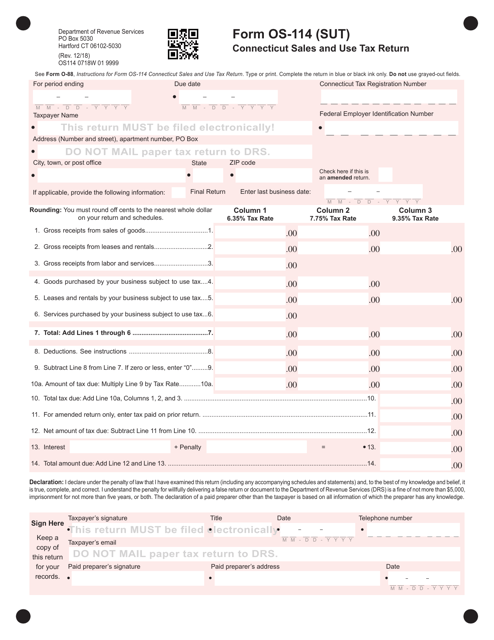

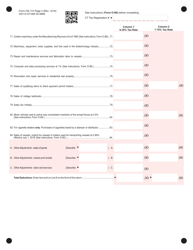

Form OS-114 (SUT) Connecticut Sales and Use Tax Return - Connecticut

What Is Form OS-114?

Form OS-114 (SUT), Connecticut Sales and Use Tax Return , is a document that all individuals, businesses, and organizations registered for sales and use taxes in the State of Connecticut must file to report their sales activity in the state. They have to do reports based on this form monthly, quarterly, and annually.

Alternate Name:

- CT Form OS-114.

CT Form OS-114 has to be completed and filed on or before the last day of the month following the end of the filing period. The filer must report all their taxable and nontaxable sales. The form must be submitted even if during the reporting period no sales were made or no tax is due.

This form was released by the Connecticut Department of Revenue Services and the latest version was issued on December 1, 2018 . A Form OS-114 fillable version is available for download below.

Form OS-114 Instructions

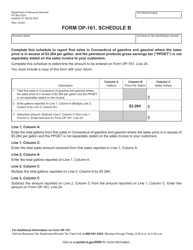

The main instructions for this form may be found in the Form O-88, Instructions for Form OS-114, Connecticut Sales and Use Tax Return, but a short summary of the Form OS-114 instructions are the following:

-

The return must be completed in blue or black ink only, and grayed-out fields should not be used. In case of paper returns filing the staples are not allowed to use.

-

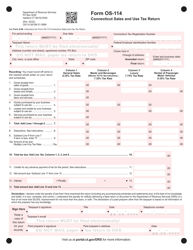

Information about the taxpayer should be indicated, including the complete name and address of the organization, its Tax Registration Number, Federal Employer Identification Number, ending period, and due date.

-

Columns from 1 through 4 are used to report general sales, meals and beverage sales, luxury purchases, and rentals of passenger motor vehicles appropriately.

-

The taxpayer should fill in all relevant lines, including Totals:

- Indicate the gross receipts from sales and the subjects to use tax on Lines 1-6, and the total on Line 7;

- Report total deductions on Line 8;

- Enter the total tax due on Line 10;

- Indicate the plastic bag fee, the net amount due, the sum of the interest and penalty, and the total amount due on Lines 11a-14.4

-

The taxpayer must sign the form, indicate the date, their telephone number, and email.

-

If the paid preparer fills out the form, their signature, address and date should be entered in the appropriate lines.

-

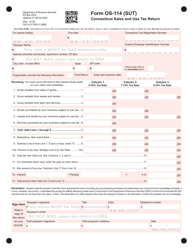

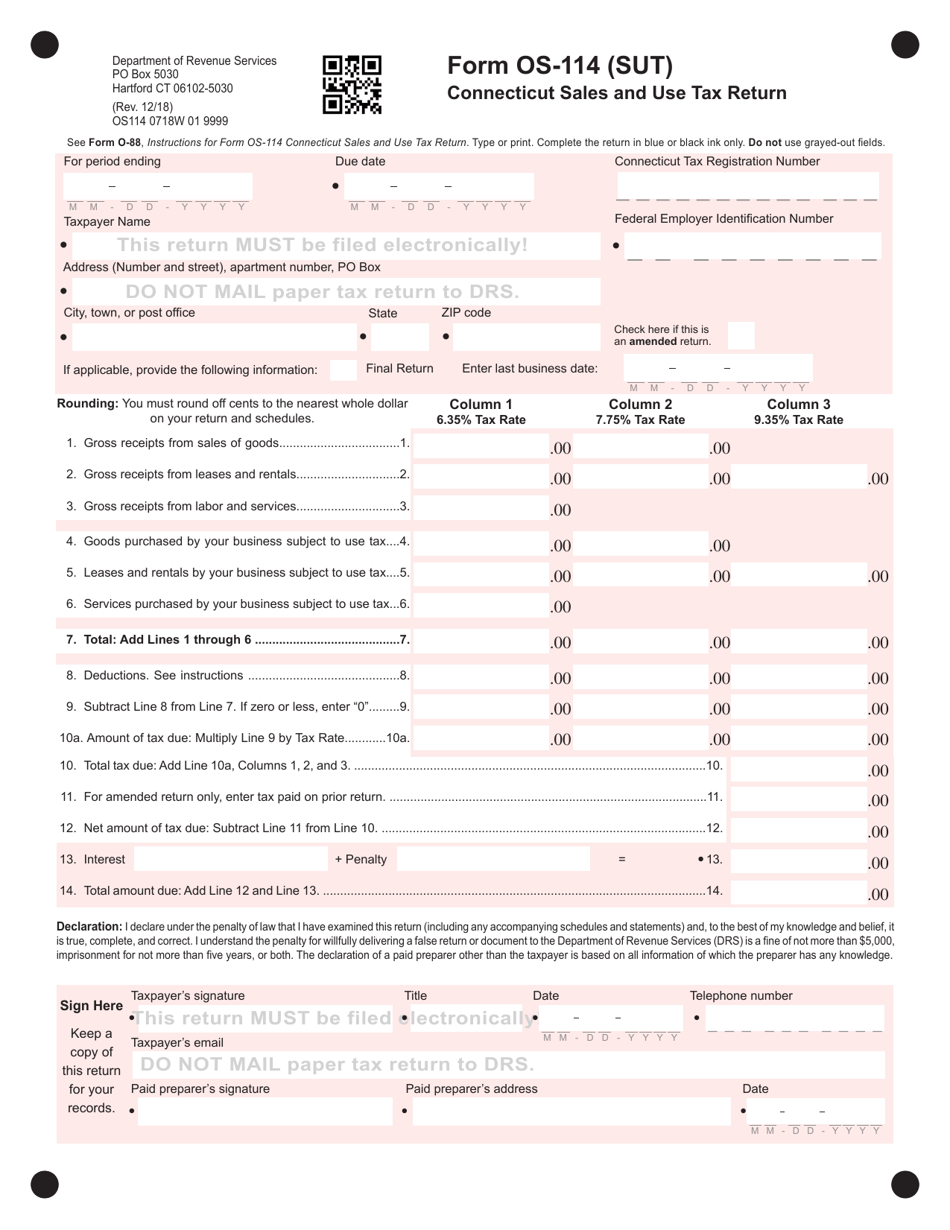

If applicable, the filer should provide information about the company's changes such as new mailing address, physical location, trade name, or ownership changes.

-

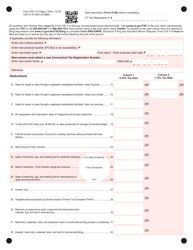

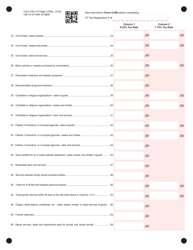

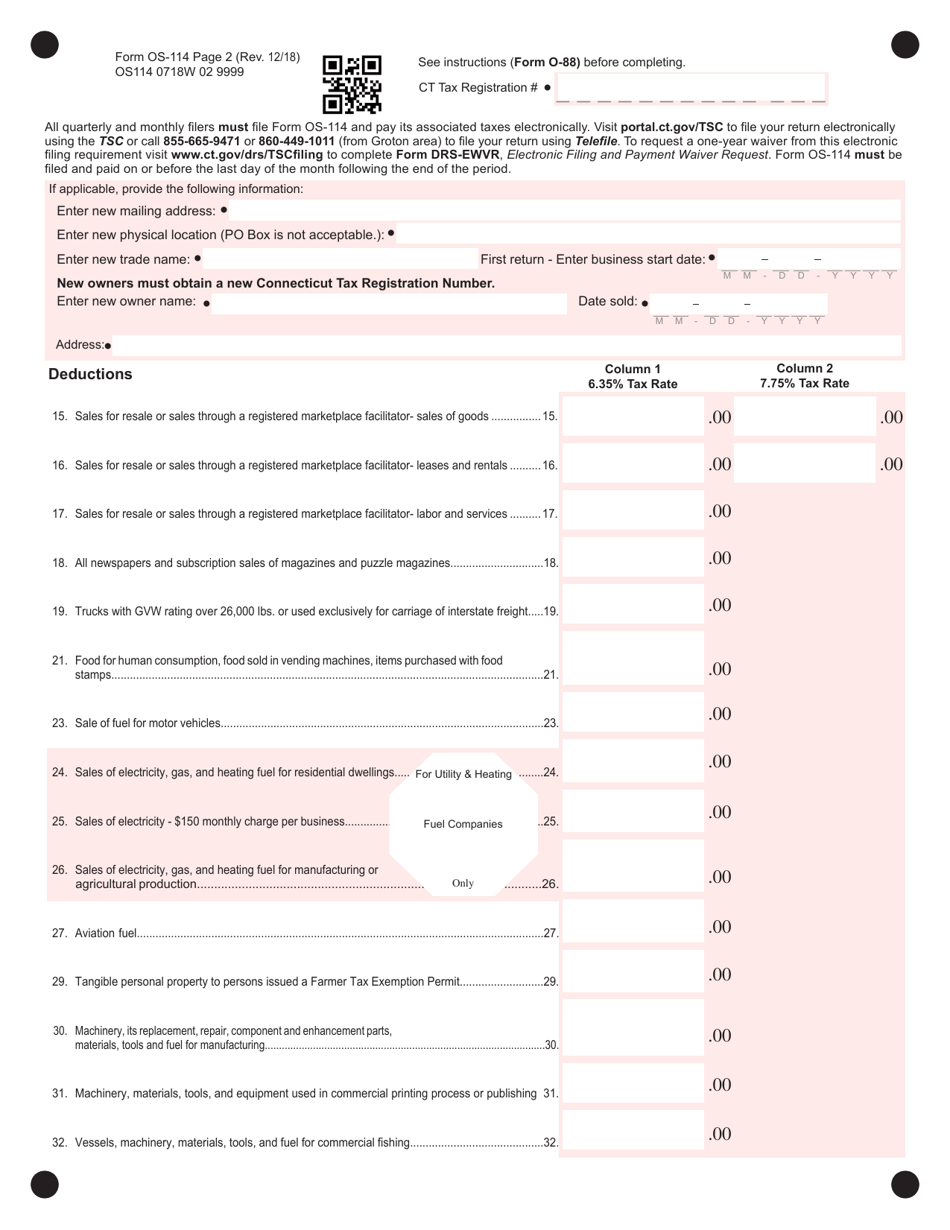

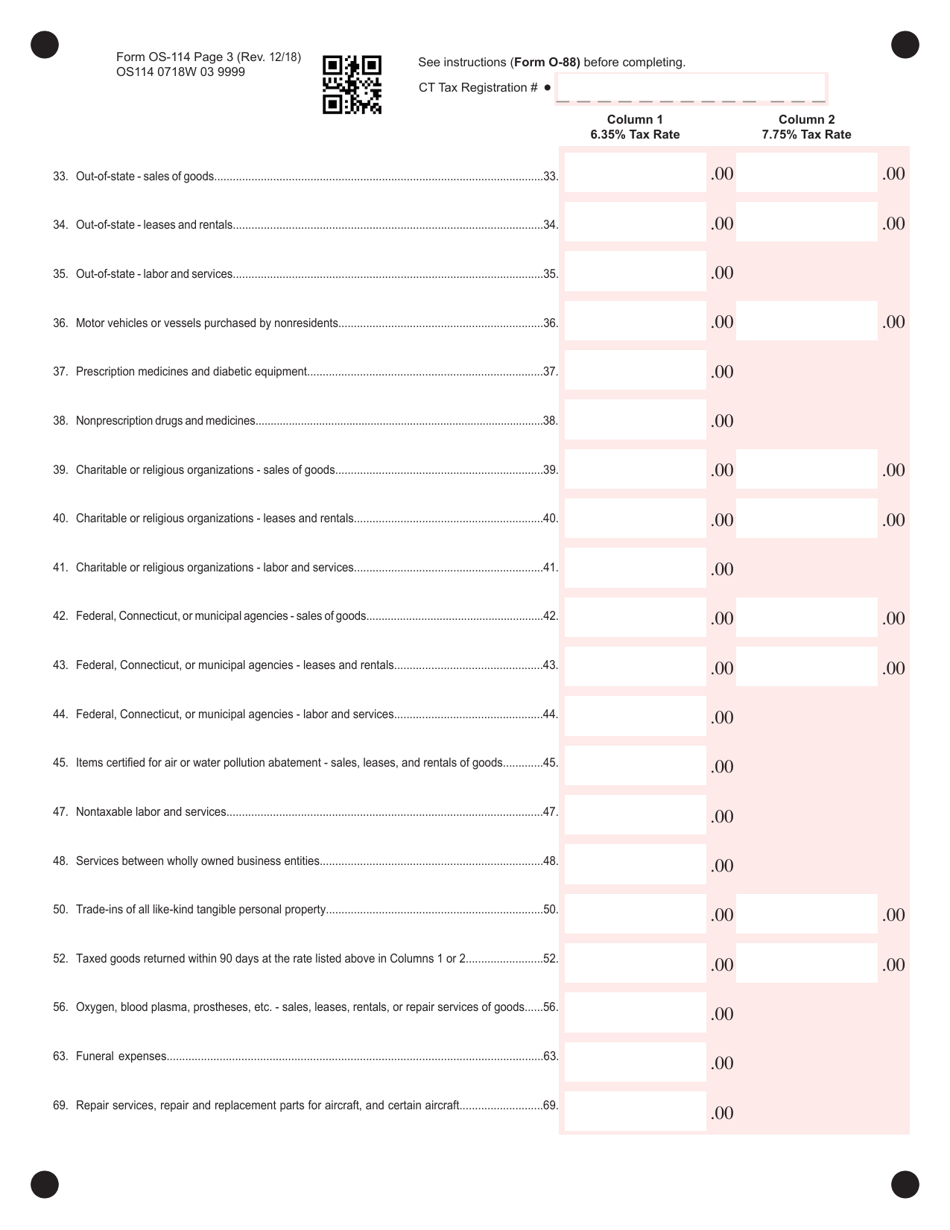

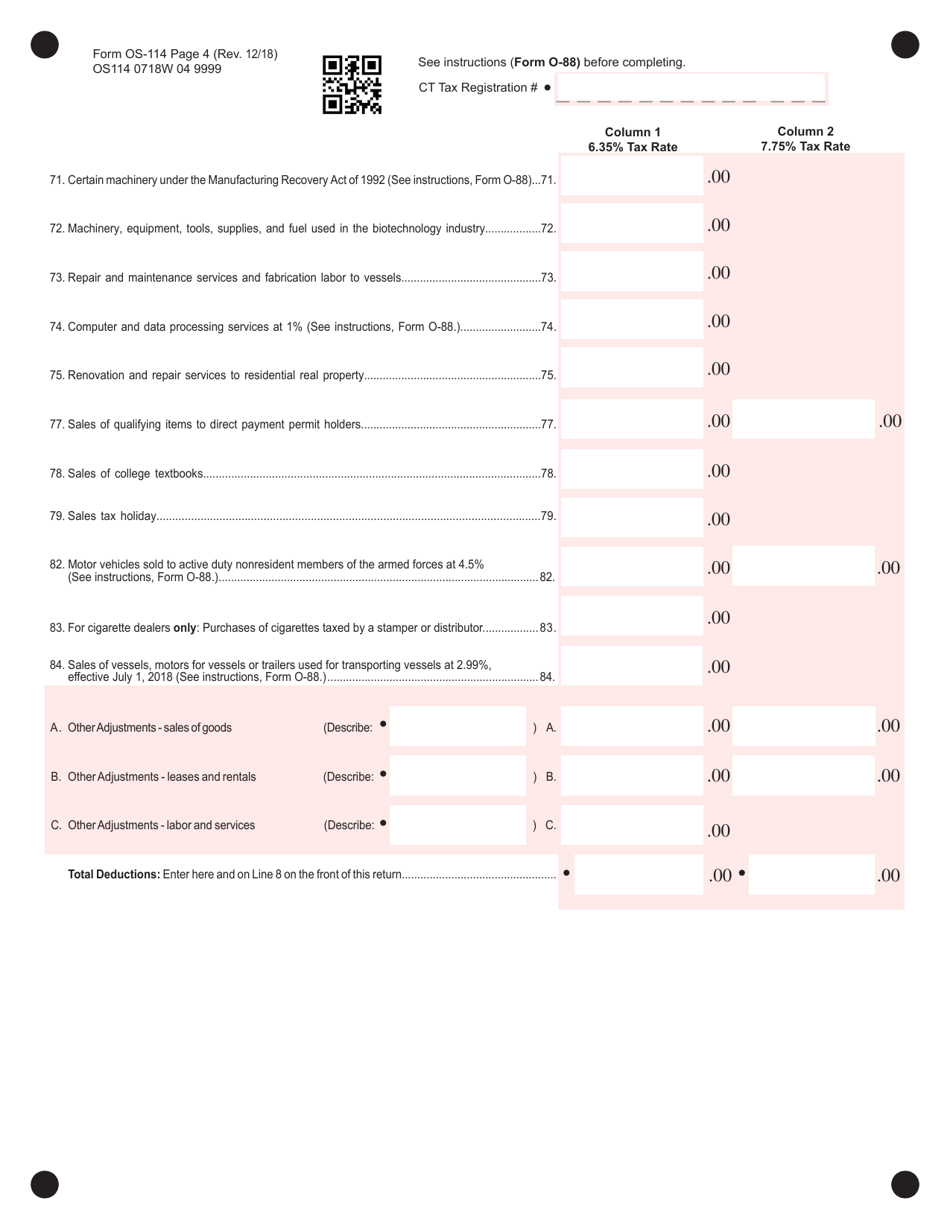

Deductions. The filer must item all nontaxable sales on the appropriate deduction lines from 15 through 84. Lines A, B, and C are used for describing any other deductions not mentioned. Total Deductions should be calculated and indicated below.

-

Quarterly and monthly reports must be submitted electronically through the Taxpayer Service Center (TSC) website. Annual reports and filers granted an electronic filing waiver should file paper returns. If the filer mails the return, it should be postmarked on or before the due date to be considered timely.

Where to Mail Form OS-114?

The completed Connecticut Sales and Use Tax Form must be sent by mail to the Connecticut Department of Revenue Services at the following address: Department of Revenue Services, PO Box 5030 Hartford, Connecticut 06102-5030.