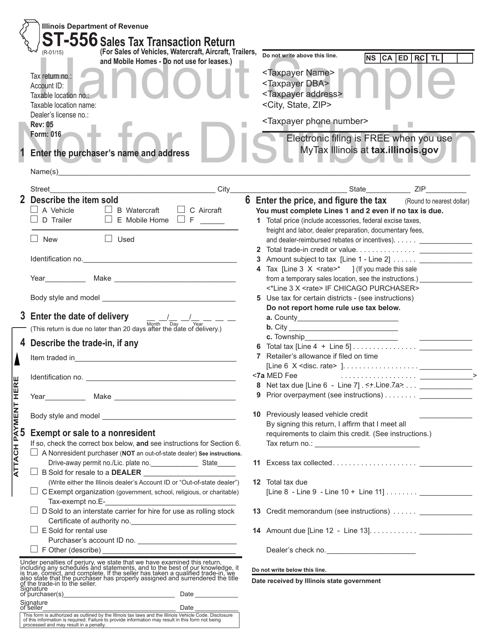

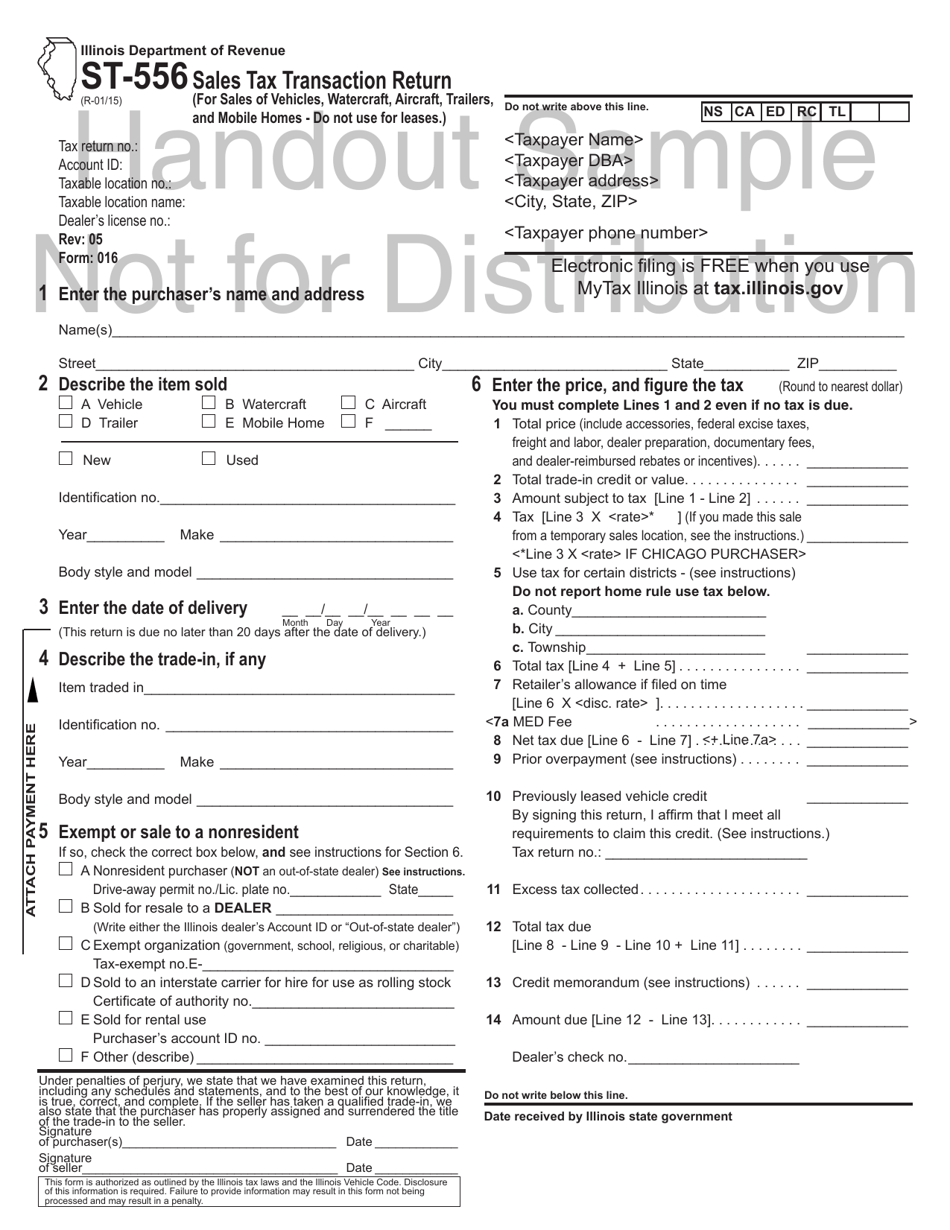

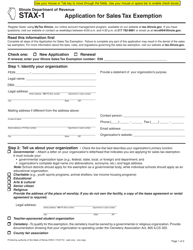

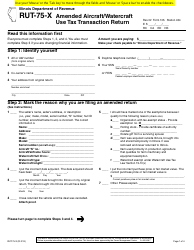

Sample Form ST-556 Sales Tax Transaction Return - Illinois

What Is Form ST-556?

Form ST-556, Sales Tax Transaction Return , is a form issued by Illinois Department of Revenue to be filed by a retail seller of items like motor cars or other vehicles, watercraft, aircraft, trailers or mobile homes; that need to be registered for a title with the State of Illinois government agency. All such sales must be reported on the most recent IL Form ST-556 revised in .

A legitimate fillable Illinois Sales Tax Transaction Return is only available through the official webpage of the Illinois Department of Revenue , but a sample of Form ST-556 can be downloaded at the bottom of this page.

Although this form is often reprinted for all business locations, it may also be ordered, if needed, by calling the phone number provided on the form. For a paperless solution, My Tax Illinois electronic filing system can be used.

Instructions for Illinois ST-556

First, as a seller, you will need to prepare to enter your information at the top of IL Form ST-556, such as your full name and your DBA (Doing Business As) and your full address, including ZIP code, and your phone number. Further information that needs to be entered will be related to a particular sale:

- Purchaser's full name and address (it has to match the name that later will be registered on the title);

- Description of the item sold;

- Date of estimated delivery; trade-in details, if any;

- Exemptions, if any (such as a sale to a non-resident buyer, but not to a dealer, or to an exempt organization like government agencies, schools, religious or charitable organizations).

Finally, you will need to enter the sale price and follow the instruction included on Form ST-556 to figure out tax. Certain addresses within the State of Illinois may have an additional sales or home use tax. For example, If a customer's address is within the limits of the city of Chicago, an additional 1.25 percent home sales tax has to be included. All forms that have been voided need to be crossed out and kept on file for 42 months.

Make sure to review, sign, and date your form ST-556 before sending it to the Illinois Department of Revenue.