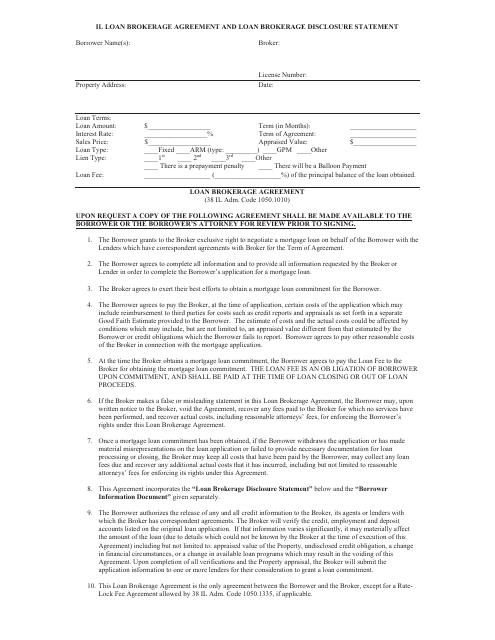

Loan Brokerage Agreement and Loan Brokerage Disclosure Statement Template - Illinois

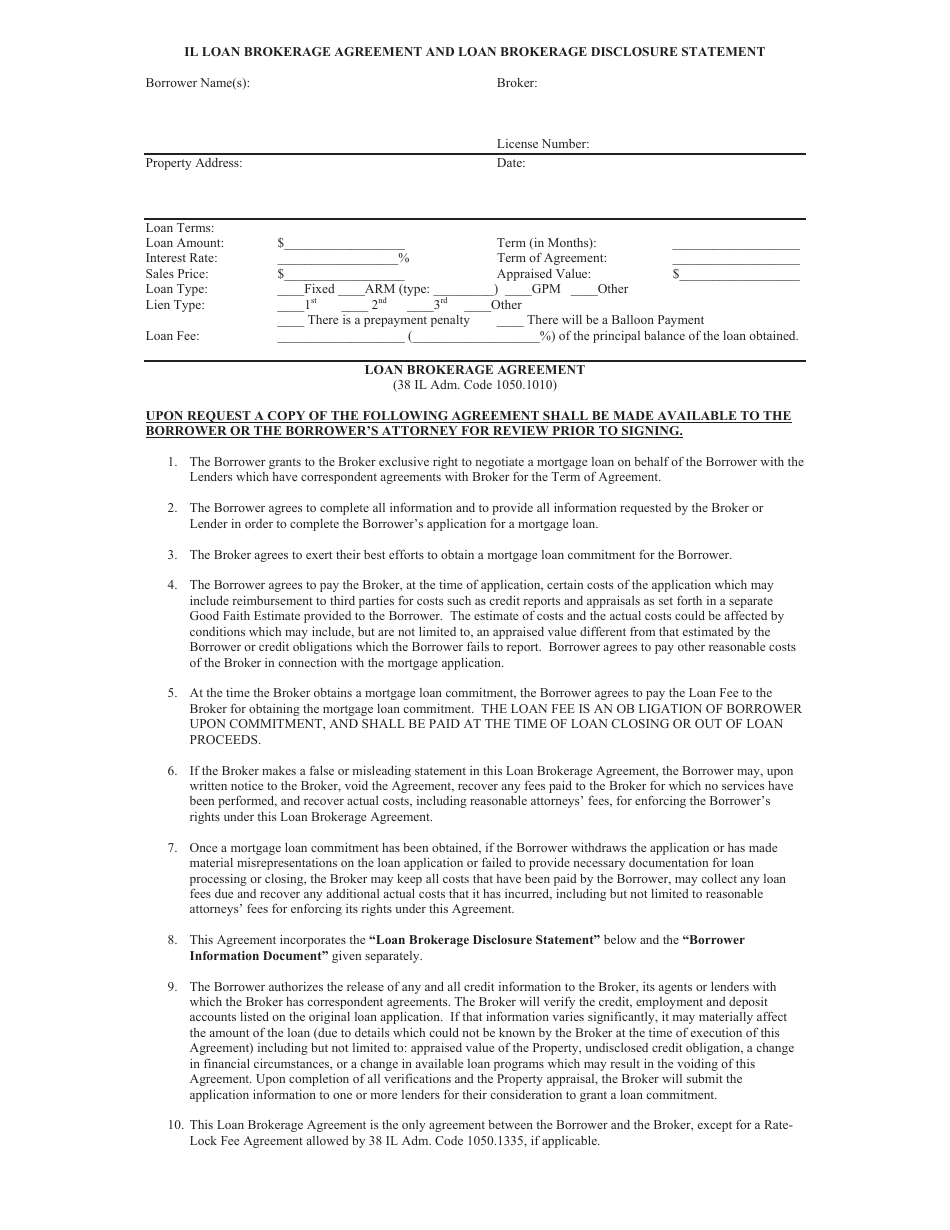

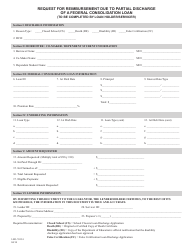

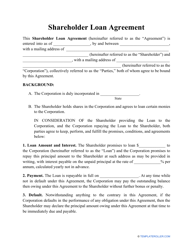

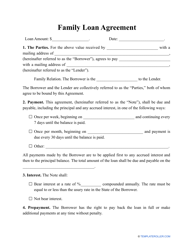

A Loan Brokerage Agreement is a contract between a loan broker and a borrower that outlines the terms and conditions of their working relationship. It sets out the responsibilities and obligations of both parties in facilitating a loan transaction.

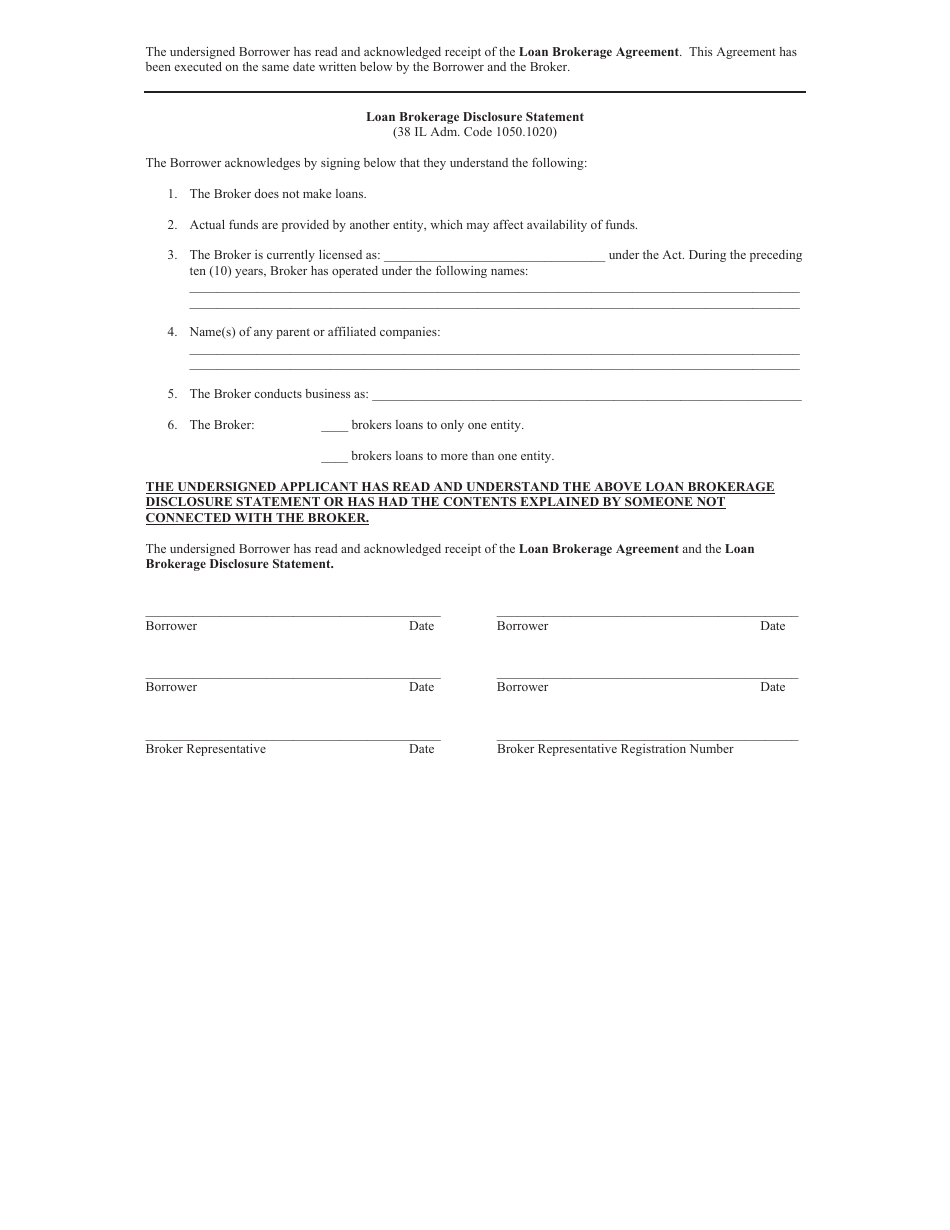

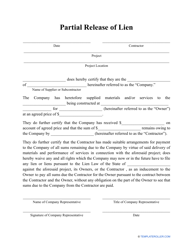

A Loan Brokerage Disclosure Statement Template is a document that the loan broker provides to the borrower in Illinois. It is meant to disclose important information about the loan, such as fees, interest rates, and any potential conflicts of interest. It ensures transparency and helps borrowers make informed decisions.

FAQ

Q: What is a loan brokerage agreement?

A: A loan brokerage agreement is a contract between a borrower and a loan broker outlining the terms and conditions of the loan brokerage services.

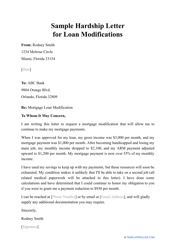

Q: What is a loan brokerage disclosure statement?

A: A loan brokerage disclosure statement is a document provided by the loan broker to the borrower that discloses important information about the loan brokerage transaction.

Q: What should be included in a loan brokerage agreement?

A: A loan brokerage agreement should include details about the parties involved, the services to be provided, fees and compensation, and any other relevant terms and conditions.

Q: What information should be disclosed in a loan brokerage disclosure statement?

A: A loan brokerage disclosure statement should disclose the name and contact information of the loan broker, the nature of the services provided, any fees or compensation, and any conflicts of interest.

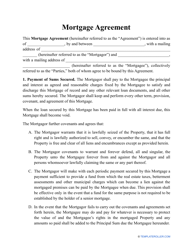

Q: Is a loan brokerage agreement legally binding?

A: Yes, a loan brokerage agreement is legally binding once both parties have agreed to its terms and have signed the agreement.

Q: Why is a loan brokerage disclosure statement important?

A: A loan brokerage disclosure statement is important because it provides transparency and allows the borrower to make informed decisions about the loan brokerage transaction.

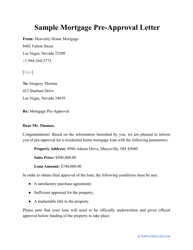

Q: Are loan brokers regulated in Illinois?

A: Yes, loan brokers in Illinois are regulated by the Illinois Department of Financial and Professional Regulation.

Q: What should I do if I have a complaint against a loan broker in Illinois?

A: If you have a complaint against a loan broker in Illinois, you can file a complaint with the Illinois Department of Financial and Professional Regulation.

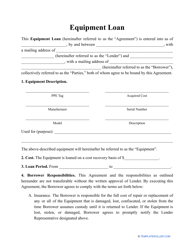

Q: Can I negotiate the terms and fees in a loan brokerage agreement?

A: Yes, you can negotiate the terms and fees in a loan brokerage agreement, but both parties must agree to any changes in writing.

Q: Are there any legal restrictions on loan brokers in Illinois?

A: Yes, loan brokers in Illinois must comply with the Illinois Consumer Fraud and Deceptive Business Practices Act and other applicable state and federal laws.