This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

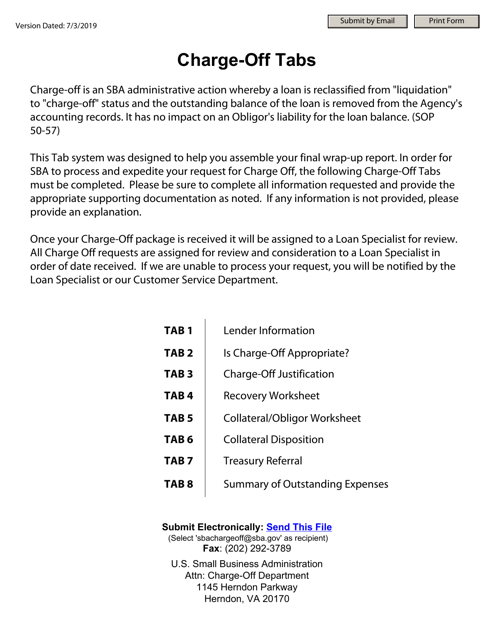

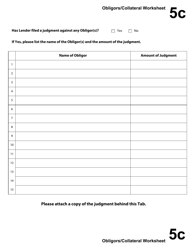

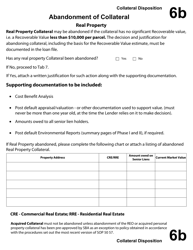

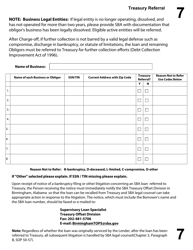

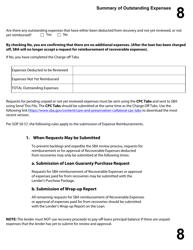

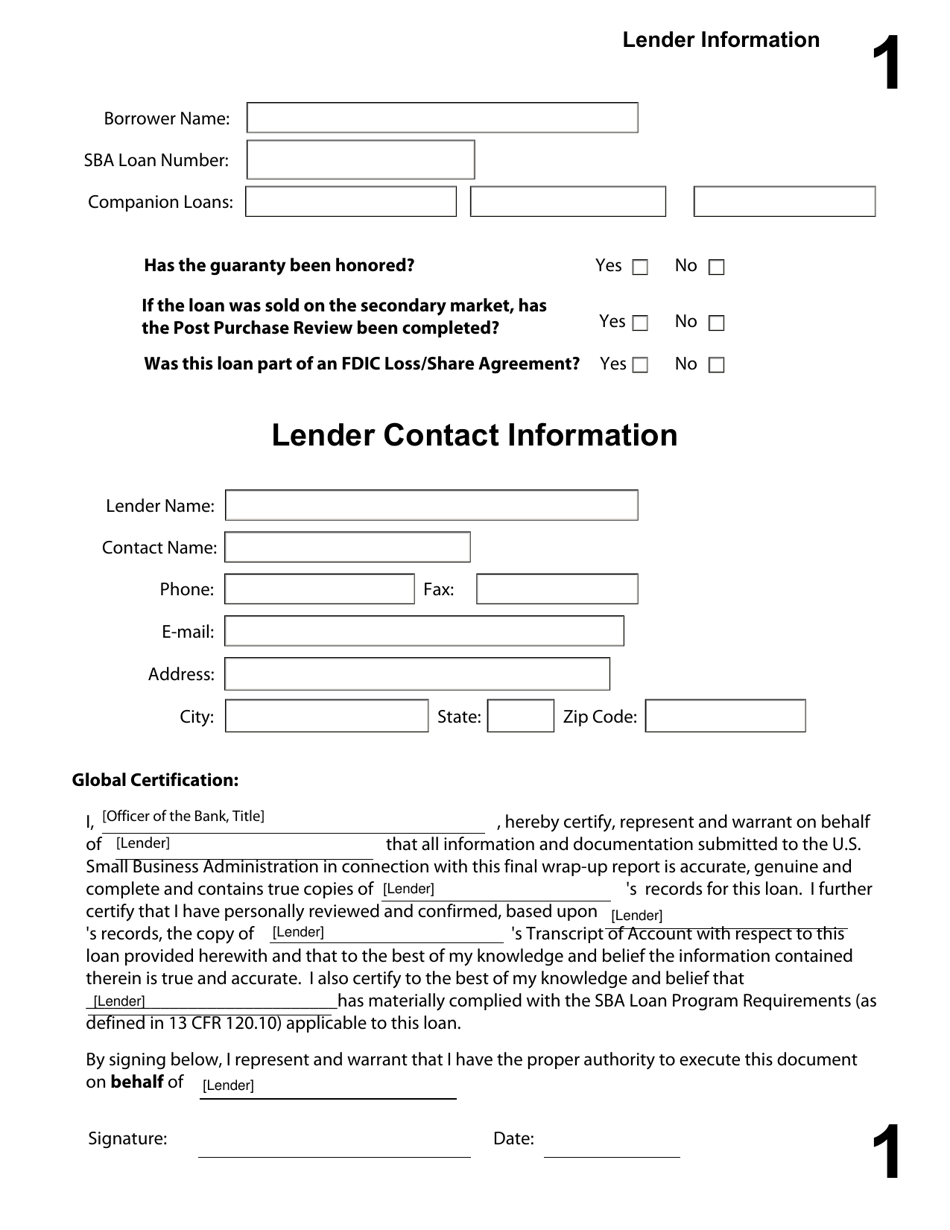

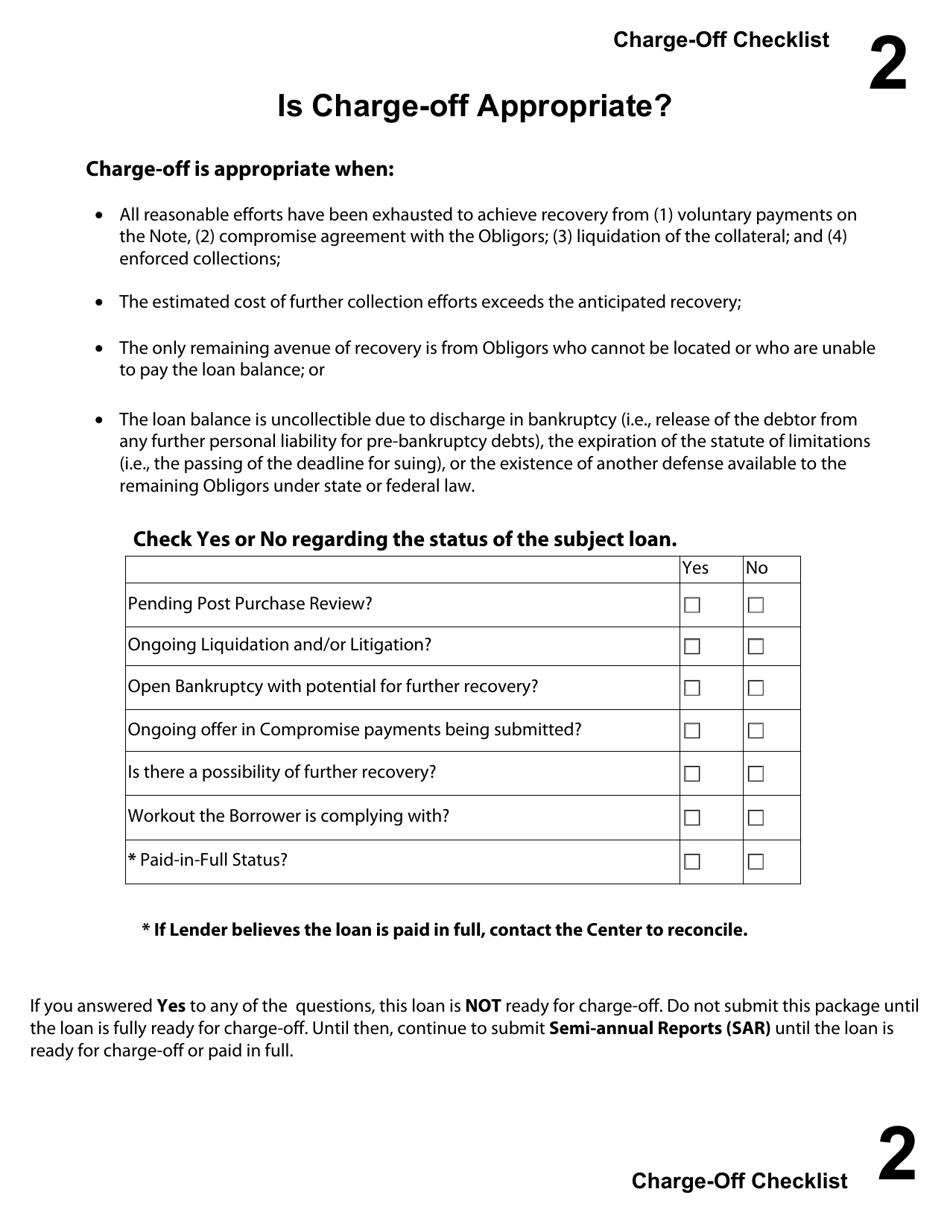

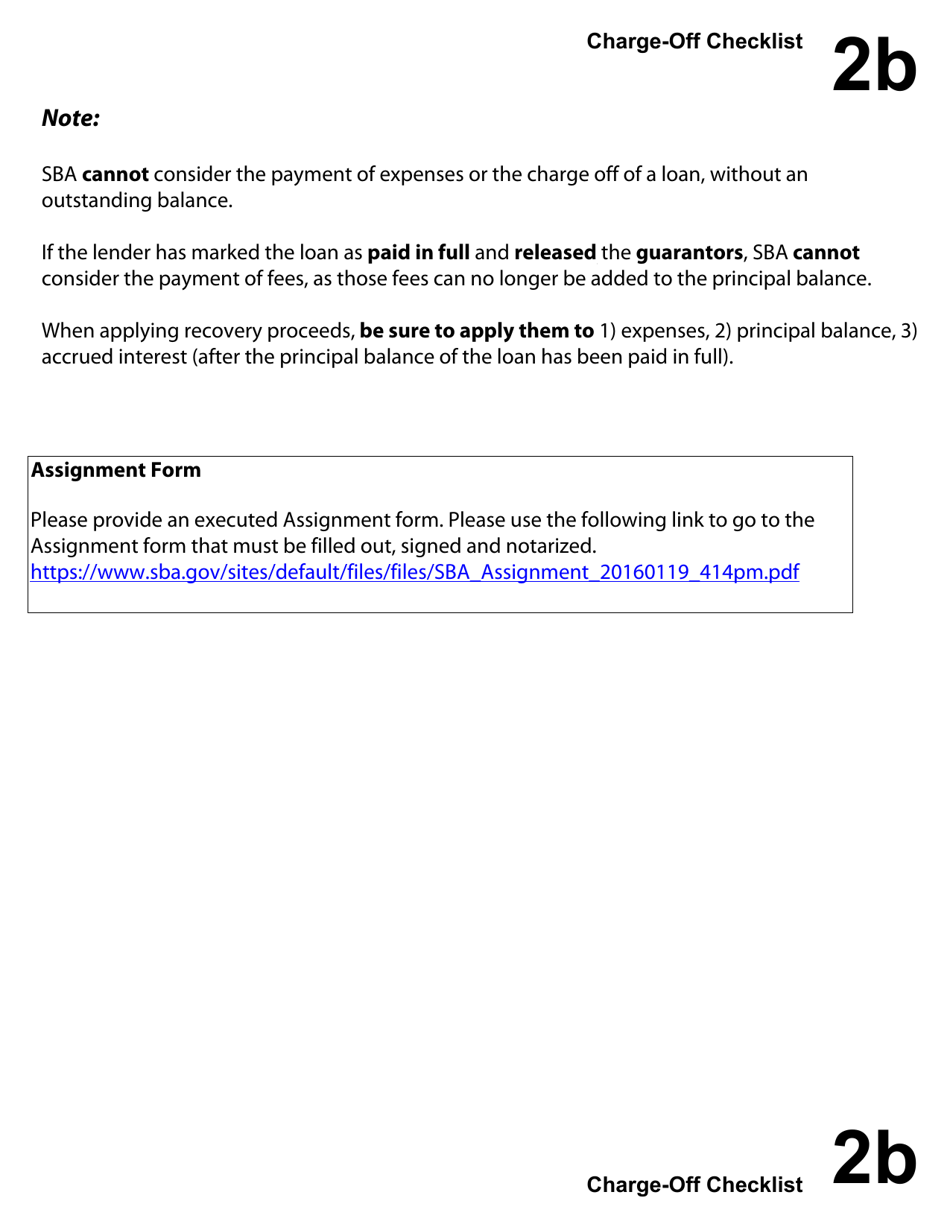

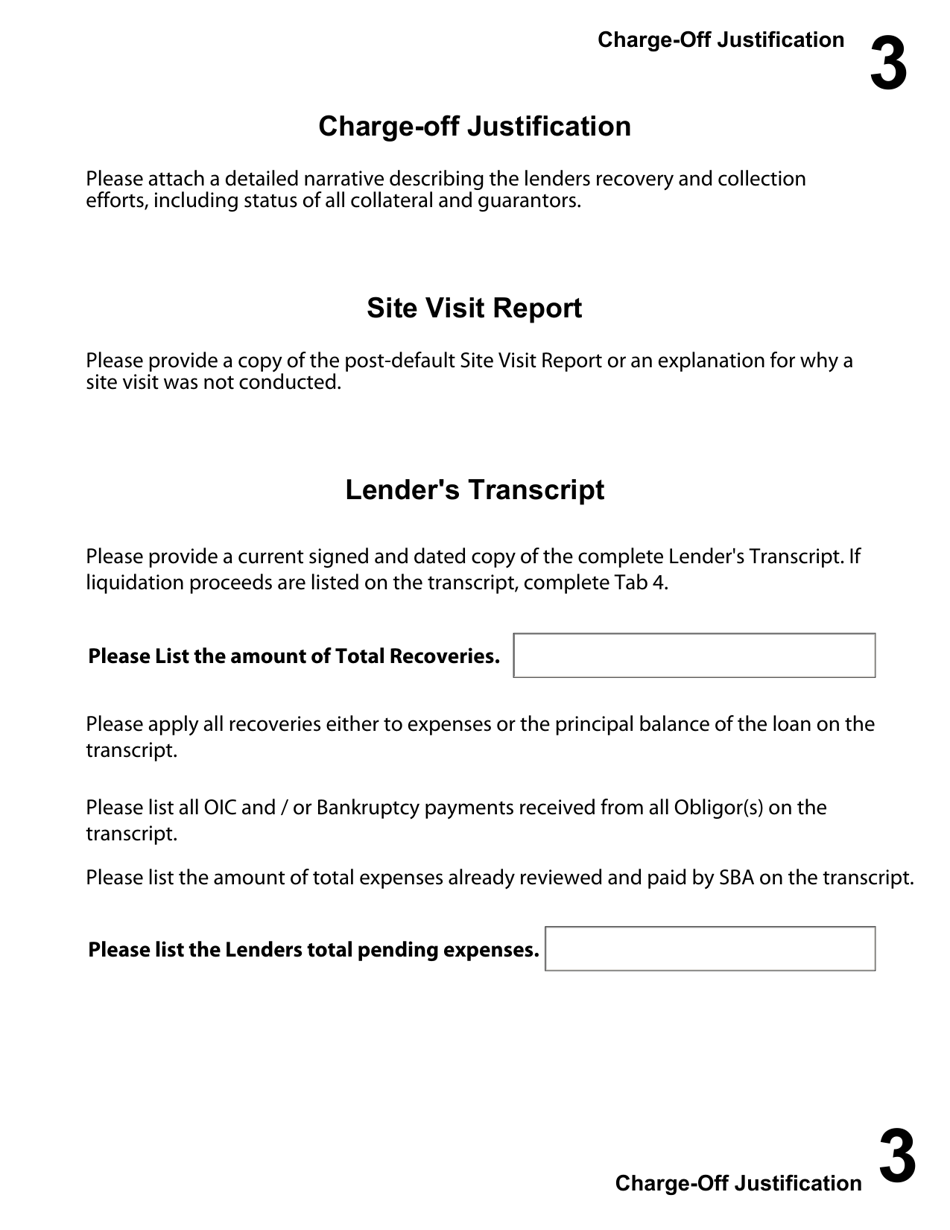

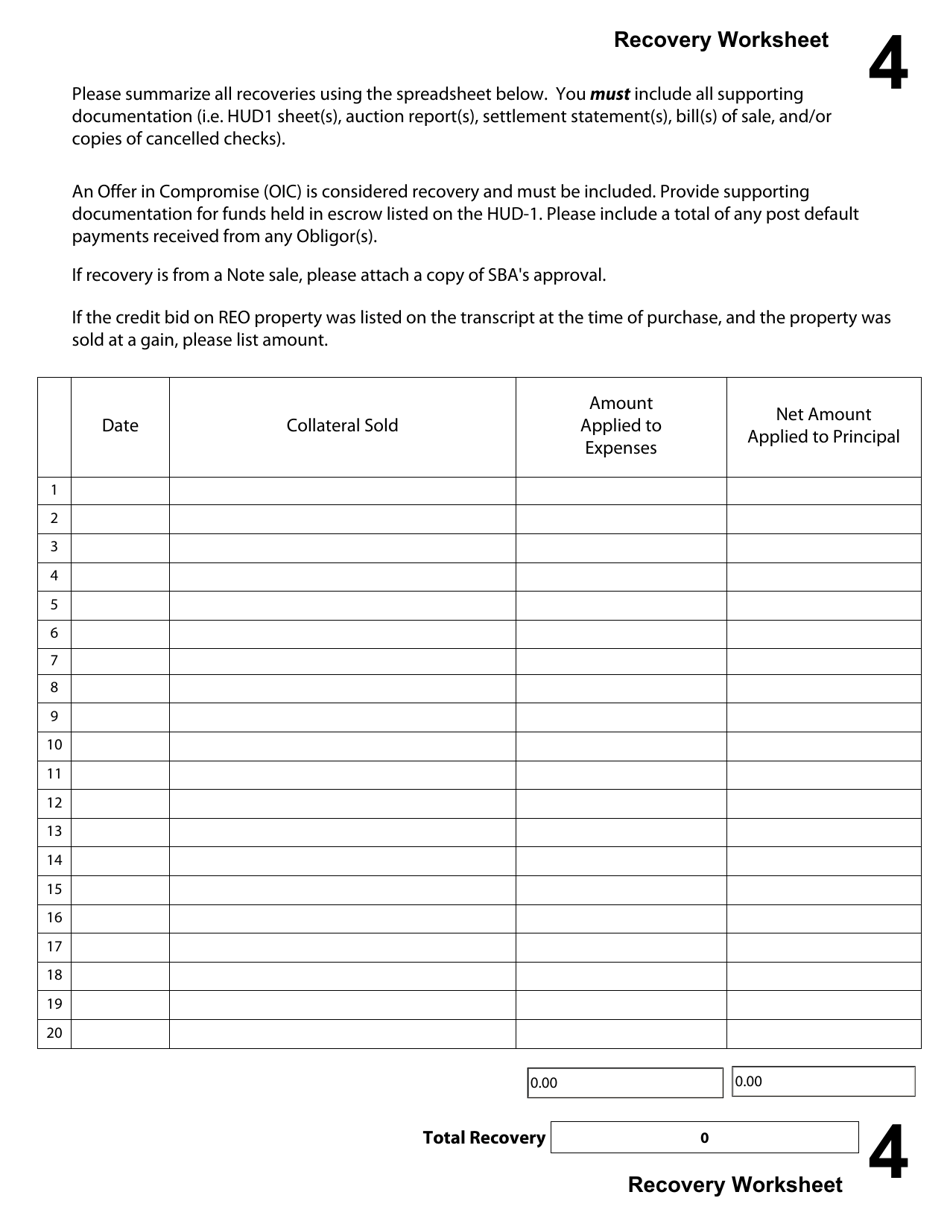

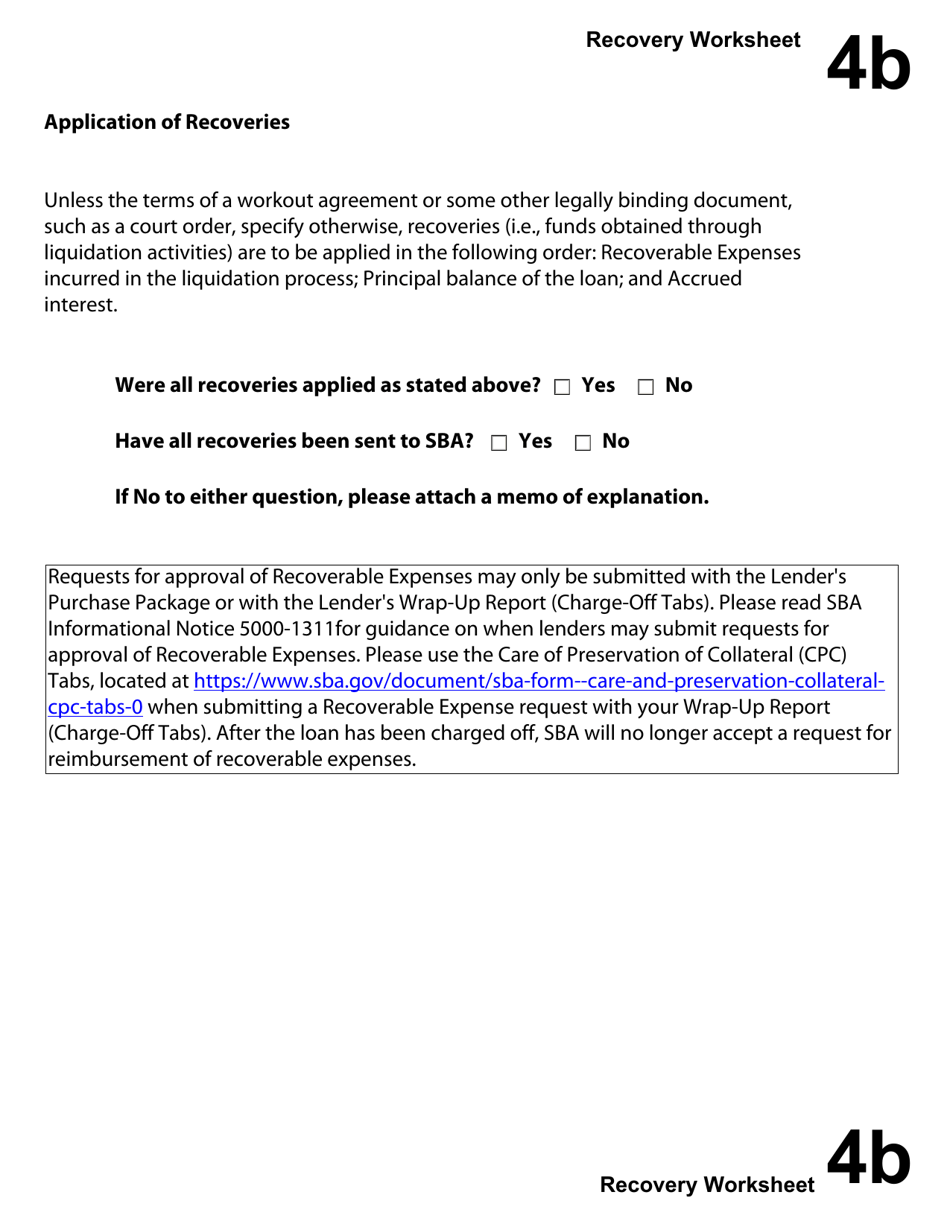

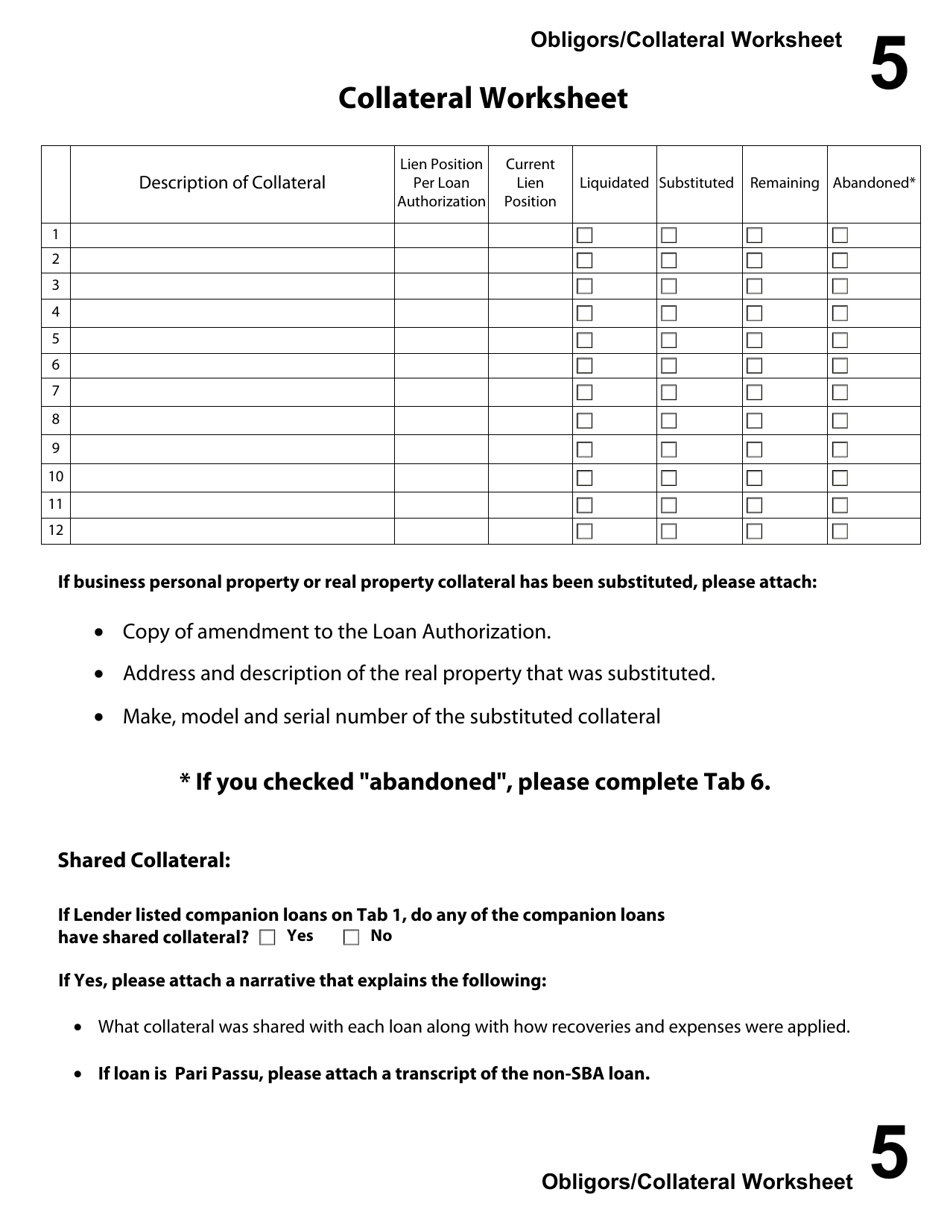

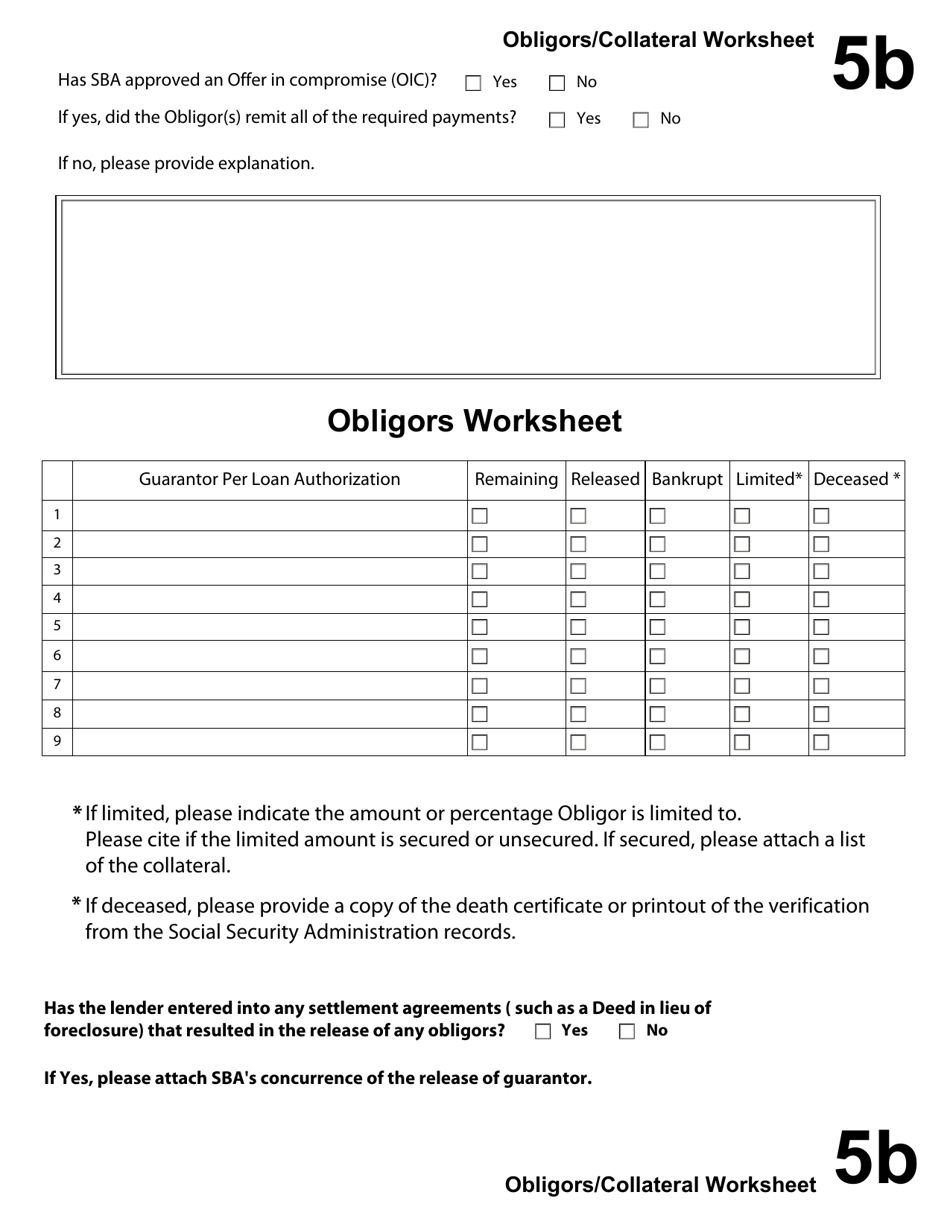

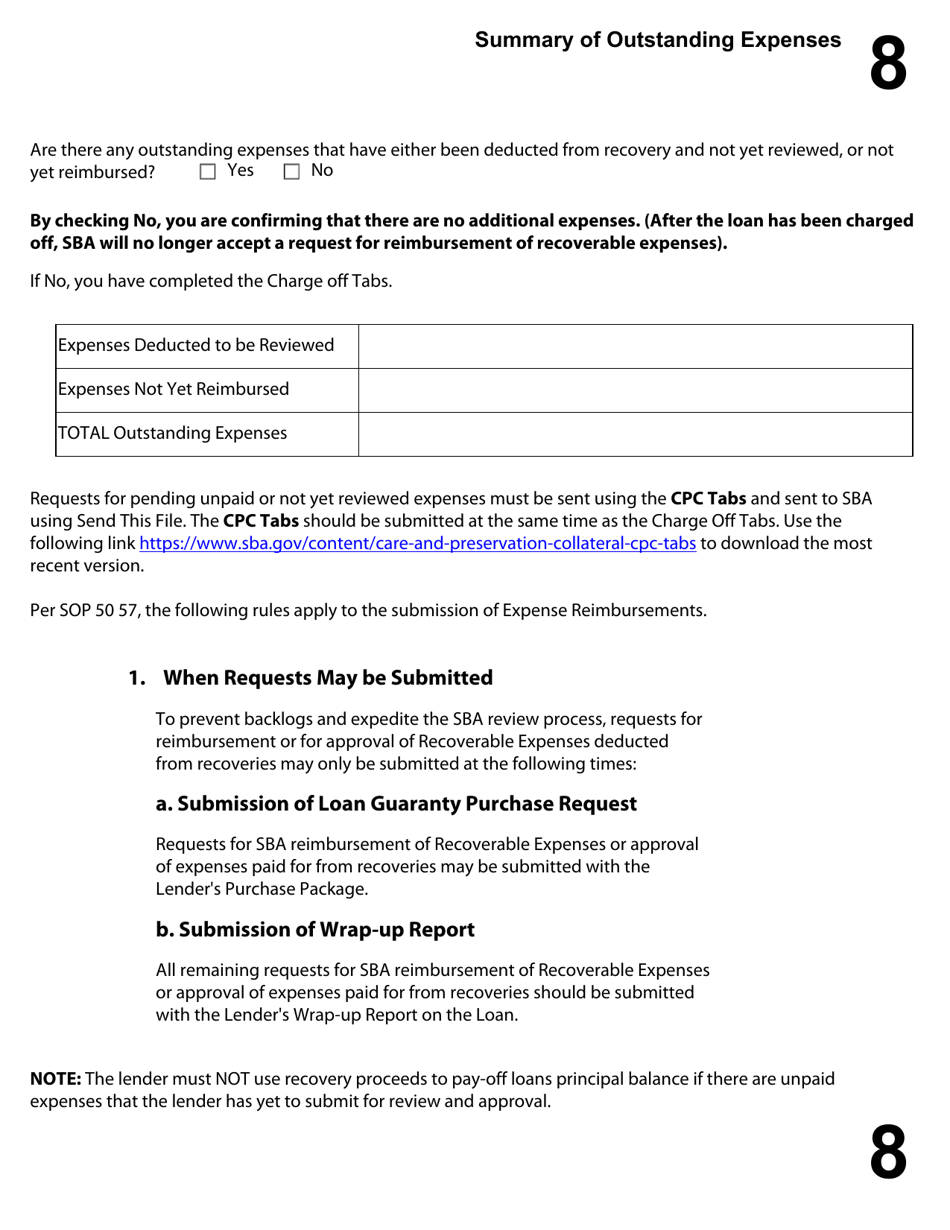

Charge-Off Tabs

Charge-Off Tabs is a 14-page legal document that was released by the U.S. Small Business Administration on July 3, 2019 and used nation-wide.

FAQ

Q: What is a charge-off?

A: A charge-off is when a creditor writes off an unpaid debt as a loss.

Q: Does a charge-off mean the debt is forgiven?

A: No, a charge-off does not mean the debt is forgiven. You are still responsible for repaying the debt.

Q: How does a charge-off affect my credit?

A: A charge-off will have a negative impact on your credit score and will stay on your credit report for up to 7 years.

Q: Can I still be sued for a debt that has been charged off?

A: Yes, a creditor can still sue you to recover the debt that has been charged off.

Q: What are my options for dealing with a charged-off debt?

A: You can try to negotiate a settlement with the creditor, set up a repayment plan, or seek assistance from a credit counseling agency.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.