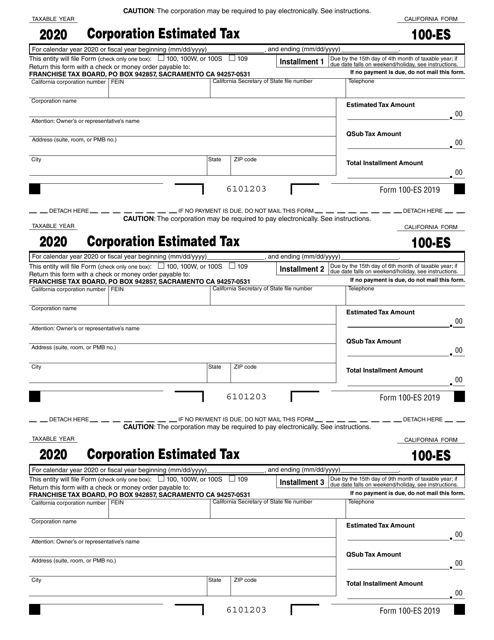

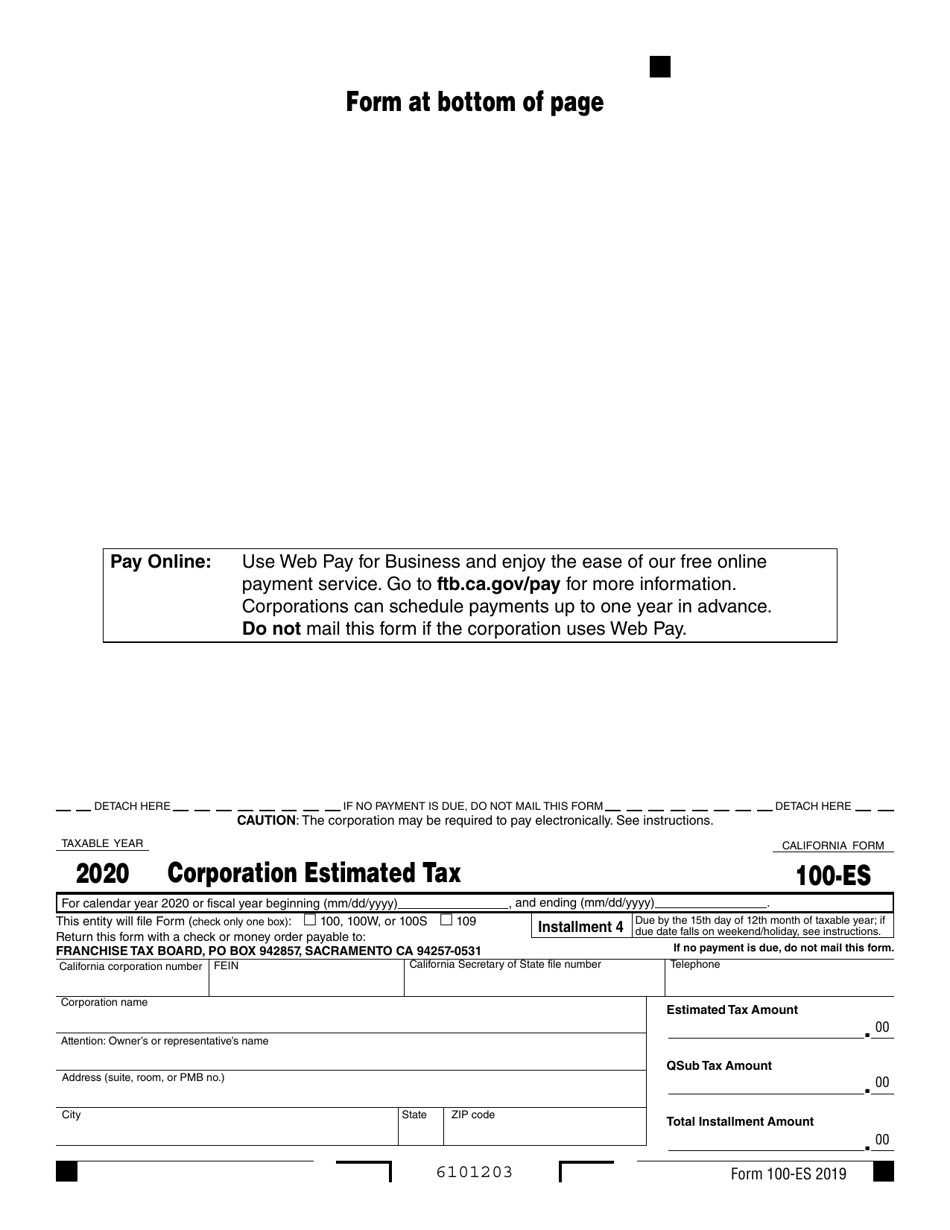

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 100-ES

for the current year.

Form 100-ES Corporation Estimated Tax - California

What Is Form 100-ES?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 100-ES?

A: Form 100-ES is the Corporation Estimated Tax form for California.

Q: Who needs to file Form 100-ES?

A: Corporations in California that estimate their annual tax liability to be greater than $500 need to file Form 100-ES.

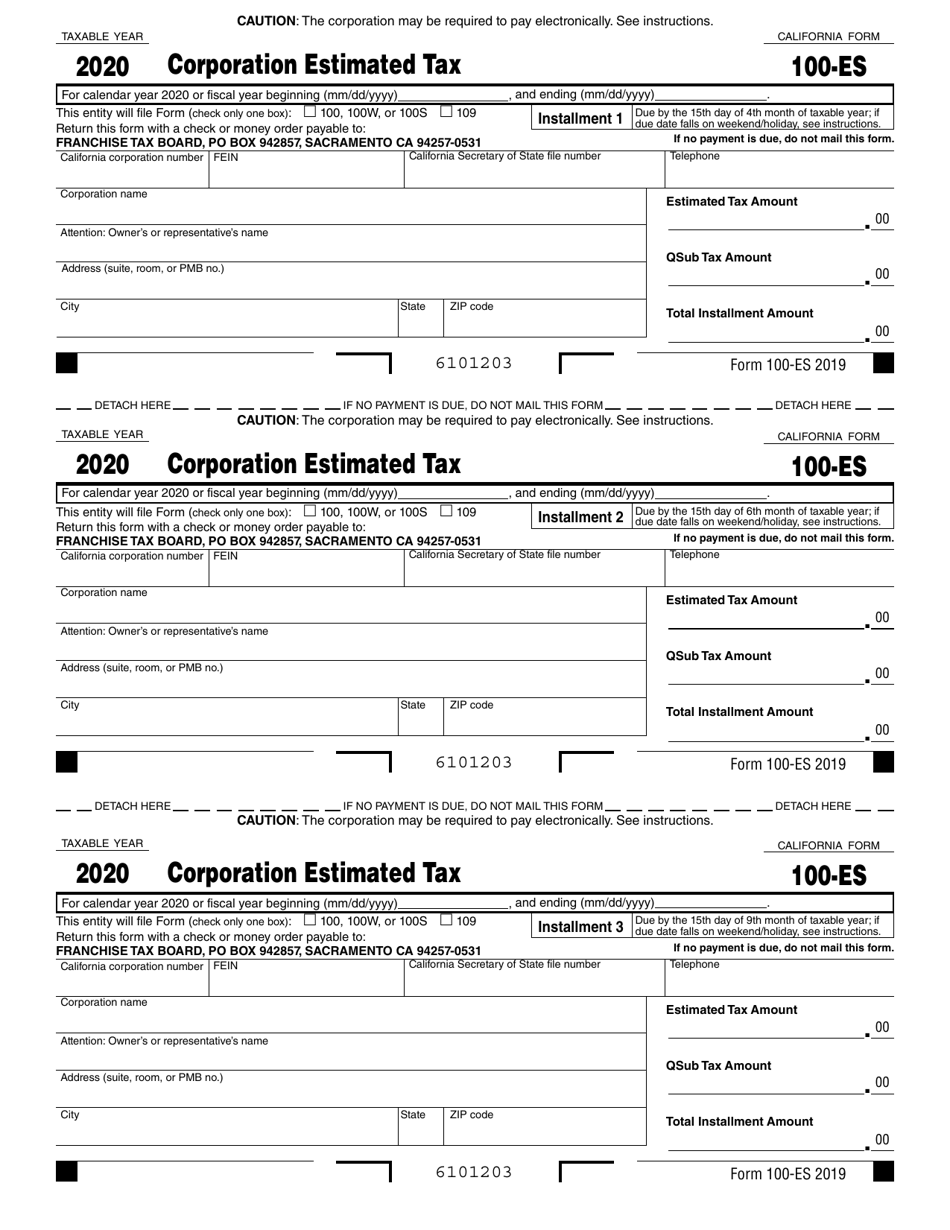

Q: When is Form 100-ES due?

A: Form 100-ES is generally due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

Q: What is the purpose of Form 100-ES?

A: Form 100-ES is used to make estimated tax payments throughout the year, so that corporations can meet their tax obligations.

Q: What happens if I don't file Form 100-ES?

A: If you don't file Form 100-ES or don't make estimated tax payments, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 100-ES by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.