This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-017

for the current year.

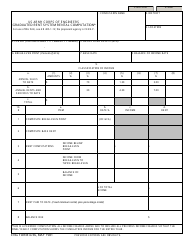

Form I-017 Rent Certificate - Wisconsin

What Is a Wisconsin Rent Certificate?

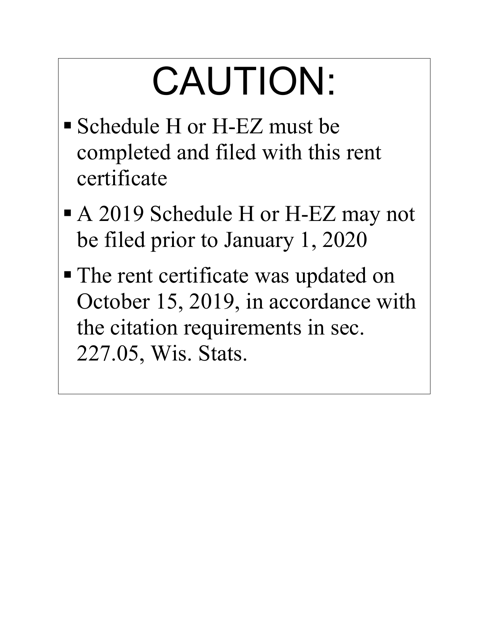

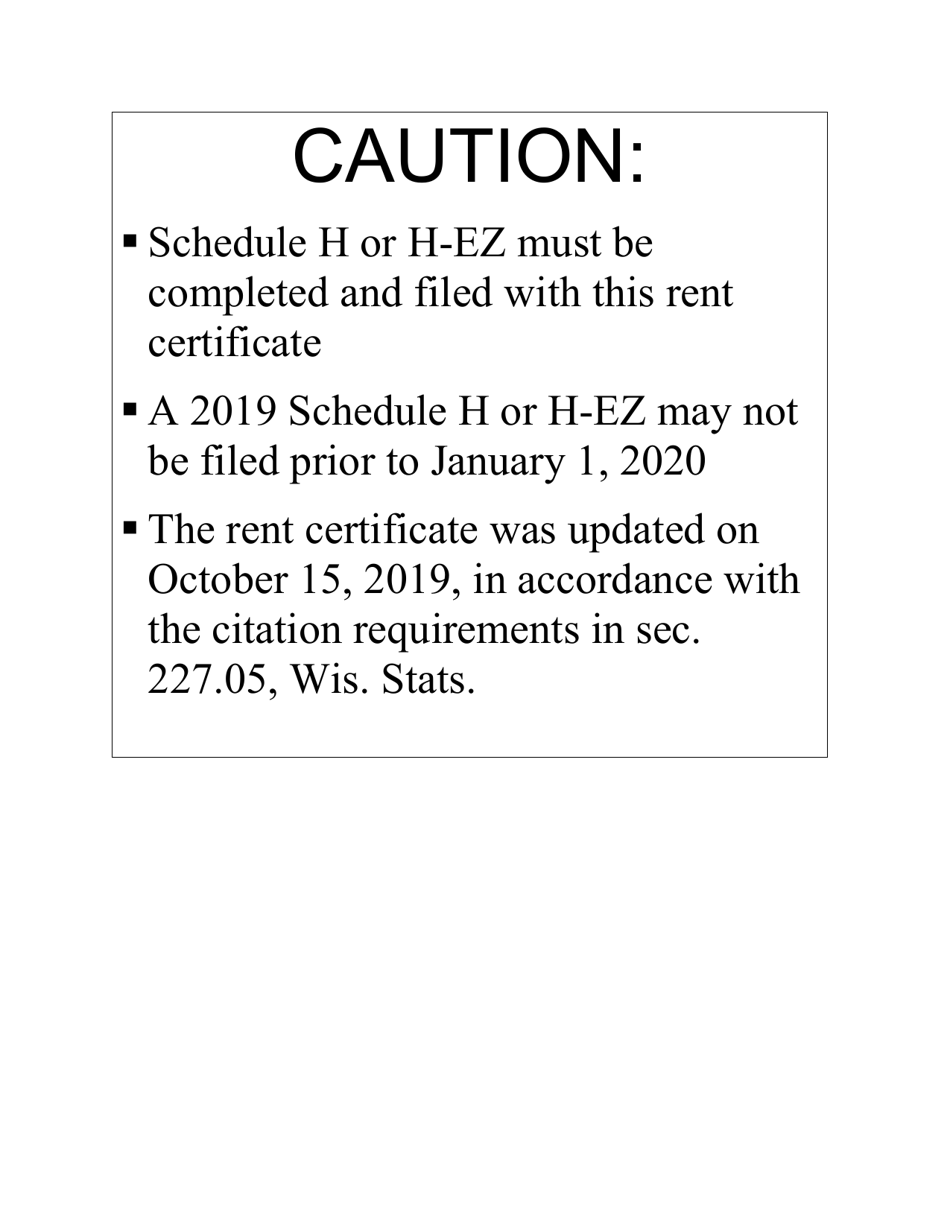

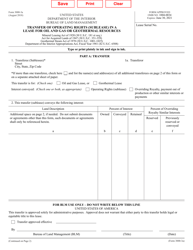

Form I-017, Rent Certificate , is a legal document filled out by a landlord as proof of the rent the renter paid during the previous calendar year to occupy a Wisconsin rental property - apartment, room, mobile home, etc. The main purpose of this document is to serve as evidence for tenants who will claim homestead credit on their Wisconsin taxes - it will verify the amount of rent paid or property tax accrued. Once you complete it, attach the Wisconsin Rent Certificate to Schedule H, Household Employment Taxes, or Schedule H-EZ, Wisconsin Homestead Credit, and file them with your tax return.

This form was released by the Wisconsin Department of Revenue . The latest version of the form was issued on October 1, 2019 , with all previous editions obsolete. A Wisconsin Rent Certificate fillable version is available for download below.

Wisconsin Rent Certificate Instructions

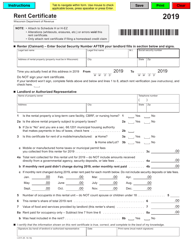

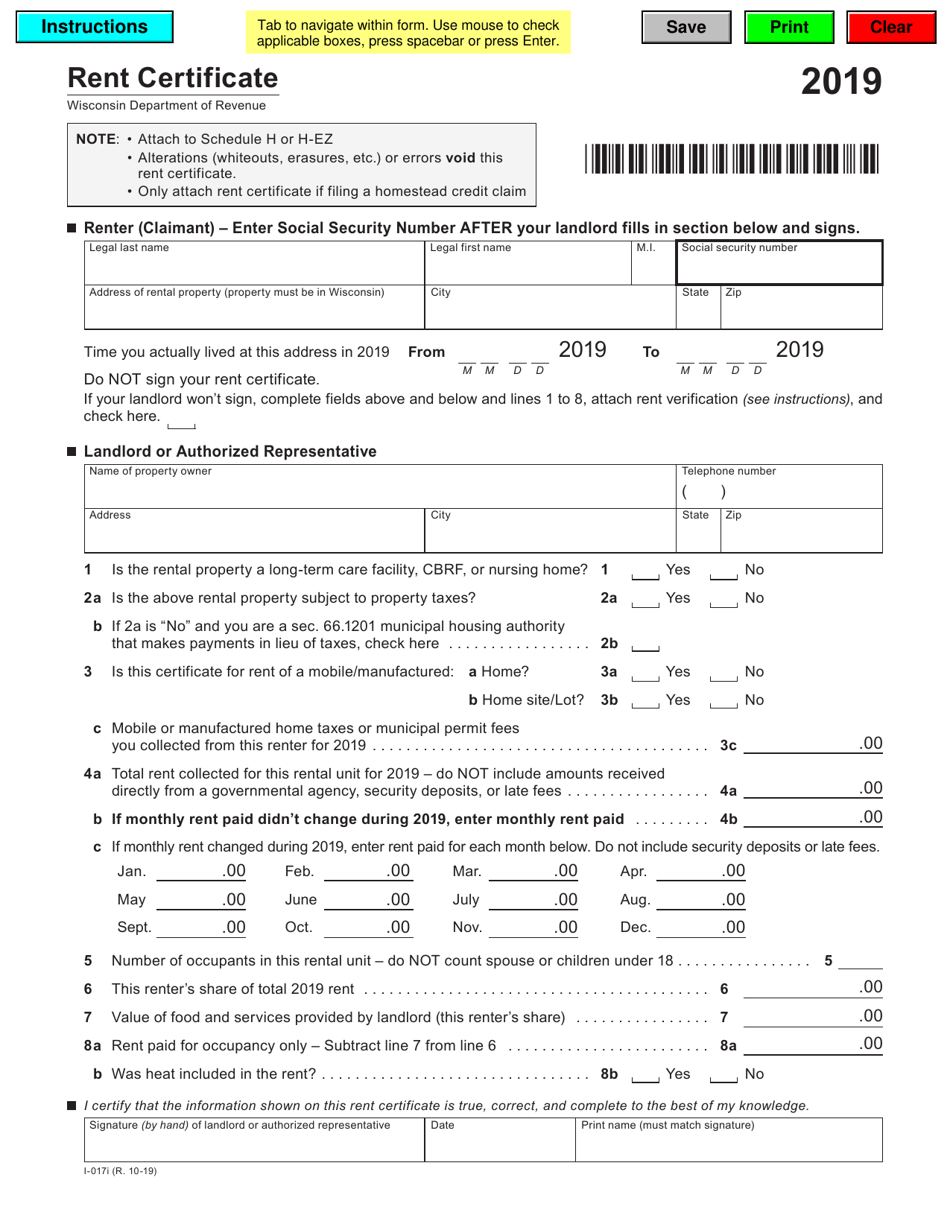

A Wisconsin Homestead Credit Rent Certificate must be completed by the renter (the claimant) and landlord:

- Renter enters their full name, social security number, address of the rental property, and the period of residence at this address in the reporting year. The claimant is not allowed to sign the certificate;

- Landlord indicates their full name, telephone number, and address. It is required to provide a short description of the rental property by answering several questions, state the monthly rent paid and the renter's share of total rent, record the number of occupants in this rental unit, and describe the elements of the rental payment. The landlord signs and dates the form.

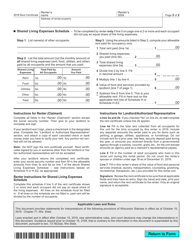

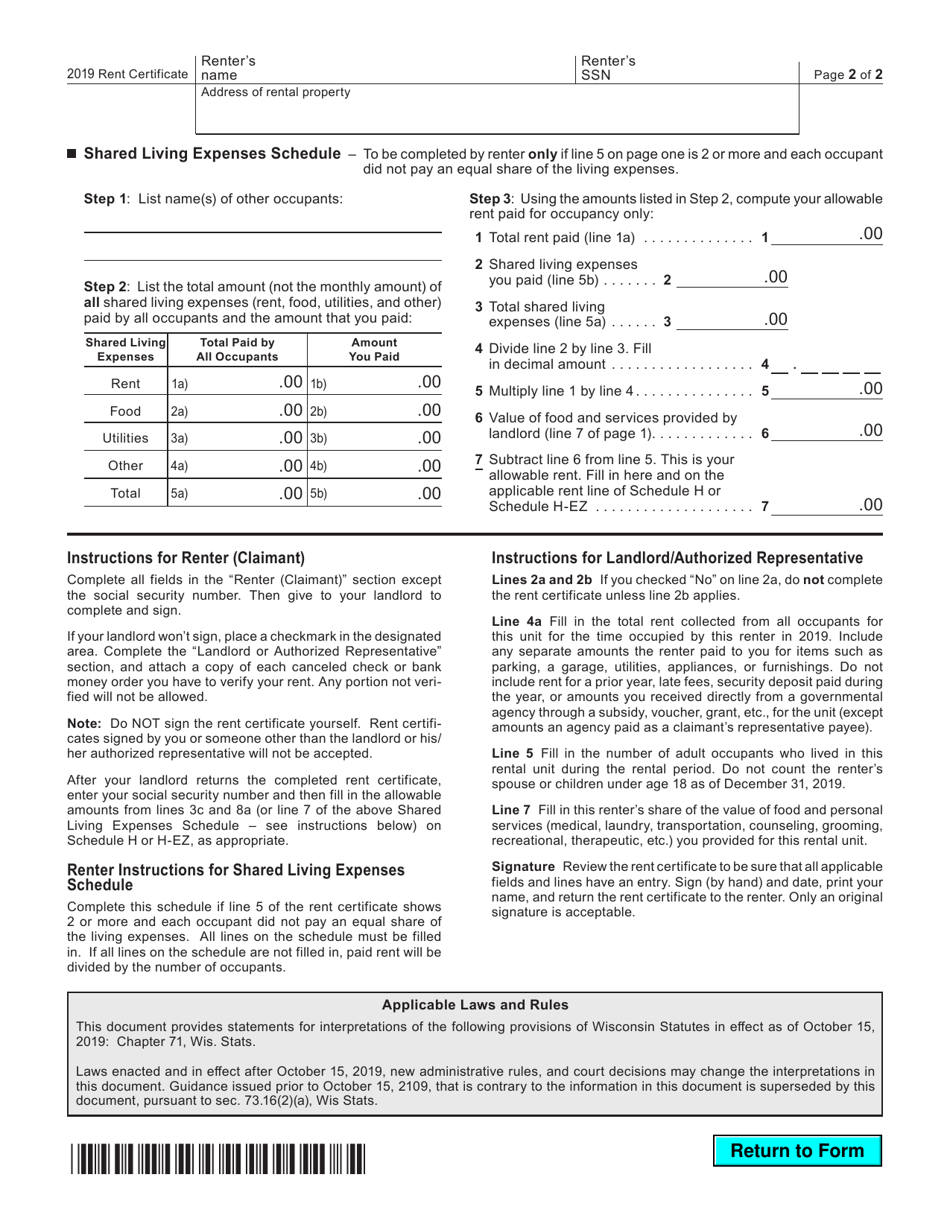

If there was more than one occupant of the rental property and the living expenses were not equally shared, the renter must fill out the shared living expenses schedule on the second page of the certificate, listing sums of money paid for rent, food, utilities, and other cost components.

In case the landlord refuses to sign the form, the renter must check the appropriate box on the first page and attach rent verification - a copy of each check or bank money order available to verify the rent.