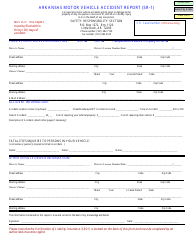

Vehicle Bill of Sale (Credit for Vehicle Sold) - Arkansas

Arkansas Vehicle Bill of Sale Form

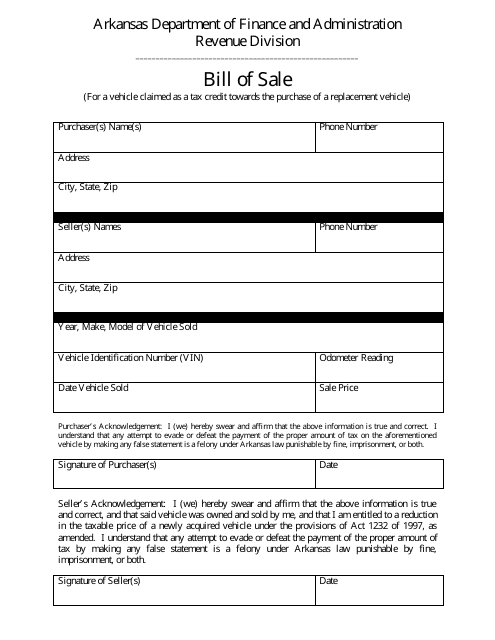

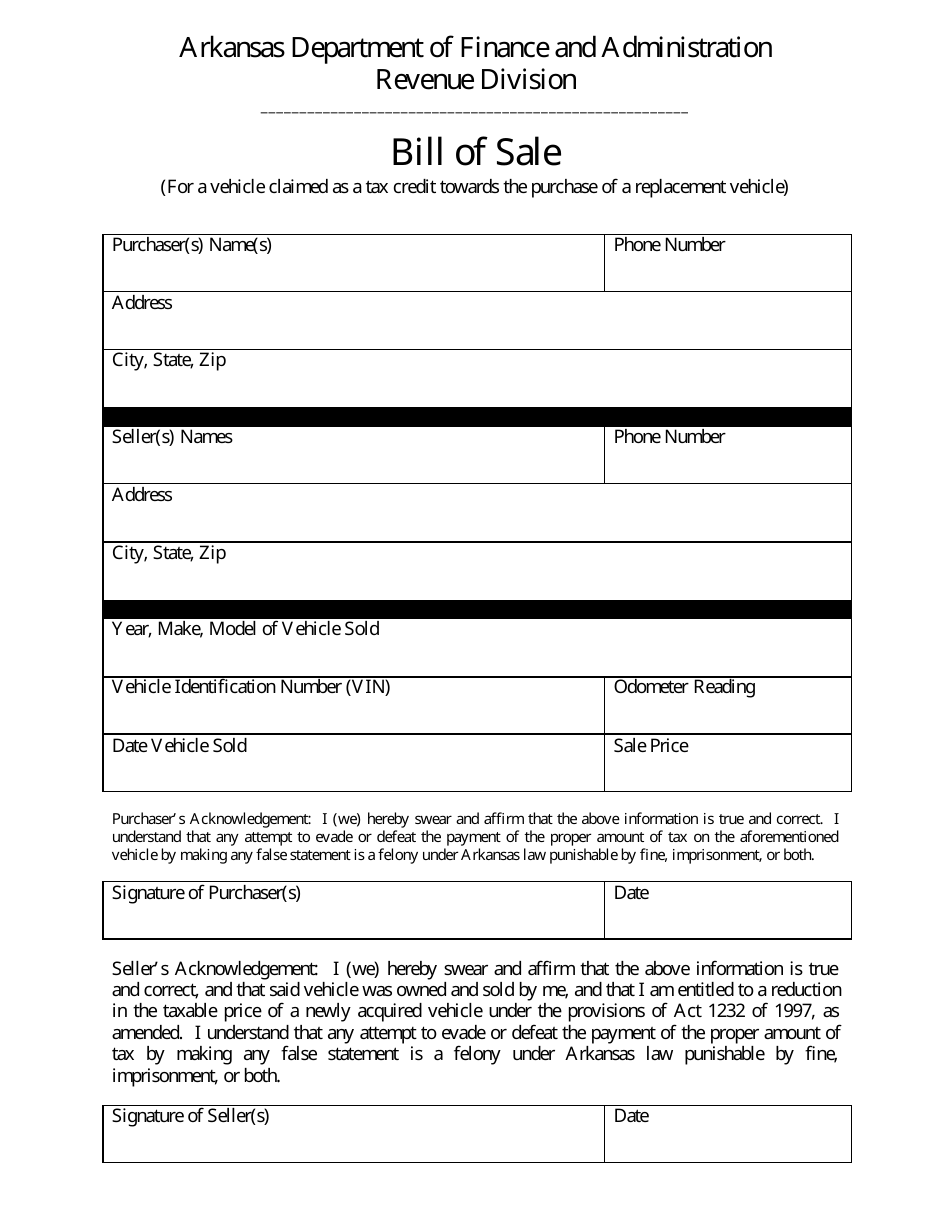

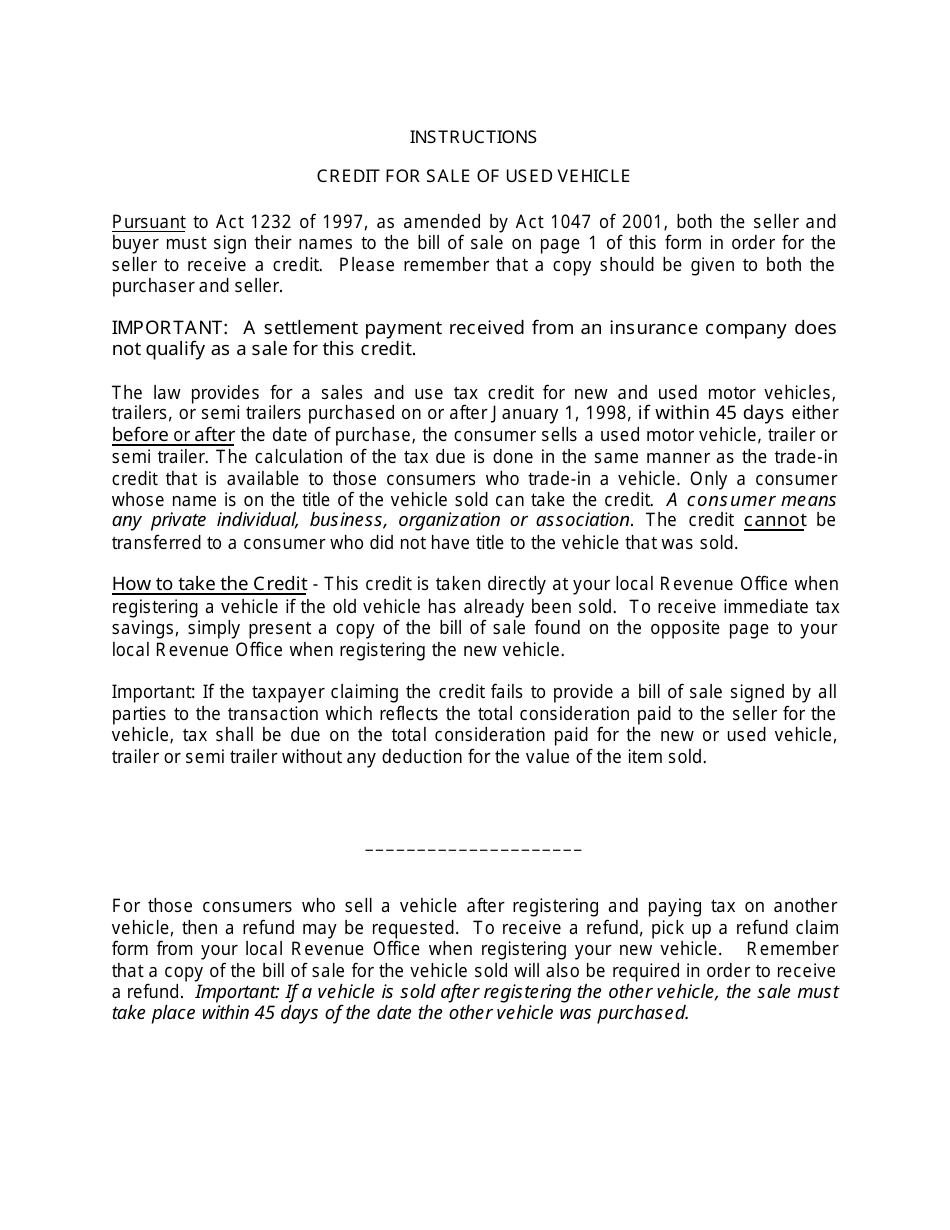

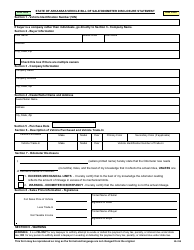

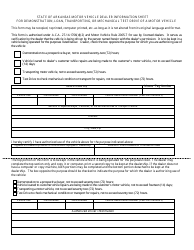

The Arkansas Vehicle Bill of Sale (Credit for Vehicle Sold) is a document that records the sale or transfer of a vehicle (used motor vehicles, trailers, and semi-trailers) from the seller to the buyer. This form was released by the Revenue Division of the Arkansas Department of Finance and Administration . The Arkansas law allows for sales and use tax credit for motor vehicle sales - a certain amount of money that a taxpayer can subtract from the taxes owed to the government. If a consumer buys a new vehicle and within 45 days before or after the date of the purchase sells a different vehicle, this individual is entitled to receive a credit of the sales or use tax on the new item. The latest edition of the form is available for download below.

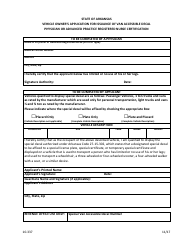

This bill of sale is not the only form used to sell a vehicle, because its scope of application is limited. If the purchase of the new vehicle has not or will not occur, you need to use the State of Arkansas Vehicle Bill of Sale/Odometer Disclosure Statement. This document provides the description of the vehicle, buyer/company information, dealer's/seller's name and address, date of the purchase, and the sales price information.

Do You Need a Bill of Sale to Register a Car in Arkansas?

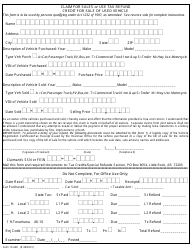

An Arkansas bill of sale is required to register a car. Any motor vehicle has to be registered within one month of purchasing it. You need to visit your local Department of Revenue Office to undergo the process of registration. Additionally, the Revenue Office is the place where you can receive immediate tax savings. You will need to submit a copy of the form and pay all your registration fees. If the vehicle has not been registered in Arkansas before, the vehicle identification number (VIN) will be inspected. If you bought and registered a new vehicle prior to selling the old one, you can request a refund for all or part of the tax paid. To do this, fill out a refund claim form in your local Revenue Office when you register your new car.

How to Write a Bill of Sale for a Car in Arkansas?

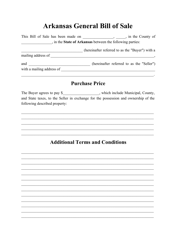

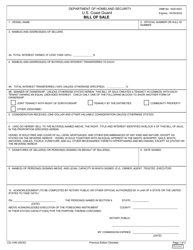

All bills of sale for vehicles must comply with the state requirements for the seller to receive credit. This form contains the purchaser's and the seller's full names, phone numbers, addresses, description of the vehicle (year, make, model, VIN, and odometer reading), the date of the sale, price, and signatures of the parties. The seller and the buyer must have a copy of the document.

Does a Vehicle Bill of Sale Have to be Notarized in Arkansas?

The form is an official document released by the Arkansas Department of Finance and Administration and does not require to be notarized.

Take a look at these related forms below: