This version of the form is not currently in use and is provided for reference only. Download this version of

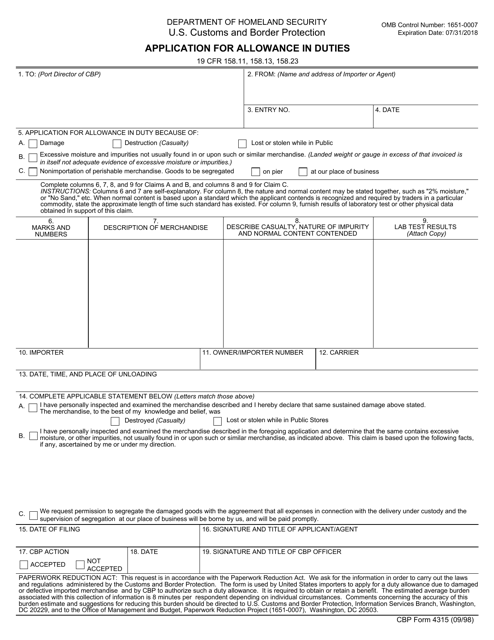

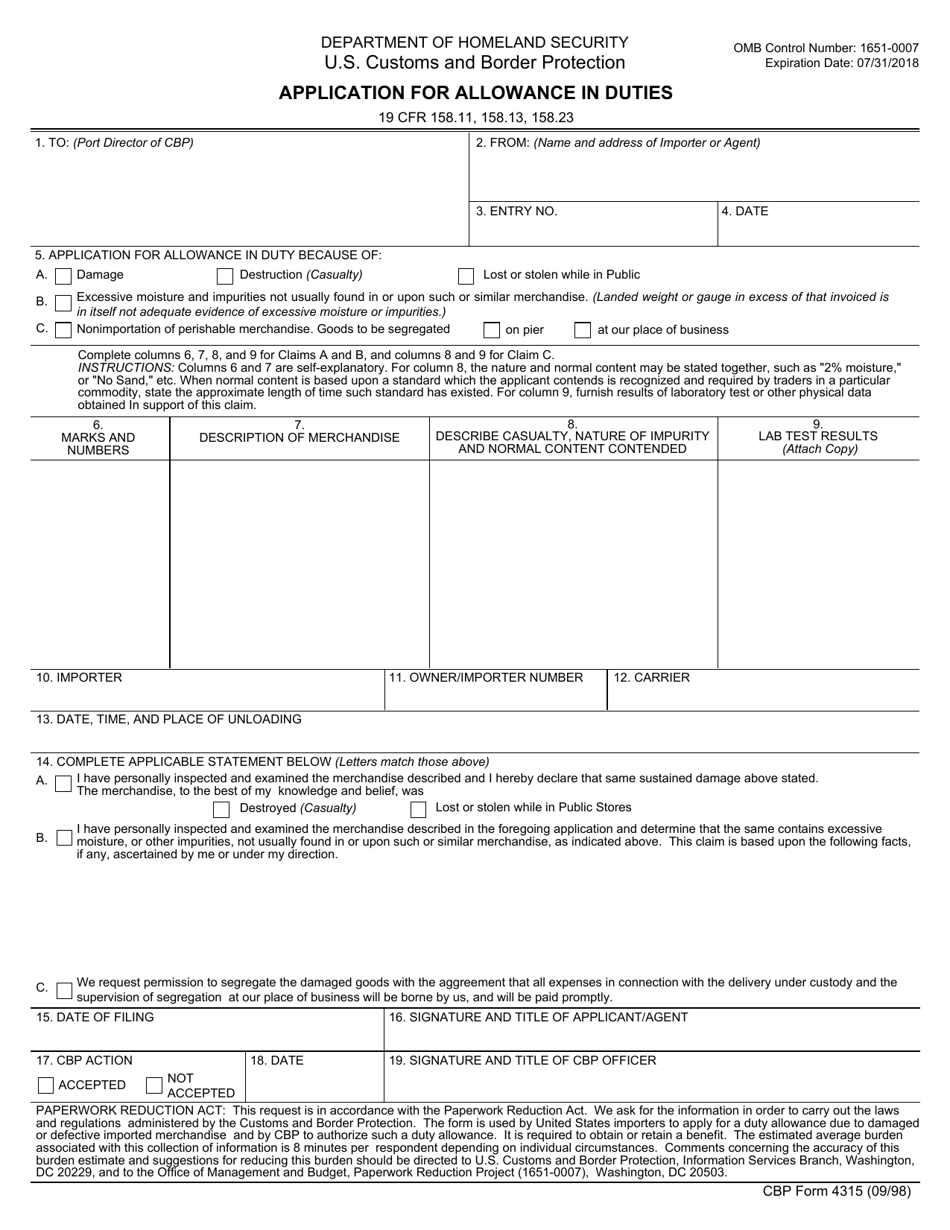

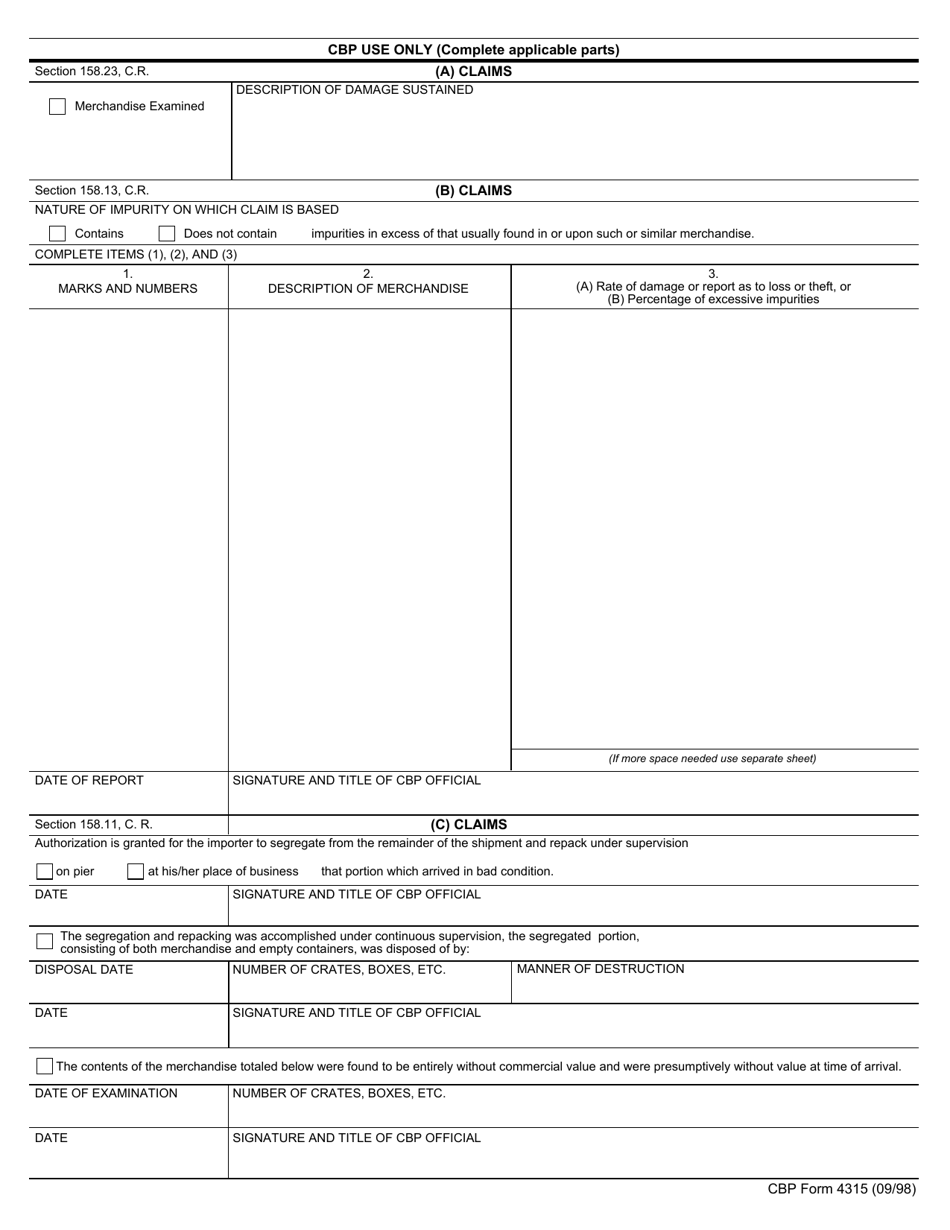

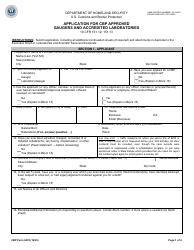

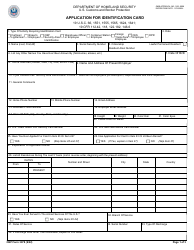

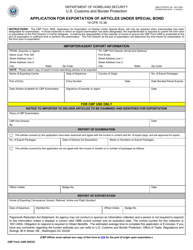

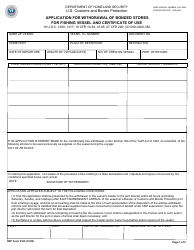

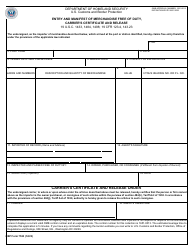

CBP Form 4315

for the current year.

CBP Form 4315 Application for Allowance in Duties

What Is CBP Form 4315?

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on September 1, 1998 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CBP Form 4315?

A: CBP Form 4315 is an Application for Allowance in Duties form.

Q: What is the purpose of CBP Form 4315?

A: The purpose of CBP Form 4315 is to apply for an allowance in duties for imported goods.

Q: What is an allowance in duties?

A: An allowance in duties is a reduction or exemption from customs duties that may be granted for certain imported goods.

Q: Who needs to fill out CBP Form 4315?

A: Any individual or business importing goods and seeking an allowance in duties may need to fill out CBP Form 4315.

Q: Are there any fees associated with CBP Form 4315?

A: There may be fees associated with CBP Form 4315, such as processing fees or fees related to the importation of goods.

Q: What supporting documents are required with CBP Form 4315?

A: The specific supporting documents required with CBP Form 4315 may vary depending on the nature of the importation and the requested allowance in duties.

Q: How long does it take to process CBP Form 4315?

A: The processing time for CBP Form 4315 can vary depending on the complexity of the application and other factors. It is best to check with CBP or your customs broker for an estimate.

Q: Can I appeal a decision on CBP Form 4315?

A: Yes, if your application for allowance in duties is denied, you may have the option to appeal the decision.

Form Details:

- Released on September 1, 1998;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 4315 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.