This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

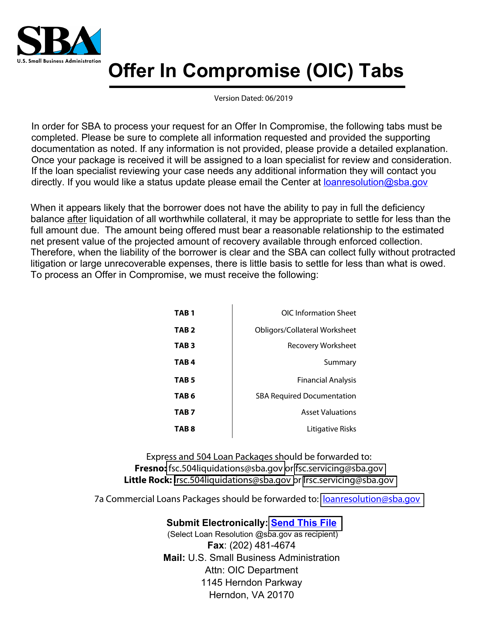

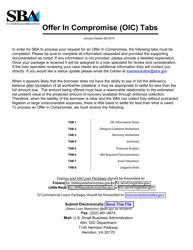

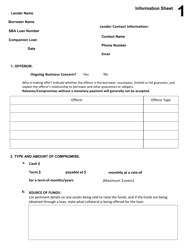

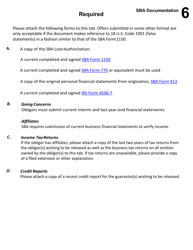

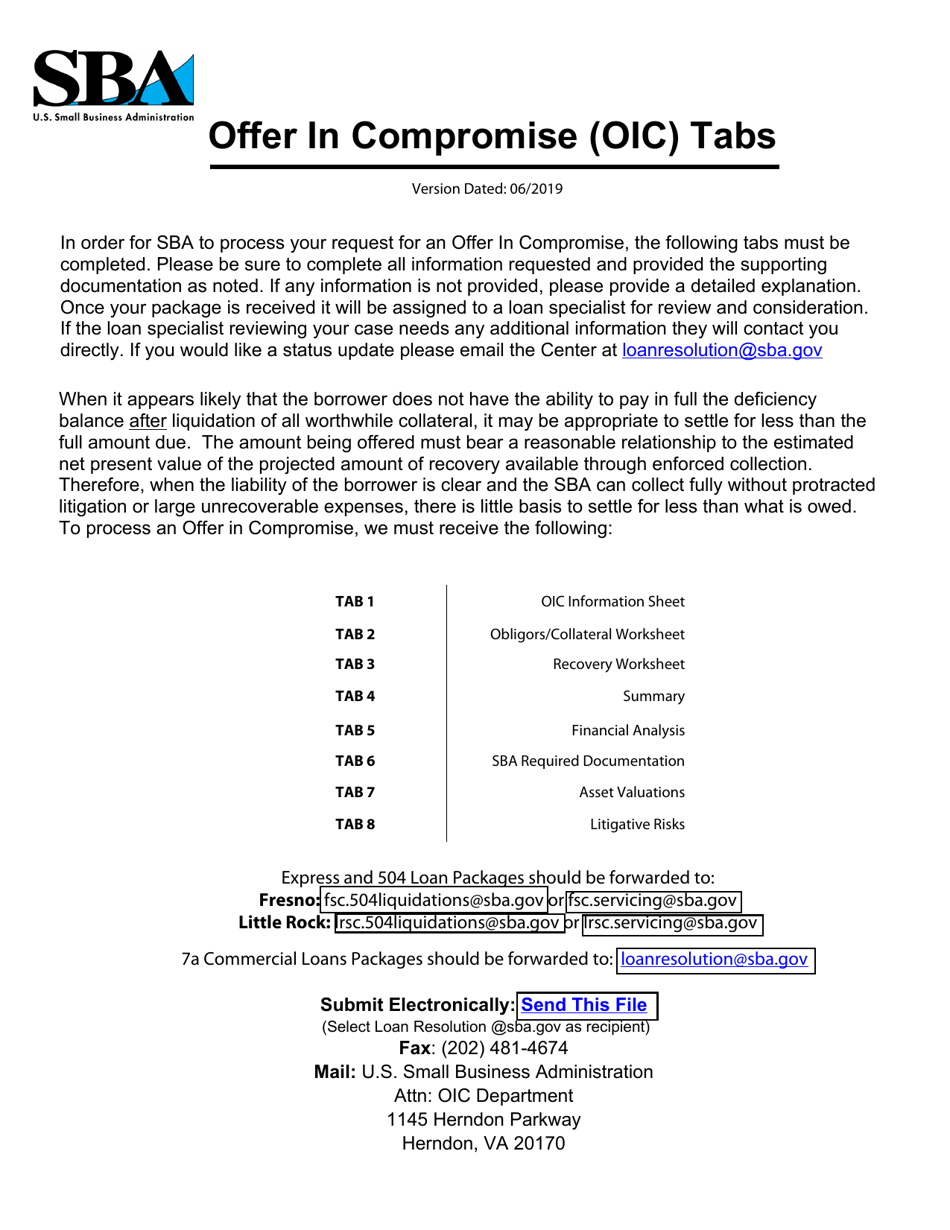

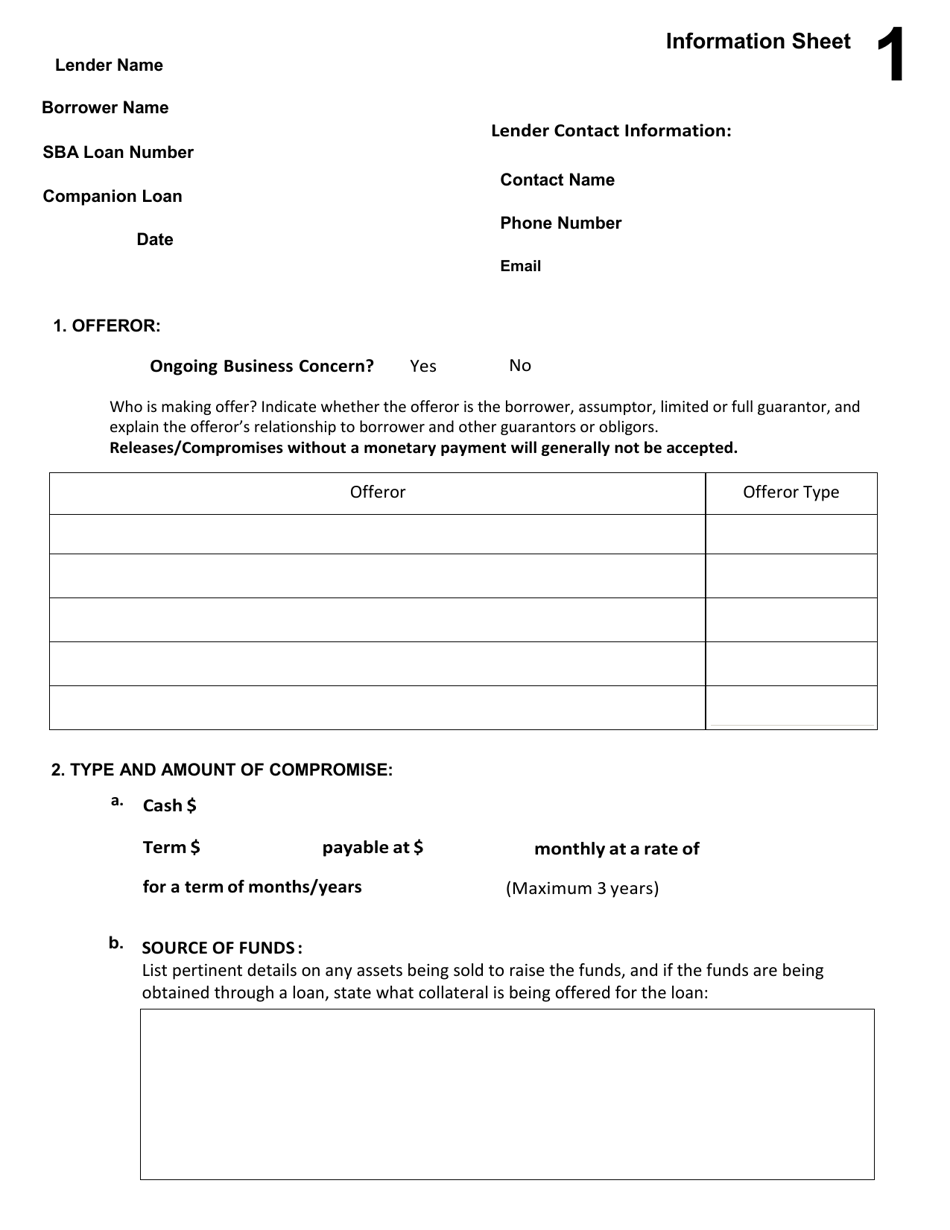

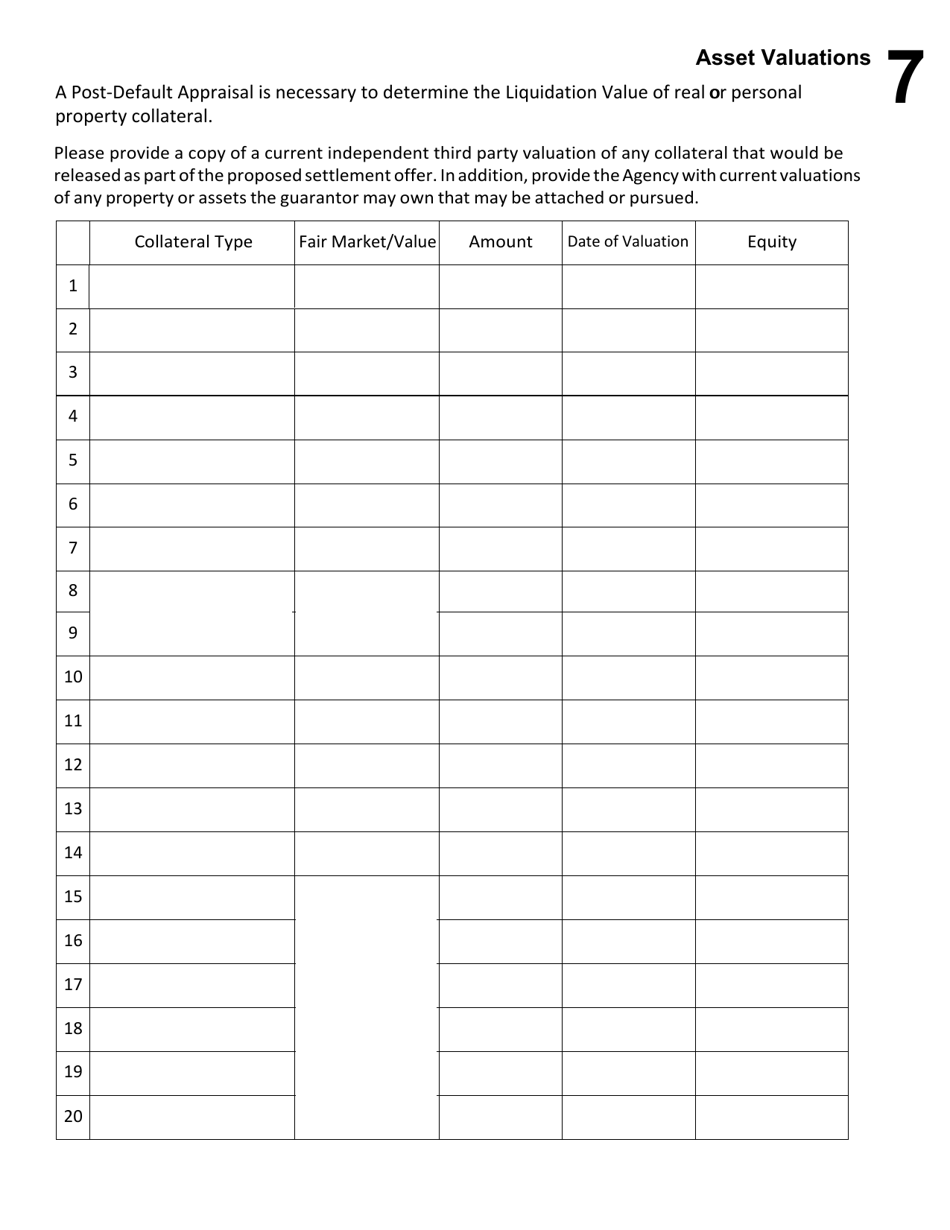

Offer in Compromise (OIC) Tabs

Offer in Compromise (OIC) Tabs is a 9-page legal document that was released by the U.S. Small Business Administration on June 1, 2019 and used nation-wide.

FAQ

Q: What is an Offer in Compromise (OIC)?

A: An Offer in Compromise (OIC) is an agreement between a taxpayer and the IRS that settles their tax debt for less than the full amount owed.

Q: Who is eligible to submit an Offer in Compromise (OIC)?

A: Individuals, businesses, and self-employed individuals with tax debt can submit an Offer in Compromise (OIC).

Q: How do I know if I qualify for an Offer in Compromise (OIC)?

A: To qualify for an Offer in Compromise (OIC), you must demonstrate that you are unable to pay the full tax debt or that doing so would cause financial hardship.

Q: What is the process for submitting an Offer in Compromise (OIC)?

A: The process for submitting an Offer in Compromise (OIC) involves completing several forms, providing supporting documentation, and paying an application fee.

Q: What happens after I submit an Offer in Compromise (OIC)?

A: After you submit an Offer in Compromise (OIC), the IRS will review your application, request additional information if needed, and make a decision on whether to accept or reject your offer.

Q: What are the benefits of an Offer in Compromise (OIC)?

A: The benefits of an Offer in Compromise (OIC) include resolving your tax debt, avoiding further collection actions, and potentially paying less than the full amount owed.

Q: Are there any risks or drawbacks to submitting an Offer in Compromise (OIC)?

A: There are risks and drawbacks to submitting an Offer in Compromise (OIC), such as the possibility of rejection, the requirement to disclose financial information, and the potential for a lengthy application process.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.