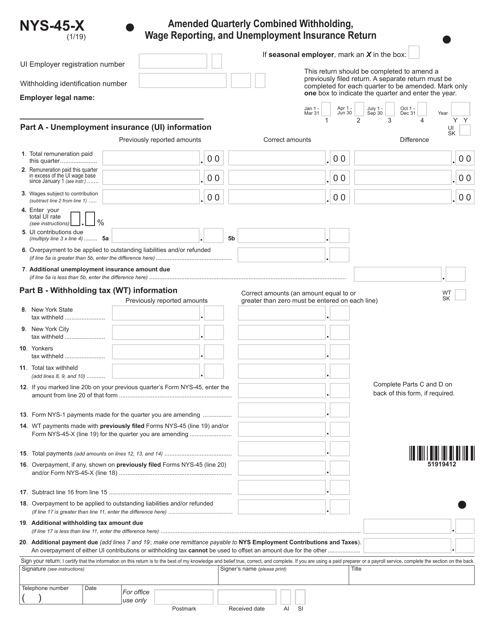

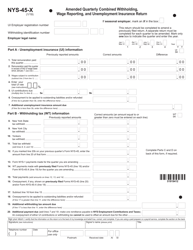

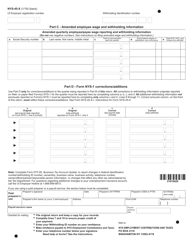

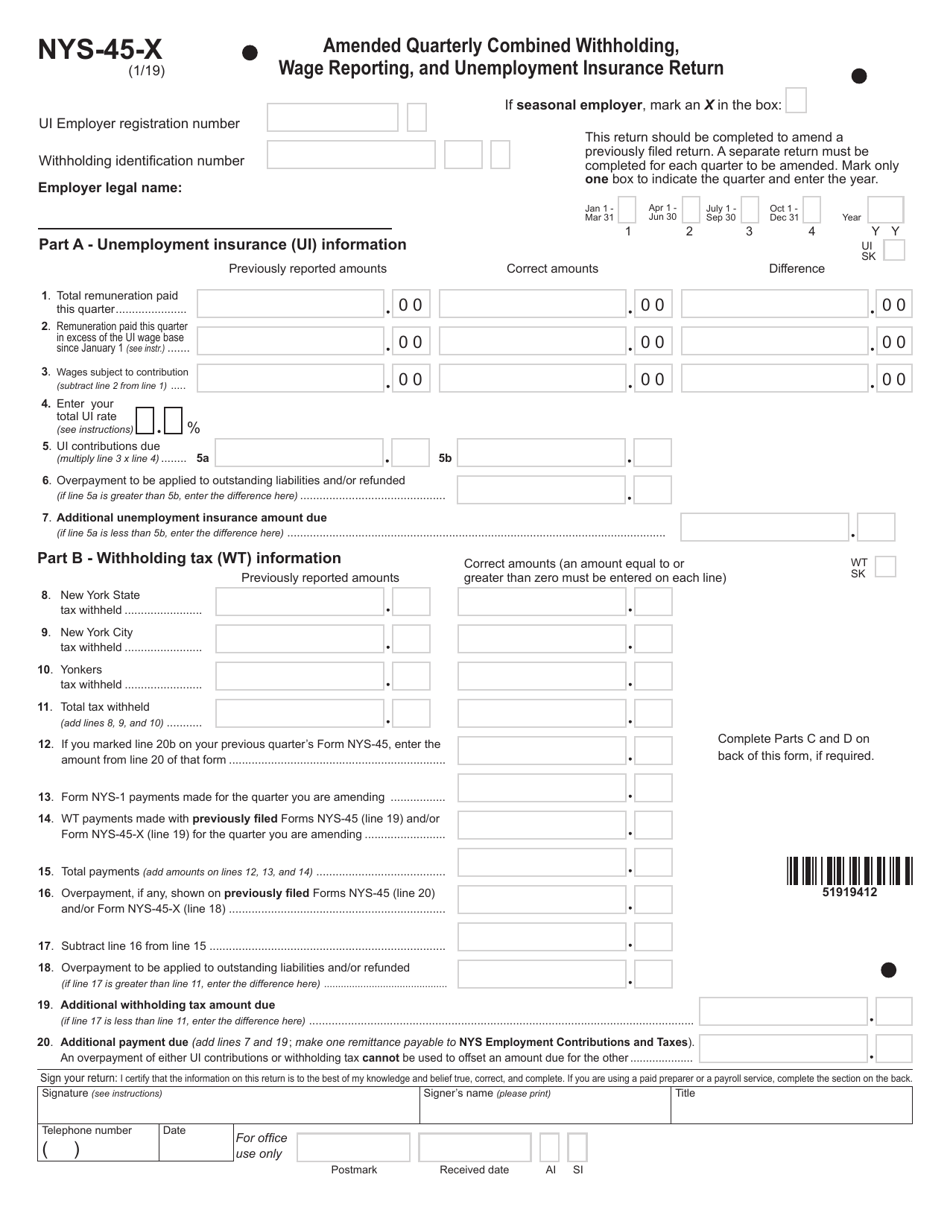

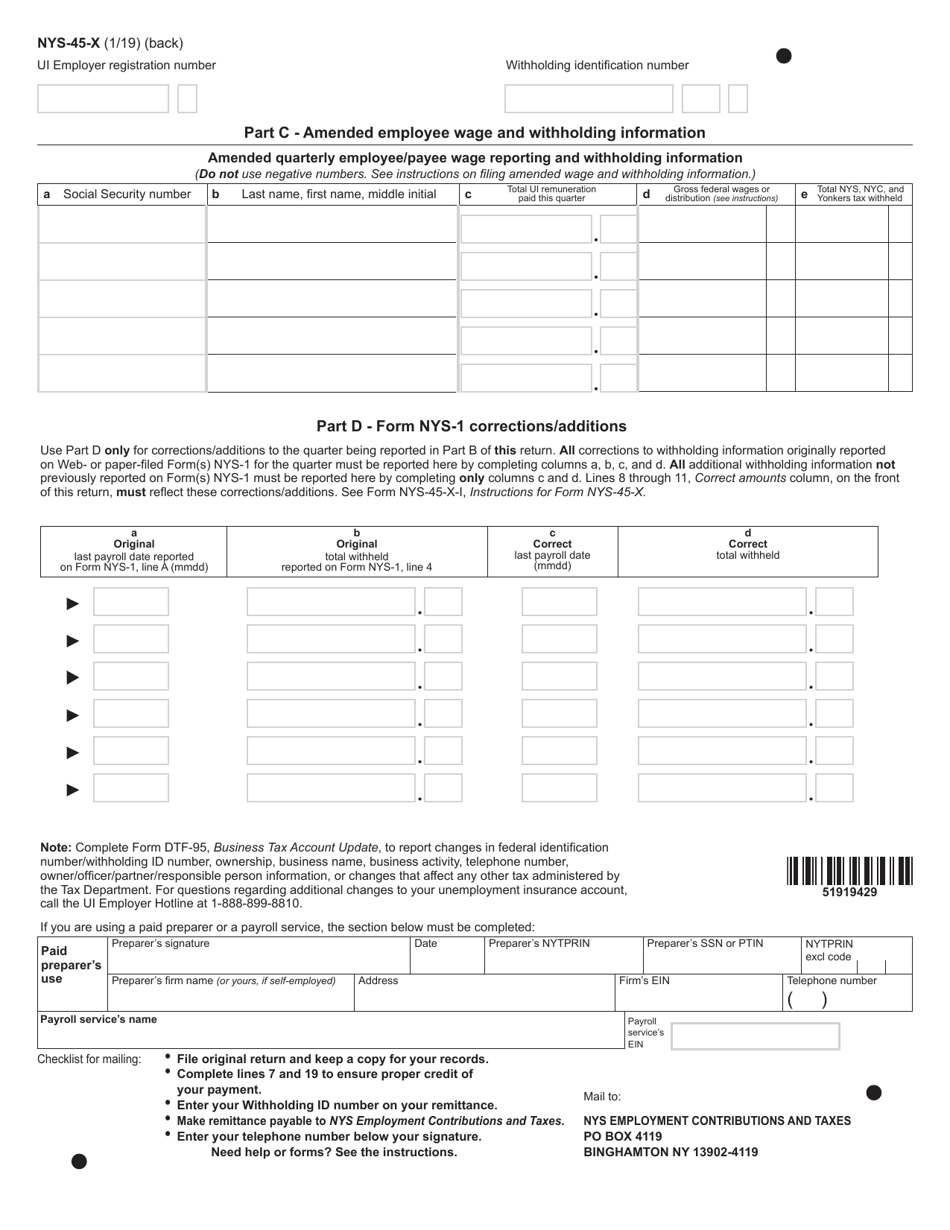

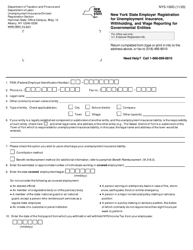

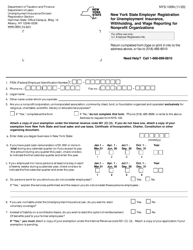

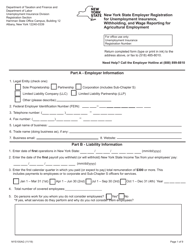

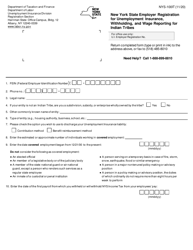

Form NYS-45-X Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return - New York

What Is Form NYS-45-X?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NYS-45-X?

A: Form NYS-45-X is an amended quarterly combined withholding, wage reporting, and unemployment insurance return for businesses in New York.

Q: Who needs to file Form NYS-45-X?

A: Businesses in New York that need to amend their quarterly withholding, wage reporting, and unemployment insurance return.

Q: What is the purpose of Form NYS-45-X?

A: The purpose of this form is to correct errors or omissions in the original quarterly return and provide accurate information.

Q: When should Form NYS-45-X be filed?

A: Form NYS-45-X should be filed when there are changes or corrections to be made to the original quarterly return within the required timeframes.

Q: Are there any penalties for not filing Form NYS-45-X?

A: Failure to file an amended return when required may result in penalties and interest being assessed by the New York State Department of Taxation and Finance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NYS-45-X by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.