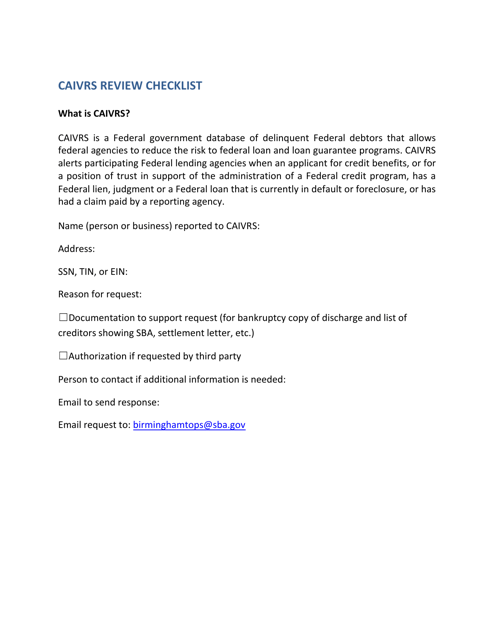

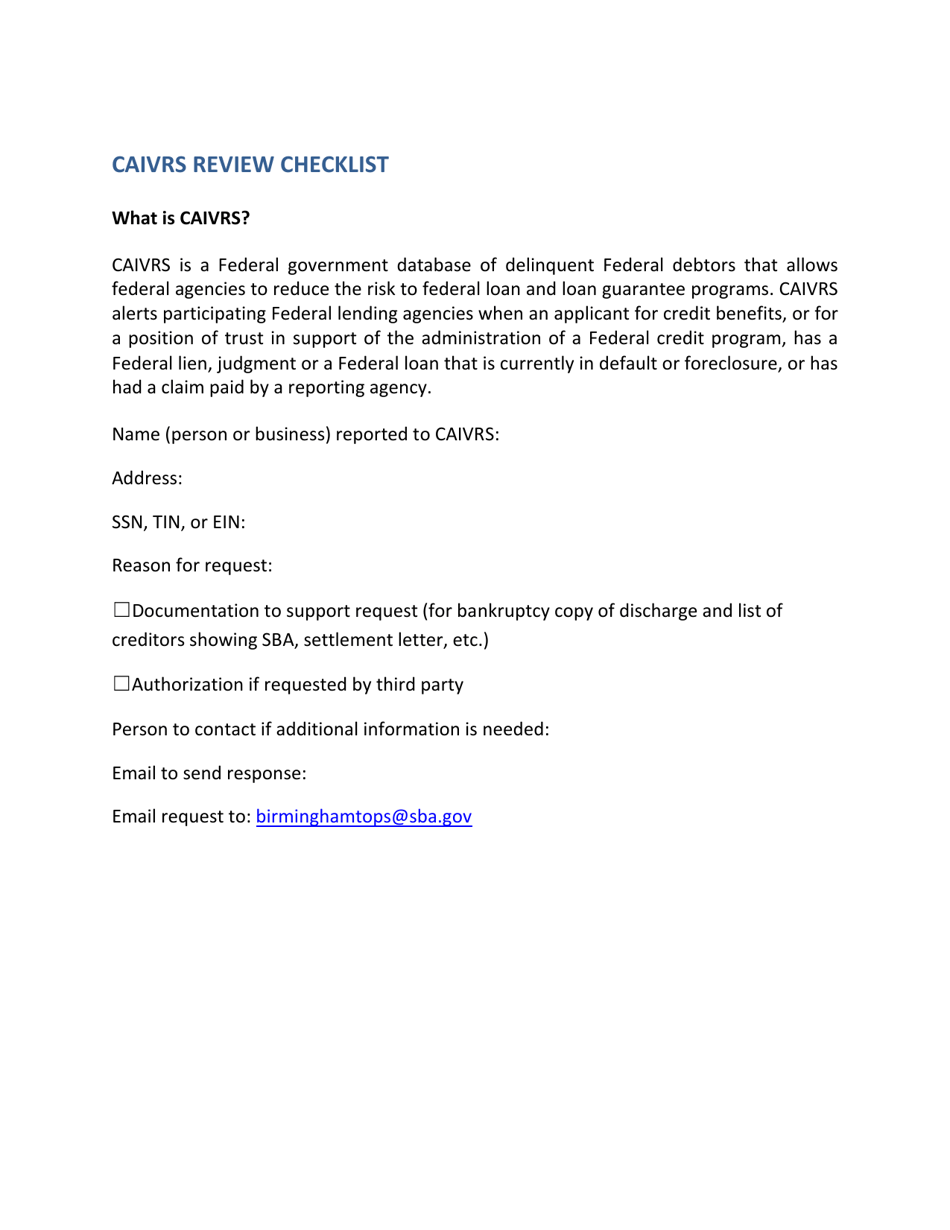

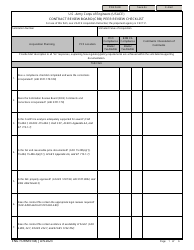

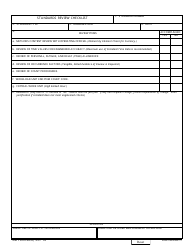

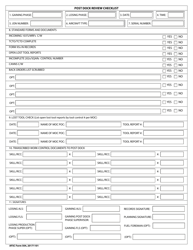

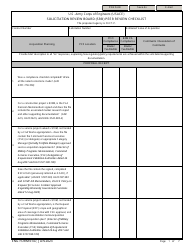

Caivrs Review Checklist

Caivrs Review Checklist is a 1-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What is a Caivrs review?

A: A Caivrs review is a process to check if an individual or business has any outstanding federal debts.

Q: Who conducts the Caivrs review?

A: The Caivrs review is conducted by the U.S. Department of Housing and Urban Development (HUD).

Q: Why is a Caivrs review important?

A: A Caivrs review is important because it determines eligibility for certain federal programs, such as FHA loans.

Q: What information is considered in a Caivrs review?

A: A Caivrs review considers information such as delinquent federal loans, defaulted student loans, and other federal debts.

Q: How can I request a Caivrs review?

A: To request a Caivrs review, you can contact HUD directly or reach out to your lender or loan servicer.

Q: What happens if I have outstanding federal debts in a Caivrs review?

A: If you have outstanding federal debts in a Caivrs review, you may be ineligible for certain federal programs or loans.

Q: How long does a Caivrs review take?

A: The duration of a Caivrs review may vary, but it typically takes a few business days to complete.

Q: Can I dispute the results of a Caivrs review?

A: Yes, you can dispute the results of a Caivrs review if you believe there are errors or inaccuracies. You will need to provide supporting documentation.

Q: Does a Caivrs review affect my credit score?

A: A Caivrs review itself does not directly impact your credit score, but it may affect your eligibility for certain loans or programs which can indirectly impact your credit.

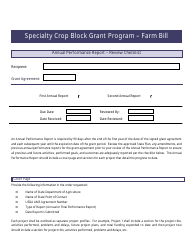

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.