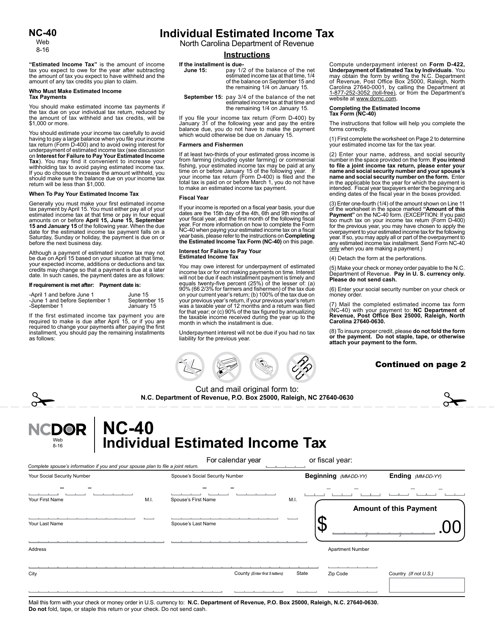

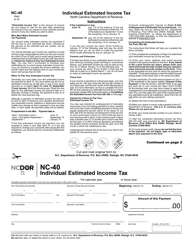

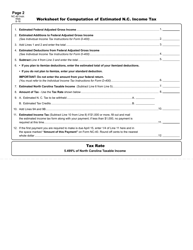

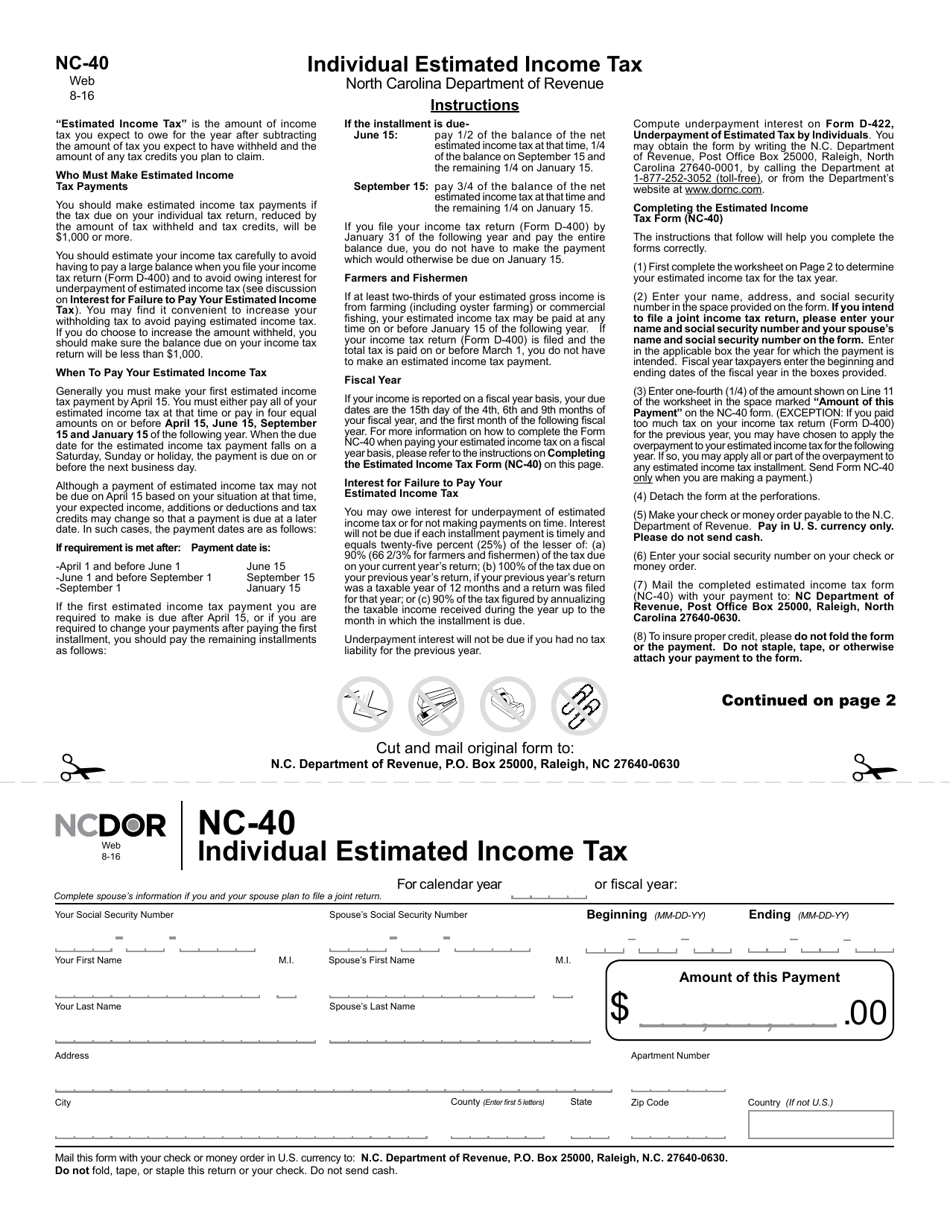

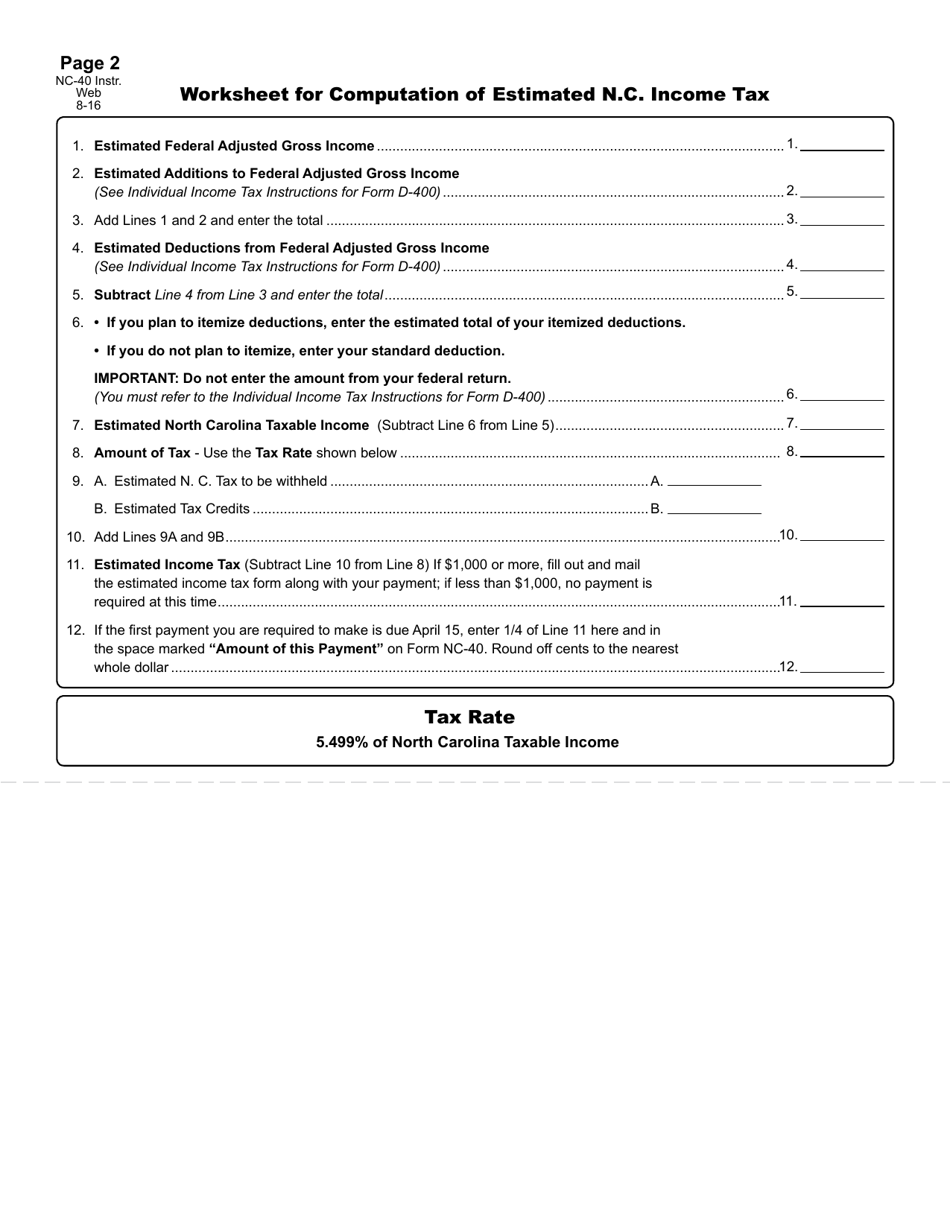

Form NC-40 Individual Estimated Income Tax - North Carolina

What Is Form NC-40?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-40?

A: Form NC-40 is the Individual Estimated Income Tax form for North Carolina.

Q: Who needs to file Form NC-40?

A: Residents of North Carolina who have income that is not subject to withholding tax or who have not paid enough tax through withholding need to file Form NC-40.

Q: When is Form NC-40 due?

A: Form NC-40 is due on April 15th of the following year, just like the federal income tax return.

Q: What information is required to complete Form NC-40?

A: To complete Form NC-40, you will need your personal information, including your name, social security number, and address, as well as information about your income and tax withholdings.

Q: Is there a penalty for not filing Form NC-40?

A: Yes, there is a penalty for not filing Form NC-40 or for filing it late. The penalty is based on the amount of tax owed and the number of days late.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-40 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.