Accounting Contract Template

Accounting Contract - What Is it?

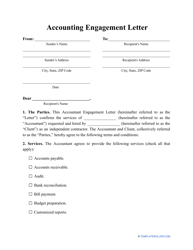

An Accounting Contract is a legal agreement between a client (individual or company) and an accountant, regarding the accounting needs of the client. Use this document to clarify your rights and responsibilities concerning the accounting services, define the scope of these services, and determine the deadlines.

Alternate Name:

- Accountant Contract.

If you would like, a ready-made Accounting Contract template can be downloaded below, or create a more personalized document with our online form builder.

You may compose a contract to specify the services that will be rendered, the accountant's fees, frequency of payments, and termination options. If any disputes or disagreements arise, a properly-drafted Accounting Contract will serve as evidence because it is recognized by all courts of law.

How to Write an Accounting Contract?

Use an Accounting Agreement to establish a professional relationship between a client and an independent accountant. This document is useful for businesses that want certain aspects of their finances handled and for individuals who have personal accounting needs. A professional accountant will know how to deal with start-up accountancy tasks, company registration, bookkeeping, accountancy references for letting agencies, and other financial challenges.

Do not confuse this document with a Bookkeeping Contract. Both agreements cover important parts of any business and they may appear to be the same from the outside, especially when the same professional is asked to provide both types of services. However, there are major differences. Bookkeeping deals with identifying, recording, and measuring financial transactions, while accounting summarizes, interprets, and communicates these transactions. The goal of bookkeeping is to keep all records of financial transactions in order, and then accounting analyzes the financial situation and communicates the insights and observations based on the available data.

Accounting Contract Clauses

Add the following details to your Accounting Services Agreement:

- Names and contact information of the parties.

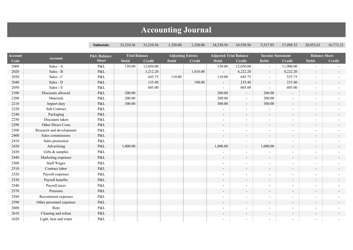

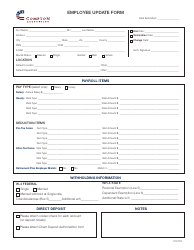

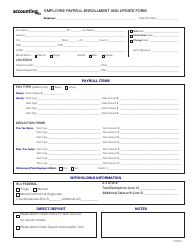

- Full list of the accounting services to be provided - for instance, handling billing and payroll records, bank reconciliations, auditing, preparation of ledgers, financial statements, and tax returns.

- Payment information. Generally, the parties agree to pay for the accounting services on a monthly basis. State the hourly rate of the accountant and the method of payment.

- Duration of the agreement.

- Independence of the relationship. The accountant acts as an independent contractor and not as an employee.

- Confidentiality clause. The accountant is not allowed to share any financial information, industry knowledge, or trade secrets received from the client while providing their services.

- Termination of the agreement. Usually, a 30-day advance written notice is enough to cancel the contract earlier than scheduled;

- Signatures of the parties that demonstrate their willingness to be bound by all the terms and conditions put in writing.

Still looking for a particular form? Take a look at these similar forms below: