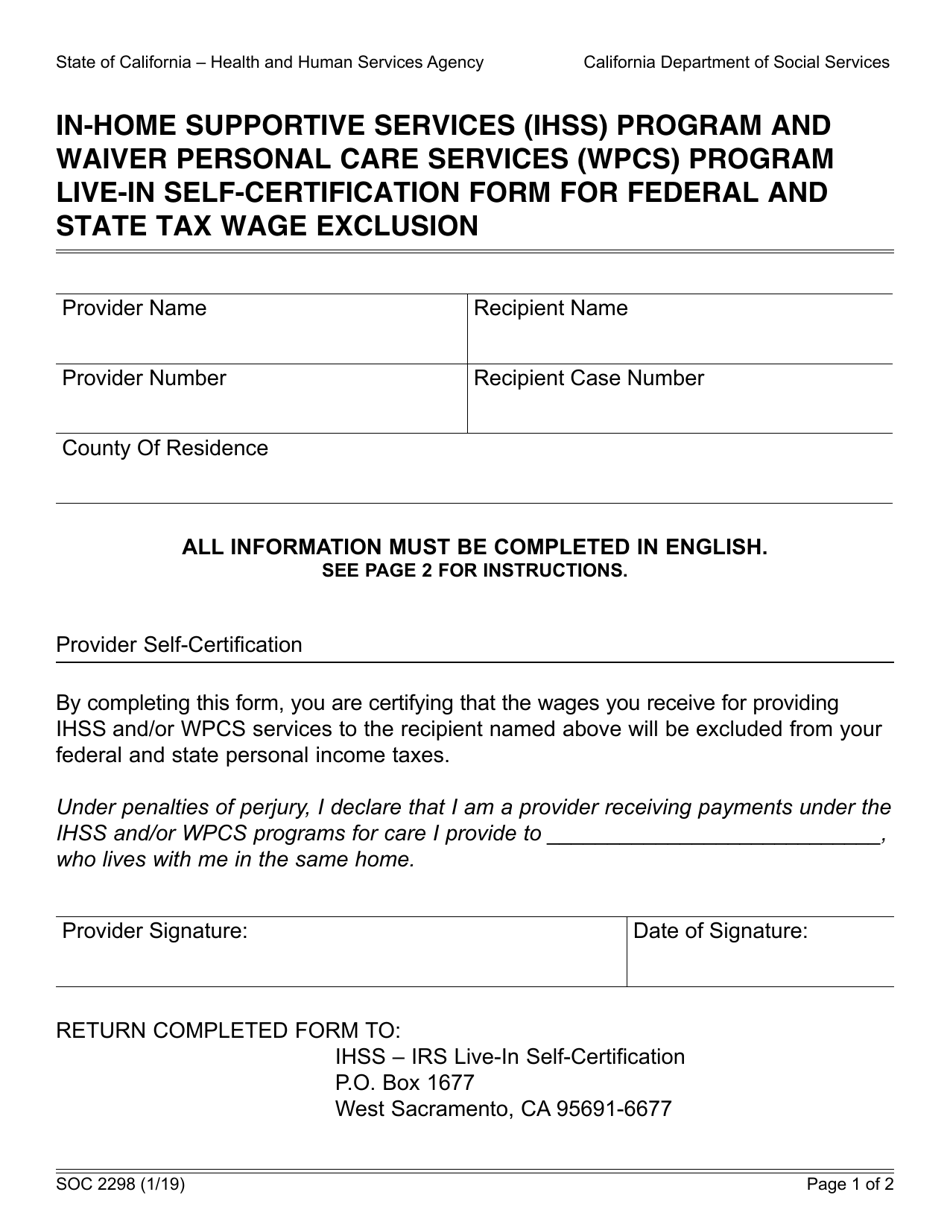

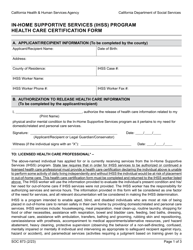

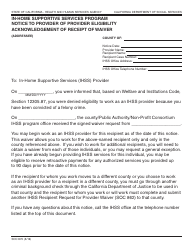

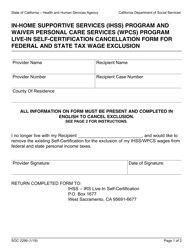

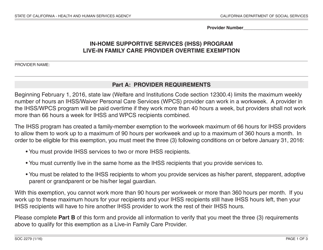

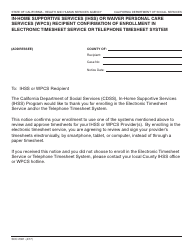

Form SOC2298 In-home Supportive Services (Ihss) Program and Waiver Personal Care Services (Wpcs) Program Live-In Self-certification Form for Federal and State Tax Wage Exclusion - California

What Is Form SOC2298?

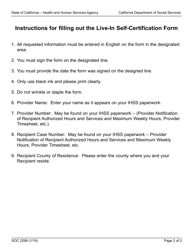

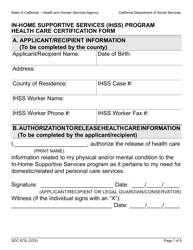

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SOC2298?

A: Form SOC2298 is the Live-In Self-certification Form for Federal and State Tax Wage Exclusion in California.

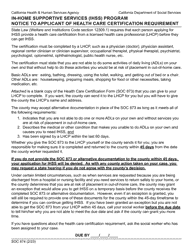

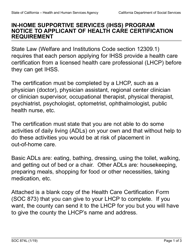

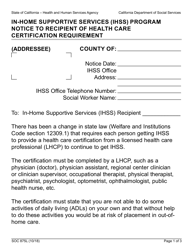

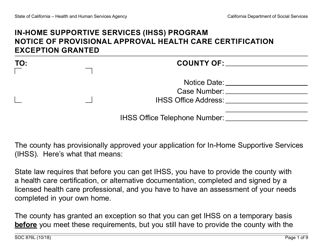

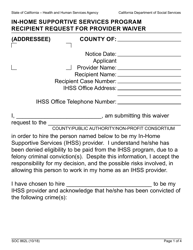

Q: What is the purpose of Form SOC2298?

A: The purpose of Form SOC2298 is to certify that an individual is eligible for the Federal and State Tax Wage Exclusion for the In-home Supportive Services (IHSS) Program and Waiver Personal Care Services (WPCS) Program in California.

Q: Who should complete Form SOC2298?

A: Form SOC2298 should be completed by individuals who are receiving services through the IHSS Program and WPCS Program and qualify for the Live-In Self-certification.

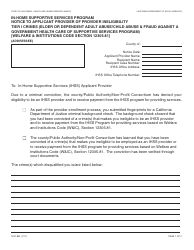

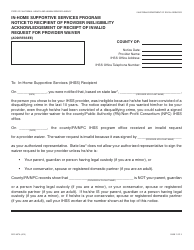

Q: What is the Live-In Self-certification?

A: The Live-In Self-certification is a process that allows certain IHSS and WPCS recipients in California to exclude their wages from federal and state taxes.

Q: What are the eligibility requirements for the Live-In Self-certification?

A: To be eligible for the Live-In Self-certification, an individual must be receiving services through the IHSS Program or WPCS Program, have a qualifying disability or health condition, and meet certain residency and living arrangement criteria.

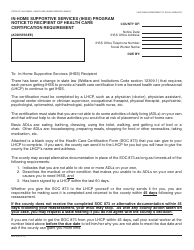

Q: How should I submit Form SOC2298?

A: Form SOC2298 should be completed and submitted to your local county IHSS office.

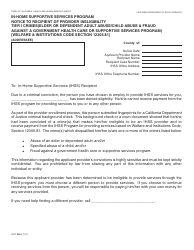

Q: What happens after I submit Form SOC2298?

A: After you submit Form SOC2298, your eligibility for the Live-In Self-certification will be determined by your local county IHSS office.

Q: Are the wages excluded from federal and state taxes if I am approved for the Live-In Self-certification?

A: Yes, if you are approved for the Live-In Self-certification, your wages earned through the IHSS Program or WPCS Program will be excluded from federal and state taxes.

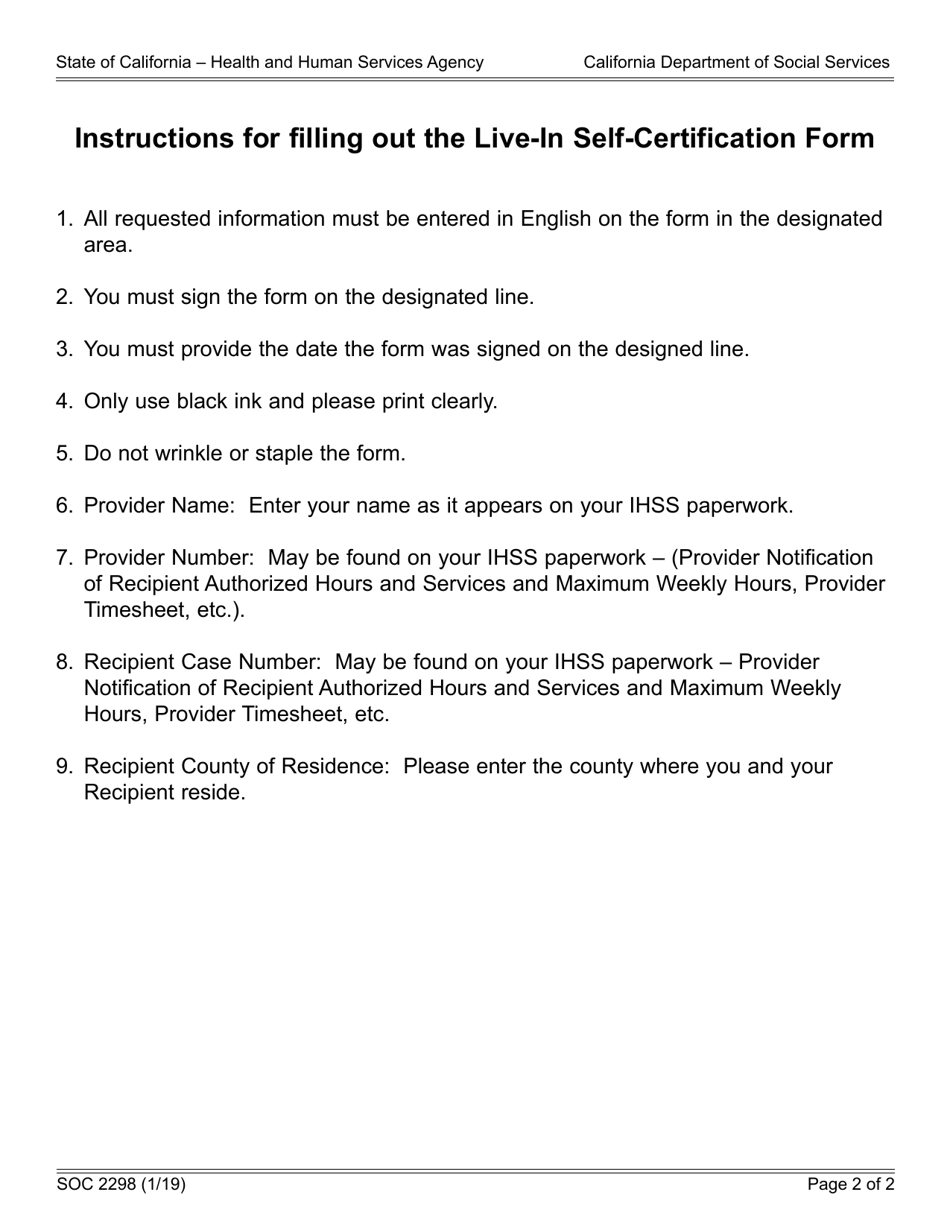

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SOC2298 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.