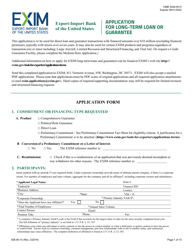

Streamlined Servicing for Guaranteed Loans

Streamlined Servicing for Guaranteed Loans is a 1-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What are guaranteed loans?

A: Guaranteed loans are loans backed by a government agency or organization.

Q: What is streamlined servicing for guaranteed loans?

A: Streamlined servicing is a simplified and efficient process for managing and servicing guaranteed loans.

Q: Who benefits from streamlined servicing for guaranteed loans?

A: Borrowers and lenders both benefit from streamlined servicing for guaranteed loans. Borrowers experience easier loan management, and lenders enjoy more efficient loan servicing processes.

Q: What are the advantages of streamlined servicing for guaranteed loans?

A: The advantages of streamlined servicing include reduced paperwork, faster loan processing, and improved customer service.

Q: Are all types of loans eligible for streamlined servicing?

A: No, only guaranteed loans are eligible for streamlined servicing.

Q: How can borrowers and lenders access streamlined servicing?

A: Borrowers and lenders can access streamlined servicing through government agencies or organizations that administer guaranteed loan programs.

Q: Does streamlined servicing affect the terms or conditions of the loan?

A: No, streamlined servicing does not impact the terms or conditions of the loan. It simply improves the loan management and servicing process.

Q: What should borrowers and lenders do to take advantage of streamlined servicing?

A: Borrowers and lenders should reach out to the relevant government agency or organization for guidance on accessing streamlined servicing for guaranteed loans.

Q: Can guaranteed loans be serviced through other methods?

A: Yes, guaranteed loans can still be serviced through traditional methods if borrowers and lenders prefer.

Q: What should borrowers and lenders consider before opting for streamlined servicing?

A: Borrowers and lenders should consider factors such as their specific loan requirements, the efficiency of the streamlined servicing process, and any associated costs.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.