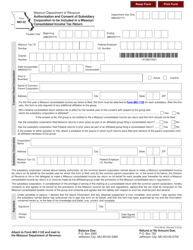

This version of the form is not currently in use and is provided for reference only. Download this version of

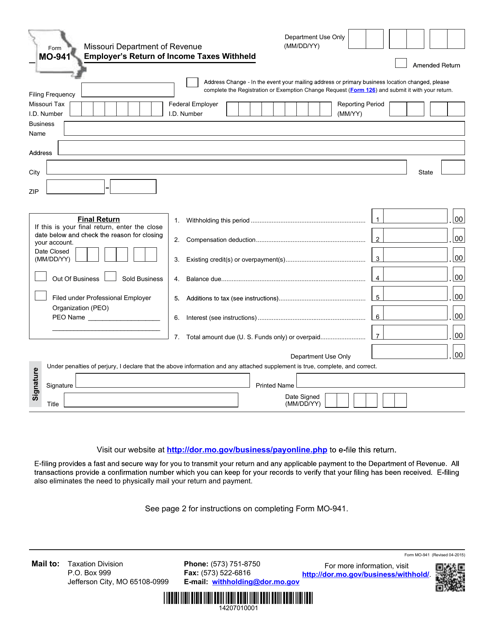

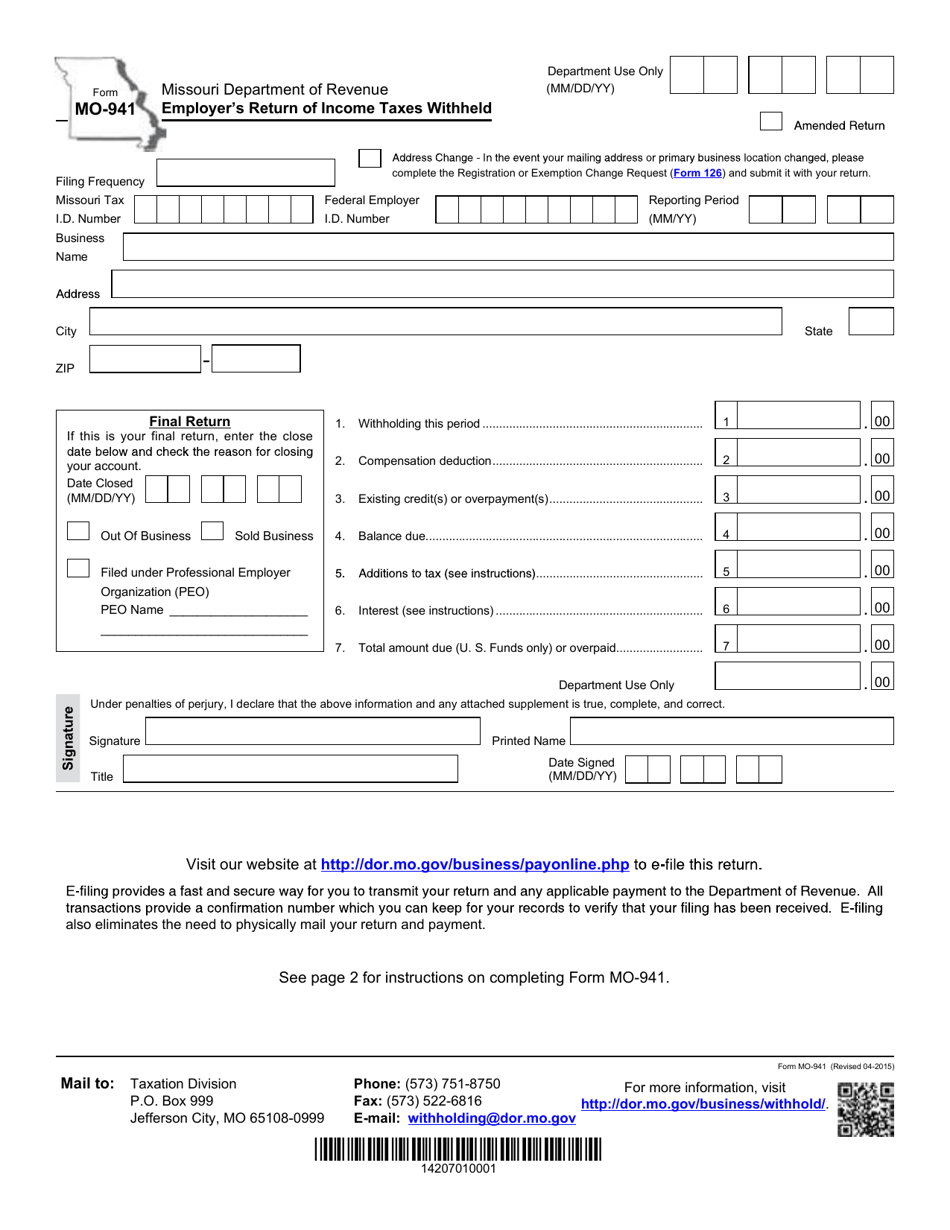

Form MO-941

for the current year.

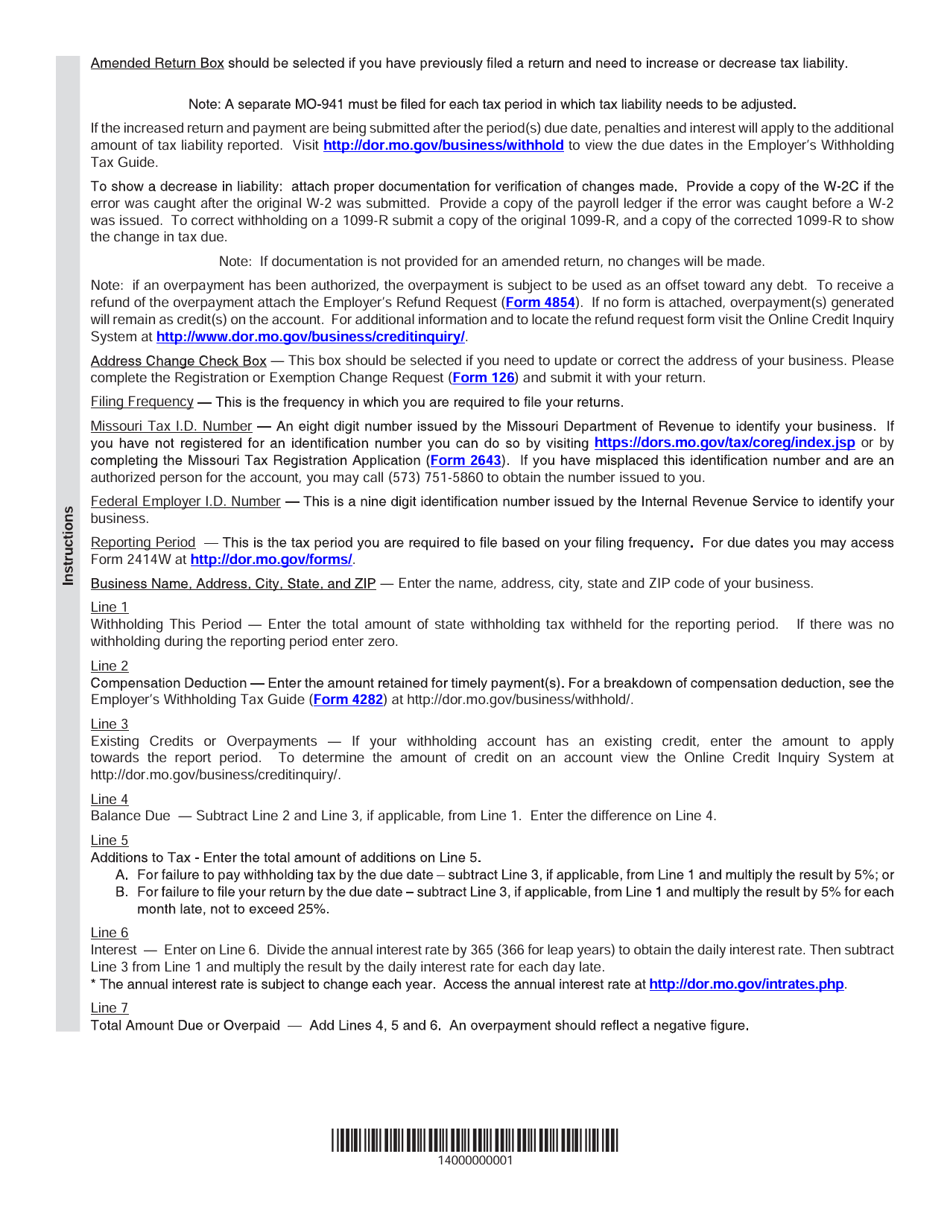

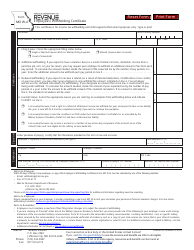

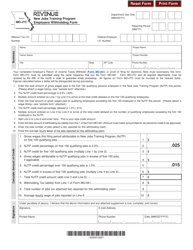

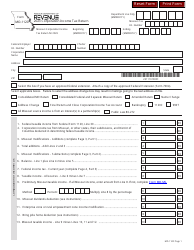

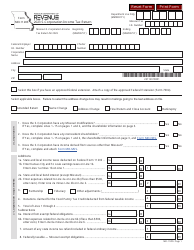

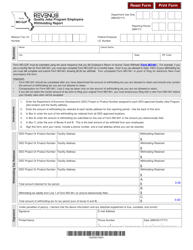

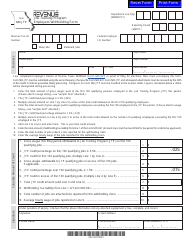

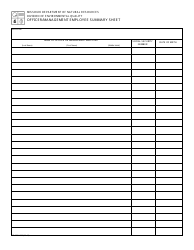

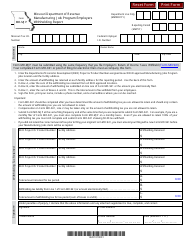

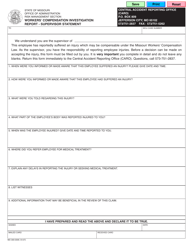

Form MO-941 Employer's Return of Income Taxes Withheld - Missouri

What Is Form MO-941?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-941?

A: Form MO-941 is the Employer's Return of Income Taxes Withheld in Missouri.

Q: Who needs to file Form MO-941?

A: Employers in Missouri who withhold income taxes from their employees' wages need to file Form MO-941.

Q: What information is required on Form MO-941?

A: Form MO-941 requires information about the employer, the total amount of wages paid, the total amount of income taxes withheld, and other related details.

Q: When is Form MO-941 due?

A: Form MO-941 is due quarterly, with the following deadlines: April 30th, July 31st, October 31st, and January 31st.

Q: Are there any penalties for late filing of Form MO-941?

A: Yes, there are penalties for late filing and late payment of taxes owed. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-941 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.