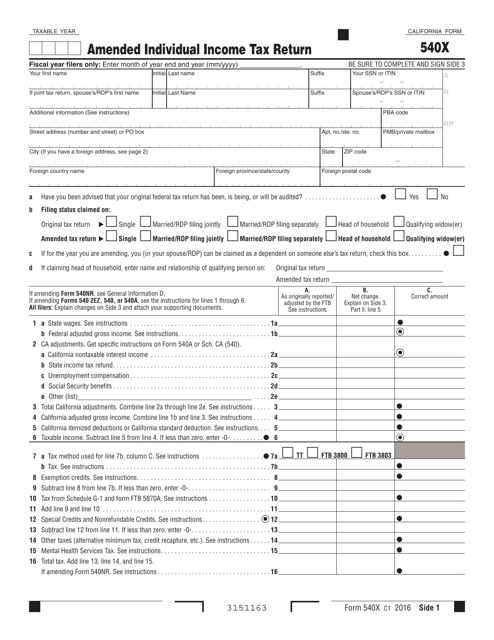

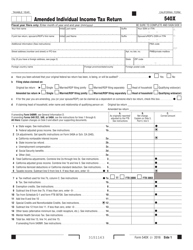

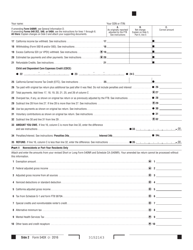

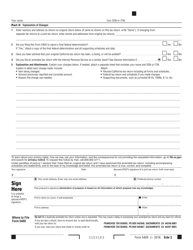

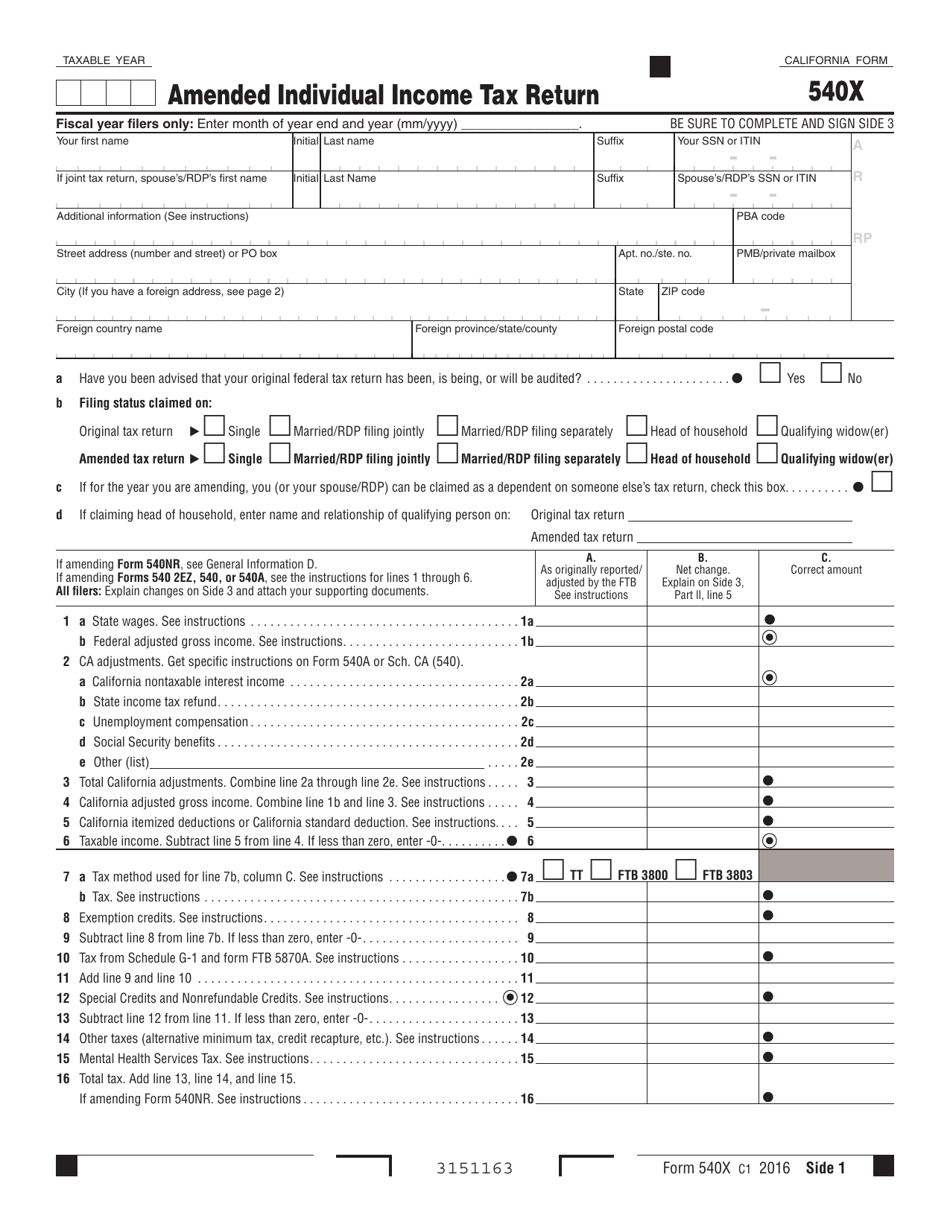

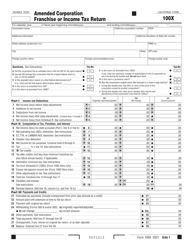

Form 540X Amended Individual Income Tax Return - California

What Is Form 540X?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540X?

A: Form 540X is the Amended Individual Income Tax Return for California.

Q: When should I use Form 540X?

A: You should use Form 540X if you need to make changes to your California individual income tax return.

Q: What kind of changes can I make with Form 540X?

A: You can use Form 540X to correct errors, report missed deductions, or add additional income on your California individual income tax return.

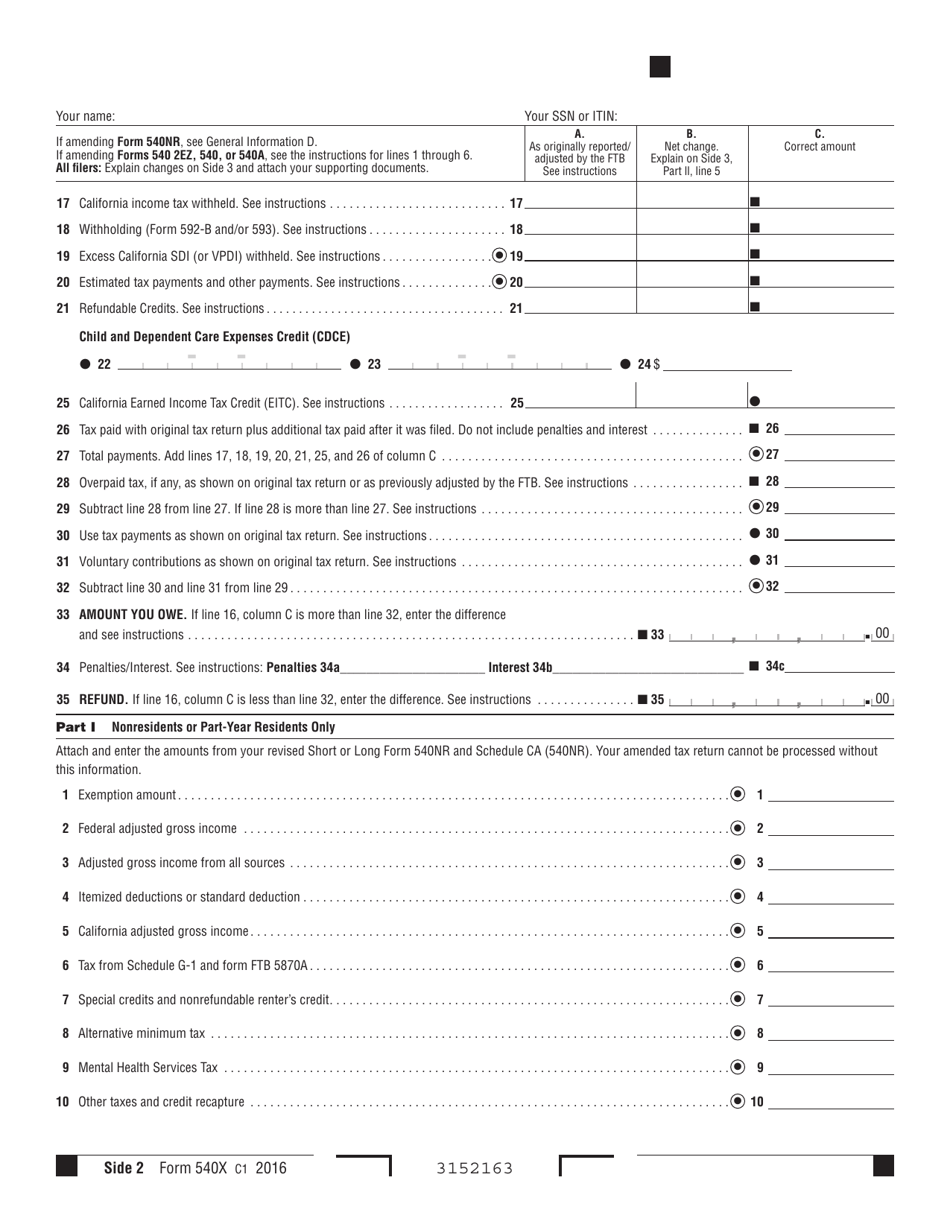

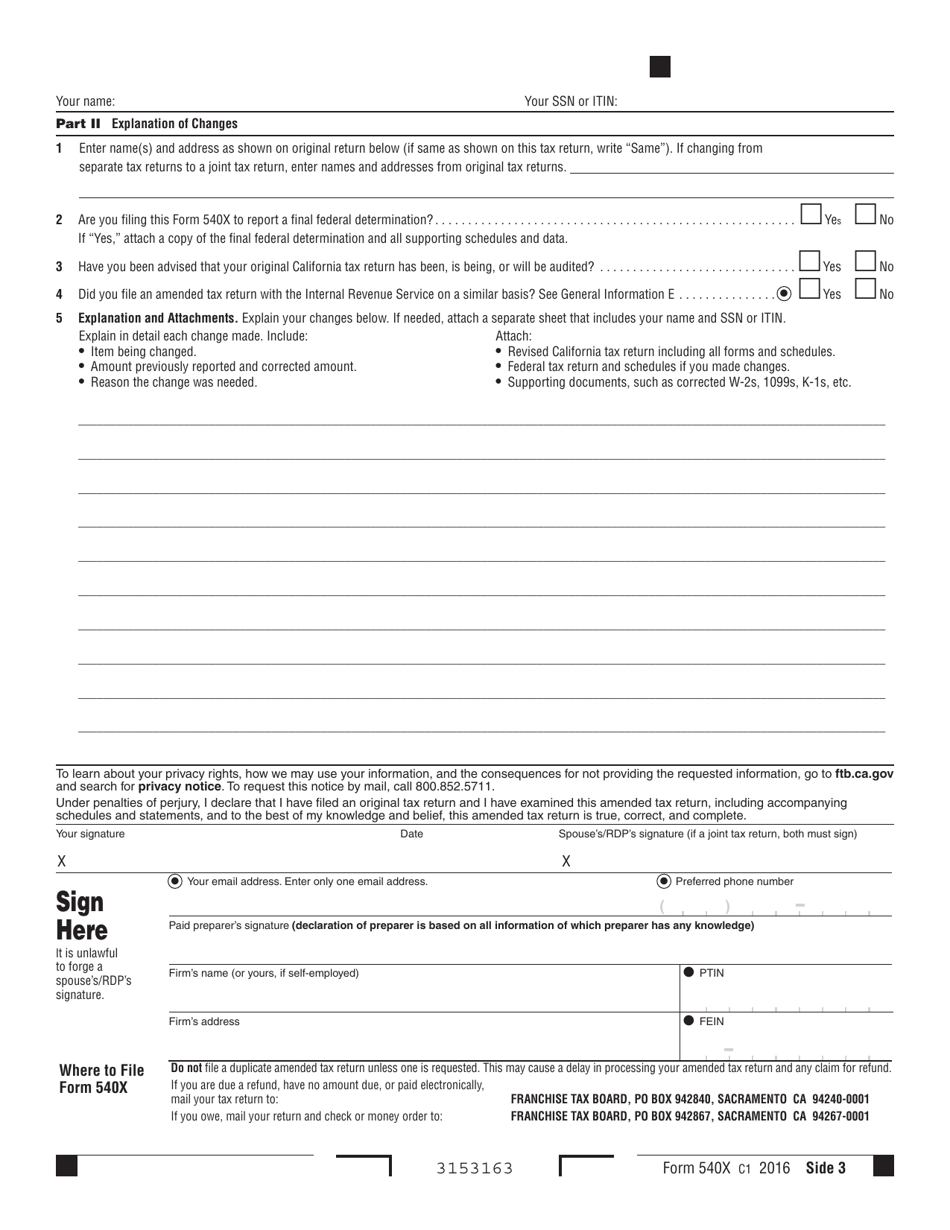

Q: How do I fill out Form 540X?

A: You need to provide your personal information, explain the changes you are making, and attach any supporting documents.

Q: Is there a deadline for filing Form 540X?

A: Yes, you generally have 4 years from the original due date of your California individual income tax return to file Form 540X.

Q: Will filing Form 540X affect my federal tax return?

A: No, Form 540X is specific to California state taxes and does not impact your federal tax return.

Q: Do I need to pay any fees to file Form 540X?

A: No, there are no fees to file Form 540X.

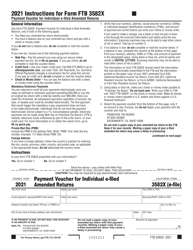

Q: Can I e-file Form 540X?

A: No, you cannot e-file Form 540X. It must be mailed to the California Franchise Tax Board.

Q: How long does it take for the California Franchise Tax Board to process Form 540X?

A: It can take up to 16 weeks for the California Franchise Tax Board to process Form 540X.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 540X by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.