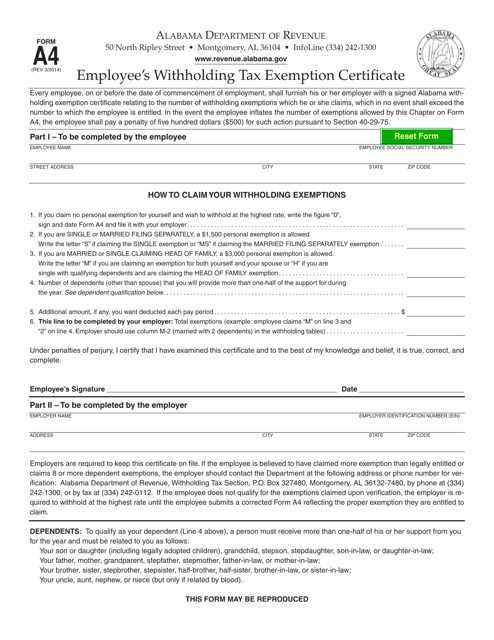

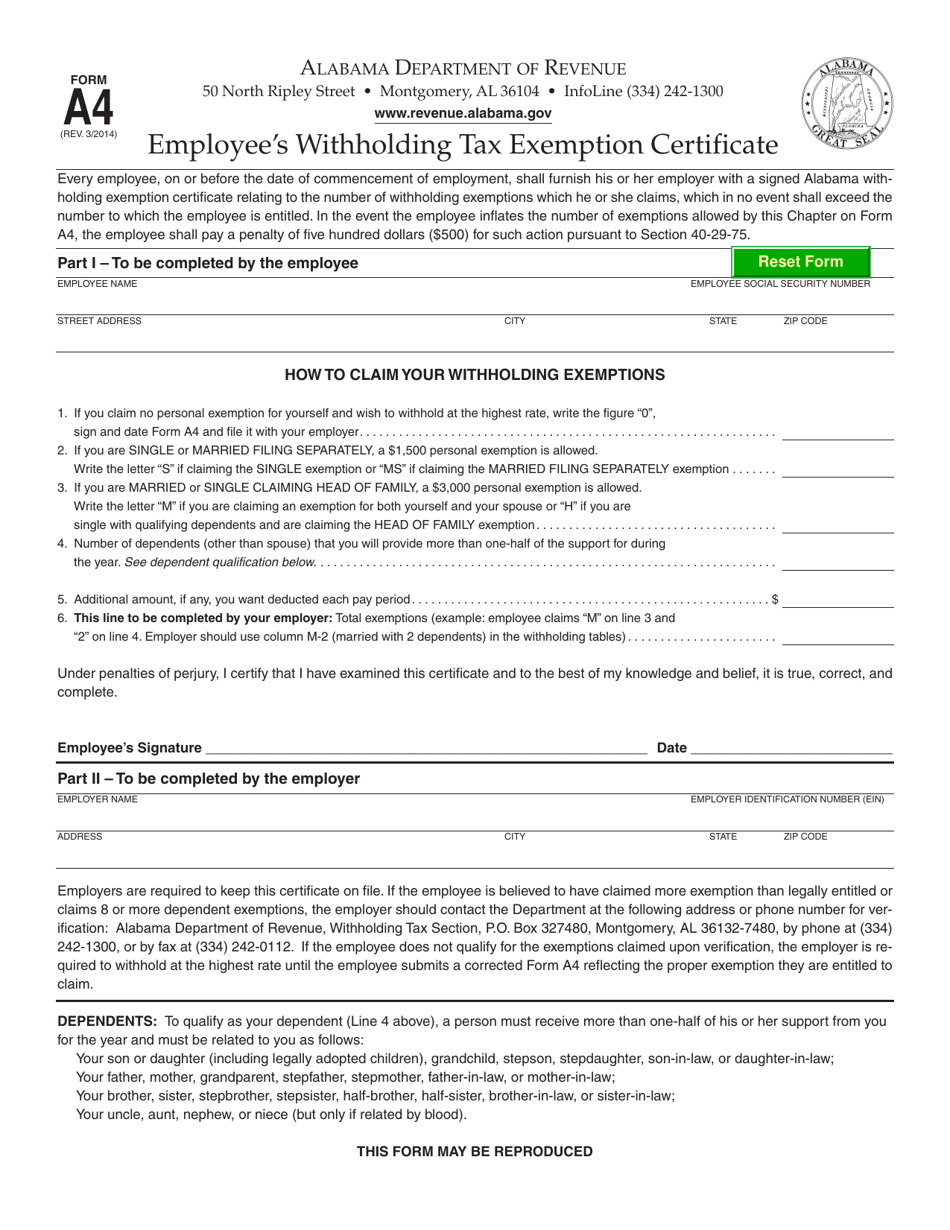

Form A4 Employee's Withholding Tax Exemption Certificate - Alabama

What Is Form A4?

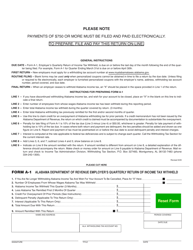

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

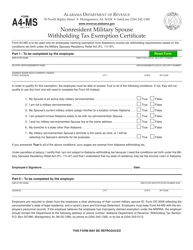

Q: What is Form A4?

A: Form A4 is the Employee's Withholding Tax Exemption Certificate used in Alabama.

Q: Who uses Form A4?

A: Employees in Alabama use Form A4 to claim exemption from withholding taxes.

Q: What is the purpose of Form A4?

A: The purpose of Form A4 is to determine the amount of tax to be withheld from an employee's wages.

Q: Can everyone use Form A4 to claim exemption from withholding?

A: No, not everyone can use Form A4 to claim exemption. It is only applicable if the employee qualifies for an exemption.

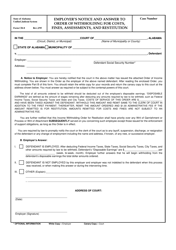

Q: How do I fill out Form A4?

A: You need to provide your personal information, including your name, address, social security number, and marital status. You also need to indicate the number of exemptions you are claiming.

Q: Is Form A4 specific to Alabama?

A: Yes, Form A4 is specific to Alabama and cannot be used for other states.

Q: Do I need to submit Form A4 every year?

A: Yes, you need to submit Form A4 every year if you want to claim exemption from withholding taxes.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A4 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.