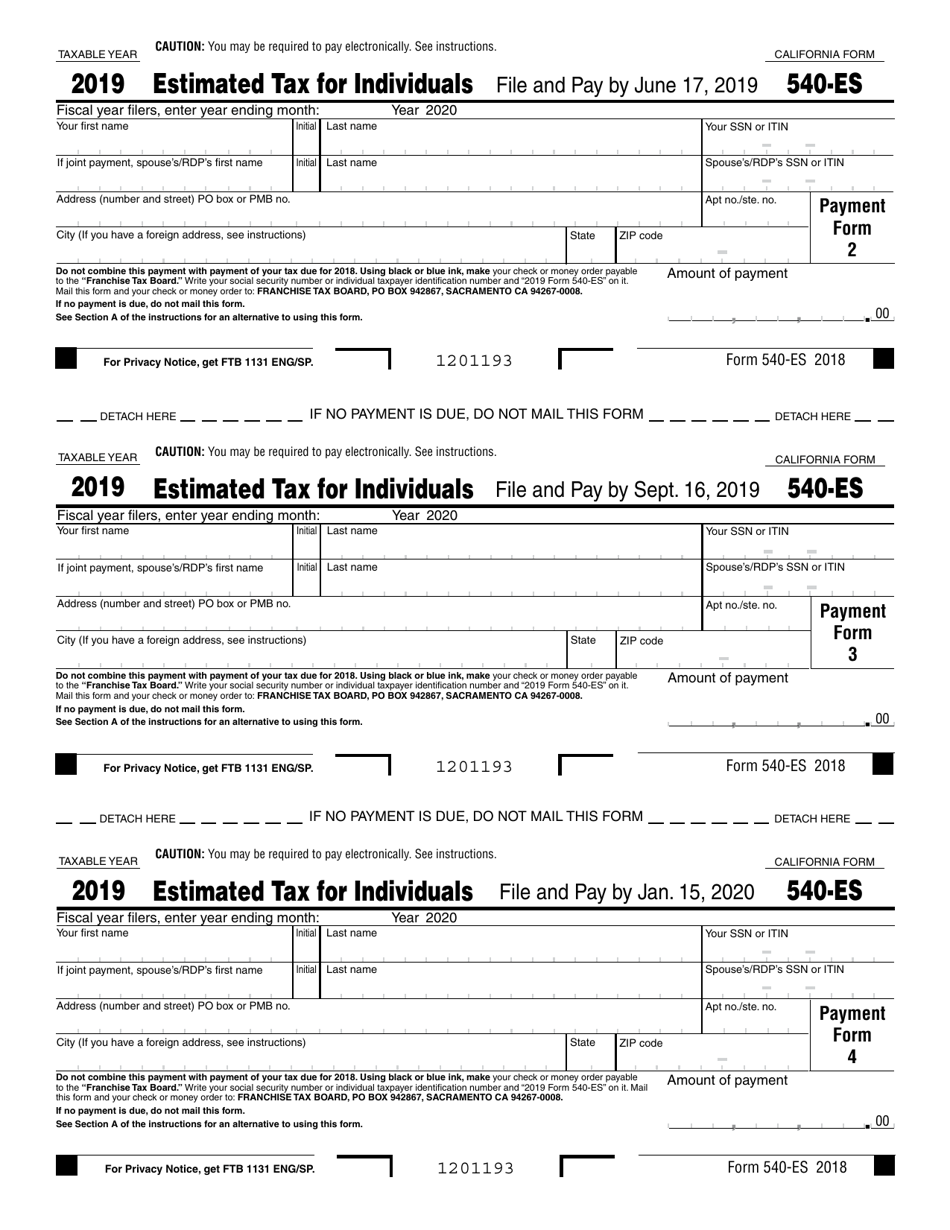

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 540-ES

for the current year.

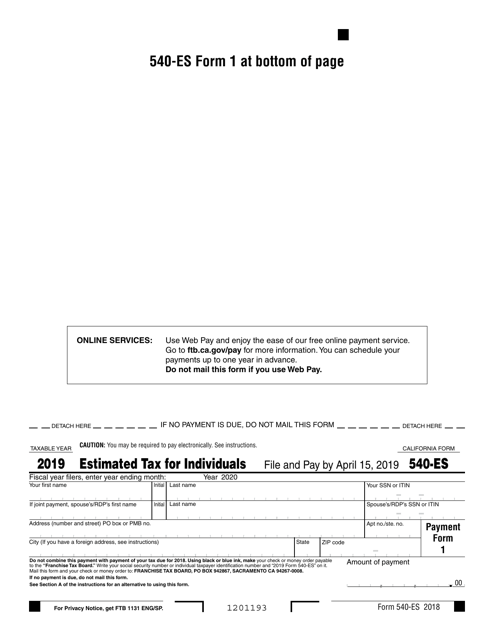

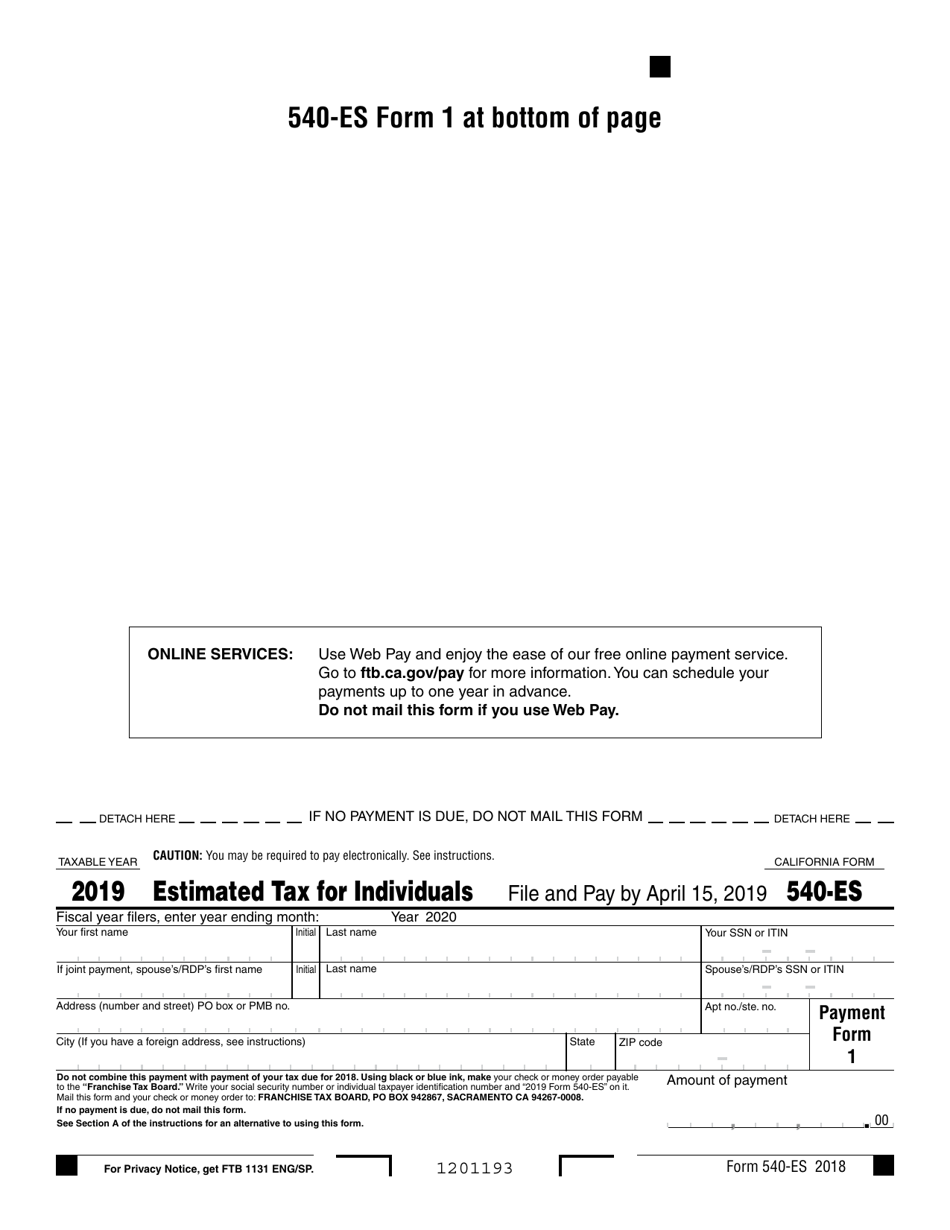

Form 540-ES Estimated Tax for Individuals - California

What Is Form 540-ES?

Form 540-ES, Estimated Tax for Individuals, is an official tax document issued on , by the California Franchise Tax Board (FTB) that needs to be filed and paid in four installments throughout the year. A fillable Form 540-ES version is available for download at the bottom of this page. Online filing is also available through FTB official site.

When Are California Estimated Tax Payments Due?

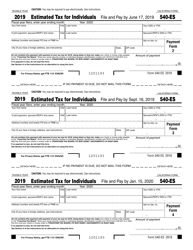

Due dates for the 2019 tax year are as following:

- April, 15;

- June, 17;

- September, 16;

- January, 15.

California 540-ES consists of four separate estimated payment forms, a separate payment form for each due date. It is important to use the form with the correct due date shown at the top of the form for each payment.

How to Calculate California Estimated Tax Payments?

Estimated tax for Individuals is the tax you can estimate to owe for the current tax year after subtracting new credits you plan to take or taxes you expect to have withheld. In most cases, if you are employed, all tax payments are automatically deducted from your paycheck. When you file an annual tax return, you may out that you either paid too much (you will get a refund) or you have paid too little (you still owe taxes). Therefore, if you expect to owe a certain amount, you must make estimated tax payments throughout the year.

You must plan to make estimated tax payments in 2019 if you expect to owe at least $500 as a single person, or $250 if married or filing separately, or if you expect to have a high income. As a general rule, you must pay your estimated tax based on 90% of your tax for the previous year.

Form 540-ES Instructions

Please use blue or black ink only. To fill out Form 540-ES you will need to provide your personal information. This includes your full name and address, your Social Security Number (SSN), and your estimated payment amount.

If you are filing jointly with your spouse you will need to provide his or her personal information as well, including full name, address, and an SSN. These estimated payments for the current year should not be combined with your tax payments for the previous year. This system is created to avoid the burden of paying a large sum of tax at the end of the year.

Official FTB instructions for Form 540-ES are only available upon request.

Where to Mail California Form 540-ES?

California Form 540-ES can be mailed with your payments to the Franchise Tax Board, PO Box 942867, Sacramento, California 94267-0008. Checks and money orders have to be payable to the FRANCHISE TAX BOARD.