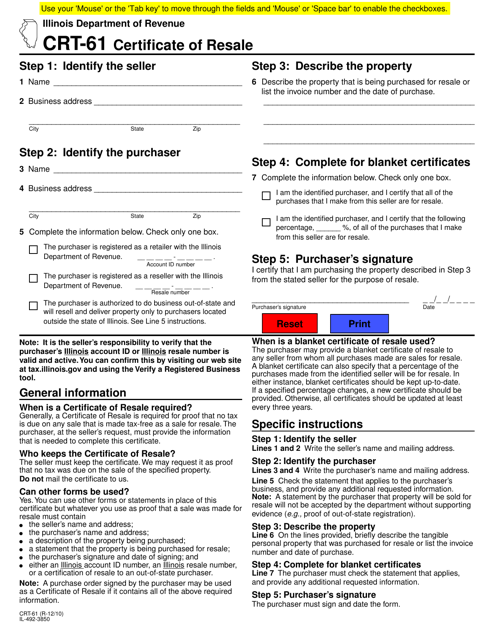

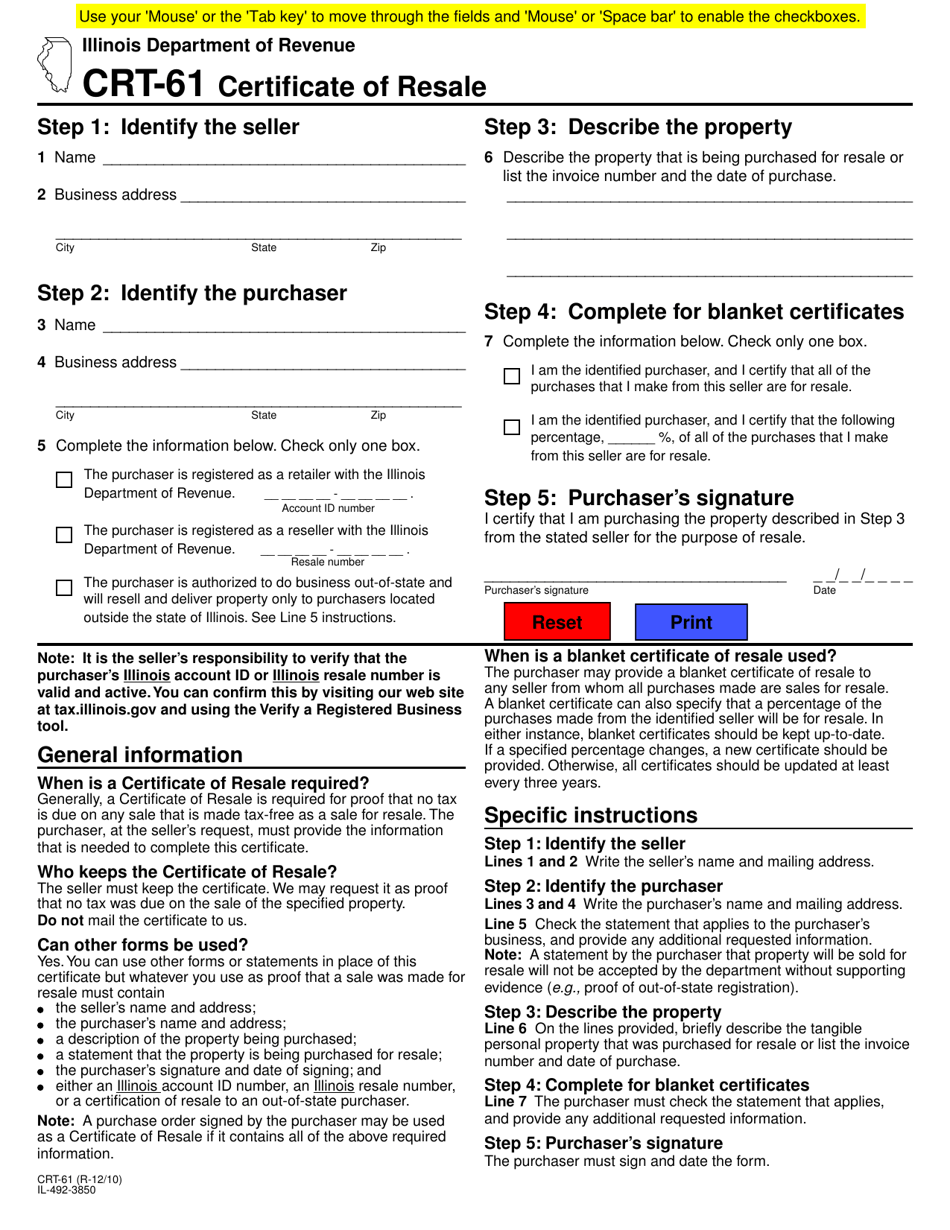

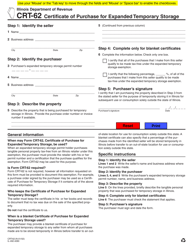

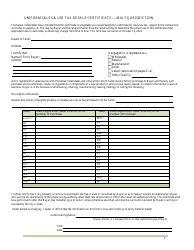

Form CRT-61 Certificate of Resale - Illinois

What Is CRT-61?

Form CRT-61, Certificate of Resale , is used as proof to a seller that no tax is due on a tax-free sale made as a sale for resale. The subject of such a transaction is tangible personal property. Form CRT-61 is a document that must be completed by the purchaser and transferred to the seller. The seller has to request the purchaser all necessary information and the purchaser must provide it by specifying it in the certificate.

An Illinois Certificate of Resale contains the following information:

- The seller's and the purchaser's names and mailing addresses;

- Description of the property and approval that it is being purchased for resale;

- Illinois account ID number;

- Illinois resale number of the purchaser or proof of out-of-state registration;

- The seller has to keep the certificate and to provide it to the Department of Revenue on demand.

The form was released by the Illinois Department of Revenue and the latest version was issued on December 1, 2010 . A CRT-61 printable form is available for download below.

How to Apply for a CRT-61 in Illinois?

The instructions for filling in a CRT-61 Form are the following:

-

Step 1, identify the seller. The seller's name and business address should be indicated in Lines 1 to 2.

-

Step 2, identify the purchaser.

- The purchaser's name and business address should be entered in Lines 3 to 4;

- An applicable statement regarding the purchaser's business should be checked by the purchaser in Line 5. Only one box can be chosen. The filer can move through the fields with the mouse to enable the appropriate checkboxes;

- If the filer is a retailer, registered in the state, their Illinois account ID number should be entered. If the purchaser is a reseller, registered in the state, their Illinois resale number should be indicated. The seller's responsibility is to check that the specified numbers are valid and active. This verification can be performed through the web site of the Department;

- If the filer is going to sell the property for resale, the Department would accept this statement after receiving a document that confirms the out-of-state registration of the purchaser.

-

Step 3, describe the property. The purchaser can describe their tangible personal property for resale on the space provided in Line 6 or enter its invoice number and the date of purchase.

-

Step 4, complete for blanket certificates. The purchaser must choose the applicable statement from those listed in Line 7. It is only allowed to check only one box. It is necessary to indicate that the purpose of all of the purchases from the specified seller is resale. If not, all of them are for resale, the filer should enter a certain percentage of the resale purchases. If an indicated percentage changes, the purchaser has to provide a new certificate. Even if there are no changes to the specified information, all the certificates are necessary to update at least every three years.

-

Step 5, purchaser's signature. The purchaser should sign Illinois CRT-61 and indicate the date. By signing this form, the purchaser certifies that the purpose of purchasing the described property from the specified seller is resale.