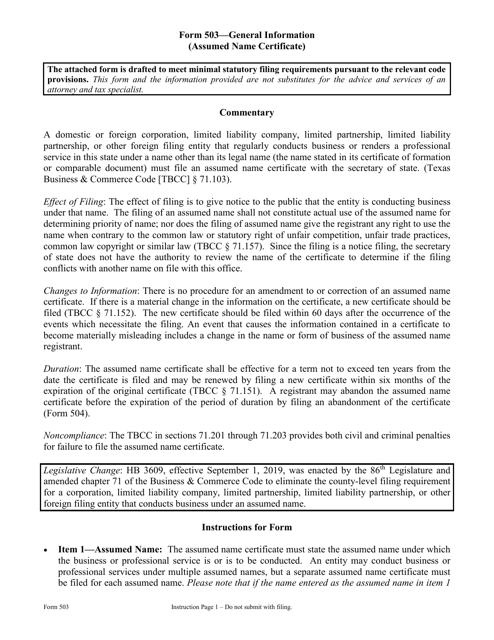

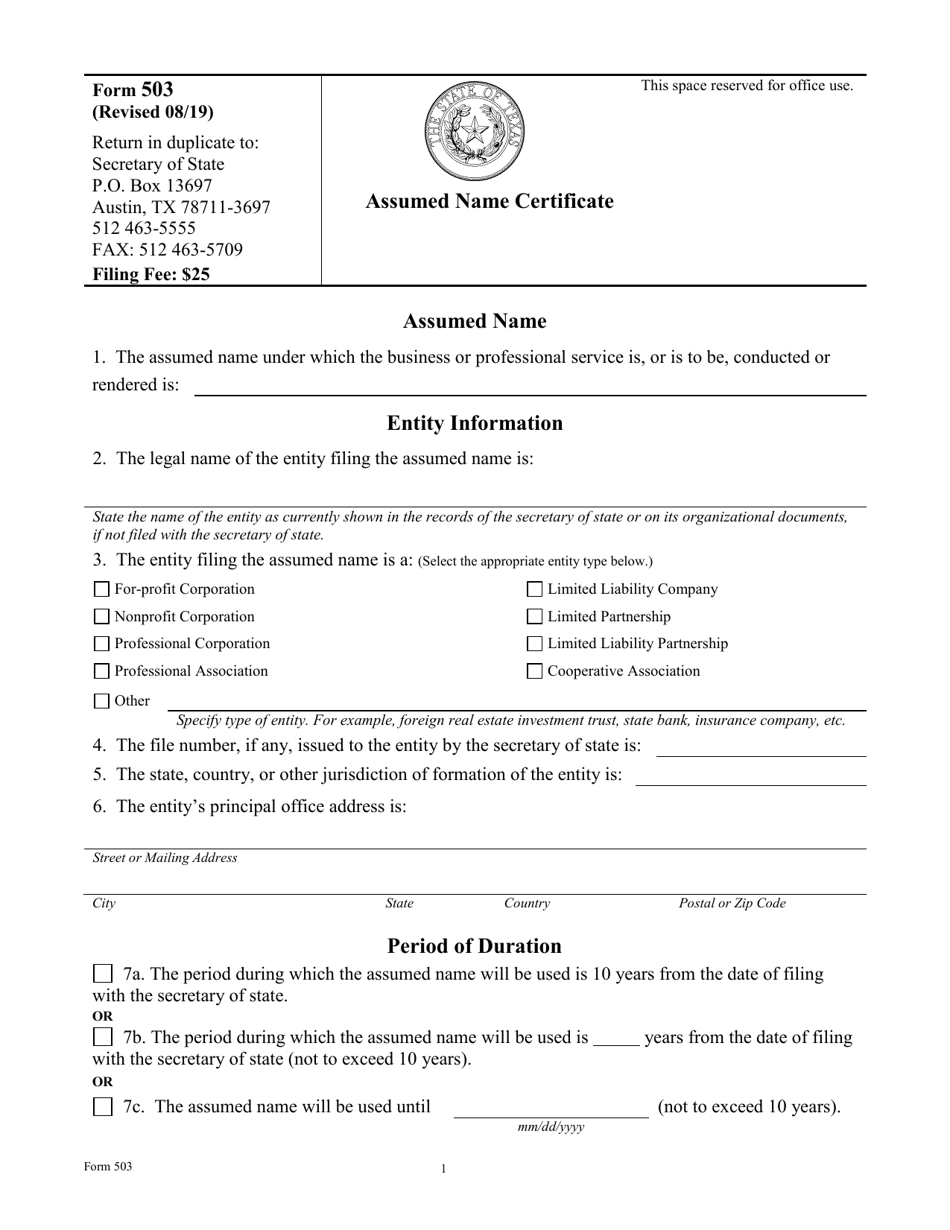

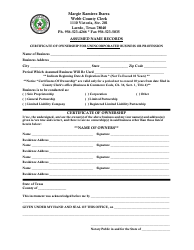

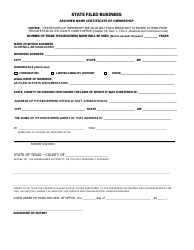

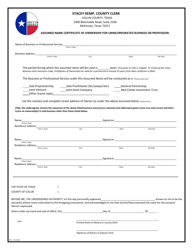

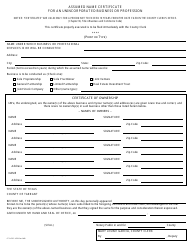

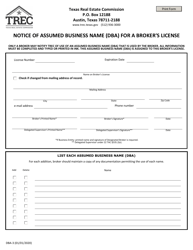

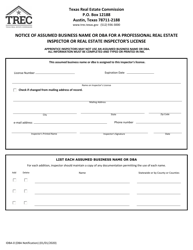

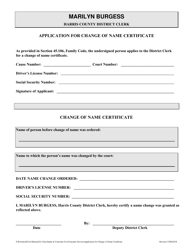

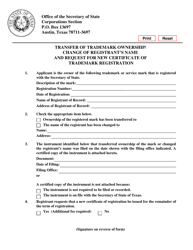

Form 503 Assumed Name Certificate - Texas

What Is Form 503?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 503?

A: Form 503 is the Assumed Name Certificate in Texas.

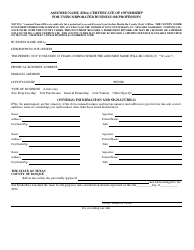

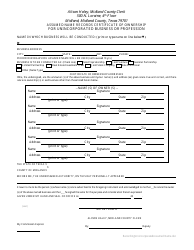

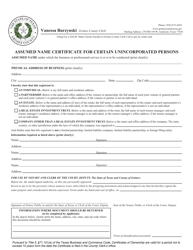

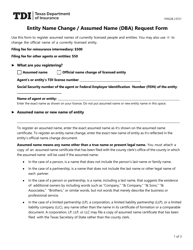

Q: What is an Assumed Name Certificate?

A: An Assumed Name Certificate is a legal document that allows individuals or businesses to operate under a name that is different from their legal entity name.

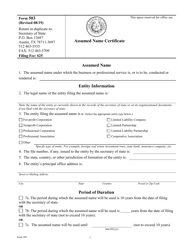

Q: Who needs to file Form 503?

A: Anyone who intends to conduct business under an assumed name in Texas must file Form 503.

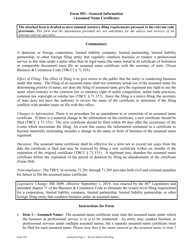

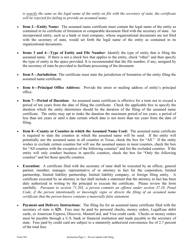

Q: What information is required on Form 503?

A: Form 503 requires the legal entity name, the assumed name being used, and the address of the business.

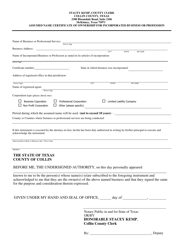

Q: Is there a fee for filing Form 503?

A: Yes, there is a fee for filing Form 503. The fee varies depending on the county where the form is filed.

Q: How long is Form 503 valid?

A: Form 503 is valid for 10 years from the date of filing.

Q: Are there any penalties for not filing Form 503?

A: Yes, there may be penalties for not filing Form 503, including fines and the loss of certain legal rights.

Q: Can I use an assumed name without filing Form 503?

A: No, it is illegal to use an assumed name without filing Form 503 in Texas.

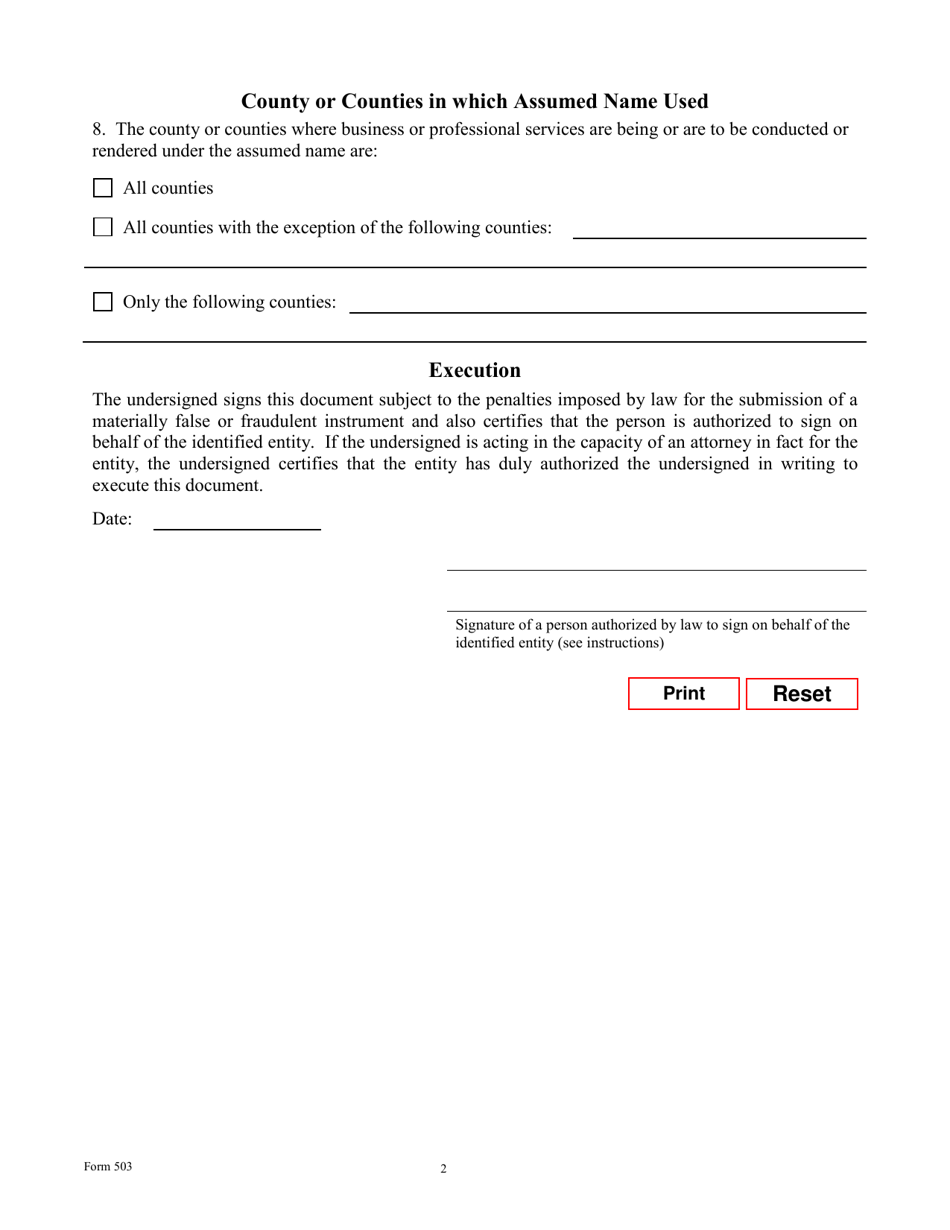

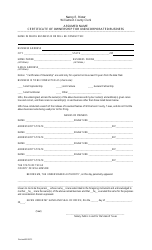

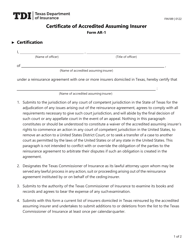

Q: Can I amend or cancel Form 503?

A: Yes, amendments or cancellations can be made to Form 503 by filing the appropriate forms with the County Clerk's office.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 503 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.